false000111729700011172972025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2025

QUINSTREET, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-34628 |

|

77-0512121 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

950 Tower Lane, 12th Floor

Foster City, CA 94404

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (650) 578-7700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share |

QNST |

The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 6, 2025, QuinStreet, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the second quarter ended December 31, 2024. A copy of the Company’s press release is attached hereto as Exhibit 99.1.

The information furnished under Item 2.02 of this Current Report on Form 8-K, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference into the Company’s filings with the SEC under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibit

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

QUINSTREET, INC. |

|

|

|

|

Dated: February 6, 2025 |

By: |

|

/s/ Gregory Wong |

|

|

|

Gregory Wong |

|

|

|

Chief Financial Officer |

Exhibit 99.1

QuinStreet Reports Record Results for Second Quarter Fiscal 2025

•Record quarterly revenue of $283 million, up 130% YoY

•Record auto insurance quarterly revenue, up 615% YoY

•Non-insurance revenue grew 15% YoY

•Raising outlook for full fiscal year 2025 revenue and Adjusted EBITDA

FOSTER CITY, CA – February 6, 2025 – QuinStreet, Inc. (Nasdaq: QNST), a leader in performance marketplaces and technologies for the financial services and home services industries, today announced financial results for the fiscal second quarter ended December 31, 2024.

For the fiscal second quarter, the Company reported revenue of $282.6 million, up 130% year-over-year.

GAAP loss for the fiscal second quarter was $(1.5) million, or $(0.03) per diluted share. Adjusted net income for the fiscal second quarter was $11.9 million, or $0.20 per diluted share.

Adjusted EBITDA for the fiscal second quarter was $19.4 million.

“Record fiscal Q2 revenue results were driven by the unprecedented ramp and broadening of Auto Insurance client demand and by double-digit growth in our other client verticals,” commented Doug Valenti, CEO of QuinStreet.

“Adjusted EBITDA remained strong. We expect Adjusted EBITDA margin to expand further on optimization efforts, and as we continue to make progress on a range of other growth and margin expansion initiatives.”

“We expect strong demand in Auto Insurance to continue, and we expect continued strong growth in our non-Insurance client verticals.”

“Turning to our outlook, we expect fiscal Q3 revenue to be between $265 and $275 million, and fiscal Q3 Adjusted EBITDA to be between $19.5 and $20.0 million. We are raising our outlook for full fiscal year 2025. We now expect revenue to be between $1.065 and $1.105 billion, and Adjusted EBITDA to be between $80 and $85 million,” concluded Valenti.

Conference Call Today at 2:00 p.m. PT

The Company will host a conference call and corresponding live webcast at 2:00 p.m. PT. To access the conference call dial +1 800-717-1738 (domestic) or +1 646-307-1865 (international). A replay of the conference call will be available beginning approximately two hours after the completion of the call by dialing +1 844-512-2921 (domestic) or +1 412-317-6671 (international) and using passcode #1165226. The webcast of the conference call will be available live and via replay on the investor relations section of the Company's website at http://investor.quinstreet.com.

About QuinStreet

QuinStreet, Inc. (Nasdaq: QNST) is a leader in performance marketplaces and technologies for the financial services and home services industries. QuinStreet is a pioneer in delivering online marketplace solutions to match searchers with brands in digital media, and is committed to providing consumers with the information and tools they need to research, find and select the products and brands that meet their needs.

Non-GAAP Financial Measures and Definitions of Client Verticals

This release and the accompanying tables include a discussion of adjusted EBITDA, adjusted net income, adjusted diluted net income per share and free cash flow and normalized free cash flow, all of which are non-GAAP financial measures that are provided as a complement to results provided in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The term "adjusted EBITDA" refers to a financial measure that we define as net loss less provision for income taxes, depreciation expense, amortization expense, stock-based compensation expense, interest and other expense, net, acquisition costs, contingent consideration adjustment, litigation settlement expense, and restructuring costs. The term "adjusted net income" refers to a financial measure that we define as net loss adjusted for amortization expense, stock-based compensation expense, acquisition costs, contingent consideration adjustment, litigation settlement expense, and restructuring costs, net of estimated taxes. The term "adjusted diluted net income per share" refers to a financial measure that we define as adjusted net income divided by weighted average diluted shares outstanding. The term “free cash flow” refers to a financial measure that we define as net cash provided by operating activities,

less capital expenditures and internal software development costs. The term “normalized free cash flow” refers to free cash flow less changes in operating assets and liabilities. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for, or superior to, GAAP results. In addition, our definition of adjusted EBITDA, adjusted net income, adjusted diluted net income per share and free cash flow and normalized free cash flow may not be comparable to the definitions as reported by other companies.

