SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant

¨

Filed by a Party other

than the Registrant þ

Check the appropriate box:

| þ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| ¨ |

Soliciting Material Under Rule 14a-12 |

ASA Gold and Precious Metals Limited

(Name of Registrant as Specified In Its Charter)

Saba Capital Management, L.P.

Boaz R. Weinstein

Ketu Desai

Frederic Gabriel

Paul Kazarian

Garry Khasidy

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (check the appropriate box):

| þ |

No fee required. |

| |

|

| ¨ |

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

3) |

Per unit price

or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| |

|

|

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| |

|

|

| |

|

|

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Check box if any part of the fee is

offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

|

|

| |

|

|

| |

4) |

Date Filed: |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED [●]

ASA Gold and Precious Metals Limited

__________________________

PROXY STATEMENT

OF

|

| Saba Capital Management, L.P. |

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD

PROXY CARD TODAY

This proxy statement (this “Proxy Statement”)

and the enclosed GOLD proxy card are being furnished by Saba Capital Management, L.P. (“Saba Capital”), Boaz

R. Weinstein (“Mr. Weinstein,” and together with Saba Capital “Saba,” “we,” or “us”) and

the Nominees (as defined below) named in Proposal 1 (the Nominees together with Saba, the “Participants”), in connection with

the solicitation of proxies from the shareholders of ASA Gold and Precious Metals Limited, a Bermuda exempted limited liability company

and closed-end management investment company registered under the Bermuda Companies Act of 1981, as amended, and the Investment Company

Act of 1940, as amended (the “Fund”).

As a result of what we believe to be the continued

poor investment performance of the Fund, the Fund’s common shares of beneficial interest, par value $1.00 per share (the “Common

Shares”) trade at a significant discount to the Fund’s net asset value (“NAV”).1

For this reason and because we believe that the Fund’s

board of directors (the “Board”) needs fresh ideas and perspectives to address the Fund’s persistent trading discount,

we have nominated a slate of highly qualified and independent Nominees for election to the Board, whose election will send a strong message

that the Fund’s shareholders are not satisfied with the Fund’s management and their inability to address the Fund’s

significant discount to NAV.

We are convinced that NOW is the time

to take action to close the Fund’s discount and we urge shareholders to elect the Nominees, who we believe, if elected, would serve

the best interests of all shareholders.

We are therefore seeking your support at the upcoming

2024 annual meeting of shareholders, including any adjournments or postponements thereof and any special meeting which may be called in

lieu thereof (the “Annual Meeting”), that is scheduled to be held on [●], 2024 [via live webcast].

This Proxy Statement and the enclosed GOLD

proxy card are first being furnished to the Fund’s shareholders on or about [●].

Saba is seeking your support at the Annual Meeting with respect to the following

proposals (the “Proposals”) and to consider and act upon any other business that may properly come before the Annual Meeting.

| Proposal |

|

Our Recommendation |

| |

1. |

To elect Saba’s

slate of four nominees — Ketu Desai, Frederic Gabriel, Paul Kazarian, and Garry Khasidy (each, a “Nominee” and

collectively, the “Nominees”) — to serve as directors and hold office until the Fund’s 2025 annual meeting

of shareholders, or until their respective successors are duly elected and qualified. |

|

FOR

ALL of the Nominees |

| |

|

|

|

|

_________________________________

1 From

November 30, 2018 to November 30, 2023, the Fund’s average discount to NAV was -14.79%. Source: Bloomberg Terminal.

| |

2. |

To

ratify and approve the appointment of Tait, Weller & Baker LLP, an independent registered public accounting firm, as the Company’s

independent auditors for the fiscal year ending November 30, 2024, and the authorization of the Nominating, Audit and Ethics Committee

of the Board of Directors to set the independent auditors’ remuneration.

Such

other business as may properly come before the Meeting or any adjournment or postponement thereof.

|

|

FOR

the ratification and approval

|

Based on the Fund’s proxy statement (the “Fund’s

Proxy Statement”), the Board is currently comprised of four directors, with all directors standing for election each year. Each

director is elected for a term of one year, with the term of all of the directors expiring at each annual meeting of shareholders. At

the Annual Meeting, four directors are to be elected by holders of Common Shares for a one-year term expiring at the Fund’s 2025

annual meeting of shareholders. If at least three of the Nominees are elected, the Nominees will represent a majority of the members of

the Board.

Through this Proxy Statement and enclosed GOLD

proxy card, we are soliciting proxies in support of the election of the Nominees to serve as directors.

The Fund has set the record date for determining

shareholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”) as [●], 2024.

Shareholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. As of the close

of business on the Record Date, the Participants may be deemed to “beneficially own” (such term as used in Schedule 14A

within the meaning of Rule 13d-3 or Rule 16a-1 under the Securities Exchange Act of 1934 (the “Exchange Act”)), in the

aggregate, [●] Common Shares, including [●] Common Shares held in record name, as further described in Annex

I. There were [●] Common Shares outstanding as of the Record Date according to the Fund’s Proxy Statement.

We urge you to sign, date and return the GOLD

proxy card “FOR ALL” of the Nominees in Proposal 1 and “FOR” the ratification and

approval of the appointment of the independent auditors and their remuneration in Proposal 2. By returning the GOLD proxy

card, you are authorizing Saba to vote on your behalf, and if you do not indicate how you would like to vote, your vote will be counted

“FOR ALL” of the Nominees in Proposal 1 and FOR” Proposal 2.

According to the bylaws

of the Fund (the “Bylaws”) and the Fund’s Proxy Statement, the election of directors requires the affirmative

vote of a majority of the votes cast at the annual meeting, including by proxy. For all other matters,

the affirmative vote of a majority of the votes cast at the Annual Meeting, including by proxy, shall be required.

Saba intends to deliver this Proxy Statement and the

accompanying Form of GOLD Proxy Card to holders of at least the percentage of the Fund’s voting shares required under

applicable law to elect the Nominees in Proposal 1 and to approve Proposal 2 at the Annual Meeting and otherwise intends to solicit proxies

or votes from shareholders of the Fund in support of Proposals 1 and 2. This proxy solicitation is being made by Saba and not on behalf

of the Board or management of the Fund or any other third party. We are not aware of any other matters to be brought before the Annual

Meeting other than as described herein. Should other matters be brought before the Annual Meeting, the persons named as proxies in the

enclosed GOLD proxy card will vote on such matters in their discretion to the extent allowed by Rule 14a-4(c)(3) under the

Exchange Act.

If you have already voted using the Fund’s

white proxy card, you have every right to change your vote by completing and mailing the enclosed GOLD proxy card in the enclosed

pre-paid envelope or by voting via Internet or by telephone by following the instructions on the GOLD proxy card. Importantly,

only the latest validly executed proxy that you submit will be counted. In addition, any proxy may be revoked at any time prior to its

exercise at the Annual Meeting by following the instructions under “Can I change my vote or revoke my proxy?” in the Questions

and Answers section.

