(Commission File No.: 001-38481) Pursuant

to Rule 425 of the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: HTLF (Commission File No.: 001-15393) The followings materials were included in a

presentation to investors of UMB Financial Corporation, as filed on Form 8-K on July 30, 2024.

Acquisition Update

HTLF Acquisition – Strategically

Compelling Creating a ~$65B Asset Regional Champion Increases density in existing markets Expands into attractive new geographies Top 10 deposit market share ranking in 5 states (3) UMB: 89 Heartland: 107 Pro Forma: 196 Builds Presence in Midwest

& Southwest Pro Forma Snapshot (1) (1) Pro Forma metrics based on March 31,2024 data. These are subject to assumptions and uncertainties. See additional information on slide 50; (2) Market cap based on stock price as of 04/26/24; (3) Deposit

data generated from S&P Capital IQ based on the FDIC Summary of Deposits data study as of 06/30/23; (4) UMB’s branch locations in Illinois are part of St. Louis MSA. Additional HTLF States Shared States Market Pro Forma Deposits

(1)

Acquisition Update Expected Timeline

Progress Submitted regulatory applications and filed S-4 / proxy statement Management participated in site visits and townhall meetings with stakeholders in all HTLF regions Established an integration program governance structure, working with EY,

to lead planning and execution Functional teams within both UMBF and HTLF Focus on organizational alignment; security and oversight support; financial reconciliation Integration/Conversion team Focus on product and system mapping and conversion;

customer segmentation Director candidate vetting continues for the five prospective UMBF board seats to be held by HTLF directors Both UMBF and HTLF completing cultural fitness diagnostic exercise Active discussions regarding community benefits 2024

2025 2Q’24 3Q’24 4Q’24 1Q’25 2Q’25 4Q’25 3Q’25 April 29 Announcement June 13 Regulatory application filed July 2 Preliminary S-4 filed August 6 Shareholder meeting INTEGRATION PLANNING & DEVELOPMENT

Target Closing (1) Target System & Brand Conversion (1) Subject to shareholder and customary regulatory approvals. June Launched integration programs

Cautionary Note Regarding Forward Looking

Statements This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934,

as amended, and Rule 3b-6 promulgated thereunder, which statements involve inherent risks and uncertainties. Any statements about UMB Financial Corporation’s (“UMB”), Heartland Financial USA, Inc.’s (“HTLF”) or

the combined company’s plans, objectives, expectations, strategies, beliefs, or future performance or events constitute forward-looking statements. Such statements are generally identified as those that include words or phrases such as

“believes,” “expects,” “anticipates,” “plans,” “trend,” “objective,” “continue,” or similar expressions or future or conditional verbs such as “will,”

“would,” “should,” “could,” “might,” “may,” or similar expressions. Forward-looking statements involve known and unknown risks, uncertainties, assumptions, estimates, and other important

factors that change over time and could cause actual results to differ materially from any results, performance, or events expressed or implied by such forward-looking statements. Such forward-looking statements include but are not limited to

statements about the benefits of the business combination transaction between UMB and HTLF (the “Transaction”), including future financial and operating results, the combined company’s plans, objectives, expectations and

intentions, and other statements that are not historical facts. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those projected. In addition to factors previously

disclosed in UMB’s and HTLF’s reports filed with the U.S. Securities and Exchange Commission (the “SEC”), the following factors, among others, could cause actual results to differ materially from forward-looking statements or

historical performance: the occurrence of any event, change, or other circumstance that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between UMB and HTLF; the outcome of any legal

proceedings that may be instituted against UMB or HTLF; the possibility that the Transaction does not close when expected or at all because required regulatory, shareholder, or other approvals and other conditions to closing are not received or

satisfied on a timely basis or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the Transaction); the risk that the benefits from the

Transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in, or problems arising from, general economic and market conditions, interest and exchange rates, monetary policy, laws and

regulations and their enforcement, and the degree of competition in the geographic and business areas in which UMB and HTLF operate; the ability to promptly and effectively integrate the businesses of UMB and HTLF; the possibility that the

Transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; reputational risk and potential adverse reactions of UMB’s or HTLF’s customers, employees or other business partners,

including those resulting from the announcement or completion of the Transaction; the dilution caused by UMB’s issuance of additional shares of its capital stock in connection with the Transaction; and the diversion of management’s

attention and time from ongoing business operations and opportunities on merger-related matters. These factors are not necessarily all of the factors that could cause UMB’s, HTLF’s or the combined company’s actual results,

performance, or achievements to differ materially from those expressed in or implied by any of the forward-looking statements. Other factors, including unknown or unpredictable factors, also could harm UMB’s, HTLF’s or the combined

company’s results. All forward-looking statements attributable to UMB, HTLF, or the combined company, or persons acting on UMB’s or HTLF’s behalf, are expressly qualified in their entirety by the cautionary statements set forth

above. Forward-looking statements speak only as of the date they are made and UMB and HTLF do not undertake or assume any obligation to update publicly any of these statements to reflect actual results, new information or future events, changes in

assumptions, or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If UMB or HTLF update one or more forward-looking statements, no inference should be drawn that UMB or HTLF will make

additional updates with respect to those or other forward-looking statements. Further information regarding UMB, HTLF and factors which could affect the forward-looking statements contained herein can be found in UMB’s Annual Report on Form

10-K for the fiscal year ended December 31, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000101382/000095017024018456/umbf-20231231.htm) and its subsequent Quarterly Reports on Form 10-Q, Current Reports on Form