We believe adjusted EBITDA, adjusted net income and adjusted diluted net income per share are relevant and useful information because they provide us and investors with additional measurements to analyze the Company's operating performance.

Adjusted EBITDA is useful to us and investors because (i) we seek to manage our business to a level of adjusted EBITDA as a percentage of net revenue, (ii) it is used internally by us for planning purposes, including preparation of internal budgets; to allocate resources; to evaluate the effectiveness of operational strategies and capital expenditures as well as the capacity to service debt, (iii) it is a key basis upon which we assess our operating performance, (iv) it is one of the primary metrics investors use in evaluating Internet marketing companies, (v) it is a factor in determining compensation, (vi) it is an element of certain financial covenants under our historical borrowing arrangements, and (vii) it is a factor that assists investors in the analysis of ongoing operating trends. In addition, we believe adjusted EBITDA and similar measures are widely used by investors, securities analysts, ratings agencies and other interested parties in our industry as a measure of financial performance, debt-service capabilities and as a metric for analyzing company valuations.

We use adjusted EBITDA as a key performance measure because we believe it facilitates operating performance comparisons from period to period by excluding potential differences caused by variations in capital structures (affecting interest expense), tax positions (such as the impact of changes in effective tax rates or fluctuations in permanent differences or discrete quarterly items), non-recurring charges, certain other items that we do not believe are indicative of core operating activities (such as litigation settlement expense, acquisition costs, contingent consideration adjustment, restructuring costs and other income and expense) and the non-cash impact of depreciation expense, amortization expense and stock-based compensation expense.

With respect to our adjusted EBITDA guidance, the Company is not able to provide a quantitative reconciliation to the most directly comparable GAAP financial measure without unreasonable efforts due to the high variability, complexity and low visibility with respect to certain items such as taxes, and income and expense from changes in fair value of contingent consideration from acquisitions. We expect the variability of these items to have a potentially unpredictable and potentially significant impact on future GAAP financial results, and, as such, we also believe that any reconciliations provided would imply a degree of precision that would be confusing or misleading to investors.

Adjusted net income and adjusted diluted net income per share are useful to us and investors because they present an additional measurement of our financial performance, taking into account depreciation, which we believe is an ongoing cost of doing business, but excluding the impact of certain non-cash expenses (stock-based compensation, amortization of intangible assets, and contingent consideration adjustment), non-recurring charges and certain other items that we do not believe are indicative of core operating activities. We believe that analysts and investors use adjusted net income and adjusted diluted net income per share as supplemental measures to evaluate the overall operating performance of companies in our industry.

Free cash flow is useful to investors and us because it represents the cash that our business generates from operations, before taking into account cash movements that are non-operational, and is a metric commonly used in our industry to understand the underlying cash generating capacity of a company’s financial model. Normalized free cash flow is useful as it removes the fluctuations in operating assets and liabilities that occur in any given quarter due to the timing of payments and cash receipts and therefore helps investors understand the underlying cash flow of the business as a quarterly metric and the cash flow generation potential of the business model. We believe that analysts and investors use free cash flow multiples as a metric for analyzing company valuations in our industry.

We intend to provide these non-GAAP financial measures as part of our future earnings discussions and, therefore, the inclusion of these non-GAAP financial measures will provide consistency in our financial reporting. A reconciliation of these non-GAAP measures to GAAP is provided in the accompanying tables.

