Talis Biomedical Corporation (Nasdaq: TLIS), a diagnostic company

dedicated to advancing health equity and outcomes through the

delivery of accurate infectious disease testing in the moment of

need, at the point of care, today announced it has initiated a

process to explore strategic alternatives with the goal of

maximizing shareholder value. While the Company has made progress

developing the Talis One® system, it believes that this is a

prudent path forward given current market conditions.

As part of this process, the Company’s Board of Directors has

appointed a special committee of independent, disinterested

directors to consider a wide range of strategic alternatives,

including, but not limited to, equity or debt financing

alternatives, an acquisition, merger, reverse merger, divestiture

of assets, licensing or other strategic transactions. The Company

has engaged TD Cowen to act as a financial advisor in its review of

strategic alternatives. Seyfarth Shaw has been appointed as legal

advisor to the review process.

In connection with the evaluation of strategic alternatives and

to preserve cash, Talis Biomedical is reducing its workforce by

approximately 90 percent and consolidating operations to a single

site in Chicago. Further to these actions, the Company will be

implementing additional cost-saving measures to lower cash

burn.

There can be no assurance that the ongoing strategic review will

result in Talis Biomedical entering into any transaction or that

any transaction will be completed on attractive terms. The Company

has not set a timetable for completion of the strategic process and

does not intend to provide progress updates unless and until it is

determined that further disclosure is appropriate or necessary.

Third Quarter 2023 Financial Results Revenue

was $0.1 million for the third quarter of 2023, compared to $0.8

million for the same period in 2022.

Operating expenses were $17.1 million in the third quarter of

2023, compared to $27.6 million for the same period in 2022. The

decrease was primarily driven by a decline in depreciation expense,

lower investments in raw card inventory and manufacturing as well

as the realization of benefits from the cost reduction measures

implemented during 2022.

Net loss was $15.7 million for the third quarter of 2023,

compared to $26.0 million for the same period in 2022.

Cash and cash equivalents as of September 30, 2023, were $88.0

million.

Due to its exploration of strategic alternatives, Talis

Biomedical will not host a conference call to discuss third quarter

results. For further detail and discussion of the Company’s

financial performance, please refer to the company’s Quarterly

Report on Form 10-Q for the third quarter ended September 30,

2023.

About the Talis One SystemThe Talis One system

is a compact, sample-to-answer molecular testing platform designed

to enable rapid, highly accurate point-of care infectious disease

testing in non-laboratory settings. The Talis One test cartridge is

a fully self-contained, closed device that includes all the

necessary reagents to perform a Talis One test. When loaded into

the Talis One instrument, each cartridge fully automates sample

lysis, nucleic acid extraction and purification, isothermal

amplification, and target detection. The Talis One test system is

not authorized, cleared, or approved by the FDA and is not

available for sale.

About Talis BiomedicalTalis Biomedical is

dedicated to advancing health equity and outcomes through the

delivery of accurate infectious disease testing in the moment of

need, at the point of care. The Company plans to develop and

commercialize innovative products on its sample-to-answer Talis

One® system to enable accurate, low cost, and rapid molecular

testing. For more information, visit talisbio.com.

Forward-Looking Statements This press release

may contain forward-looking statements within the meaning of The

Private Securities Litigation Reform Act of 1995. Words such as

“may,” “might,” “will,” “would,” “should,” “believe,” “expect,”

“anticipate,” “could,” “estimate,” “continue,” “predict,”

“potential,” “forecast,” “project,” “plan,” “intend” or similar

expressions, or other words that convey uncertainty of future

events or outcomes can be used to identify these forward-looking

statements. Forward-looking statements include statements regarding

our intentions, beliefs, projections, outlook, analyses or current

expectations concerning, among other things: the possibility that

no strategic alternatives will be available to us and that our

stockholders will not realize any value in our shares; our future

revenue growth and profit margins; and our ability to lower our

cash burn, extend operations and extend our cash runway. These

statements are not guarantees of future performance and are subject

to certain risks, uncertainties and other factors that could cause

actual results and events to differ materially and adversely from

those indicated by such forward-looking statements including, among

others: the risk that exploration of strategic alternatives may not

result in any definitive transaction or enhance stockholder value

and may create a distraction or uncertainty that may adversely

affect our operating results, business, or investor perceptions;

expectations regarding future costs and expenses; the uncertainty

about the paths of our programs and our ability to evaluate and

identify a path forward for those programs, particularly given the

constraints we have as a small company with limited financial,

personnel and other operating resources (including with respect to

the allocation of our limited capital and the sufficiency of our

capital in the near term for any path we do select). These and

other risks and uncertainties are described more fully in the “Risk

Factors” section and elsewhere in our filings with the Securities

and Exchange Commission and available at www.sec.gov, including in

our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

These statements are based upon information available to us as of

the date of this press release, and while we believe such

information forms a reasonable basis for such statements, such

information may be limited or incomplete, and our statements should

not be read to indicate that we have conducted an exhaustive

inquiry into, or review of, all potentially available relevant

information. These statements are inherently uncertain and

investors are cautioned not to unduly rely upon these statements.

