Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

November 30 2023 - 7:40AM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Issuer Free Writing Prospectus dated November 30, 2023

Relating to Preliminary Prospectus Supplement dated November 29,

2023

to Prospectus dated November 29, 2023

Registration No. 333-275785

We have filed a registration statement on Form F-3

(Registration No. 333-275785), including a prospectus dated November 29, 2023, and a preliminary prospectus supplement dated

November 29, 2023 with the Securities and Exchange Commission (the “SEC”) for the offering to which this free writing

prospectus relates. Before you invest, you should read the prospectus included in the registration statement, the preliminary

prospectus supplement, the documents incorporated by reference in the registration statement and other documents we have filed with

the SEC for more complete information about us and this offering. Investors should rely upon the prospectus, the preliminary

prospectus supplement and this free writing prospectus for complete details of this offering. You may get these documents and other

documents we have filed for free by visiting EDGAR on the SEC website at www.sec.gov. Copies of the prospectus supplement and the

accompanying base prospectus may be obtained by contacting Goldman Sachs & Co. LLC, Prospectus Department, 200 West Street, New

York, NY 10282, telephone: 1-866-471-2526, facsimile: 212-902-9316 or by emailing Prospectus-ny@ny.email.gs.com. You may also access

our most recent preliminary prospectus supplement dated November 29, 2023, as filed with the SEC via EDGAR on November 29, 2023, by

visiting EDGAR on the SEC website at https://www.sec.gov/Archives/edgar/data/1595761/000110465923122068/tm2331532-4_424b5.htm.

The following information supplements and updates the information contained

in the Company’s preliminary prospectus supplement dated November 29, 2023 (the “Preliminary Prospectus Supplement”).

This free writing prospectus reflects the following amendments and supplements that are hereby made to the Preliminary Prospectus Supplement:

| · | The number of the ADSs that we will lend to the ADS Borrower pursuant to the ADS Lending Agreement is, in total, 6,233,785 ADSs (the

“Borrowed ADSs”). |

| · | The Borrowed ADSs will initially be offered at a price of US$10.19 per Borrowed ADS. |

This issuer free writing prospectus updates the information contained

in the Preliminary Prospectus Supplement. Capitalized terms herein have the same meaning as in the Preliminary Prospectus Supplement.

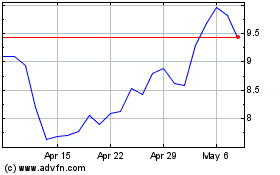

Weibo (NASDAQ:WB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Weibo (NASDAQ:WB)

Historical Stock Chart

From Apr 2023 to Apr 2024