8-K, and its other filings with the SEC, in HTLF’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/920112/000092011224000026/htlf-20231231.htm),

and its subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and its other filings with the SEC, and the risks described in HTLF’s definitive joint proxy statement/prospectus related to the Transaction, which was filed with

the SEC on July 5, 2024 (and which is available at http://www.sec.gov/Archives/edgar/data/d771152ddefm14a.htm/000119312524175616/0001193125-24-175616-index.html). Additional Information about the Transaction and Where to Find It This communication

does not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell, any securities or a solicitation of any vote or approval. In connection with the Transaction, UMB filed with the SEC a registration statement on Form S-4 on

June 13, 2024, as amended on July 2, 2024 (and which is available at http://www.sec.gov/Archives/edgar/data/d771152ds4a.htm/000119312524174327/0001193125-24-174327-index.html) to register the shares of UMB capital stock to be issued in connection

with the Transaction. The registration statement includes a joint proxy statement of UMB and HTLF and also includes a prospectus of UMB. The registration statement was declared effective by the SEC on July 5, 2024. HTLF filed a definitive joint

proxy statement/prospectus on July 5, 2024 (and which is available at http://www.sec.gov/Archives/edgar/data/d771152ddefm14a.htm/000119312524175616/0001193125-24-175616-index.html), and it was first mailed to HTLF stockholders on July 5, 2024.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4, AS AMENDED, AND THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS, WHICH IS AVAILABLE AT

HTTP://WWW.SEC.GOV/ARCHIVES/EDGAR/DATA/D771152DDEFM14A.HTM/000119312524175616/0001193125-24-175616-INDEX.HTML, AS WELL AS ANY OTHER RELEVANT AMENDMENTS THERETO, DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY

REFERENCE INTO THE JOINT PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING UMB, HTLF, THE TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other

documents filed with the SEC by UMB or HTLF through the website maintained by the SEC at http://www.sec.gov or from UMB at its website, www.UMB.com, or from HTLF at its website, www.htlf.com. Documents filed with the SEC by UMB will be available

free of charge by accessing the “Investor Relations” page of UMB’s website at www.https://investorrelations.umb.com/overview/default.aspx, or alternatively by directing a request by mail to UMB, Attention: Corporate Secretary, 1010

Grand Boulevard, Kansas City, Missouri 64106, and documents filed with the SEC by HTLF will be available free of charge by accessing HTLF’s website at www.htlf.com under the “Investor Relations” tab or, alternatively, by directing

a request by mail to HTLF’s Corporate Secretary, 1800 Larimer Street, Suite 1800, Denver, Colorado 80202.

Participants in the Solicitation UMB,

HTLF, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of UMB and stockholders of HTLF in connection with the Transaction under the rules of the

SEC. Information about the interests of the directors and executive officers of UMB and HTLF and other persons who may be deemed to be participants in the solicitation of shareholders of UMB and stockholders of HTLF in connection with the

Transaction and a description of their direct and indirect interests, by security holdings or otherwise, is included in HTLF’s definitive joint proxy statement/prospectus related to the Transaction, which was filed with the SEC on July 5, 2024

(and which is available at http://www.sec.gov/Archives/edgar/data/d771152ddefm14a.htm/000119312524175616/0001193125-24-175616-index.html). Information about the directors and executive officers of UMB and their ownership of UMB common stock is also

set forth in the definitive proxy statement for UMB’s 2024 Annual Meeting of Shareholders, as filed with the SEC on March 3, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000101382/000119312524066457/d706079ddef14a.htm). Information about the directors and executive officers of UMB, their ownership of UMB common stock, and UMB’s transactions with related persons

is set forth in the sections entitled “Directors, Executive Officers and Corporate Governance,” “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters,” and “Certain

Relationships and Related Transactions, and Director Independence” included in UMB’s annual report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 22, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000101382/000095017024018456/umbf-20231231.htm), and in the sections entitled “Our Board of Directors” and “Stock Owned by Directors, Nominees, and Executive Officers” included

in UMB’s definitive proxy statement in connection with its 2024 Annual Meeting of Stockholders, as filed with the SEC on March 3, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000101382/000119312524066457/d706079ddef14a.htm). To the extent holdings of UMB common stock by the directors and executive officers of UMB have changed from the amounts of UMB common stock held by

such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of HTLF and their ownership of HTLF common stock

can also be found in HTLF’s definitive proxy statement in connection with its 2024 Annual Meeting of Stockholders, as filed with the SEC on April 9, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/920112/000092011224000086/htlf-20240409.htm) and other documents subsequently filed by HTLF with the SEC. Information about the directors and executive officers of HTLF, their ownership of HTLF common

stock, and HTLF’s transactions with related persons is set forth in the sections entitled “Directors, Executive Officers and Corporate Governance,” “Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters,” and “Certain Relationships and Related Transactions, and Director Independence” included in HTLF’s annual report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on

February 23, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/920112/000092011224000026/htlf-20231231.htm), and in the sections entitled “Security Ownership of Certain Beneficial Owners and Management” and

“Related Person Transactions” included in HTLF’s definitive proxy statement in connection with its 2024 Annual Meeting of Stockholders, as filed with the SEC on April 9, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/920112/000092011224000086/htlf-20240409.htm). To the extent holdings of HTLF common stock by the directors and executive officers of HTLF have changed from the amounts of HTLF common stock held by such

persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Free copies of these documents may be obtained as described above.

UMB Financial (NASDAQ:UMBF)

Historical Stock Chart

From Jun 2024 to Jul 2024

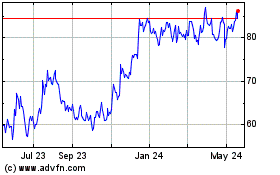

UMB Financial (NASDAQ:UMBF)

Historical Stock Chart

From Jul 2023 to Jul 2024