UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

For

the month of November 2024

Commission

file number: 001-38041

SCISPARC

LTD.

(Translation

of registrant’s name into English)

20

Raul Wallenberg Street, Tower A,

Tel

Aviv 6971916 Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

CONTENTS

This

Report of Foreign Private Issuer on Form 6-K consists of: (i) SciSparc Ltd.’s (the “Registrant”) Unaudited

Consolidated Interim Financial Statements as of June 30, 2024, which is attached hereto as Exhibit 99.1; and (ii) the

Registrant’s Management’s Discussion and Analysis of Financial Condition and Results of Operations for the six months

ended June 30, 2024, which is attached hereto as Exhibit 99.2.

This

Report of Foreign Private Issuer on Form 6-K is incorporated by reference into the Registrant’s registration statements on

Form F-3 (File Nos. 333-269839, 333-266047, 333-233417, 333-248670, 333-255408 and 333-275305) and on Form S-8 (File Nos. 333-225773

and 333-278437) filed with the Securities and Exchange Commission to be a part thereof from the date on which this report is submitted,

to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

SciSparc Ltd. |

| |

|

|

| Date: November 4, 2024 |

By: |

/s/ Oz Adler |

| |

Name: |

Oz Adler |

| |

Title: |

Chief Executive Officer

and Chief Financial Officer |

2

Exhibit 99.1

SCISPARC LTD.

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2024

UNAUDITED

INDEX

SCISPARC LTD.

CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION

| | |

| |

June 30, | | |

December 31, | |

| | |

| |

2024 | | |

2023 | | |

2023 | |

| | |

| |

Unaudited | | |

Audited | |

| | |

Note | |

USD in thousands | |

| | |

| |

| | |

| | |

| |

| ASSETS | |

| |

| | |

| | |

| |

| | |

| |

| | |

| | |

| |

| CURRENT ASSETS: | |

| |

| | |

| | |

| |

| Cash and cash equivalents | |

| |

$ | 252 | | |

$ | 2,081 | | |

$ | 2,076 | |

| Restricted deposit | |

| |

| 64 | | |

| 44 | | |

| 65 | |

| Short-term deposit | |

| |

| 2,308 | | |

| - | | |

| 3,000 | |

| Trade receivables | |

| |

| 19 | | |

| 43 | | |

| 22 | |

| Other accounts receivable | |

| |

| 298 | | |

| 815 | | |

| 540 | |

| Inventory | |

| |

| 415 | | |

| 660 | | |

| 742 | |

| | |

| |

| | | |

| | | |

| | |

| | |

| |

| 3,356 | | |

| 3,643 | | |

| 6,445 | |

| | |

| |

| | | |

| | | |

| | |

| NON-CURRENT ASSETS: | |

| |

| | | |

| | | |

| | |

| Intangible asset, net | |

4 | |

| 3,006 | | |

| 4,474 | | |

| 3,189 | |

| Related parties | |

5,6 | |

| 2,448 | | |

| - | | |

| - | |

| Investment in company account for at equity | |

3 | |

| 1,196 | | |

| 893 | | |

| 781 | |

| Investments in financial assets | |

5 | |

| 403 | | |

| 849 | | |

| 659 | |

| Property and equipment, net | |

| |

| 73 | | |

| 33 | | |

| 108 | |

| | |

| |

| | | |

| | | |

| | |

| | |

| |

| 7,126 | | |

| 6,249 | | |

| 4,737 | |

| | |

| |

| | | |

| | | |

| | |

| | |

| |

$ | 10,482 | | |

$ | 9,892 | | |

$ | 11,182 | |

The accompanying notes are an integral part of

the interim consolidated financial statements.

SCISPARC LTD.

CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION

| | |

| |

June 30, | | |

December 31, | |

| | |

| |

2024 | | |

2023 | | |

2023 | |

| | |

| |

Unaudited | | |

Audited | |

| | |

Note | |

USD in thousands | |

| | |

| |

| | |

| | |

| |

| LIABILITIES AND EQUITY | |

| |

| | |

| | |

| |

| | |

| |

| | |

| | |

| |

| CURRENT LIABILITIES: | |

| |

| | |

| | |

| |

| Trade payables | |

| |

$ | 1,164 | | |

$ | 1,247 | | |

$ | 802 | |

| Other accounts payable | |

| |

| 253 | | |

| 153 | | |

| 185 | |

| Warrants | |

8 | |

| 345 | | |

| 1,714 | | |

| 532 | |

| | |

| |

| | | |

| | | |

| | |

| Lease liability | |

| |

| 38 | | |

| - | | |

| 52 | |

| | |

| |

| | | |

| | | |

| | |

| | |

| |

| 1,800 | | |

| 3,114 | | |

| 1,571 | |

| | |

| |

| | | |

| | | |

| | |

| NON-LIABILITIES | |

| |

| | | |

| | | |

| | |

| Lease liability | |

| |

| 26 | | |

| - | | |

| 24 | |

| | |

| |

| | | |

| | | |

| | |

| EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE COMPANY: | |

9 | |

| | | |

| | | |

| | |

| Share capital and premium | |

| |

| 67,258 | | |

| 58,898 | | |

| 64,526 | |

| Reserve from share-based payment transactions | |

| |

| 5,298 | | |

| 5,248 | | |

| 5,282 | |

| Warrants | |

| |

| 5,190 | | |

| 5,190 | | |

| 5,190 | |

| Foreign currency translation reserve | |

| |

| 497 | | |

| 497 | | |

| 497 | |

| Transactions with non-controlling interests | |

| |

| 810 | | |

| 712 | | |

| 810 | |

| Accumulated deficit | |

| |

| (72,133 | ) | |

| (66,449 | ) | |

| (68,691 | ) |

| | |

| |

| | | |

| | | |

| | |

| | |

| |

| 6,920 | | |

| 4,096 | | |

| 7,614 | |

| Non-controlling interests | |

| |

| 1,736 | | |

| 2,682 | | |

| 1,973 | |

| | |

| |

| | | |

| | | |

| | |

| Total equity | |

| |

$ | 8,656 | | |

$ | 6,778 | | |

$ | 9,587 | |

| | |

| |

| | | |

| | | |

| | |

| Total liabilities and equity | |

| |

$ | 10,482 | | |

$ | 9,892 | | |

$ | 11,182 | |

The accompanying notes are an integral part of

the interim consolidated financial statements.

SCISPARC LTD.

CONSOLIDATED

STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE LOSS

| | |

| |

Six months ended

June 30, | | |

Year Ended

December 31, | |

| | |

| |

2024 | | |

2023 | | |

2023 | |

| | |

| |

Unaudited | | |

Audited | |

| | |

Note | |

USD in thousands, except per share amounts | |

| | |

| |

| | |

| | |

| |

| Revenues | |

| |

$ | 840 | | |

$ | 1,972 | | |

$ | 2,879 | |

| | |

| |

| | | |

| | | |

| | |

| Cost of goods sold | |

| |

| (366 | ) | |

| (508 | ) | |

| (683 | ) |

| | |

| |

| | | |

| | | |

| | |

| Gross profit | |

| |

| 474 | | |

| 1,464 | | |

| 2,196 | |

| | |

| |

| | | |

| | | |

| | |

| Research and development expenses | |

10a | |

| 841 | | |

| 781 | | |

| 1,641 | |

| Sales and marketing | |

| |

| 528 | | |

| 729 | | |

| 1,297 | |

| Impairment of intangible asset | |

| |

| - | | |

| - | | |

| 1,042 | |

| General and administrative expenses | |

11b | |

| 2,632 | | |

| 2,921 | | |

| 5,031 | |

| Operating loss | |

| |

| 3,527 | | |

| 2,967 | | |

| 6,815 | |

| Company’s share of losses of companies accounted for at equity, net | |

| |

| 208 | | |

| 99 | | |

| 210 | |

| Finance income | |

| |

| (323 | ) | |

| (1,024 | ) | |

| (2,219 | ) |

| Finance expenses | |

| |

| 272 | | |

| 877 | | |

| 1,055 | |

| Loss before income taxes | |

| |

| 3,684 | | |

| 2,919 | | |

| 5,861 | |

| | |

| |

| | | |

| | | |

| | |

| Taxes on income | |

| |

| (5 | ) | |

| 13 | | |

| 22 | |

| | |

| |

| | | |

| | | |

| | |

| Total comprehensive loss | |

| |

| 3,679 | | |

| 2,932 | | |

| 5,883 | |

| Attributable to: | |

| |

| | | |

| | | |

| | |

| Equity holders of the Company | |

| |

| 3,442 | | |

| 2,880 | | |

| 5,122 | |

| Non-controlling interests | |

| |

| 237 | | |

| 52 | | |

| 761 | |

| | |

| |

| 3,679 | | |

| 2,932 | | |

| 5,883 | |

| Basic loss per share attributable to equity holders of the Company: | |

| |

| | | |

| | | |

| | |

| Loss from operations | |

| |

| 1.70 | | |

| 10.85 | (*) | |

| 14.43 | |

| Diluted loss per share attributable to equity holders of the Company: | |

| |

| | | |

| | | |

| | |

| Loss from operations | |

| |

| 1.70 | | |

| 10.85 | (*) | |

| 14.43 | |

The accompanying notes are an integral part of

the interim consolidated financial statements.

