Form 8-K - Current report

January 28 2025 - 2:22PM

Edgar (US Regulatory)

false

0001638833

0001638833

2025-01-28

2025-01-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the

Securities Exchange

Act of 1934

Date

of Report (Date of earliest event reported): January 28, 2025

Surgery Partners, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-37576 |

47-3620923 |

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

340 Seven Springs Way, Suite 600

Brentwood, Tennessee 37027

(Address of Principal Executive Offices) (Zip Code)

(615) 234-5900

(Registrant's Telephone Number, Including Area Code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common

Stock, par value $0.01 per share |

|

SGRY |

|

The

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On January 28, 2025, Surgery Partners, Inc. (the

“Company”) issued a press release confirming the receipt of an unsolicited and non-binding proposal on January 27, 2025, from

a group represented by Bain Capital Private Equity, LP, to acquire all of the outstanding shares of common stock of the Company.

A copy of the press release is included herein as

Exhibit 99.1 and is incorporated herein by reference.

| Item 9.01. | Financial Statements

and Exhibits. |

(d) Exhibits:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

SURGERY PARTNERS, INC. |

|

| |

|

| By: |

/s/ David T. Doherty |

|

|

David T. Doherty |

|

|

Executive Vice President and Chief Financial Officer |

|

| |

|

|

| Date: January 28, 2025 |

|

Exhibit

99.1

Surgery

Partners, Inc. Confirms Receipt of Non-Binding Acquisition Proposal from Bain Capital

BRENTWOOD,

Tenn., January 28, 2025 – Surgery Partners, Inc. (NASDAQ: SGRY) (“Surgery Partners” or the “Company”),

a leading short-stay surgical facility owner and operator, today announced that its Board of Directors (the “Board”) received

a non-binding proposal, dated January 27, 2025, from Bain Capital Private Equity, LP (“Bain Capital”) to acquire all of the

outstanding shares of Surgery Partners not already owned by Bain Capital for a cash consideration of $25.75 per share (the “Bain

Capital Proposal”). Bain Capital and its affiliates own approximately 39% of the Company’s outstanding common stock, based

on the Schedule 13D/A filing dated January 28, 2025.

A

Special Committee of independent directors of the Board is expected to consider the Bain Capital Proposal with the assistance of independent

financial and legal advisors.

The

Bain Capital Proposal indicates that any potential transaction would be subject to a non-waivable condition requiring the approval of

the holders of a majority of the shares of Common Stock that are not owned by Bain Capital and its affiliates, and the approval of a

fully empowered Special Committee comprised solely of independent and disinterested directors.

The

Company cautions its shareholders and others considering trading in its securities that no decisions have been made with respect to the

Company's response to the proposal. The Bain Capital Proposal is non-binding and there can be no assurance that any definitive offer

will be made, that any agreement will be executed or that this or any other transaction will be approved or consummated. The Company

does not undertake any obligation to provide any updates with respect to this or any other transaction, except as required by applicable

law.

About

Surgery Partners

Headquartered

in Brentwood, Tennessee, Surgery Partners is a leading healthcare services company with a differentiated outpatient delivery model focused

on providing high-quality, cost-effective solutions for surgical and related ancillary care in support of both patients and physicians.

Founded in 2004, Surgery Partners is one of the largest and fastest growing surgical services businesses in the country, with more than

200 locations in 33 states, including ambulatory surgery centers, surgical hospitals, multi-specialty physician practices and urgent

care facilities. For additional information, visit www.surgerypartners.com.

Forward-Looking

Statements

This

press release contains forward-looking statements, including, but not limited to, expectations regarding the proposed transaction and

the formation of a Special Committee. You are cautioned not to rely on any forward-looking statements and reminded that the Bain Capital

Proposal is non-binding and there can be no assurance that any definitive offer will be made, that any agreement will be executed or

that this or any other transaction will be approved or consummated. The Company undertakes no obligation to update any forward-looking

statements made in this press release to reflect events or circumstances after the date of this press release or to reflect new information

or the occurrence of unanticipated events, except as required by law.

Contacts

Investors

Surgery

Partners Investor Relations

(615)

234-8940

IR@surgerypartners.com

Media

Matt

Sherman / Jed Repko / Ed Trissel

Joele

Frank, Wilkinson Brimmer Katcher

212-355-4449

SGRY-Media@joelefrank.com

v3.24.4

Cover

|

Jan. 28, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 28, 2025

|

| Entity File Number |

001-37576

|

| Entity Registrant Name |

Surgery Partners, Inc.

|

| Entity Central Index Key |

0001638833

|

| Entity Tax Identification Number |

47-3620923

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

340 Seven Springs Way

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Brentwood

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37027

|

| City Area Code |

615

|

| Local Phone Number |

234-5900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

SGRY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

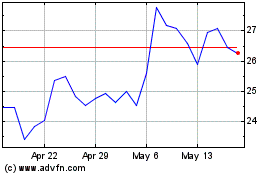

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

From Jan 2025 to Feb 2025

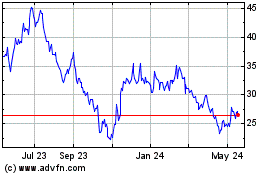

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

From Feb 2024 to Feb 2025