Legal Notice Regarding Forward Looking Statements

This press release and its attachments contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 that involve risks and uncertainties. Words such as "estimate", "will”, "believe", “expect”, "intend", “outlook”, "potential", “promises” and similar expressions are intended to identify forward-looking statements. These forward-looking statements include the statements in quotations from management in this press release, as well as any statements regarding the Company's anticipated financial results, growth and strategic and operational plans and results of analyses on impairment charges. The Company's actual results may differ materially from those anticipated in these forward-looking statements. Factors that may contribute to such differences include, but are not limited to: the Company’s ability to maintain and increase client marketing spend; the Company's ability, whether within or

outside the Company’s control, to maintain and increase the number of visitors to its websites and to convert those visitors and those to its third-party publishers' websites into client prospects in a cost-effective manner; the Company's exposure to data privacy and security risks; the impact of changes in industry standards and government regulation including, but not limited to investigation enforcement activities or regulatory activity by the Federal Trade Commission, the Federal Communications Commission, the Consumer Finance Protection Bureau and other state and federal regulatory agencies; the impact of changes in our business, our industry, and the current economic and regulatory climate on the Company’s quarterly and annual results of operations; the Company's ability to compete effectively against others in the online marketing and media industry both for client budget and access to third-party media; the Company’s ability to protect our intellectual property rights; and the impact from risks relating to counterparties on the Company's business. More information about potential factors that could affect the Company's business and financial results are contained in the Company's annual report on Form 10-K and quarterly reports on Form 10-Q as filed with the Securities and Exchange Commission ("SEC"). Additional information will also be set forth in the Company's quarter report on Form 10-Q for the fiscal quarter ended December 31, 2024, which will be filed with the SEC. The Company does not intend and undertakes no duty to release publicly any updates or revisions to any forward-looking statements contained herein.

Investor Contact:

Robert Amparo

(347) 223-1682

ramparo@quinstreet.com

QUINSTREET, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

June 30, |

|

|

|

2024 |

|

|

2024 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

57,835 |

|

|

$ |

50,488 |

|

Accounts receivable, net |

|

|

150,360 |

|

|

|

111,786 |

|

Prepaid expenses and other assets |

|

|

11,074 |

|

|

|

6,813 |

|

Total current assets |

|

|

219,269 |

|

|

|

169,087 |

|

Property and equipment, net |

|

|

17,732 |

|

|

|

19,858 |

|

Operating lease right-of-use assets |

|

|

8,554 |

|

|

|

10,440 |

|

Goodwill |

|

|

125,056 |

|

|

|

125,056 |

|

Intangible assets, net |

|

|

33,072 |

|

|

|

38,008 |

|

Other assets, noncurrent |

|

|

5,964 |

|

|

|

6,097 |

|

Total assets |

|

$ |

409,647 |

|

|

$ |

368,546 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

55,357 |

|

|

$ |

48,204 |

|

Accrued liabilities |

|

|

91,078 |

|

|

|

68,822 |

|

Other liabilities |

|

|

13,256 |

|

|

|

9,372 |

|

Total current liabilities |

|

|

159,691 |

|

|

|

126,398 |

|

Operating lease liabilities, noncurrent |

|

|

6,554 |

|

|

|

7,879 |

|

Other liabilities, noncurrent |

|

|

19,150 |

|

|

|

17,444 |

|

Total liabilities |

|

|

185,395 |

|

|

|

151,721 |

|

Stockholders' equity: |

|

|

|

|

|

|

Common stock |

|

|

57 |

|

|

|

55 |

|

Additional paid-in capital |

|

|

357,789 |

|

|

|

347,449 |

|

Accumulated other comprehensive loss |

|

|

(268 |

) |

|

|

(268 |

) |

Accumulated deficit |

|

|

(133,326 |

) |

|

|

(130,411 |

) |

Total stockholders' equity |

|

|

224,252 |

|

|

|

216,825 |

|

Total liabilities and stockholders' equity |

|

$ |

409,647 |

|

|

$ |

368,546 |

|

QUINSTREET, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net revenue |

|

$ |

282,596 |

|

|

$ |

122,683 |

|

|

$ |

561,815 |

|

|

$ |

246,606 |

|

Cost of revenue (1) |

|

|

255,842 |

|

|

|

115,830 |

|

|

|

506,656 |

|

|

|

232,104 |

|

Gross profit |

|

|

26,754 |

|

|

|

6,853 |

|

|

|

55,159 |

|

|

|

14,502 |

|

Operating expenses: (1) |

|

|

|

|

|

|

|

|

|

|

|

|

Product development |

|

|

8,710 |

|

|

|

7,272 |

|

|

|

17,330 |

|

|

|

14,909 |

|

Sales and marketing |

|

|

5,083 |

|

|

|

3,325 |

|

|

|

9,227 |

|

|

|

6,449 |

|

General and administrative |

|

|

14,349 |

|

|

|

7,651 |

|

|

|

31,197 |

|

|

|

14,438 |

|

Operating loss |

|

|

(1,388 |

) |

|

|

(11,395 |

) |

|

|

(2,595 |

) |

|

|

(21,294 |

) |

Interest income |

|

|

3 |

|

|

|

166 |

|

|

|

17 |

|

|

|

332 |

|

Interest expense |

|

|

(126 |

) |

|

|

(111 |

) |

|

|

(250 |

) |

|

|

(222 |

) |

Other (expense) income |

|

|

(83 |

) |

|

|

38 |

|

|

|

(181 |

) |

|

|

67 |

|

Loss before income taxes |

|

|

(1,594 |

) |

|

|

(11,302 |

) |

|

|

(3,009 |

) |

|

|

(21,117 |

) |

Benefit from (provision for) income taxes |

|

|

45 |

|

|

|

(252 |

) |

|

|

94 |

|

|

|

(1,002 |

) |

Net loss |

|

$ |

(1,549 |

) |

|

$ |

(11,554 |

) |

|

$ |

(2,915 |

) |

|

$ |

(22,119 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.03 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.41 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used in computing net loss per share, basic and diluted |

|

|

56,335 |

|

|

|

54,759 |

|

|

|

56,079 |

|

|

|

54,612 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Cost of revenue and operating expenses include stock-based compensation expense as follows: |

|

Cost of revenue |

|

$ |

3,337 |

|

|

$ |

2,229 |

|

|

$ |

6,212 |

|

|

$ |

4,281 |

|

Product development |

|

|

1,236 |

|

|

|

837 |

|

|

|

2,282 |

|

|

|

1,610 |

|

Sales and marketing |

|

|

1,325 |

|

|

|

723 |

|

|

|

2,420 |

|

|

|

1,363 |

|

General and administrative |

|

|

3,154 |

|

|

|

2,279 |

|

|

|

6,545 |

|

|

|

4,089 |

|

QUINSTREET, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Cash Flows from Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(1,549 |

) |

|

$ |

(11,554 |

) |

|

$ |

(2,915 |

) |

|

$ |

(22,119 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

9,052 |

|

|

|

6,068 |

|

|

|

17,459 |

|

|

|

11,343 |

|

Depreciation and amortization |

|

|

6,238 |

|

|

|

5,713 |

|

|

|

12,679 |

|

|

|

11,051 |

|

Change in the fair value of contingent consideration |

|

|

5,000 |

|

|

|

— |

|

|

|

11,194 |

|

|

|

— |

|

Provision for sales returns and doubtful accounts receivable |

|

|

317 |

|

|

|

159 |

|

|

|

1,793 |

|

|

|

382 |

|

Non-cash lease expense |

|

|

114 |

|

|

|

(357 |

) |

|

|

83 |

|

|

|

(610 |

) |

Deferred income taxes |

|

|

(56 |

) |

|

|

201 |

|

|

|

(154 |

) |

|

|

745 |

|

Other adjustments, net |

|

|

105 |

|

|

|

98 |

|

|

|

(247 |

) |

|

|

(230 |

) |

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

23,227 |

|

|

|

(7,202 |

) |

|

|

(40,367 |

) |

|

|

(7,361 |

) |

Prepaid expenses and other assets |

|

|

(3,505 |

) |

|

|

911 |

|

|

|

(4,262 |

) |

|

|

2,000 |

|

Accounts payable |

|

|

(5,121 |

) |

|

|

(1,123 |

) |

|

|

7,222 |

|

|

|

(4,725 |

) |

Accrued liabilities |

|

|

4,856 |

|

|

|

3,431 |

|

|

|

22,487 |

|

|

|

897 |

|

Net cash provided by (used in) operating activities |

|

|

38,678 |

|

|

|

(3,655 |

) |

|

|

24,972 |

|

|

|

(8,627 |

) |

Cash Flows from Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(447 |

) |

|

|

(1,339 |

) |

|

|

(884 |

) |

|

|

(2,962 |

) |

Internal software development costs |

|

|

(2,321 |

) |

|

|

(2,945 |

) |

|

|

(4,490 |

) |

|

|

(6,415 |

) |

Net cash used in investing activities |

|

|

(2,768 |

) |

|

|

(4,284 |

) |

|

|

(5,374 |

) |

|

|

(9,377 |

) |

Cash Flows from Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options and issuance of common stock under employee stock purchase plan |