SCISPARC LTD.

CONSOLIDATED

STATEMENTS OF CHANGES IN EQUITY (DEFICIT)

For the six months ended June 30, 2024

| | |

Attributable to equity holders of the Company | | |

| | |

| |

| | |

Share

capital

and

premium | | |

Reserve

from

share-based

payment

transactions | | |

Warrants | | |

Transactions

with non-

controlling

interests | | |

Foreign

currency

translation

reserve | | |

Accumulated

deficit | | |

Total | | |

Non-

controlling

interests | | |

Total

equity | |

| | |

USD in thousands | |

| Balance at January 1, 2024 | |

$ | 64,526 | | |

| 5,282 | | |

| 5,190 | | |

| 810 | | |

| 497 | | |

| (68,691 | ) | |

| 7,614 | | |

| 1,973 | | |

| 9,587 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,442 | ) | |

| (3,442 | ) | |

| (237 | ) | |

| (3,679 | ) |

| Issuance of shares, net of issuance expenses | |

| 2,722 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,722 | | |

| - | | |

| 2,722 | |

| Cost of share-based payment | |

| 10 | | |

| 16 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 26 | | |

| - | | |

| 26 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at June 30, 2024 | |

$ | 67,258 | | |

| 5,298 | | |

| 5,190 | | |

| 810 | | |

| 497 | | |

| (72,133 | ) | |

| 6,920 | | |

| 1,736 | | |

| 8,656 | |

The accompanying notes are an integral part of

the interim consolidated financial statements.

SCISPARC LTD.

CONSOLIDATED

STATEMENTS OF CHANGES IN EQUITY (DEFICIT)

For the six months ended June 30, 2023

| | |

Attributable to equity holders of the Company | | |

| | |

| |

| | |

Share

capital

and

premium | | |

Reserve

from

share-based

payment

transactions | | |

Warrants | | |

Transactions

with non-

controlling

interests | | |

Foreign

currency

translation

reserve | | |

Accumulated

deficit | | |

Total | | |

Non-

controlling

interests | | |

Total

equity | |

| | |

USD in thousands | |

| Balance at January 1, 2023 | |

$ | 58,592 | | |

| 5,180 | | |

| 5,190 | | |

| 559 | | |

| 497 | | |

| (63,569 | ) | |

| 6,449 | | |

| - | | |

| 6,449 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,880 | ) | |

| (2,880 | ) | |

| (52 | ) | |

| (2,932 | ) |

| Issuance of share capital in respect of investment in affiliate | |

| 288 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 288 | | |

| - | | |

| 288 | |

| Sale of minority interest in subsidiary | |

| - | | |

| - | | |

| - | | |

| 153 | | |

| - | | |

| - | | |

| 153 | | |

| 2,734 | | |

| 2,887 | |

| Issuance of shares, net of issuance expenses | |

| (45 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (45 | ) | |

| - | | |

| (45 | ) |

| Cost of share-based payment | |

| 63 | | |

| 68 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 131 | | |

| - | | |

| 131 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at June 30, 2023 | |

$ | 58,898 | | |

| 5,248 | | |

| 5,190 | | |

| 712 | | |

| 497 | | |

| (66,449 | ) | |

| 4,096 | | |

| 2,682 | | |

| 6,778 | |

The accompanying notes are

an integral part of the interim consolidated financial statements.

SCISPARC LTD.

CONSOLIDATED

STATEMENTS OF CHANGES IN EQUITY

For the year ended December 31, 2023

| | |

Attributable to equity holders of the Company | | |

| | |

| |

| | |

Share

capital

and

premium | | |

Reserve

from

share-based

payment

transactions | | |

Warrants | | |

Transactions

with non-

controlling

interests | | |

Foreign

currency

translation

reserve | | |

Accumulated

deficit | | |

Total | | |

Non-

controlling

interests | | |

Total

equity | |

| | |

USD in thousands | |

| Balance at January 1, 2023 | |

$ | 58,592 | | |

| 5,180 | | |

| 5,190 | | |

| 559 | | |

| 497 | | |

| (63,569 | ) | |

| 6,449 | | |

| - | | |

| 6,449 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (5,122 | ) | |

| (5,122 | ) | |

| (761 | ) | |

| (5,883 | ) |

| Sales of minority interest in subsidiary | |

| - | | |

| - | | |

| - | | |

| 251 | | |

| - | | |

| - | | |

| 251 | | |

| 2,734 | | |

| 2,985 | |

| Issuance of share capital in respect of investment in affiliate | |

| 288 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 288 | | |

| - | | |

| 288 | |

| Issuance of share capital, net of issuance expenses | |

| 5,552 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 5,552 | | |

| - | | |

| 5,552 | |

| Cost of share-based payment | |

| 94 | | |

| 102 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 196 | | |

| - | | |

| 196 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at December 31, 2023 | |

$ | 64,526 | | |

| 5,282 | | |

| 5,190 | | |

| 810 | | |

| 497 | | |

| (68,691 | ) | |

| 7,614 | | |

| 1,973 | | |

| 9,587 | |

The accompanying notes are an integral part of

the interim consolidated financial statements.

SCISPARC LTD.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

| | |

Six months ended

June 30, | | |

Year Ended

December 31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

Unaudited | | |

Audited | |

| | |

USD in thousands | |

| | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | |

| | |

| |

| | |

| | |

| | |

| |

| Loss | |

$ | (3,679 | ) | |

$ | (2,932 | ) | |

$ | (5,883 | ) |

| | |

| | | |

| | | |

| | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Adjustments to the profit or loss items: | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 219 | | |

| 267 | | |

| 538 | |

| Loss on impairment of intangible asset | |

| - | | |

| - | | |

| 1,042 | |

| Cost of share-based payment | |

| 26 | | |

| 131 | | |

| 196 | |

| Finance expenses, net | |

| (206 | ) | |

| (1,023 | ) | |

| (2,205 | ) |

| Group’s share of losses of company accounted for at equity, net | |

| 185 | | |

| 98 | | |

| 210 | |

| Losses from remeasurement of investment in financial assets | |

| 256 | | |

| 855 | | |

| 1,048 | |

| | |

| | | |

| | | |

| | |

| | |

| 480 | | |

| 328 | | |

| 829 | |

| | |

| | | |

| | | |

| | |

| Working capital adjustments: | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Decrease (increase) in other accounts receivable | |

| 242 | | |

| (684 | ) | |

| (409 | ) |

| Increase (decrease) in trade payables | |

| 362 | | |

| 48 | | |

| (397 | ) |

| Increase (decrease) in other accounts payable | |

| 68 | | |

| (40 | ) | |

| (8 | ) |

| Decrease (increase) in trade receivables | |

| 3 | | |

| 39 | | |

| 55 | |

| Decrease (increase) in inventory | |

| 327 | | |

| 8 | | |

| (74 | ) |

| | |

| | | |

| | | |

| | |

| | |

| 1,002 | | |

| (629 | ) | |

| (833 | ) |

| | |

| | | |

| | | |

| | |

| Net cash used in operating activities | |

$ | (2,197 | ) | |

$ | (3,233 | ) | |

$ | (5,887 | ) |

The accompanying notes are an integral part of

the interim consolidated financial statements.