For instructions on how to vote, including the quorum

and voting requirements for the Fund and other information about the proxy materials, see the Questions and Answers section.

|

We urge you to promptly sign,

date and return your GOLD proxy card. |

If you have any questions or require any assistance

with voting your shares, please contact our proxy solicitor, InvestorCom. Toll free at (877) 972-0090 or collect at (203) 972-9300.

| REASONS FOR THIS PROXY SOLICITATION |

As the Fund’s largest shareholder, Saba is committed

to improving the Fund for the benefit of all shareholders and, to this end, has nominated a slate of highly-qualified and independent

Nominees to the Board, who, Saba believes, will bring fresh ideas and perspectives to address the Fund’s deep trading discount.

The Fund has persistently traded at a substantial discount

to NAV. Specifically, from November 30, 2018 to November 30, 2023, ASA’s average discount to NAV was -14.79%.2 We believe

the Board has been ineffective in addressing this discount to NAV. Saba is therefore nominating four highly-qualified and independent

director nominees who, if elected, will endeavor to close the Fund’s discount to NAV.

Due to the Fund’s persistent trading discount to NAV, Saba

also believes the Board should terminate the Investment Advisory Agreement between the Fund and Merk Investments LLC (the “Merk

Advisory Agreement”). Should the Board terminate the Merk Advisory Agreement, Saba believes the Fund will have at its disposal a

variety of stellar manager replacement options to choose from, and the Board will have the ability to appoint an interim manager and/or

long-term manager of its choosing, the latter being subject to shareholder approval. In such instance, Saba Capital would stand ready

to assist in any way it can to help the Board ensure that a capable manager is installed, and may at such time offer its services to the

Board to act as an interim or long-term manager to the Fund and/or recommend to the Board various third-party manager candidates for the

Board to consider at its discretion. For the avoidance of doubt, the Board’s termination of the Merk Advisory Agreement alone (should

it choose to do so) will not require the Fund to pursue any agreement with Saba relating to the appointment of a new manager, be it Saba

Capital or any other potential manager replacement, and shareholders will have the final say on the appointment of any long-term manager.

We urge you to join us and support the election of the Nominees by voting

on the GOLD proxy card today.

| The Fund’s Common Shares currently trade at a value significantly less than what the securities held by the Fund are worth. We recommend voting “FOR ALL” four of the Nominees in Proposal 1 who, if nominated, will endeavor to close the Fund’s discount to NAV. |

______________________________

2 See Id.

| PROPOSAL 1: ELECTION OF DIRECTORS |

According to the Fund’s Proxy Statement, the

Board is currently comprised of four directors, each of whom are elected annually. According to the Fund’s Proxy Statement, there

will be four directors elected by holders of Common Shares at the Annual Meeting.

We are soliciting proxies to elect the Nominees—

Ketu Desai, Frederic Gabriel, Paul Kazarian, and Garry Khasidy—to serve as directors with a term expiring at the 2025 annual meeting

of shareholders (Proposal 1). The Participants intend to vote all of their Common Shares in favor of the Nominees.

The Nominees, if elected, will serve a one-year term

until the 2025 annual meeting of shareholders, or until their successors have been duly elected and qualified. There is no assurance that

any of the Fund’s nominees will serve as a director if one or more, but less than all, of the Nominees are elected to the Board.

The age and other information related to the Nominees

shown below are as of the date of this Proxy Statement.

Nominees:

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| Name, Address, and Age |

Position(s) Held with Fund |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Portfolios in Fund

Complex Overseen by Director or Nominee for Director |

Other Directorships Held by Director or Nominee for Director |

|

Ketu Desai

Address

c/o Saba Capital Management, L.P., 405 Lexington Avenue, 58th

Floor, New York, New York 10174

Age

41

|

None |

N/A |

Principal, i-squared Wealth Management, Inc., 2016 –

Present

Chief Investment Officer, Centerfin, 2020 - Present |

N/A |

Trustee

of Templeton Global Income Fund since February 2023

Trustee of Saba Capital

Income & Opportunities Fund since July 2020 |

Mr. Desai earned a B.A. in Economics from Stony Brook

University, and a M.S. in Economics from New York University. Mr. Desai has also received an MBA from NYU Stern in Finance, Financial

Instruments and Markets, and Entrepreneurship and Innovation.

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| Name, Address, and Age |

Position(s) Held with Fund |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Portfolios in Fund

Complex Overseen by Director or Director for Trustee |

Other Directorships Held by Trustee or Nominee for Trustee |

|

Frederic Gabriel

Address

c/o Saba Capital Management, L.P., 405 Lexington Avenue, 58th

Floor, New York, New York 10174

Age

49

|

None |

N/A |

Chief Executive Officer, Orion Realty NYC LLC, 2014-Present

|

N/A |

Trustee of Templeton Global Income Fund since May 2021 |

Mr. Gabriel attended ENSAM/Paris Tech (Arts

et Métiers), located at 151 Bd de l'Hôpital, 75013 Paris, France, from 1994 to 1997 and received a degree in engineering

from the school. He also attended HEC Paris, located at 1 Rue de la Libération, 78350 Jouy-en-Josas, France, from 1998 to 1999

and received a MS in International Finance from the school.

Mr. Gabriel’s qualifications to serve as a director

include his extensive financial experience, his entrepreneurial expertise having founded a real estate investment firm, and his leadership

experience having served in leadership roles at leading financial institutions.

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| Name, Address, and Age |

Position(s) Held with Fund |

Term of Office and Length of Time Served |

Principal Occupation During Past 5 Years |

Number of Portfolios in Fund

Complex Overseen by Director or Director for Trustee |

Other Directorships Held by Trustee or Nominee for Trustee |

|

Paul Kazarian

Address

c/o Saba Capital Management, L.P., 405 Lexington Avenue, 58th

Floor, New York, New York 10174

Age

39

|

None |

N/A |

Partner, Saba Capital Management, L.P., 2013 - Present |

N/A |

Trustee of Templeton

Global Income Fund since May 2021

Trustee of Miller/Howard

High Income Equity Fund since October 2022

Trustee of Destra Multi-Alternative

Fund since December 2023 |

Mr. Kazarian received his B.A. in Political

Science from Bates College.

Mr. Kazarian’s qualifications to serve

as a director include his broad expertise in bonds, loans, equities, derivatives, ETFs.

