180 Degree Capital Corp. Notes Average Discount of Net Asset Value Per Share to Stock Price for Ninth Month of Initial Measurement Period of Its Discount Management Program

October 01 2024 - 8:00AM

180 Degree Capital Corp. (“180 Degree Capital”) (NASDAQ: TURN),

noted today that the average discount between its estimated daily

net asset value per share (“NAV”) and its daily closing stock price

during September 2024 and year-to-date through the end of September

2024, were approximately 21% and 20%, respectively.1 This discount

was approximately 24% on September 30, 2024.

As previously disclosed in a press release on

November 13, 2023, 180 Degree Capital’s Board of Directors (the

“Board”) has set two measurement periods of 1) January 1, 2024 to

December 31, 2024, and 2) January 1, 2025 to June 30, 2025, in

which it will evaluate the average discount between TURN’s

estimated daily NAV and its closing stock price pursuant to a

Discount Management Program. Should TURN’s common stock trade at an

average daily discount to NAV of more than 12% during either of

these measurement periods, the Board will consider all available

options at the end of each measurement period including, but not

limited to, a significant expansion of 180 Degree Capital’s current

stock buyback program of up to $5 million, cash distributions

reflecting a return of capital to shareholders, or a tender offer.

We currently believe that any option and amount selected by the

Board will be chosen carefully to not jeopardize the long-term

potential of TURN to create value by requiring the monetization of

a significant portion of TURN’s portfolio at historically low stock

prices.

“We believe that what we stated in our press

release at the beginning of September remains true today,” said

Kevin M. Rendino, Chief Executive Officer of 180 Degree Capital.

“We believe the sentiment towards small capitalization stocks has

started to shift, in part, as a result of the first reduction in

interest rates by the Fed in over two years. This action, coupled

with improvements in cyclical industries that are sensitive to

interest rates and the realization that a soft landing is indeed

possible should accrue to the benefit of companies such as those we

own. We continue to believe that our current discount to NAV is

wholly inconsistent with what we believe is the potential upside

within our existing portfolio as well as our actual NAV. We have

spent a lot of time evaluating options related to the Discount

Management Program, as well as other additional paths designed to

increase shareholder value. We appreciate the perspectives provided

by our stockholders, particularly our long-term shareholders, and

are committed to approaching our decisions with shareholder

interests as our number one priority. While we do not have anything

to announce on this front as of today, do not let that give you the

impression we are sitting idle. We are actively evaluating

potential actions to take regarding the Discount Management

Program, as well as other ways of potentially building stockholder

value.”

Daniel B. Wolfe, President of 180 Degree

Capital, added, “We continue to greatly appreciate the support of

our largest and long-term investors. To be clear, the Board has not

decided about ending the first measurement period early, and/or if

it decides to do so, what steps might be taken amongst those

mentioned previously or other available alternatives. Any decisions

made will be made by the Board in order to serve the best interests

of all shareholders of TURN, which is why we appreciate the

thoughts and feedback Kevin mentioned above. We remain laser

focused on taking steps that we believe will lead to the creation

of value for all shareholders, whether that be through growth of

net assets, the Discount Management Program, or other strategic

efforts.”

About 180 Degree Capital

Corp.

180 Degree Capital Corp. is a publicly traded

registered closed-end fund focused on investing in and providing

value-added assistance through constructive activism to what we

believe are substantially undervalued small, publicly traded

companies that have potential for significant turnarounds. Our goal

is that the result of our constructive activism leads to a reversal

in direction for the share price of these investee companies, i.e.,

a 180-degree turn. Detailed information about 180 and its holdings

can be found on its website at www.180degreecapital.com.

Press Contact:Daniel B. WolfeRobert E. Bigelow180 Degree Capital

Corp.973-746-4500ir@180degreecapital.com

Mo ShafrothRF BinderMorrison.shafroth@rfbinder.com

Forward-Looking Statements

This press release may contain statements of a

forward-looking nature relating to future events. These

forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These

statements reflect the Company's current beliefs, and a number of

important factors could cause actual results to differ materially

from those expressed in this press release. Please see the

Company's securities filings filed with the Securities and Exchange

Commission for a more detailed discussion of the risks and

uncertainties associated with the Company's business and other

significant factors that could affect the Company's actual results.

Except as otherwise required by Federal securities laws, the

Company undertakes no obligation to update or revise these

forward-looking statements to reflect new events or uncertainties.

The reference and link to the website www.180degreecapital.com has

been provided as a convenience, and the information contained on

such website is not incorporated by reference into this press

release. 180 is not responsible for the contents of third-party

websites.

1. Daily estimated NAVs used for the discount

calculation outside of quarter-end dates are determined as

prescribed in 180’s Valuation Procedures for Level 3 assets.

Non-investment-related assets and liabilities used to determine

estimated daily NAV are those reported as of the end of the prior

quarter.

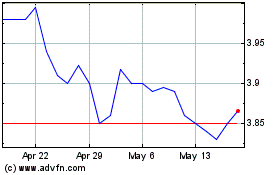

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Oct 2024 to Nov 2024

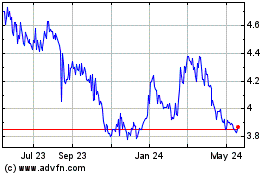

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Nov 2023 to Nov 2024