SCISPARC LTD.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

| | |

Six months ended

June 30, | | |

Year Ended

December 31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

Unaudited | | |

Audited | |

| | |

USD in thousands | |

| | |

| | |

| | |

| |

| Cash flows from investing activities: | |

| | |

| | |

| |

| | |

| | |

| | |

| |

| Investment (withdrawal) in restricted bank deposits | |

$ | 1 | | |

$ | 16 | | |

$ | (5 | ) |

| Investment (withdrawal) in short-term bank deposits | |

| 692 | | |

| - | | |

| (3,000 | ) |

| Purchase of property and equipment | |

| (1 | ) | |

| - | | |

| - | |

| Investment in a company accounted for at equity | |

| (600 | ) | |

| (400 | ) | |

| (400 | ) |

| Investments in financial assets | |

| - | | |

| - | | |

| (689 | ) |

| Purchase of financial assets at fair value through profit or loss | |

| - | | |

| (687 | ) | |

| - | |

| | |

| | | |

| | | |

| | |

| Net cash provided by investing activities | |

| 92 | | |

| (1,071 | ) | |

| (4,094 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Proceeds from issuance of share capital and warrants (net of issuance expenses) | |

| 2,722 | | |

| (50 | ) | |

| 5,552 | |

| Repayment of lease liability | |

| (41 | ) | |

| (26 | ) | |

| (47 | ) |

| Interest paid on lease liability | |

| - | | |

| - | | |

| (7 | ) |

| Proceeds from issuance of shares to minority interests in a subsidiary | |

| - | | |

| 2,887 | | |

| 2985 | (*) |

| Loans to related parties | |

| (2,400 | ) | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | |

| Net cash provided by financing activities | |

| 281 | | |

| 2,811 | | |

| 8,483 | |

| | |

| | | |

| | | |

| | |

| Increase (decrease) in cash and cash equivalents | |

| (1,824 | ) | |

| (1,493 | ) | |

| (1,498 | ) |

| Cash and cash equivalents at the beginning of the period | |

| 2,076 | | |

| 3,574 | | |

| 3,574 | |

| | |

| | | |

| | | |

| | |

| Cash and cash equivalents at the end of the period | |

$ | 252 | | |

$ | 2,081 | | |

$ | 2,076 | |

The accompanying notes are an integral part of

the interim consolidated financial statements.

SCISPARC LTD.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

| | |

Six months ended

June 30, | | |

Year Ended

December 31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

Unaudited | | |

Audited | |

| | |

USD in thousands | |

| | |

| | |

| | |

| |

| (a) Significant non-cash transactions: | |

| | |

| | |

| |

| | |

| | |

| | |

| |

| Mutual share exchange of ordinary shares (see note 10) | |

$ | - | | |

$ | 288 | | |

$ | 288 | |

| Right-of-use asset recognized with corresponding lease liability | |

$ | - | | |

$ | - | | |

$ | 102 | |

The accompanying notes are an integral part of

the interim consolidated financial statements.

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 1:- GENERAL

| |

a. |

SciSparc Ltd. (formerly known as Therapix Biosciences Ltd.) (“SciSparc” or the “Company” or the “Group”), a specialty clinical-stage pharmaceutical company, was incorporated in Israel and commenced its operations on August 23, 2004. Until March 2014, SciSparc and its subsidiaries at the time were mainly engaged in developing several innovative immunotherapy products and SciSparc’s own patents in the immunotherapy field. In August 2015, the Company decided to adopt a different business strategy and began focusing on developing a portfolio of approved drugs based on cannabinoid molecules. With this focus, the Company is currently engaged in development programs based on Δ9-tetrahydrocannabinol (“THC”) and/or non-psychoactive cannabidiol for the treatment of Tourette syndrome, Alzheimer’s disease and agitation, autism spectrum disorder and Status Epilepticus. The headquarters of the Company are located in Tel Aviv, Israel. |

| |

|

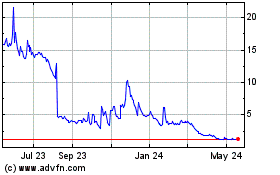

The Company’s ordinary shares are listed

on Nasdaq and are trading under the symbol “SPRC”.

As of June 30, 2024, the Company had three private

subsidiaries, including an inactive company incorporated under the laws of Israel: Evero Health Ltd (“Evero”); an inactive

company incorporated under the laws of Israel: Brain Bright Ltd (“Brain Bright”); and a company incorporated under the laws

of the State of Delaware: SciSparc Nutraceuticals Inc. (“SciSparc Nutraceuticals”) (together with Evero and Brain Bright,

the “Subsidiaries”).

On September 14, 2023, the Company’s

board of directors (the “Board”) resolved that the final ratio for the Third Reverse Split (as defined below) will be 26:1,

which became effective on September 28, 2023. Consequently, all share numbers, share prices, and exercise prices have been retroactively

adjusted in these interim consolidated financial statements for all periods presented. |

| |

b. |

These interim consolidated financial statements should be read in conjunction with the Company’s annual financial statements for the year ended December 31, 2023, and accompanying notes, that were approved on March 31, 2024, and signed on April 1, 2024 (the “2023 Annual Consolidated Financial Statements”). |

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 1:- GENERAL

(cont.)

| | c. | The Company incurred a net loss of $3,679 and had negative cash flows from operating activities of $2,197 for the six-month period ended June 30, 2024. As of June 30, 2024, the Company had an accumulated deficit of $72,133 as a result of recurring operating losses. As of June 30, 2024, the Company’s cash and cash equivalents position is not sufficient to fund the Company’s planned operations for at least a year beyond the date of the filing date of the consolidated financial statements. The Company’s pharmaceuticals operations are dependent on its ability to raise additional funds from existing and/or new investors. This dependency will continue until the Group is able to completely finance its operations by generating revenue from its pharmaceutical products. These above-mentioned factors raise substantial doubt about the Group’s ability to continue as a going concern. The Company intends to finance operating costs over the next twelve months through a combination of actions that may include existing cash on hand and issuing equity and/or debt securities. The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern, which contemplates the realization of assets and liabilities and commitments in the normal course of business. The interim consolidated financial statements for the period ended June 30, 2024, do not include any adjustments to the carrying amounts and classifications of assets and liabilities that might result should the Group be unable to continue as a going concern. |

| |

d. |

The interim consolidated financial statements of the Company for the

six-month period ended on June 30, 2024, were approved for issuance on October 22, 2024 (the “Approval Date”). In

connection with the preparation of the interim consolidated financial statements and in accordance with authoritative guidance for

subsequent events, the Company evaluated subsequent events after the consolidated statements of financial position date of June 30,

2024, through November 4, 2024, the date on which the unaudited interim consolidated financial statements were available to be

issued. |

NOTE 2:- SIGNIFICANT

ACCOUNTING POLICIES

Unaudited Interim Financial Information

The Company’s unaudited condensed

consolidated financial statements have been prepared in accordance with International Accounting Standard (“IAS”) 34, “Interim

Financial Reporting”. The significant accounting policies adopted in the preparation of the interim consolidated financial statements

are consistent with those followed in the preparation of the 2023 Annual Consolidated Financial Statements. Accordingly, these condensed

consolidated financial statements should be read in conjunction with the 2023 Annual Consolidated Financial Statements. The results for

any interim period are not necessarily indicative of results for any future period.

The unaudited condensed consolidated

financial statements have been prepared on the same basis as the audited financial statements. In the opinion of the Company’s management,

the accompanying unaudited condensed consolidated financial statements contain all adjustments that are necessary to present fairly the

Company’s financial position and results of operations for the interim periods presented. The results for the six-month period ended

June 30, 2024, are not necessarily indicative of the results for the year ending December 31, 2024, or for any future period.

As of June 30, 2024, there have been

no material changes in the Company’s significant accounting policies from those that were disclosed in the 2023 Annual Consolidated

Financial Statements.