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| Name, Address, and Age |

Position(s)

Held with Fund |

Term of Office and Length of Time Served |

Principal Occupation During Past 5 Years |

Number

of Portfolios in Fund Complex Overseen by Director or Director for Trustee |

Other

Directorships Held by Trustee or Nominee for Trustee |

|

Garry Khasidy

Address

c/o Saba Capital Management, L.P., 405 Lexington Avenue, 58th

Floor, New York, New York 10174

Age

50

|

None |

N/A |

Managing Director, ISAM Holdings LLC, 2022-Present

Managing Director, IMAN Capital, 2020-2022

Managing Director, Odyssey Infrastructure, 2018-2020 |

N/A |

Trustee of Templeton Global Income Fund since March 2023 |

Mr. Khasidy earned a Bachelor of Science in Economics

and Legal Studies from University of Pennsylvania Wharton School of Business.

Mr. Khasidy’s qualifications to serve as a trustee

include his extensive leadership experience across a variety of executive positions in both the Finance and Investment Management sectors.

The Nominees do not currently hold, and have not at

any time held, any position with the Fund. The Nominees do not oversee any portfolios in the Fund’s Fund Complex (as defined in

the Investment Company Act of 1940 (the “40 Act”)).

As of the date of this Proxy Statement, the dollar

range of the equity securities of the Fund beneficially owned by the Nominees and the aggregate range of equity securities in all funds

to be overseen by the Nominees, are as follows:

| Name of Nominee |

Dollar Range of Equity Securities in the Fund |

Aggregate Dollar Range of Equity Securities in All Companies to be Overseen by the Nominee in a Family of Investment Companies |

| Ketu Desai |

None |

None |

| Frederic Gabriel |

None |

None |

| Paul Kazarian |

None |

None |

| Garry Khasidy |

None |

None |

None of the organizations or corporations referenced

above is a parent, subsidiary, or other affiliate of the Fund. We believe that, if elected, the Nominees will be considered independent

directors of the Fund under (i) the pertinent listing standards of the New York Stock Exchange,

and (ii) paragraph (a)(1) of Item 407 of Regulation S-K. In addition, we believe that the Nominees are not and will not be “interested

persons” of the Fund within the meaning of section 2(a)(19) of the 40 Act.

We refer shareholders to the Fund’s Proxy Statement

for the names, background, qualifications and other information concerning the Fund’s director nominees. The Fund’s Proxy

Statement and form of proxy will become available free of charge on the website of the Securities and Exchange Commission (the “SEC”)

at www.sec.gov.

Each of the Nominees, with the exception of Mr. Kazarian

and Mr. Weinstein, have entered into a nominee agreement (the “Nominee Agreements”) pursuant to which Saba Capital has agreed

to advance an amount not to exceed $5,000 to cover the reimbursement of fees the nominees may incur (i) in connection with their nominations;

(ii) to defend and indemnify the Nominees against, and with respect to, any losses that may be incurred by such Nominee in the event he

becomes a party to litigation based on his nomination as a candidate for election to the Board, the solicitation of proxies in support

of his election, or both; or (iii) both (i) and (ii). If elected or appointed, the Nominees will be entitled to such compensation from

the Fund as is consistent with the Fund’s practices for services of non-employee directors. The Nominees will not receive any compensation

from Saba for their services as directors of the Fund if elected or for any other reason.

The

Nominees have agreed to being nominated as nominees in this Proxy Statement and have confirmed their willingness to serve on the Board

if elected. We do not expect that the Nominees will be unable to stand for election, but, in the event that a Saba Nominee is unable

to or for good cause will not serve, the Common Shares represented by the GOLD proxy

card will be voted for a substitute candidate selected by Saba, a right that Saba

has

reserved in its nomination notice. In the case of any of the foregoing, Saba will give prompt written notice to the Fund if it chooses

to nominate any such additional or substitute nominee and Saba will file and deliver supplemental proxy materials, including a revised

proxy card, disclosing the information relating to such additional person that is required to be disclosed in solicitations for proxies

for the election of directors pursuant to Section 14 of the Exchange Act. If Saba determines to

add nominees, whether because the Fund expands the size of the Board subsequent to the date of this Proxy Statement or for any other

reason, Saba will supplement this Proxy Statement.

Vote Required.

According to the Bylaws and

the Fund’s Proxy Statement, the election of directors requires the affirmative vote of a majority of the votes cast at the annual

meeting.

Abstentions

and “broker non-votes” (i.e., shares held by brokers, banks or other nominees for which (i) instructions have not been received

from the beneficial owner or persons entitled to vote and (ii) the broker, bank or nominee does not have discretionary voting power on

a particular matter), if any, will be counted for purposes of determining whether a quorum is present, but will be disregarded in determining

the “votes cast” on a proposal. Therefore, abstentions and “broker non-votes” will have no effect on the vote

for Proposal 1.

We urge you to sign and return our GOLD proxy

card. If you have already voted using the Fund’s white proxy card, you have every right to change your vote by completing and

mailing the enclosed GOLD proxy card in the enclosed pre-paid envelope or by voting via Internet or by telephone by following

the instructions on the GOLD proxy card. Only the latest validly executed proxy that you submit will be counted; any proxy

may be revoked at any time prior to its exercise at the Annual Meeting by following the instructions under “Can I change my vote

or revoke my proxy?” If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor,

InvestorCom, toll free at (877) 972-0090 or collect at (203) 972-9300.

| We Recommend a Vote FOR ALL of the Nominees for election at the Annual Meeting on the GOLD proxy card. |

| PROPOSAL 2: APPROVAL AND RATIFICATION OF INDEPENDENT PUBLIC AUDITING FIRM |

We expect the Fund will ask shareholders to ratify

and approve the re-appointment of Tait, Weller, & Baker LLP (“Tait, Weller, & Baker”) as the Company’s independent

auditors for the fiscal year ending November 30, 2024, and the authorization of the Nominating, Audit and Ethics Committee of the Board

of Directors to set the independent auditors’ remuneration.

We expect the

Fund’s proxy statement to state that if stockholders do not ratify the appointment of Tait, Weller, & Baker as the independent

registered public accounting firm of the Fund, the Fund will reconsider its selection of Tait, Weller, & Baker.

Vote Required.

According to the Bylaws and the Fund’s Proxy

Statement, the ratification and approval of the appointment of the Company’s independent auditors and the authorization for the

Committee to set the auditors’ remuneration requires the affirmative vote of a majority of the votes cast at the Annual Meeting.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING |

Who is entitled to vote?

Only holders of Common Shares (the “Shares”)

at the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting. Shareholders who sold their Shares

before the Record Date (or acquire them without voting rights after the Record Date) may not vote such Shares. Shareholders of record

on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such Shares after the Record

Date (unless they also transfer their voting rights as of the Record Date).

How do I vote my shares?

Shares held in record name. If your Shares are

registered in your own name, please vote today by signing, dating and returning the enclosed GOLD proxy card in the postage-paid

envelope provided. Execution and delivery of a proxy by a record holder of Shares will be presumed to be a proxy with respect to all shares

held by such record holder unless the proxy specifies otherwise.

