Galileo Launches Secured Credit with Dynamic Funding Empowering Banks and Fintechs to Simplify Credit-Building for Consumers

September 25 2024 - 7:00AM

Business Wire

New solution offers a consolidated balance view

for debit and secured credit.

Galileo Financial Technologies, a leading financial technology

company owned by SoFi Technologies, Inc. (NASDAQ: SOFI), announced

the launch of Secured Credit with Dynamic Funding. Built to help

fintechs, banks and other businesses address the needs of

underbanked and underserved customers, Galileo Secured Credit with

Dynamic Funding simplifies the secured credit process, making it

easier for consumers to manage their debit and credit accounts.

This streamlined solution also reduces the risk for lenders by

backing credit with secured deposits.

With more than 45 million Americans either credit unserved or

underserved, the need for secured credit is high. Traditional

secured models have long been plagued with complexities around

where consumers want to use their funds. Customers face the dilemma

of keeping their cash in their demand deposit account (DDA) for use

with their debit card or in their collateral account to use as

secured credit. The behavior of dividing these funds puts consumers

at a disadvantage throughout their credit-building journey.

The Galileo Secured Credit with Dynamic Funding solution

resolves those complexities. By automating the movement of funds

between accounts, customers are empowered to manage all their money

in one single account that powers both debit and credit

transactions. It eliminates the need for users to make manual

transfers between collateral and DDA accounts when the need arises

to make larger purchases. With this solution, cardholders can

manage one "available to spend" balance, streamlining the process

and ensuring real-time updates of transactions.

“Dynamic Funding gives our clients an edge in offering flexible,

secured credit with debit to underserved consumers, helping them

build credit and save without the typical friction,” said David

Feuer, CPO at Galileo. “With this solution, financial institutions,

fintechs and other businesses can provide a user-friendly

experience that empowers consumers to manage their finances in

real-time.”

Key Features of Galileo Secured Credit with Dynamic

Funding:

- Simplified Experience: DDA and collateral funds are kept

together in a single pool, ready to be spent as debit or credit,

enabling larger purchases when needed.

- Customer-Centric Secured Credit: This credit product

helps consumers avoid falling into a debt cycle by combining DDA

and collateral balances. When approved for a secured credit card,

there is no immediate impact on their spending account. Once their

credit is built, retrieving their deposit doesn’t affect their

credit score–it was always accessible to them.

- Differentiated Product Offering: Galileo clients can now

offer a unique secured credit solution. With seamless automation

and ease of use, Galileo Secured Credit with Dynamic Funding

provides a compelling value proposition that helps attract and

retain customers–especially those new to credit or rebuilding their

financial profiles.

Galileo Secure Credit with Dynamic Funding demonstrates the

company’s commitment to providing innovative financial solutions

that meet the evolving needs of fintechs, financial institutions

and businesses, while driving financial inclusion for underserved

markets.

For more information on Galileo’s secured credit programs and

how the Secured Credit with Dynamic Funding option can provide a

low-risk entry to your credit offerings and drive business growth,

please visit

https://docs.galileo-ft.com/pro/docs/secured-credit.

About Galileo Financial Technologies

Galileo Financial Technologies, LLC and certain of its

affiliates collectively comprise a financial technology company

owned and operated independently by SoFi Technologies, Inc.

(NASDAQ: SOFI) that enables fintechs, financial institutions, and

emerging and established brands to build differentiated financial

solutions that deliver exceptional, customer-centric experiences.

Through modern, open APIs, Galileo’s flexible, secure, scalable and

fully integrated platform drives innovation across payments and

financial services. Trusted by digital banking heavyweights,

early-stage innovators and enterprise clients alike, Galileo

supports issuing physical and virtual payment cards, mobile push

provisioning, tailored and differentiated financial products and

more, across industries and geographies.

©2024 Galileo Financial Technologies, LLC. All rights

reserved.

Galileo Financial Technologies, LLC is a technology company, not

a bank. Galileo partners with many issuing banks to provide banking

services in North and Latin America.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240925975533/en/

MEDIA CONTACT: Solomon Joseph The Fletcher Group

905.510.1400 solomon@fletchergroupllc.com

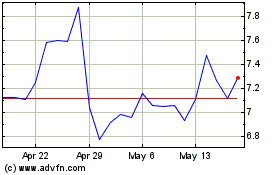

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

From Nov 2024 to Dec 2024

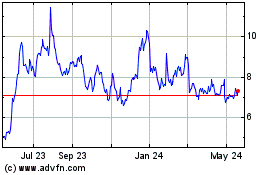

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

From Dec 2023 to Dec 2024