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 3:- INVESTMENT

IN ASSOCIATE

On March 10, 2022, the Company entered

into a Founders and Investment Agreement with Dr. Alon Silberman, or the MitoCareX Agreement. Pursuant to the MitoCareX Agreement, the

Company invested an initial amount of $700, and agreed to invest over the next two years, an additional $1,000, subject to the achievement

of certain pre-determined milestones as agreed upon in the MitoCareX Agreement, for up to a 50.01% ownership in MitoCareX Bio Ltd. (“MitoCareX”).

MitoCareX is focused on the discovery and development of potential drugs for cancers and other life-threatening conditions. The MitoCareX

Agreement also contains customary representations, warranties, covenants, and indemnification provisions. On March 31, 2022, the closing

conditions were met, and the Company paid the initial investment amount of $700 to MitoCareX. As of December 31, 2022, the Company owned

31.48% of the outstanding shares of MitoCareX.

On February 17, 2023, MitoCareX achieved

its first milestone pursuant to the MitoCareX Agreement. As a result of MitoCareX meeting this milestone, the Company invested an additional

sum of $400 in MitoCareX and increased its share ownership in MitoCareX from 31.48% to 41.92%.

On November 25, 2023, MitoCareX achieved

its second milestone pursuant to the MitoCareX Agreement. As a result of MitoCareX meeting this milestone, the Company invested an additional

sum of $600 in MitoCareX and increased its share ownership in MitoCareX from 41.92% to 52.73%. Notwithstanding the above, the Company

and MitoCareX agreed for the additional $600 installment to be deferred to March 25, 2024, and the $600 installment was paid March 11,

2024.

During the six months ended June 30,

2024, and 2023, the Company recorded equity losses from the investment in MitoCareX in the amount of $185 and $98, respectively.

The table below summarizes the fair

value of the investment in MitoCareX:

| Balance at January 1, 2023 | |

$ | 591 | |

| Investment following achievement of first milestone | |

| 400 | |

| Equity losses from investment in MitoCareX | |

| (210 | ) |

| | |

| | |

| Balance at December 31, 2023 | |

| 781 | |

| | |

| | |

| Investment following achievement of second milestone | |

| 600 | |

| Equity losses from investment in MitoCareX | |

| (185 | ) |

| | |

| | |

| Balance at June 30, 2024 | |

$ | 1,196 | |

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 4:- INTANGIBLE ASSET

On September 30, 2022, the Company

announced the closing of the acquisition (“Wellution Acquisition”) of WellutionTM, an Amazon Marketplace account

and American food supplement and cosmetics brand and trademark (the “Brand”). In connection with the Wellution Acquisition,

the Company incorporated a new wholly owned Delaware subsidiary, SciSparc Nutraceuticals., to hold the new assets. The definitive agreement

for the acquisition of the Brand was entered into with Merhavit M.R.M Holding and Management Ltd (“M.R.M”).

At the closing, the Company paid a

cash payment of $4,540 and an additional $321 in purchase costs.

In addition, the Company issued to

M.R.M $15,000 worth of warrants to purchase ordinary shares of the Company at an exercise price of $7.00 per share (with a cashless exercise

mechanism) and with an exercise period of five years from the closing of the Wellution Acquisition (the “September 2022 Warrants”).

The September 2022 Warrants will become exercisable upon the earlier of (i) an achievement of $100 million of gross sales by the Brand

in the aggregate or (ii) if the price of the Company’s ordinary shares closes at $10.00 per share or above. On March 26, 2024,

M.R.M. agreed with the Company to waive all its rights under the M.R.M. Warrants and have the M.R.M. warrants cancelled for no consideration.

The Company reviewed the transaction

and deemed it to be the purchase of assets for accounting purposes under generally accepted accounting principles. The Company reviewed

the guidance under International Financial Reporting Standard (“IFRS”) 3, Business Combinations, for the transaction and determined

that the fair value of the gross assets acquired was concentrated in a single identifiable asset, a brand. Accordingly, the Company treated

the transaction as an asset acquisition. On the closing date of the Wellution Acquisition, the Company fully recognized the Wellution

Acquisition amount total of $4,861 as an intangible asset, to be amortized over a period of 10 years.

In the years ended December 31, 2022,

and 2023, the Brand recorded significant losses. As of December 31, 2023, the Company has determined there are signs of decline in the

value of the Brand and recognized a loss as a result of impairment to its intangible asset of $1,042.

The impairment loss was determined

based on the revenue projections of the Brand, using the relief from royalty approach. Under the relief from royalty approach, the fair

value of a brand is determined based on discounted future royalty payments that the owner of the asset would have been required to pay

if instead of purchasing the intangible asset it would have been licensed from a third party. Revenues were projected for a period of

8.7 years commensurate with the remaining estimated useful life of the Brand and with no terminal value. The projections were determined

based on the current period revenues, assuming a short-term growth rate that is consistent with management’s expectations that revenues

of the Brand will resume their past extent, as of the date of purchase of the Brand, a growth rate thereafter of 13.8% and a declining

growth rate for the long term, reaching 2% at the terminal year. Theoretical royalties arising from the Brand were capitalized at a discount

rate of 20.6%.

The table below

summarizes the fair value of the intangible asset:

| Balance at January 1, 2023 | |

$ | 4,717 | |

| Loss on impairment of intangible asset | |

| (1,042 | ) |

| Depreciation of intangible asset | |

| (486 | ) |

| | |

| | |

| Balance at December 31, 2023 | |

| 3,189 | |

| | |

| | |

| Depreciation of intangible asset | |

| (183 | ) |

| | |

| | |

| Balance at June 30, 2024 | |

$ | 3,006 | |

During the six months ended June 30,

2024, and 2023, the Company recorded depreciation expenses with respect to intangible asset in the amount of $183 and $ 243, respectively.

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 5:- INVESTMENT IN FINANCIAL ASSETS

Share Purchase Agreement

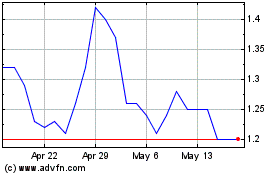

On June 25, 2023, the Company entered

into a share purchase agreement (the “Share Purchase Agreement”) with AutoMax Motors Ltd. (“AutoMax”), an Israeli

company traded on the Tel Aviv Stock Exchange (“TASE”) and the leading parallel importer and distributor of vehicles in Israel,

pursuant to which, at the closing and upon the terms and conditions set forth in the Share Purchase Agreement, the Company invested NIS

2,500 (approximately $689) in cash, in exchange for ordinary shares, NIS 0.05 par value, of AutoMax (the “AutoMax Shares”)

based on a price per share of NIS 0.5. As of June 30, 2024, the listed share price of AutoMax on the TASE was NIS 0.213, and the Company

has recorded a loss in its statements of comprehensive loss of $246 on its investment.

Bridge Loan Agreement

On January 16, 2024, the Company entered, as a lender, into an agreement (the “Bridge Loan Agreement”) with AutoMax, pursuant to which AutoMax received from the Company a bridge loan (the “Bridge Loan”) in the amount of $1,400, further to the previously announced non-binding letter of intent for the Company to acquire AutoMax (the “AutoMax Acquisition”).

The Bridge Loan Agreement states that the principal amount of the Bridge Loan will bear interest at a rate of 7% per annum (or 9% per annum if the AutoMax Acquisition is not consummated prior to the repayment date), compounded annually. The Bridge Loan amount, together with any accrued interest (the “Owed Amount”), may be repaid in part or in whole at the discretion of AutoMax prior to the repayment date. The repayment of the Owed Amount will be due at the earlier date of: (a) the consummation of the Merger (as defined below), in which the Owed Amount shall be deemed a part of, and set-off against, the financing amount the Company will provide AutoMax with upon Closing, which is expected to be $4,250; or (b) if the definitive agreement for the AutoMax Acquisition is terminated in accordance with its terms, within three months from such termination date; or (c) July 15, 2024.