Shares beneficially owned or held in “street”

name. If you hold your Shares in “street” name with a broker, bank, dealer, trust company, or other nominee, only that

nominee can exercise the right to vote with respect to the Shares that you beneficially own through such nominee and only upon receipt

of your specific instructions. Accordingly, it is critical that you promptly give instructions to your broker, bank, dealer, trust

company, or other nominee to vote FOR the Nominees. Please follow the instructions to vote provided on the enclosed GOLD

voting instruction form. If your broker, bank, dealer, trust company, or other nominee provides for proxy instructions to be delivered

to them by telephone or Internet, instructions will be included on the enclosed GOLD voting instruction form. We urge you

to confirm in writing your instructions to the person responsible for your account and provide a copy of those instructions by emailing

them to Saba@investor-com.com or mailing them to Saba Capital Management, L.P., c/o InvestorCom, 19 Old Kings Highway

S., Suite 130, Darien, CT 06820, so that we will be aware of all instructions given and can attempt to ensure that such instructions are

followed.

Note: Shares represented by properly executed

GOLD proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, FOR

Saba’s Nominees and Proposal 2.

How should I vote

on the Proposals?

We recommend that you vote your shares on the

GOLD proxy card as follows:

“FOR ALL” four of

the Nominees standing for election to the Board named in this Proxy Statement (Proposal 1); and

“FOR” the ratification

and approval of the appointment of the independent Auditors and authorization of the nominating, audit and ethics Committee of the board

to set the auditors’ remuneration (Proposal 2).

Each Proposal is a separate proposal. You may

vote on each separately and in accordance with your discretion.

How many shares must be present

to hold the Annual Meeting?

According to

the Bylaws and the Fund’s Proxy Statement, the holders of one-third (1/3) of the Company’s outstanding common shares present

by proxy and entitled to vote constitutes a quorum at the Meeting. Abstentions and broker non-votes, if any, will be treated as votes

present for purposes of determining a quorum.

What vote is needed

to approve the Proposals?

Proposal 1 – Election

of Directors. According to the Bylaws and the Fund’s Proxy Statement, the election of directors requires the affirmative vote

of a majority of the votes cast at the annual meeting. Abstentions and broker non-votes, if any, will have no effect on the outcome of

Proposal 1.

Proposal 2 – Approval and Ratification of

Independent Accounting Firm. According to the Bylaws and the Fund’s Proxy Statement, the ratification and approval of the appointment

of the Company’s independent auditors and

the authorization for the Committee to set the auditors’ remuneration requires the affirmative vote of a majority of the votes

cast at the annual meeting. Abstentions and broker non-votes, if any, will have no effect on the outcome of Proposal 2.

PLEASE DO NOT SIGN OR RETURN A WHITE PROXY CARD

FROM THE FUND. DOING SO WILL REVOKE ANY PREVIOUS VOTING INSTRUCTIONS YOU PROVIDED ON THE GOLD PROXY CARD.

What are “broker non-votes”

and what effect do they have on the Proposals?

Generally, broker

non-votes occur when shares held by a broker, bank, or other nominee in “street name” for a beneficial owner are not voted

with respect to a particular proposal because the broker, bank, or other nominee has not received voting instructions from the beneficial

owner and lacks discretionary voting power to vote those shares with respect to that particular proposal. If your shares are held in the

name of a brokerage firm, and the brokerage firm has not received voting instructions from you, as the beneficial owner of such shares

with respect to that proposal, the brokerage firm cannot vote such shares on that proposal unless it is a “routine” matter.

Under the rules and interpretations of the New York Stock Exchange, if you receive proxy materials from or on behalf of both Saba and

the Fund, brokers, banks, and other nominees will not be permitted to exercise discretionary authority regarding any of the proposals

to be voted on at the Annual Meeting, whether “routine” or not. Because Saba has initiated a contested proxy solicitation,

there will be no “routine” matters at the Annual Meeting for any broker accounts that are provided with proxy materials by

Saba. As a result, there will be no broker non-votes by such banks, brokers, or other nominees with respect to such accounts. If you do

not submit any voting instructions to your broker, bank, or other nominee with respect to such accounts, your shares in such accounts

will not be counted in determining the outcome of any of the proposals at the Annual Meeting, nor will your shares be counted for purposes

of determining whether a quorum exists.

What should I do if I receive

a proxy card from the Fund?

You may receive

proxy solicitation materials from the Fund, including an opposition proxy statement and a white proxy card. We are not responsible for

the accuracy of any information contained in any proxy solicitation materials used by the Fund or any other statements that it may otherwise

make.

We recommend

that you discard any proxy card or solicitation materials that may be sent to you by the Fund. If you have already voted using the Fund’s

white proxy card, you have every right to change your vote by using the enclosed GOLD proxy card by signing, dating and returning

the enclosed GOLD proxy card in the postage-paid envelope provided. Only the latest validly executed proxy that you submit will

be counted; any proxy may be revoked at any time prior to its exercise at the Annual Meeting by following the instructions below under

“Can I change my vote or revoke my proxy?”

If you have

any questions or require any assistance with voting your shares, please contact our proxy solicitor, InvestorCom. Shareholders may call

toll free at (877) 972-0090 or collect at (203) 972-9300.

Can I change my vote

or revoke my proxy?

If you are the shareholder of record, you may

change your proxy instructions or revoke your proxy at any time before your proxy is voted at the Annual Meeting. Proxies may be revoked

by any of the following actions:

| · | signing, dating and returning

the enclosed GOLD proxy card in the postage-paid envelope provided or signing, dating and returning a white proxy card (the

latest dated proxy is the only one that counts); |

| · | delivering a written revocation

to the secretary of the Fund; or |

| · | attending the Annual Meeting

and voting by ballot in person (although attendance at the Annual Meeting will not, by itself, revoke a proxy). |

If your shares are held in a brokerage account by a broker, bank, or other

nominee, you should follow the instructions provided by your broker, bank, or other nominee. If you attend the Annual Meeting and you

beneficially own Common Shares but are not the record owner, your mere attendance at the Annual Meeting WILL NOT be sufficient to revoke

any previously submitted proxy card. You must have written authority from the record owner to vote your shares held in its name at the

meeting in the form of a “legal proxy” issued in your name from the bank, broker, or other nominee that holds your shares.

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, InvestorCom, toll free

at (877) 972-0090 or collect at (203) 972-9300.

IF YOU HAVE ALREADY VOTED USING THE FUND’S

WHITE PROXY CARD, WE URGE YOU TO REVOKE IT BY FOLLOWING THE INSTRUCTIONS ABOVE. Although a revocation is effective if delivered to

the Fund, we request

that a copy of any revocation be mailed to Saba Capital Management, L.P., c/o InvestorCom, 19 Old Kings Highway S., Suite 130, Darien,

CT 06820, so that we will be aware of all revocations.

Who is making this

Proxy Solicitation and who is paying for it?