|

|

7 |

|

|

|

122 |

|

|

|

1,369 |

|

|

|

1,700 |

|

Payment of withholding taxes related to release of restricted stock, net of share settlement |

|

|

(3,076 |

) |

|

|

(1,161 |

) |

|

|

(8,500 |

) |

|

|

(3,348 |

) |

Post-closing payments and contingent consideration related to acquisitions |

|

|

(0 |

) |

|

|

(952 |

) |

|

|

(5,144 |

) |

|

|

(6,229 |

) |

Repurchase of common stock |

|

|

— |

|

|

|

(862 |

) |

|

|

— |

|

|

|

(2,288 |

) |

Net cash used in financing activities |

|

|

(3,069 |

) |

|

|

(2,853 |

) |

|

|

(12,275 |

) |

|

|

(10,165 |

) |

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

12 |

|

|

|

7 |

|

|

|

24 |

|

|

|

12 |

|

Net decrease in cash, cash equivalents and restricted cash |

|

|

32,853 |

|

|

|

(10,785 |

) |

|

|

7,347 |

|

|

|

(28,157 |

) |

Cash, cash equivalents and restricted cash at beginning of period |

|

|

24,997 |

|

|

|

56,320 |

|

|

|

50,503 |

|

|

|

73,692 |

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

57,850 |

|

|

$ |

45,535 |

|

|

$ |

57,850 |

|

|

$ |

45,535 |

|

Reconciliation of cash, cash equivalents, and restricted cash to the condensed consolidated balance sheets |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

57,835 |

|

|

$ |

45,520 |

|

|

$ |

57,835 |

|

|

$ |

45,520 |

|

Restricted cash included in other assets, noncurrent |

|

|

15 |

|

|

|

15 |

|

|

|

15 |

|

|

|

15 |

|

Total cash, cash equivalents and restricted cash |

|

$ |

57,850 |

|

|

$ |

45,535 |

|

|

$ |

57,850 |

|

|

$ |

45,535 |

|

QUINSTREET, INC.

RECONCILIATION OF NET LOSS TO

ADJUSTED NET INCOME (LOSS)

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income (loss) |

|

$ |

(1,549 |

) |

|

$ |

(11,554 |

) |

|

$ |

(2,915 |

) |

|

$ |

(22,119 |

) |

Amortization of intangible assets |

|

|

2,454 |

|

|

|

2,578 |

|

|

|

4,936 |

|

|

|

5,156 |

|

Stock-based compensation |

|

|

9,052 |

|

|

|

6,068 |

|

|

|

17,459 |

|

|

|

11,343 |

|

Contingent consideration adjustment |

|

|

5,000 |

|

|

|

— |

|

|

|

11,194 |

|

|

|

— |

|

Restructuring costs |

|

|

72 |

|

|

|

31 |

|

|

|

379 |

|

|

|

301 |

|

Litigation settlement expense |

|

|

429 |

|

|

|

— |

|

|

|

499 |

|

|

|

— |

|

Acquisition costs |

|

|

— |

|

|

|

— |

|

|

|

105 |

|

|

|

— |

|

Tax impact of non-GAAP items |

|

|

(3,592 |

) |

|

|

622 |

|

|

|

(7,248 |

) |

|

|

1,645 |

|

Adjusted net income (loss) |

|

$ |

11,866 |

|

|

$ |

(2,255 |

) |

|

$ |

24,409 |

|

|

$ |

(3,674 |

) |

Adjusted diluted net income (loss) per share |

|

$ |

0.20 |

|

|

$ |

(0.04 |

) |

|

$ |

0.42 |

|

|

$ |

(0.07 |

) |

Weighted average shares used in computing adjusted diluted net income (loss) per share |

|

|

58,438 |

|

|

|

54,759 |

|

|

|

58,158 |

|

|

|

54,612 |

|

QUINSTREET, INC.