On June 9, 2024, the Company entered into an amendment (the “Amendment”) to the Bridge Loan Agreement with AutoMax. Pursuant to the Amendment, the Company extended an additional loan in the amount of $1,000 to AutoMax under terms similar to the Bridge Loan Agreement, bringing the total Bridge Loan amount to $2,400. In addition, the repayment date was amended such as that the Owed Amount will be due at the earlier date of: (a) the consummation of the Merger, in which the Owed Amount shall be deemed a part of, and set-off against, the financing amount the Company will provide AutoMax with upon Closing, which is expected to be $4,250; or (b) if the definitive agreement for the AutoMax Acquisition is terminated in accordance with its terms, within three months from such termination date. As of June 30, 2024, the loan amount and accrued interest stand at $2,448.

On September 5, 2024, the Company entered into a second amendment (the “Second Amendment”) to the Bridge Loan Agreement with AutoMax. Pursuant to the Second Amendment, the Company extended an additional loan in the amount of $1,850 to AutoMax under terms similar to the Bridge Loan Agreement, bringing the total Bridge Loan amount to $4,250. In consideration for the loan amount, AutoMax established a first ranking fixed charge security interest on AutoMax’s shares of its wholly-owned subsidiary AutoMax Leasing Ltd. in favor of the Company.

Merger Agreement

On April 10, 2024, the Company entered into an Agreement and Plan of Merger, as amended (the “Merger Agreement”) with AutoMax and SciSparc Merger Sub Ltd., an Israeli limited company and wholly-owned subsidiary of the Company (“Merger Sub”). Upon the terms and subject to the satisfaction of the conditions described in the Merger Agreement, including approval of the transaction by the Company’s shareholders and AutoMax’s shareholders, Merger Sub will be merged with and into AutoMax, with AutoMax surviving the Merger as a wholly-owned subsidiary of the Company (the “Merger”) (see also note 6).

At the effective time of the Merger (the “Effective Time”, as further defined in the Merger Agreement): (a) each outstanding share of AutoMax’s share capital will be converted into the right to receive ordinary shares of the Company, equal to the exchange ratio set forth in the Merger Agreement (the “Exchange Ratio”). Under the Exchange Ratio, following the Effective Time, the former AutoMax shareholders immediately before the Merger (other than the Company) are expected to hold together approximately 47.49% (minus the Finder Fee, as defined in the Merger Agreement) of the aggregate number of the outstanding ordinary shares of the Company on fully diluted basis (subject to certain exceptions). The shareholders of the Company, together with the holders of the Company’s convertible securities, immediately before the Merger are expected to hold together approximately 52.51% of the aggregate number of the outstanding ordinary shares of the Company on fully diluted basis (subject to certain exceptions); (b) subject to the consummation of the Merger (as defined in the Merger Agreement, the “Closing”), and immediately after the Effective Time, AutoMax shall have the right to (i) designate two members to the Company’s board of directors (the “Company’s Board”) if the Company’s Board is comprised of five or six directors; or (ii) designate three members if the Company’s Board is comprised of seven directors. At least one such designee shall be an independent director, as defined under the Nasdaq Stock Market listing rules.

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 6:- TRANSACTIONS AND BALANCES WITH RELATED

PARTIES

| |

a. |

Balances with related parties: |

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

Key

management

personnel | | |

Other

related

parties | | |

Key

management

personnel | | |

Other

related

parties | |

| Current assets | |

$ | - | | |

$ | 15 | | |

$ | - | | |

$ | 121 | |

| Non-current assets | |

$ | - | | |

$ | 2,554 | (*) | |

$ | - | | |

$ | 108 | |

| Current liabilities | |

$ | 167 | | |

$ | - | | |

$ | 95 | | |

$ | - | |

| | b. | Transactions with related parties (not including amounts described in Note 6c): |

| | |

Six months ended | | |

Year ended | |

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| Research and development expenses | |

$ | 26 | | |

$ | - | | |

$ | 40 | |

| Sale of minority interest in subsidiary | |

$ | - | | |

$ | - | | |

$ | 2,985 | (*) |

| (*) | Sale of approximately 49% of the outstanding shares of Scisparc

Nutraceuticals Inc. to Jeffs’ Brands Holdings Inc. |

| | c. | Benefits to key management personnel (including directors): |

| | |

Six months ended | | |

Year ended | |

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| Short-term benefits | |

$ | 438 | | |

$ | 585 | | |

$ | 1,204 | |

| | |

| | | |

| | | |

| | |

| Management fees | |

$ | 60 | | |

$ | 80 | | |

$ | 220 | |

| | |

| | | |

| | | |

| | |

| Cost of share-based payment | |

$ | 11 | | |

$ | 54 | | |

$ | 84 | |

| | d. | On February 23, 2023, the Company entered into an agreement with Jeffs’ Brands Ltd. (“Jeffs’ Brands”) and Jeffs’ Brands Holdings Inc. (“Jeffs’ Holdings”), a newly-formed wholly owned subsidiary of Jeffs’ Brands, in which Jeffs’ Holdings acquired from the Company common stock of SciSparc Nutraceuticals equal to approximately a 49% for a cash consideration of $2,500. In consideration, the Company received from Jeffs’ Brands an additional amount accounting for certain purchase price adjustments related to inventory and working capital. Mr. Oz Adler, the Company’s Chief Executive Officer and Chief Financial Officer, is the chairman of the board of directors of Jeffs’ Brands. |

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 6:- TRANSACTIONS AND BALANCES WITH RELATED

PARTIES (cont.)

| | e. | On March 7, 2022, the Company entered into a cooperation agreement with Clearmind Medicine Inc. (“Clearmind”) in which the Company and Clearmind test and integrate their core technologies with a view to developing novel psychedelic drug candidates (the “Cooperation Agreement”). Dr. Adi Zuloff-Shani, our Chief Technologies Officer, Mr. Amitai Weiss, our President, and Mr. Adler, our Chief Executive Officer and Chief Financial Officer serve as officers and directors of Clearmind. During the six-month period ended June 30, 2024, the Company recognized expenses in respect of the Cooperation Agreement in the amount of $26. |

| | f. | Mr. Weiss, our chairman of the board of directors, is the chairman of the board of directors of AutoMax (see Note 5). |

NOTE 7:- FINANCIAL INSTRUMENTS

Classification of financial assets

and financial liabilities:

The financial assets and financial

liabilities in the consolidated statements of financial position are classified by groups of financial instruments pursuant to IFRS 9,

“Financial Instruments”:

| | |

| | |

June 30, | | |

December 31, | |

| | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

| | |

Unaudited | | |

Audited | |

| | |

Note | | |

USD in thousands | |

| | |

| | |

| | |

| | |

| |

| Financial assets: | |

| | |

| | |

| | |

| |

| Cash and cash equivalents | |

| | | |

$ | 316 | | |

$ | 2,081 | | |

$ | 2,141 | |

| Short-term deposits | |

| | | |

| 2,308 | | |

| - | | |

| 3,000 | |

| Loans to related party | |

| | | |

| 2,448 | | |

| - | | |

| - | |

| Trade receivables | |

| | | |

| 19 | | |

| 43 | | |

| 22 | |

| Government authorities | |

| | | |

| 74 | | |

| 100 | | |

| 62 | |

| Other receivables | |

| | | |

| 97 | | |

| 715 | | |

| 203 | |

| Investments in financial assets | |

| | | |

| 403 | | |

| 849 | | |

| 659 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

$ | 5,665 | | |

$ | 3,788 | | |

$ | 6,087 | |

| | |

| | | |

| | | |

| | | |

| | |

| Financial liabilities: | |

| | | |

| | | |

| | | |

| | |

| Credit from others | |

| | | |

$ | - | | |

$ | - | | |

$ | 48 | |

| Warrants liability | |

| | | |

| 345 | | |

| 1,714 | | |

| 532 | |

| Lease liability | |

| | | |

| 64 | | |

| - | | |

| 76 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total financial and lease liabilities | |

| | | |

$ | 409 | | |

$ | 1,714 | | |

$ | 656 | |

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 8:- WARRANTS

On June 1, 2022, the Company completed

a private offering with an investor for gross proceeds of $10,210 (the “June 2022 Private Placement”), providing for the issuance

of an aggregate of 136,388 units and pre-funded units, as follows: (a) 12,884 units at a price of $74.88 per unit, each consisting of

(i) one ordinary share of the Company, and (ii) two warrants each to purchase one ordinary share (the “June 2022 Warrants”),

and (b) 123,504 pre-funded units at a price of $73.294 per unit, each consisting of (i) one pre-funded warrant to purchase one ordinary

share and (ii) two June 2022 Warrants.