The solicitation of proxies

pursuant to this proxy solicitation is being made by the Participants. Proxies may be solicited by mail, facsimile, telephone, telegraph,

Internet, in person, or by advertisements. Saba will solicit proxies from individuals, brokers, banks, bank nominees, and other institutional

holders. Saba will request banks, brokerage houses, and other custodians, nominees, and fiduciaries to forward all solicitation materials

to the beneficial owners of the Common Shares they hold of record. Saba will reimburse these record holders for their reasonable out-of-pocket

expenses in so doing. It is anticipated that certain regular employees of Saba will also participate in the solicitation of proxies in

support of the Nominees. Such employees will receive no additional consideration if they assist in the solicitation of proxies.

Saba has retained InvestorCom

to provide solicitation and advisory services in connection with this solicitation. InvestorCom will be paid a fee not to exceed $[●]

based upon the campaign services provided. In addition, Saba will advance costs and reimburse InvestorCom for reasonable out-of-pocket

expenses and will indemnify InvestorCom against certain liabilities and expenses, including certain liabilities under the federal securities

laws. InvestorCom will solicit proxies from individuals, brokers, banks, bank nominees, and other institutional holders. It is anticipated

that InvestorCom will employ up to approximately 25 persons to solicit the Fund’s shareholders as part of this solicitation. InvestorCom

does not believe that any of its owners, managers, officers, employees, affiliates, or controlling persons, if any, is a “participant”

in this proxy solicitation.

The entire expense of soliciting

proxies is being borne by Saba. Costs of this proxy solicitation are currently estimated to be approximately $[●]. We estimate that

through the date hereof, Saba’s expenses in connection with the proxy solicitation are approximately $[●]. If successful

in its proxy solicitation through the election of the Nominees listed in Proposal 1, Saba may seek reimbursement of these costs from the

Fund. For the avoidance of doubt, such reimbursement is not guaranteed. In the event that Saba decides to seek reimbursement of its

expenses, Saba does not intend to submit the matter to a vote of the Fund’s shareholders. The Board, which may consist of the four

Nominees, if all are elected, would be required to evaluate the requested reimbursement consistent with their fiduciary duties to the

Fund and its shareholders.

What is Householding of Proxy Materials?

The SEC has adopted rules

that permit companies and intermediaries (such as brokers and banks) to satisfy the delivery requirements for proxy statements and annual

and semi-annual reports with respect to two or more shareholders sharing the same address by delivering a single proxy statement or periodic

report addressed to those shareholders. Some banks and brokers with account holders who are shareholders of the Fund may be householding

our proxy materials.

Once you have received notice

from your bank or broker that it will be householding communications to your address, householding will continue until you are notified

otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive

a separate proxy statement and annual report, please notify your bank or broker and direct your requests to the Fund at [●], or

by calling [●].

Because Saba

has initiated a contested proxy solicitation, we understand that banks and brokers with account holders who are shareholders of the Fund

will not be householding our proxy materials.

Where can I find additional

information concerning the Fund?

Pursuant to Rule 14a-5(c) promulgated under the Exchange

Act, we have omitted from this Proxy Statement certain disclosure required by applicable law to be included in the Fund’s definitive

proxy statement in connection with the Annual Meeting. Such disclosure includes information regarding securities of the Fund beneficially

owned by the Fund’s directors, nominees and management; the Fund’s investment manager and administrator; the Audit Committee

of the Board; certain shareholders’ beneficial ownership of more than 5% of the Fund’s voting securities; information concerning

the Fund’s directors; information concerning executive compensation; and information concerning the procedures for submitting shareholder

proposals and director nominations intended for consideration at the 2025 annual meeting of shareholders and for consideration for inclusion

in the proxy materials for that meetings. We take no responsibility for the accuracy or completeness of any information that we expect

to be contained in the Fund’s definitive proxy statement. Except as otherwise noted herein, the information in this Proxy Statement

concerning the Fund has been taken from or is based upon documents and records on file with the SEC and other publicly available information.

This Proxy

Statement and all other solicitation materials in connection with this proxy solicitation will be available on the internet, free of

charge, on the SEC’s website at https://www.edgar.sec.gov. The Edgar file number for the Fund is 811-21650.

We urge you to carefully consider the information contained

in this Proxy Statement and then support our efforts by signing, dating, and returning the enclosed GOLD proxy card today.

Thank you for your support,

|

| Saba Capital Management, L.P. |

|

Boaz R. Weinstein

Ketu Desai

Frederic Gabriel

Paul Kazarian

Garry Khasidy |

| |

| [DATE] |

ANNEX I: INFORMATION

ON THE PARTICIPANTS

Beneficial Ownership and Other Information

This proxy solicitation is being made by the

Participants. As of the date of this Proxy Statement, the Participants may be deemed to “beneficially own” (such term as

used in Schedule 14A within the meaning of Rule 13d-3 or Rule 16a-1 under the Exchange Act for the purposes of this Annex I)

3,253,837 Common Shares in the aggregate, representing 16.9% of the outstanding Common Shares. The percentage used herein is based

upon 19,289,905 Common Shares outstanding as of May 31, 2023, as disclosed in the Fund’s semi-annual report on Form N-CSRS

filed with the SEC on July 27, 2023. Of the 3,253,837 Common Shares owned in the aggregate by the Participants, such Common Shares may

be deemed to be beneficially owned as follows: (a) 3,253,837 Common Shares (including a total of 1,039,700 Common Shares held in

record name by Saba Capital Master Fund, Ltd., Saba Capital Bluebird Fund, Ltd., Saba Capital CEF Opportunities 2, Ltd., and Saba

Capital Carry Neutral Tail Hedge Master Fund Ltd. (the foregoing, together, the “Saba Record Holders”)) may be deemed to

be beneficially owned by Saba Capital by virtue of its status as the investment manager of various funds and accounts (such funds

and accounts, the “Saba Entities”); and (b) 3,253,837 Common Shares (including 1,039,700 Common Shares held in record

name by the Saba Record Holders) may be deemed to be beneficially owned by Mr. Weinstein by virtue of his status as the principal of

Saba.

As of the date of this Proxy Statement, none of the

Nominees beneficially own any Common Shares or any other securities of the Fund.

The principal business of Saba Capital is to serve

as investment manager to the Saba Entities. The principal business of Saba I is to serve as a private investment fund. The principal business

of Mr. Weinstein is investment management and serving as the principal of Saba Capital. The principal business of the Saba Entities is

to invest in securities.

The business address of each member of Saba and the

Saba Entities is 405 Lexington Avenue, 58th Floor, New York, New York 10174.

The principal occupation and business address of each

of the Nominees are disclosed in the section of this Proxy Statement titled “PROPOSAL 1: ELECTION OF DIRECTORS”.