RECONCILIATION OF NET LOSS TO

ADJUSTED EBITDA

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net loss |

|

$ |

(1,549 |

) |

|

$ |

(11,554 |

) |

|

$ |

(2,915 |

) |

|

$ |

(22,119 |

) |

Interest and other expense, net |

|

|

206 |

|

|

|

(93 |

) |

|

|

414 |

|

|

|

(177 |

) |

(Benefit from) provision for income taxes |

|

|

(45 |

) |

|

|

252 |

|

|

|

(94 |

) |

|

|

1,002 |

|

Depreciation and amortization |

|

|

6,238 |

|

|

|

5,713 |

|

|

|

12,679 |

|

|

|

11,051 |

|

Stock-based compensation |

|

|

9,052 |

|

|

|

6,068 |

|

|

|

17,459 |

|

|

|

11,343 |

|

Contingent consideration adjustment |

|

|

5,000 |

|

|

|

— |

|

|

|

11,194 |

|

|

|

— |

|

Restructuring costs |

|

|

72 |

|

|

|

31 |

|

|

|

379 |

|

|

|

301 |

|

Litigation settlement expense |

|

|

429 |

|

|

|

— |

|

|

|

499 |

|

|

|

— |

|

Acquisition costs |

|

|

— |

|

|

|

— |

|

|

|

105 |

|

|

|

— |

|

Adjusted EBITDA |

|

$ |

19,403 |

|

|

$ |

417 |

|

|

$ |

39,720 |

|

|

$ |

1,401 |

|

QUINSTREET, INC.

RECONCILIATION OF CASH USED IN

OPERATING ACTIVITIES TO FREE CASH FLOW

AND NORMALIZED FREE CASH FLOW

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net cash provided by (used in) operating activities |

|

$ |

38,678 |

|

|

$ |

(3,655 |

) |

|

$ |

24,972 |

|

|

$ |

(8,627 |

) |

Capital expenditures |

|

|

(447 |

) |

|

|

(1,339 |

) |

|

|

(884 |

) |

|

|

(2,962 |

) |

Internal software development costs |

|

|

(2,321 |

) |

|

|

(2,945 |

) |

|

|

(4,490 |

) |

|

|

(6,415 |

) |

Free cash flow |

|

|

35,910 |

|

|

|

(7,939 |

) |

|

|

19,598 |

|

|

|

(18,004 |

) |

Changes in operating assets and liabilities |

|

|

(19,457 |

) |

|

|

3,908 |

|

|

|

14,920 |

|

|

|

9,004 |

|

Normalized free cash flow |

|

$ |

16,453 |

|

|

$ |

(4,031 |

) |

|

$ |

34,518 |

|

|

$ |

(9,000 |

) |

QUINSTREET, INC.

DISAGGREGATION OF REVENUE

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Financial Services |

|

$ |

219,934 |

|

|

$ |

71,334 |

|

|

$ |

430,825 |

|

|

$ |

143,458 |

|

Home Services |

|

|

59,575 |

|

|

|

49,333 |

|

|

|

124,650 |

|

|

|

98,728 |

|

Other Revenue |

|

|

3,087 |

|

|

|

2,016 |

|

|

|

6,340 |

|

|

|

4,420 |

|

Total net revenue |

|

$ |

282,596 |

|

|

$ |

122,683 |

|

|

$ |

561,815 |

|

|

$ |

246,606 |

|

v3.25.0.1

Cover

|

Feb. 06, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 06, 2025

|

| Entity File Number |

001-34628

|

| Entity Registrant Name |

QUINSTREET, INC.

|

| Entity Central Index Key |

0001117297

|

| Entity Tax Identification Number |

77-0512121

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

950 Tower Lane

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

Foster City

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94404

|

| City Area Code |

650

|

| Local Phone Number |

578-7700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

QNST

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

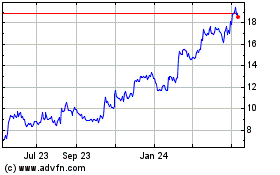

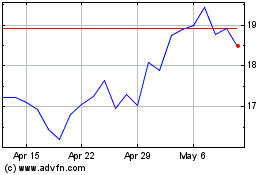

QuinStreet (NASDAQ:QNST)

Historical Stock Chart

From Jan 2025 to Feb 2025

QuinStreet (NASDAQ:QNST)

Historical Stock Chart

From Feb 2024 to Feb 2025