The June 2022 Warrants have an exercise

price of $68.38 per ordinary share. The June 2022 Warrants were exercisable upon issuance and will expire seven years from the date of

issuance.

General Overview of Valuation Approaches

used in the Valuation:

Fair value is the price that would

be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement

date.

Economic methodology:

The June 2022 Warrants’ fair

value was calculated using the Black–Scholes option pricing model, which takes into account the parameters as disclosed below for

each period valuated, in which a valuation was performed at (i) the issuance date, and (ii) each reporting date with the following assumptions:

| | |

December 31,

2023 | | |

June 30,

2024 | |

| Dividend yield (%) | |

| 0 | | |

| 0 | |

| Expected volatility (%) | |

| 72 | | |

| 72 | |

| Risk-free interest rate (%) | |

| 3.872 | | |

| 4.324 | |

| Underlying share price ($) | |

| 4.88 | | |

| 0.80 | |

| Exercise price ($) | |

| 68.38 | | |

| 68.38 | |

| Warrants fair value ($) | |

| 192 | | |

| 4 | |

The June 2022 Warrants are classified

as current warrant liability in the Company’s balance sheet, as they are exercisable at any given time.

During the six months ended June 30,

2024, and 2023, the Company recorded finance income from the change in fair value of the June 2022 Warrants in the amount of $188 and

$1,023, respectively.

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 9:- EQUITY

Reverse Share Split

On August 18, 2023, the Company convened

a general meeting of its shareholders, whereby the shareholders approved, inter alia, a reverse split of the Company’s share capital

up to a ratio of 30:1. Following the implementation of the Reverse Split, the Company’s authorized share capital was not adjusted

under the Company’s Articles, which as of the date of these financial statements consisted of 75,000,000 ordinary shares, no par

value.

On September 14, 2023, the Company’s

Board resolved that the final ratio for the Reverse Split will be 26:1, which became effective on September 28, 2023.

| | a. | Composition of share capital as of June 30, 2024, June 30, 2023, and December 31, 2023: |

| | | |

June 30, 2024 | | |

December 31, 2023 | | |

June 30, 2023 | |

| | | |

Authorized | | |

Issued and

outstanding | | |

Authorized | | |

Issued and

outstanding | | |

Authorized | | |

Issued and

outstanding | |

| | | |

Number of shares | |

| Ordinary shares, no par value | | |

| 75,000,000 | | |

| 3,586,104 | | |

| 75,000,000 | | |

| 706,683 | | |

| 75,000,000 | | |

| 282,782 | |

| |

b. |

Changes in share capital: |

Issued and outstanding share capital:

| | |

Number of

ordinary

shares | |

| Balance at January 1, 2024 | |

| 706,683 | |

| | |

| | |

| Issuance of share capital – in respect of Standby Equity Purchase Agreement (Note 6j) | |

| 980,452 | |

| | |

| | |

| Shares issued to consultants (Note 6e) | |

| 5,869 | |

| | |

| | |

| Issuance of share in respect of exercise of pre-funded October 2023 Warrants (Note 6i) | |

| 1,893,100 | |

| | |

| | |

| Balance at June 30, 2024 | |

| 3,586,104 | |

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 9:- EQUITY

(cont.)

| |

c. |

Rights attached to shares: |

Voting rights at shareholders meetings,

right to dividends, rights upon liquidation of the Company and right to nominate the directors in the Company.

| |

d. |

Capital management in the Company: |

The Company’s capital management

objectives are to preserve the Company’s ability to ensure business continuity thereby creating a return for the shareholders, investors

and other interested parties. The Company is not under any minimal equity requirements nor is it required to attain a certain level of

capital return.

| |

e. |

Additional issuance of ordinary shares: |

On February 26, 2024, the Company issued

a consultant 3,465 ordinary shares in respect of services rendered in the amount of $10.

On April 9, 2024, the Company issued

2,404 ordinary shares to two consultants in respect of services rendered in the amount of $7.

| |

f. |

March 2021 Financing Round |

On March 4, 2021, the Company completed

a private offering with several accredited and institutional investors for gross proceeds of $8,150, providing for the issuance of an

aggregate of 44,331 units, as follows: (a) 35,242 units at a price of $183,82 per unit, consisting of (i) one ordinary share of the Company,

and (ii) a Series A Warrant to purchase an equal number of units purchased (the “2021 Series A Warrants”) and a Series B Warrant

(the “2021 Series B Warrants” and, collectively with the 2021 Series A Warrants, the “March 2021 Warrants) to purchase

half the number of units, and (b) 9,089 pre-funded units at a price of $183.794 per unit, consisting of (i) one pre-funded warrant to

purchase one ordinary share and (ii) one 2021 Series A Warrant and one 2021 Series B Warrant.

The Series A Warrants have an exercise

price of $183.82 per ordinary share and the Series B Warrants have an exercise price of $275.60 per ordinary share).

Both were exercisable upon issuance and will expire five years from the date of issuance.

The March 2021 Warrants are classified

as issued warrants in the Company’s equity.

During the six-month period ended June

30, 2024, and the year ended December 31, 2023, there were no exercises of the 2021 Series A Warrants.

| |

g. |

June 2022 Financing Round (see also note 8) |

On June 1, 2022, the Company completed

the June 2022 Private Placement with an investor for gross proceeds of $10,210, providing for the issuance of an aggregate of 136,388

units and pre-funded units, as follows: (a) 12,884 units at a price of $74.88 per unit, each consisting of (i) one ordinary share of the

Company, and (ii) two warrants each to purchase one ordinary share (the “June 2022 Warrants”), and (b) 123,504 pre-funded

units at a price of $73.294 per unit, each consisting of (i) one pre-funded warrant to purchase one ordinary share and (ii) two June 2022

Warrants.

The June 2022 Warrants have an exercise

price of $68.38 per ordinary share. The June 2022 Warrants were exercisable upon issuance and will expire seven years from the

date of issuance.

The June 2022 Warrants are classified

as current warrant liability in the Company’s balance sheet, as they are exercisable at any given time.

During the six-month period ended June

30, 2024, and the year ended December 31, 2023, there were no exercises of the June 2022 Warrants.

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 9:- EQUITY (cont.)

| |

h. |

August 2023 Financing Round |

On August 14, 2023, the Company closed

an underwritten public offering (the “2023 Public Offering”) of 212,500 ordinary shares, at a purchase price of $5.20 per

ordinary share, and pre-funded warrants to purchase up to 37,500 ordinary shares at a purchase price of $5.174 per pre-funded warrant,

for aggregate gross proceeds of approximately $1,300, pursuant to an underwriting agreement between the Company and Aegis Capital Corp,

the underwriter in the 2023 Public Offering, dated August 10, 2023. Pursuant to the terms of the underwriting agreement, the Company also

granted the underwriter a 45-day option to purchase up to an additional 37,500 ordinary shares solely to cover over-allotments. This 45-day

option was not exercised.

| |

i. |

October 2023 Financing Round |

On October 13, 2023, the Company announced

the closing of a private placement with an institutional investor with gross cash proceeds to the Company of approximately $5,026, before

deducting fees related to the placement agent and other offering expenses payable by the Company.

In connection with the private placement,

the Company issued an aggregate of 1,930,108 units, each unit consisting of two pre-funded warrants (the “October 2023 Warrants”).

The October 2023 Warrants have an exercise price of $0.001, are immediately exercisable upon issuance and have a term of five years from

the date of issuance.

During the six-month period ended June

30, 2024, 1,893,100 ordinary shares were issued in respect to the exercise of 1,893,100 October 2023 Warrants.

During the period between July 1, 2024,

and through to the date of this report, 1,784,211 ordinary shares were issued in respect to the exercise of 1,784,211 October 2023 Warrants.