Unless otherwise noted as shares held in record name

by the Saba Entities, the Common Shares held by the Saba Entities are held in commingled margin accounts, which may extend margin credit

to such parties from time to time, subject to applicable federal margin regulations, stock exchange rules and credit policies. In such

instances, the positions held in the margin account are pledged as collateral security for the repayment of debit balances in the account.

The margin accounts bear interest at a rate based upon the broker’s call rate from time to time in effect. Because other securities

are held in the margin accounts, it is not possible to determine the amounts, if any, of margin used to purchase the Common Shares reported

herein since margin may have been attributed to such other securities and since margin used is not disclosed on an individual per-security

basis.

Except as set forth

in this Proxy Statement (including the Appendices hereto), (i) within the past 10 years, no Participant in this solicitation has been

convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no Participant and no associate or “Immediate

Family Member” (as defined in Item 22 of Schedule 14A under the Exchange Act (“Item 22”)) of any Participant, is a record

owner or direct or indirect beneficial owner of any securities of the Fund, any parent or subsidiary of the Fund, any investment adviser,

principal underwriter, or “Sponsoring Insurance Company” (as defined in Item 22) of the

Fund, or in any registered investment companies overseen or to be overseen by the Participant within the same “Family of Investment

Companies” (as defined in Item 22) that directly or indirectly controls, is controlled by or is under common control with an investment

adviser, principal underwriter, or Sponsoring Insurance, or affiliated person of the Fund; (iii)

no Participant in this solicitation directly or indirectly beneficially owns any securities of the Fund which are owned of record but

not beneficially; (iv) no Participant in this solicitation has purchased or sold any securities of the Fund or the Fund’s investment

adviser within the past two years, nor from either entity’s “Parents” or “Subsidiaries” (as defined in Item

22); (v) no Participant has any “family relationship” for the purposes of Item 22 whereby a family member is an “Officer”

(as defined in Item 22), director (or person nominated to become an Officer or director), employee, partner, or copartner of the Fund,

the Fund’s investment adviser, and/or a principal underwriter of any of the foregoing, or any Subsidiary or other potential affiliate

of any of the foregoing; (vi) no part of the purchase price or market value of the securities of the Fund owned by any Participant in

this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vii)

no Participant in this solicitation is, or within the past year was, a party to any contract, arrangements, or understandings with any

person with respect to any securities of the Fund, including, but not limited to, joint ventures, loan or option arrangements, puts or

calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (viii)

no associate of any Participant in this solicitation owns beneficially, directly or indirectly, any securities of the Fund; (ix) no Participant

in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Fund; (x) within the

last five years, no Nominee has had any arrangement or understanding with any other person pursuant to which he was selected to be a nominee

for election as a director to the Fund other than the Nominee Agreements described herein; (xi) no Participant and no Immediate Family

Member of any Participant in this solicitation or any of his or its associates was a party to, or had a direct or indirect material relationship

in, any transaction or series of similar transactions since the beginning of the Fund’s last fiscal year, or is a party to any currently

proposed transaction, or series of similar transactions in which the amount involved exceeds $120,000 and for which any of the following

was or is a party: (a) the Fund or any of its subsidiaries; (b) an Officer of the Fund; (c) an investment company, or a person that would

be an investment company but for the exclusions provided by sections 3(c)(1) and 3(c)(7) of the 40 Act, having the same investment adviser,

principal underwriter, or Sponsoring Insurance Company as the Fund or having an investment adviser, principal underwriter, or Sponsoring

Insurance Company that directly or indirectly controls, is controlled by or is under common control with the investment adviser, principal

underwriter, or Sponsoring Insurance Company of the Fund; (d) an investment adviser, principal underwriter, Sponsoring Insurance Company,

or affiliated person of the Fund; (e) any Officer or any person directly or indirectly controlling, controlled by, or under common control

with any investment adviser, principal underwriter, Sponsoring Insurance Company, or affiliated person of the Fund; (f) an Officer of

an investment adviser, principal underwriter, or Sponsoring Insurance Company of the Fund; or (g) an Officer of a person directly or indirectly

controlling, controlled by, or under common control with an investment adviser, principal underwriter, or Sponsoring Insurance Company

of the Fund; (xii) during the last five years, no Participant and no Immediate Family Member of any Participant has had a position or

office with: (a) the Fund; (b) an investment company, or a person that would be an investment company but for the exclusions provided

by Sections 3(c)(1) and 3(c)(7) of the 40 Act, having the same investment adviser, principal underwriter, or Sponsoring Insurance Company

as the Fund or having an investment adviser, principal underwriter, or Sponsoring Insurance Company that directly or indirectly controls,

is controlled by, or is under common control with an investment adviser, principal underwriter, or Sponsoring Insurance Company of the

Fund; or (c) an investment adviser, principal underwriter, Sponsoring Insurance Company, or affiliated person (xiii) no Participant in

this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment

by the Fund or its affiliates, or with respect to any future transactions to which the Fund or any of its affiliates will or may be a

party; (xiv) no Participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise,

in any matter to be acted on at the Annual Meeting; (xv) there are no material pending legal proceedings to which any Nominee or any of

his or its associates is a party adverse to the Fund or, to the best of Saba’s knowledge after reasonable investigation, any affiliated

person of the Fund, nor does any Nominee have a material interest in such proceedings that is adverse to the Fund or, to the best of the

Saba’s knowledge after reasonable investigation, any affiliated person of the Fund; (xvi) since the beginning of the last two completed

fiscal years, no Participant (and no Immediate Family Member of a Participant) has served on the board of directors or directors of a

company or trust where an Officer of an investment adviser, principal underwriter, or Sponsoring Insurance Company of the Fund, or any

person directly or indirectly controlling, controlled by, or under common control with any of those, serves on the board of directors

or directors; and (xvii) no Participant has withheld information that is required to be disclosed under the following Items under Regulation

S-K under the Exchange Act: Item 401(f) with respect to involvement in certain legal proceedings, Item 401(g) with respect to promoters

and control persons, and Item 405 with respect to beneficial ownership and required filings.

Transactions by the Participants with respect

to the Fund’s securities

The following tables set forth all transactions effected

during the past two years by Saba, by virtue of Saba Capital’s direct and indirect control of the Saba Entities, with respect to

securities of the Fund. The Common Shares reported herein are held in either cash accounts or margin accounts in the ordinary course of

business. Unless otherwise indicated, all transactions were effected on the open market.

