180 Degree Capital Corp. Reports Net Asset Value Per Share of $2.68 as of September 30, 2017; Third Consecutive Quarter of N...

November 01 2017 - 3:30PM

180 Degree Capital Corp. (NASDAQ:TURN) (“180” and the “Company”),

today reported its financial results as of September 30,

2017. Key results include:

- Increases in stock price, net asset value per share (NAV) and

cash + liquid securities:

- Stock Price: $1.62 -> $1.74 (+7.4%)

- NAV/Share: $2.44 -> $2.68 (+9.8%)

- First time in over 7 years that our NAV/share increased

in three consecutive quarters

- Cash + Liquid Securities: $22.6mm -> $30.0mm

(+32.7%)

- Overall positive performance of investment portfolio

- Publicly traded position net change in value: $7.8 million

- Privately held position net change in value: $1.0

million

- Establishing resources for future growth of the Company

- Hired head of fund development

- Initiated process to establish wholly owned broker dealer

subsidiary

The Company also published a letter to

shareholders that can be viewed at

http://ir.180degreecapital.com/letters.cfm.

“We are pleased to report the results from this

quarter, particularly the meaningful increase in our NAV,” said

Kevin M. Rendino, Chairman and Chief Executive Officer of

180. “This is the first time in over seven years that we have

increased our NAV in three consecutive quarters. Our new

structure allowed us to reduce our ongoing run-rate of expenses by

over 40%; we now have an easier path to grow NAV. This

quarter, nearly 90% of the growth of our NAV came from our publicly

traded holdings. In fact, on average, our publicly traded

holdings increased by an average of 44% in the quarter. We

remain focused on increasing our liquid assets as a percentage of

our net assets. At quarter end, our cash and liquid

securities totaled $30 million, equating to 36% of our quarter

ending net assets. Relative to our quarter end stock price of

$1.74, our liquid assets represented over half of our market

capitalization. We are proud to share these results and

believe we are well positioned to continue to build value for

shareholders.”

Mr. Rendino and Daniel Wolfe, President, Chief

Financial Officer and Portfolio Manager, will host a conference

call tomorrow, Thursday, November 2, 2017, at 9am Eastern Time, to

discuss the results from the third quarter of 2017. The call

can be accessed by phone at (641) 715-0632 passcode 415049 or via

the web at join.freeconferencecall.com/daniel8166.

Additionally, slides that will be referred to during the

presentation can be found on 180’s investor relations website at

ir.180degreecapital.com under the menu option, Calendar of

Events.

About 180 Degree Capital

Corp.

180 Degree Capital Corp. is a publicly traded

registered closed-end fund focused on investing in and providing

value-added assistance through constructive activism to what we

believe are substantially undervalued small, publicly traded

companies that have potential for significant turnarounds.

Our goal is that the result of our constructive activism leads to a

reversal in direction for the share price of these investee

companies, i.e., a 180-degree turn. Detailed information

about 180 and its holdings can be found on its website at

www.180degreecapital.com.

Press Contact:Daniel B. Wolfe180 Degree Capital

Corp.973-746-4500

Forward-Looking Statements

This press release may contain statements of a

forward-looking nature relating to future events. These

forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These

statements reflect the Company's current beliefs, and a number of

important factors could cause actual results to differ materially

from those expressed in this press release. Please see the

Company's securities filings filed with the Securities and Exchange

Commission for a more detailed discussion of the risks and

uncertainties associated with the Company's business and other

significant factors that could affect the Company's actual results.

Except as otherwise required by Federal securities laws, the

Company undertakes no obligation to update or revise these

forward-looking statements to reflect new events or uncertainties.

The reference and link to the website www.180degreecapital.com has

been provided as a convenience, and the information contained on

such website is not incorporated by reference into this press

release. 180 is not responsible for the contents of third party

websites.

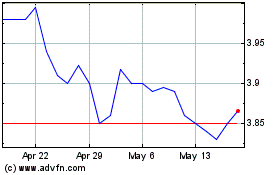

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Oct 2024 to Oct 2024

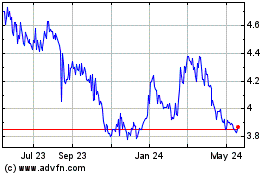

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Oct 2023 to Oct 2024