As of the date of these financial statements, there are no outstanding October 2023 Warrants.

| |

j. |

January 2024 Standby Equity Purchase Agreement |

On January 21, 2024, the Company entered

into a Standby Equity Purchase Agreement (“SEPA”), as amended on February 26, 2024, with YA II PN, LTD. (“YA”),

which provided for the sale of up to $20,000 of the Company’s Ordinary Shares (the “Advance Shares”). As of June 30,

2024, of the $20,000 eligible to be sold pursuant to the SEPA (the “Commitment Amount”), the Company has sold 925,159 ordinary

shares. The Advance Shares to be purchased or purchased by YA pursuant to the SEPA are for a share price equal to 97% of the market price,

which is defined as the lowest daily volume weighted average price of the Ordinary Shares during the three consecutive trading days commencing

on the trading day immediately following the delivery of an advance notice to YA.

In connection with the SEPA, the Company

may request pre-paid advances of the Commitment Amount, in an amount up to $5,000 (each a “Pre-Paid Advance”). Each Pre-Paid

Advance will be evidenced by a promissory note (each a “Promissory Note”). Each Promissory Note will fully mature 24 months

following its issuance and shall accrue interest on the outstanding principal balance thereon at a rate of 5% per annum, increasing to

18% per annum upon an Event of Default (as defined in the Promissory Note). Beginning 150 days after the issuance of a Promissory Note,

the Company shall pay to YA a monthly installment payment of 10% of the original principal amount of the Promissory Note and accrued interest,

payable in cash or by submitting an advance notice, where YA will offset the amount due to be paid to the Company under such notice against

an equal amount of the monthly installment amount, at the Company’s option. If the Company elects to pay in cash, the installment

amount shall also include a payment premium in the amount of 5% of the principal amount of the installment payment. The Promissory Note

contains the Company’s customary representations and warranties and events of default.

In addition, pursuant to the SEPA,

the Company issued to YA an aggregate of 55,293 of its Ordinary Shares in satisfaction of payment of the commitment fee of $200.

YA will pay all brokerage fees and

commissions and similar expenses in connection with the offer and sale of Ordinary Shares by YA pursuant to the SEPA. The Company will

pay the expenses (except brokerage fees and commissions and similar expenses) incurred and register pursuant to the Securities Act of

1933, as amended, the offer and sale of the Ordinary Shares pursuant to the SEPA by YA. See also note 11b.

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 10:-

ADDITIONAL INFORMATION TO THE ITEMS OF PROFIT OR LOSS

| | |

Six months ended

June 30, | | |

Year Ended

December 31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

Unaudited | | |

Audited | |

| | |

USD in thousands | |

| a. Research and development expenses: | |

| | |

| | |

| |

| | |

| | |

| | |

| |

| Wages and related expenses | |

$ | 224 | | |

$ | 202 | | |

$ | 392 | |

| Share-based payment | |

| 8 | | |

| 23 | | |

| 34 | |

| Clinical studies | |

| 117 | | |

| 145 | | |

| 254 | |

| Regulatory, professional and other expenses | |

| 386 | | |

| 366 | | |

| 719 | |

| Research and preclinical studies | |

| 100 | | |

| 45 | | |

| 101 | |

| Chemistry and formulations | |

| 6 | | |

| - | | |

| 141 | |

| | |

| | | |

| | | |

| | |

| | |

| 841 | | |

| 781 | | |

| 1,641 | |

| | |

| | | |

| | | |

| | |

| b. General and administrative expenses: | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Wages and related expenses | |

| 311 | | |

| 217 | | |

| 415 | |

| Share-based payment | |

| 8 | | |

| 45 | | |

| 68 | |

| Professional and directors’ fees | |

| 1,670 | | |

| 1,366 | | |

| 2,594 | |

| Business development expenses | |

| 53 | | |

| 38 | | |

| 86 | |

| Office maintenance, rent and other expenses | |

| 68 | | |

| 48 | | |

| 110 | |

| Investor relations and business expenses | |

| 57 | | |

| 310 | | |

| 369 | |

| Wellution operating expenses | |

| 101 | | |

| 107 | | |

| 145 | |

| Amazon fees | |

| 297 | | |

| 686 | | |

| 1,042 | |

| Regulatory expenses | |

| 67 | | |

| 104 | | |

| 202 | |

| | |

| | | |

| | | |

| | |

| | |

$ | 2,632 | | |

$ | 2,921 | | |

| 5,031 | |

SCISPARC LTD.

NOTES TO

INTERIM CONSOLIDATED FINANCIAL STATEMENTS (USD in thousands, except per share and per unit amounts)

NOTE 11:-

EVENTS AFTER THE REPORTING PERIOD

| | a. | On July 8, 2024, the Company announced that it signed a non-binding letter of intent (the “LOI”) to spin off its advanced clinical stage pharmaceutical portfolio and its equity stake in SciSparc Nutraceuticals Inc. (collectively, the “Target Assets”). The LOI references a proposed asset and share purchase agreement (the “Asset and Share Purchase Agreement”), the definitive agreement of which is to be negotiated between the Company and Miza III Ventures Inc. (“Miza”) (TSXV: MIZA.P), a publicly traded company on the Toronto Stock Exchange Venture in Canada. The Asset and Share Purchase Agreement is based on the approximate total USD 3.3 million (CAD 4.5 million) enterprise value of Miza, when including its $1,000 cash position, and an approximate $11,600 (CAD 15.8 million) value of SciSparc’s assets. Pursuant to the LOI, SciSparc will sell,

assign, convey and transfer to Miza the Target Assets in consideration for 63,300,000 common shares of Miza and up to 48,000,000 Miza

contingent rights based on pre-determined milestones. Following the closing of such transaction, SciSparc would hold a controlling interest

in Miza, the exact percentage of which is contingent on agreeing definitive terms between the parties. The resulting entity, of which

SciSparc will hold a stake in the resulting entity ranging from a minimum of approximately 75% to a maximum of 84.53%, will be active

in both the pharmaceutical and supplement sectors. |

| | | |

| | b. | From July 16, 2024, through September 17,

2024, the Company has sold 4,817,626 ordinary shares in respect of the SEPA for proceeds of $3,576. |

| | | |

| | c. | On August 13, 2024, the Company entered into

an exclusive patent license agreement (the “License Agreement”) for the out-licensing of its SCI-160 program (the “Assets”)

with Polyrizon Ltd. (the “Licensee”). According to the License Agreement, SciSparc granted the Licensee a royalty-bearing,

exclusive, sub-licensable right and license to the Assets (the “License”). In consideration for the License, the Company

received and will receive certain shares of the Licensee, reflecting an issue price of $3,000, and royalties from sales related

to and income generated from the Assets. Further, the Licensee will pay SciSparc pre-determined fees upon the completion of certain development

milestones relating to the Assets. |

| | | |

| | d. | On September 26, 2024, the Company signed

a non-binding letter of intent (“LOI”) to sell its entire ownership interest in MitoCareX to a publicly-traded company in

the United States (“the Purchaser”). SciSparc currently owns 52.73% of the issued and outstanding share capital of MitoCareX.

Pursuant to the terms of the LOI, initially, in exchange for transferring and selling to the Purchaser a number of ordinary shares of

MitoCareX that constitute 27% of the Company’s ownership in MitoCareX, SciSparc will receive in cash consideration of $700. Subsequent

to this first phase, SciSparc will transfer to the Purchaser the remaining 73% of its ownership stake in MitoCareX in exchange for a

certain number of shares based on the valuation of the Purchaser equal to $8,000 and a valuation of MitoCareX equal to $5,000 (the latter

of which includes the $700 in cash consideration for SciSparc’s shares described above). The LOI also includes provisions for additional

milestones that, upon achievement, could increase the consideration paid by the Purchaser to SciSparc from $5,000 to $7,000. The details

of the full terms of this transaction are subject to negotiation and execution of definitive agreements. |