Common Shares:

Saba Capital, in its capacity as investment manager of the Saba Entities

(including the Saba Record Holders)

| Date |

Side |

Common Shares |

|

Date |

Side |

Common Shares |

| 11/21/2022 |

Buy |

100 |

|

4/20/2023 |

Buy |

30,233 |

| 11/22/2022 |

Buy |

42,746 |

|

4/24/2023 |

Buy |

2,100 |

| 11/29/2022 |

Buy |

12,077 |

|

5/1/2023 |

Buy |

18,111 |

| 11/30/2022 |

Buy |

35,348 |

|

5/2/2023 |

Buy |

1,400 |

| 12/2/2022 |

Buy |

3,301 |

|

5/11/2023 |

Buy |

15,429 |

| 12/5/2022 |

Buy |

1,397 |

|

5/15/2023 |

Buy |

1,273 |

| 12/6/2022 |

Buy |

24,096 |

|

5/19/2023 |

Buy |

18,168 |

| 12/7/2022 |

Buy |

8,435 |

|

5/25/2023 |

Buy |

5,233 |

| 12/13/2022 |

Buy |

14,984 |

|

6/6/2023 |

Buy |

6,751 |

| 12/14/2022 |

Buy |

1,204 |

|

6/7/2023 |

Buy |

33,379 |

| 12/15/2022 |

Buy |

2,862 |

|

6/8/2023 |

Buy |

8,821 |

| 12/16/2022 |

Buy |

5,500 |

|

6/13/2023 |

Buy |

6,506 |

| 12/19/2022 |

Buy |

24,386 |

|

6/21/2023 |

Buy |

55,606 |

| 12/20/2022 |

Buy |

29,782 |

|

6/22/2023 |

Buy |

9,574 |

| 12/29/2022 |

Buy |

506 |

|

6/23/2023 |

Buy |

9,380 |

| 12/30/2022 |

Buy |

2,635 |

|

6/27/2023 |

Buy |

22,128 |

| 1/4/2023 |

Buy |

24,568 |

|

6/28/2023 |

Buy |

500 |

| 1/5/2023 |

Buy |

7,263 |

|

6/29/2023 |

Buy |

4,969 |

| 1/12/2023 |

Buy |

8,208 |

|

6/30/2023 |

Buy |

3,114 |

| 1/13/2023 |

Buy |

16,597 |

|

7/3/2023 |

Buy |

7,346 |

| 1/18/2023 |

Buy |

3,900 |

|

7/7/2023 |

Buy |

5,462 |

| 1/19/2023 |

Buy |

30,240 |

|

7/10/2023 |

Buy |

8,305 |

| 1/20/2023 |

Buy |

7,391 |

|

7/11/2023 |

Buy |

10,687 |

| 1/23/2023 |

Buy |

9,291 |

|

7/17/2023 |

Buy |

30,689 |

| 1/24/2023 |

Buy |

42,447 |

|

7/18/2023 |

Buy |

7,535 |

| 1/25/2023 |

Buy |

5,300 |

|

7/19/2023 |

Buy |

3,550 |

| 1/26/2023 |

Buy |

2,380 |

|

7/20/2023 |

Buy |

2,200 |

| 1/27/2023 |

Buy |

13,889 |

|

7/21/2023 |

Buy |

4,986 |

| 1/30/2023 |

Buy |

12,185 |

|

7/24/2023 |

Buy |

14,450 |

| 1/31/2023 |

Buy |

18,634 |

|

7/25/2023 |

Buy |

8,886 |

| 2/1/2023 |

Buy |

67,136 |

|

7/26/2023 |

Buy |

16,517 |

| 2/6/2023 |

Buy |

8,784 |

|

7/27/2023 |

Buy |

52 |

| 2/13/2023 |

Buy |

1,811 |

|

7/28/2023 |

Buy |

25,440 |

| 2/16/2023 |

Buy |

9,437 |

|

7/31/2023 |

Buy |

42,771 |

| 2/21/2023 |

Buy |

20,080 |

|

8/2/2023 |

Buy |

2,135 |

| 2/28/2023 |

Buy |

23,892 |

|

8/3/2023 |

Buy |

9,387 |

| 3/1/2023 |

Buy |

30,025 |

|

8/4/2023 |

Buy |

1,844 |

| 3/8/2023 |

Buy |

31,400 |

|

8/7/2023 |

Buy |

9,689 |

| 3/9/2023 |

Buy |

19,717 |

|

8/8/2023 |

Buy |

2,267 |

| 3/23/2023 |

Buy |

8,553 |

|

8/9/2023 |

Buy |

8,349 |

| 3/30/2023 |

Buy |

1,437 |

|

8/10/2023 |

Buy |

12,144 |

| 3/31/2023 |

Buy |

15,668 |

|

8/15/2023 |

Buy |

1,914 |

| 4/3/2023 |

Buy |

30,732 |

|

8/16/2023 |

Buy |

5,198 |

| 4/4/2023 |

Buy |

38,703 |

|

8/17/2023 |

Buy |

8,075 |

| 4/6/2023 |

Buy |

2,479 |

|

8/21/2023 |

Buy |

11,202 |

| 4/10/2023 |

Buy |

3,739 |

|

8/22/2023 |

Buy |

4,957 |

| 4/11/2023 |

Buy |

41,201 |

|

8/23/2023 |

Buy |

20,811 |

| 4/12/2023 |

Buy |

4,877 |

|

8/24/2023 |

Buy |

29,201 |

| 4/13/2023 |

Buy |

9,170 |

|

8/28/2023 |

Buy |

52,634 |

| 4/14/2023 |

Buy |

6,398 |

|

8/29/2023 |

Buy |

59,002 |

| 4/18/2023 |

Buy |

47,177 |

|

8/30/2023 |

Buy |

15,417 |

| 4/19/2023 |

Buy |

28,356 |

|

8/31/2023 |

Buy |

17,979 |

| 9/7/2023 |

Buy |

7,392 |

|

11/8/2023 |

Buy |

189 |

| 9/8/2023 |

Buy |

13,897 |

|

11/9/2023 |

Buy |

31,110 |

| 9/11/2023 |

Buy |

48,047 |

|

11/13/2023 |

Buy |

21,714 |

| 9/14/2023 |

Buy |

2,039 |

|

11/14/2023 |

Buy |

131,187 |

| 9/20/2023 |

Buy |

69,455 |

|

11/15/2023 |

Buy |

87,142 |

| 9/22/2023 |

Buy |

14,184 |

|

11/16/2023 |

Buy |

37,936 |

| 9/25/2023 |

Buy |

6,985 |

|

11/17/2023 |

Buy |

10,203 |

| 9/26/2023 |

Buy |

2,855 |

|

11/20/2023 |

Buy |

104,428 |

| 9/27/2023 |

Buy |

18,110 |

|

11/21/2023 |

Buy |

40,147 |

| 9/28/2023 |

Buy |

11,560 |

|

11/22/2023 |

Buy |

56,000 |

| 9/29/2023 |

Buy |

8,716 |

|

11/27/2023 |

Buy |

50,965 |

| 10/3/2023 |

Buy |

48,817 |

|

11/28/2023 |

Buy |

46,897 |

| 10/4/2023 |

Buy |

19,272 |

|

11/29/2023 |

Buy |

8,762 |

| 10/5/2023 |

Buy |

24,432 |

|

11/30/2023 |

Buy |

78,340 |

| 10/10/2023 |

Buy |

44,805 |

|

12/1/2023 |

Buy |

16,482 |

| 10/11/2023 |

Buy |

41,154 |

|

12/4/2023 |

Buy |

24,546 |

| 10/12/2023 |

Buy |

24,320 |

|

12/5/2023 |

Buy |

4,075 |

| 10/24/2023 |

Buy |

23,403 |

|

12/6/2023 |

Buy |

16,370 |

| 10/25/2023 |

Buy |

24,581 |

|

12/7/2023 |

Buy |

18,699 |

| 10/26/2023 |

Buy |

13,005 |

|

12/13/2023 |

Buy |

4,110 |

| 10/30/2023 |

Buy |

534 |

|

12/18/2023 |

Buy |

107,445 |

| 11/3/2023 |

Buy |

59,013 |

|

12/19/2023 |

Buy |

223,381 |

| 11/6/2023 |

Buy |

18,656 |

|

12/26/2023 |

Buy |

3,297 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

IMPORTANT

Tell your Board what you think! YOUR VOTE IS VERY IMPORTANT,

no matter how many or how few shares you own. Please give us your vote “FOR” the Nominees by taking three steps:

● SIGNING the enclosed GOLD

proxy card,

● DATING the enclosed GOLD

proxy card, and

| ● | MAILING the enclosed GOLD proxy card TODAY in the envelope provided (no postage is required

if mailed in the United States). |