Any forward-looking statements that we make in this announcement

speak only as of the date of this press release, and Talis assumes

no obligation to updates forward-looking statements whether as a

result of new information, future events or otherwise after the

date of this press release, except as required under applicable

law.

Contact Media & InvestorsEmily

Faucetteefaucette@talisbio.com415-595-9407

Talis Biomedical

Corporation Condensed Balance

Sheets (in thousands)

|

|

|

September 30 |

|

December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

(unaudited) |

|

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

87,996 |

|

|

$ |

130,191 |

|

|

Accounts receivable, net |

|

|

5 |

|

|

|

308 |

|

|

Prepaid expenses and other current assets |

|

|

1,531 |

|

|

|

2,783 |

|

|

Total current assets |

|

|

89,532 |

|

|

|

133,282 |

|

| Property and equipment, net |

|

|

3,332 |

|

|

|

3,312 |

|

| Operating lease

right-of-use-assets |

|

|

12,822 |

|

|

|

30,920 |

|

| Other long-term assets |

|

|

1,542 |

|

|

|

1,776 |

|

|

Total assets |

|

$ |

107,228 |

|

|

$ |

169,290 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

2,697 |

|

|

$ |

3,768 |

|

|

Accrued compensation |

|

|

2,255 |

|

|

|

4,212 |

|

|

Accrued liabilities |

|

|

637 |

|

|

|

989 |

|

|

Operating lease liabilities, current portion |

|

|

2,861 |

|

|

|

3,703 |

|

|

Total current liabilities |

|

|

8,450 |

|

|

|

12,672 |

|

| Operating lease liabilities,

long-term portion |

|

|

17,222 |

|

|

|

29,879 |

|

|

Total liabilities |

|

$ |

25,672 |

|

|

$ |

42,551 |

|

| Stockholders’ equity: |

|

|

|

|

|

Series 1 convertible preferred stock |

|

|

3 |

|

|

|

3 |

|

|

Common Stock |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

608,054 |

|

|

|

604,690 |

|

|

Accumulated deficit |

|

|

(526,501 |

) |

|

|

(477,954 |

) |

|

Total stockholders’ equity |

|

|

81,556 |

|

|

|

126,739 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

107,228 |

|

|

$ |

169,290 |

|

|

|

Talis Biomedical

Corporation Condensed Statements of

Operations and Comprehensive Loss (Unaudited)(in

thousands)

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

Grant revenue |

|

$ |

64 |

|

|

$ |

66 |

|

|

$ |

1,678 |

|

|

$ |

1,010 |

|

|

Product revenue, net |

|

|

76 |

|

|

|

730 |

|

|

|

261 |

|

|

|

3,545 |

|

|

Total revenue, net |

|

|

140 |

|

|

|

796 |

|

|

|

1,939 |

|

|

|

4,555 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Cost of products sold |

|

|

6 |

|

|

|

1,236 |

|

|

|

33 |

|

|

|

6,059 |

|

|

Research and development |

|

|

8,302 |

|

|

|

17,521 |

|

|

|

32,653 |

|

|

|

55,589 |

|

|

Selling, general and administrative |

|

|

8,803 |

|

|

|

8,825 |

|

|

|

21,612 |

|

|

|

29,933 |

|

|

Total operating expenses |

|

|

17,111 |

|

|

|

27,582 |

|

|

|

54,298 |

|

|

|

91,581 |

|

| Loss from operations |

|

|

(16,971 |

) |

|

|

(26,786 |

) |

|

|

(52,359 |

) |

|

|

(87,026 |

) |

| Other income, net |

|

|

1,289 |

|

|

|

765 |

|

|

|

3,812 |

|

|

|

943 |

|

| Net loss and comprehensive

loss |

|

$ |

(15,682 |

) |

|

$ |

(26,021 |

) |

|

$ |

(48,547 |

) |

|

$ |

(86,083 |

) |

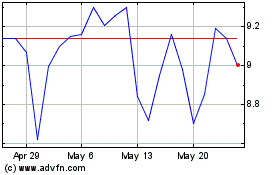

Talis Biomedical (NASDAQ:TLIS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Talis Biomedical (NASDAQ:TLIS)

Historical Stock Chart

From Jan 2024 to Jan 2025