23

18382

false

--12-31

Q2

2024-06-30

0001611746

0001611746

2024-01-01

2024-06-30

0001611746

2024-06-30

0001611746

2023-06-30

0001611746

2023-12-31

0001611746

2023-01-01

2023-06-30

0001611746

2023-01-01

2023-12-31

0001611746

ifrs-full:SharePremiumMember

2023-12-31

0001611746

ifrs-full:ReserveOfSharebasedPaymentsMember

2023-12-31

0001611746

ifrs-full:WarrantsMember

2023-12-31

0001611746

ifrs-full:OtherEquityInterestMember

2023-12-31

0001611746

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2023-12-31

0001611746

ifrs-full:RetainedEarningsMember

2023-12-31

0001611746

ifrs-full:ParentMember

2023-12-31

0001611746

ifrs-full:NoncontrollingInterestsMember

2023-12-31

0001611746

ifrs-full:SharePremiumMember

2024-01-01

2024-06-30

0001611746

ifrs-full:ReserveOfSharebasedPaymentsMember

2024-01-01

2024-06-30

0001611746

ifrs-full:WarrantsMember

2024-01-01

2024-06-30

0001611746

ifrs-full:OtherEquityInterestMember

2024-01-01

2024-06-30

0001611746

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2024-01-01

2024-06-30

0001611746

ifrs-full:RetainedEarningsMember

2024-01-01

2024-06-30

0001611746

ifrs-full:ParentMember

2024-01-01

2024-06-30

0001611746

ifrs-full:NoncontrollingInterestsMember

2024-01-01

2024-06-30

0001611746

ifrs-full:SharePremiumMember

2024-06-30

0001611746

ifrs-full:ReserveOfSharebasedPaymentsMember

2024-06-30

0001611746

ifrs-full:WarrantsMember

2024-06-30

0001611746

ifrs-full:OtherEquityInterestMember

2024-06-30

0001611746

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2024-06-30

0001611746

ifrs-full:RetainedEarningsMember

2024-06-30

0001611746

ifrs-full:ParentMember

2024-06-30

0001611746

ifrs-full:NoncontrollingInterestsMember

2024-06-30

0001611746

ifrs-full:SharePremiumMember

2022-12-31

0001611746

ifrs-full:ReserveOfSharebasedPaymentsMember

2022-12-31

0001611746

ifrs-full:WarrantsMember

2022-12-31

0001611746

ifrs-full:OtherEquityInterestMember

2022-12-31

0001611746

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2022-12-31

0001611746

ifrs-full:RetainedEarningsMember

2022-12-31

0001611746

ifrs-full:ParentMember

2022-12-31

0001611746

ifrs-full:NoncontrollingInterestsMember

2022-12-31

0001611746

2022-12-31

0001611746

ifrs-full:SharePremiumMember

2023-01-01

2023-06-30

0001611746

ifrs-full:ReserveOfSharebasedPaymentsMember

2023-01-01

2023-06-30

0001611746

ifrs-full:WarrantsMember

2023-01-01

2023-06-30

0001611746

ifrs-full:OtherEquityInterestMember

2023-01-01

2023-06-30

0001611746

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2023-01-01

2023-06-30

0001611746

ifrs-full:RetainedEarningsMember

2023-01-01

2023-06-30

0001611746

ifrs-full:ParentMember

2023-01-01

2023-06-30

0001611746

ifrs-full:NoncontrollingInterestsMember

2023-01-01

2023-06-30

0001611746

ifrs-full:SharePremiumMember

2023-06-30

0001611746

ifrs-full:ReserveOfSharebasedPaymentsMember

2023-06-30

0001611746

ifrs-full:WarrantsMember

2023-06-30

0001611746

ifrs-full:OtherEquityInterestMember

2023-06-30

0001611746

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2023-06-30

0001611746

ifrs-full:RetainedEarningsMember

2023-06-30

0001611746

ifrs-full:ParentMember

2023-06-30

0001611746

ifrs-full:NoncontrollingInterestsMember

2023-06-30

0001611746

ifrs-full:SharePremiumMember

2023-01-01

2023-12-31

0001611746

ifrs-full:ReserveOfSharebasedPaymentsMember

2023-01-01

2023-12-31

0001611746

ifrs-full:WarrantsMember

2023-01-01

2023-12-31

0001611746

ifrs-full:OtherEquityInterestMember

2023-01-01

2023-12-31

0001611746

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2023-01-01

2023-12-31

0001611746

ifrs-full:RetainedEarningsMember

2023-01-01

2023-12-31

0001611746

ifrs-full:ParentMember

2023-01-01

2023-12-31

0001611746

ifrs-full:NoncontrollingInterestsMember

2023-01-01

2023-12-31

0001611746

sprcy:EveroHealthLtdMember

2024-01-01

2024-06-30

0001611746

2022-03-10

2022-03-10

0001611746

sprcy:MitoCareXBioLtdMember

2022-03-10

2022-03-10

0001611746

sprcy:MitoCareXMember

2022-03-31

2022-03-31

0001611746

sprcy:MitoCareXMember

2022-01-01

2022-12-31

0001611746

sprcy:MitoCareXMember

2023-02-17

2023-02-17

0001611746

sprcy:MitoCareXBioLtdMember

ifrs-full:BottomOfRangeMember

2023-02-17

2023-02-17

0001611746

sprcy:MitoCareXBioLtdMember

ifrs-full:TopOfRangeMember

2023-02-17

2023-02-17

0001611746

sprcy:MitoCareXMember

2023-11-25

2023-11-25

0001611746

ifrs-full:BottomOfRangeMember

2023-11-25

2023-11-25

0001611746

ifrs-full:TopOfRangeMember

2023-11-25

2023-11-25

0001611746

2023-11-25

2023-11-25

0001611746

2024-03-11

2024-03-11

0001611746

2022-09-30

2022-09-30

0001611746

2023-12-31

2023-12-31

0001611746

ifrs-full:OtherIntangibleAssetsMember

2024-01-01

2024-06-30

0001611746

ifrs-full:OtherIntangibleAssetsMember

2023-01-01

2023-06-30

0001611746

currency:ILS

2023-06-25

0001611746

2023-06-25

0001611746

sprcy:AutoMaxMotorsLtdMember

2023-06-25

0001611746

sprcy:BridgeLoansMember

2024-01-16

0001611746

sprcy:BridgeLoansMember

2024-06-30

0001611746

sprcy:AutoMaxAcquisitionMember

2024-06-30

0001611746

sprcy:AutoMaxMember

2024-01-01

2024-06-30

0001611746

2024-06-09

2024-06-09

0001611746

sprcy:BridgeLoansMember

2024-06-09

2024-06-09

0001611746

sprcy:ScenarioForecastsMember

2024-09-05

2024-09-05

0001611746

sprcy:BridgeLoansMember

sprcy:ScenarioForecastsMember

2024-09-05

2024-09-05

0001611746

2023-02-23

2023-02-23

0001611746

ifrs-full:KeyManagementPersonnelOfEntityOrParentMember

2024-06-30

0001611746

ifrs-full:OtherRelatedPartiesMember

2024-06-30

0001611746

ifrs-full:KeyManagementPersonnelOfEntityOrParentMember

2023-12-31

0001611746

ifrs-full:OtherRelatedPartiesMember

2023-12-31

0001611746

sprcy:TransactionsWithRelatedPartiesMember

2024-01-01

2024-06-30

0001611746

sprcy:TransactionsWithRelatedPartiesMember

2023-01-01

2023-12-31

0001611746

2022-06-01

2022-06-01

0001611746

ifrs-full:WarrantsMember

2022-06-01

2022-06-01

0001611746

2022-06-30

0001611746

2023-07-01

2023-12-31

0001611746

2023-08-18

2023-08-18

0001611746

2023-08-18

0001611746

2024-02-26

2024-02-26

0001611746

2024-04-09

2024-04-09

0001611746

2021-03-04

2021-03-04

0001611746

2021-03-04

0001611746

sprcy:PrefundedWarrantsMember

2021-03-04

0001611746

sprcy:SeriesAWarrantsMember

2024-01-01

2024-06-30

0001611746

sprcy:SeriesBWarrantsMember

2024-01-01

2024-06-30

0001611746

2022-06-01

0001611746

sprcy:PrefundedWarrantsMember

2022-06-01

0001611746

sprcy:June2022WarrantsMember

2022-06-30

0001611746

2023-08-14

2023-08-14

0001611746

sprcy:PrefundedWarrantsMember

2023-08-14

2023-08-14

0001611746

sprcy:OverAllotmentMember

2023-08-14

2023-08-14

0001611746

2023-10-13

2023-10-13

0001611746