If any of your shares are held in the name of a

broker, bank, bank nominee, or other institution, only it can vote your shares and only upon receipt of your specific instructions.

Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. You may also vote by

signing, dating and returning the enclosed GOLD voting instruction form in the postage-paid envelope provided, and to ensure

that your shares are voted, you should also contact the person responsible for your account and give instructions for a GOLD

voting instruction form to be issued representing your shares.

By returning the GOLD proxy card, you

are authorizing Saba to vote on your behalf, and if you do not indicate how you would like to vote, your vote will be counted “FOR

ALL” of the Nominees in Proposal 1 and “FOR” Proposal 2.

After signing the enclosed GOLD proxy

card, DO NOT SIGN OR RETURN THE FUND’S WHITE PROXY CARD UNLESS YOU INTEND TO CHANGE YOUR VOTE, because only your latest dated

proxy card will be counted.

If you have previously signed, dated, and returned

a white proxy card to the Fund, you have every right to change your vote. Only your latest dated proxy card will count. You may revoke

any proxy card already sent to the Fund by signing, dating, and mailing the enclosed GOLD proxy card in the postage-paid

envelope provided or by voting by telephone or Internet. Any proxy may be revoked at any time prior to the Annual Meeting by delivering

a written notice of revocation or a later dated proxy for the Annual Meeting to the secretary of the Fund or by voting in person at the

Annual Meeting. Attendance at the Annual Meeting will not in and of itself constitute a revocation.

If you have any questions concerning this Proxy Statement,

would like to request additional copies of this Proxy Statement, or need help voting your shares, please contact our proxy solicitor:

19 Old Kings Highway S., Suite 130

Darien, CT 06820

Shareholders Call Toll-Free at: (877) 972-0090

E-mail: Saba@investor-com.com

PRELIMINARY COPY SUBJECT TO COMPLETION

Form of GOLD Proxy Card

ASA Gold and Precious Metals Limited

Proxy Card for 2024 Annual Meeting of Shareholders

(the “Annual Meeting”)

THIS PROXY SOLICITATION IS BEING MADE BY SABA CAPITAL

MANAGEMENT, L.P. (“SABA CAPITAL”) Boaz R. Weinstein AND THE INDIVIDUALS NAMED

IN PROPOSAL 1

THE BOARD OF DIRECTORS (THE “BOARD”) OF

ASA GOLD AND PRECIOUS METALS LIMITED IS NOT SOLICITING THIS PROXY

The undersigned appoints Michael D’Angelo, Paul

Kazarian, Eleazer Klein, Pierre Weinstein, and John Grau and each of them, attorneys and agents with full power of substitution to vote

all common shares of ASA Gold and Precious Metals Limited, a closed-end management investment company registered under the Bermuda Companies

Act of 1981, as amended, and the Investment Company Act of 1940, as amended (the “Fund”), that the undersigned would be entitled

to vote at the Annual Meeting, including at any adjournments or postponements thereof, with all powers that the undersigned would possess

if personally present, upon and in respect of the instructions indicated herein, with discretionary authority, subject to applicable law,

as to any and all other matters that may properly come before the meeting or any adjournment, postponement, or substitution thereof that

are unknown to us a reasonable time before this solicitation.

The undersigned hereby revokes any other proxy or proxies

heretofore given to vote or act with respect to said shares, and hereby ratifies and confirms all action the herein named attorneys and

proxies, their substitutes, or any of them may lawfully take by virtue hereof. This proxy will be valid until the sooner of one year from

the date indicated on the reverse side and the completion of the Annual Meeting (including any adjournments or postponements thereof).

With respect to Proposals 1 and 2, if this proxy

is signed, dated and returned, it will be voted in accordance with your instructions. If you do not specify how the proxy should be voted,

this proxy will be voted “FOR ALL” of the nominees in Proposal 1 (the “Nominees”) and “FOR” Proposal

2. A vote “against” Saba’s Nominees will not have the same effect as a vote “for” the Fund’s nominee.

None of the matters currently intended to be acted upon pursuant to this proxy are conditioned on the approval of other matters.

Should other matters be brought before the Annual Meeting,

the persons named as proxies in the enclosed GOLD proxy card will vote on such matters in their discretion to the extent

allowed by Rule 14a-4(c)(3) under the Exchange Act.

INSTRUCTIONS:

FILL IN VOTING BOXES “o” IN BLACK OR BLUE INK

We recommend that you vote “FOR ALL” of the

Nominees in Proposal 1:

Proposal 1 – Election at the Annual

Meeting of the individuals nominated by Saba Capital.

| |

FOR ALL |

ABSTAIN FOR

ALL |

AGAINST FOR

ALL |

| |

q |

q |

q |

| Nominees: |

For |

Abstain |

Against |

|

|

| Ketu Desai |

q |

q |

q |

|

|

| Frederic Gabriel |

q |

q |

q |

|

|

| Paul Kazarian |

q |

q |

q |

|

|

| Garry Khasidy |

q |

q |

q |

|

|

We recommend that you vote

“FOR” Proposal 2:

Proposal 2 – To ratify and approve the appointment of Tait,

Weller & Baker LLP as the Company’s independent auditors for the fiscal year ending November 30, 2024, and the authorization

of the Nominating, Audit and Ethics Committee of the Board of Directors to set the independent auditors’ remuneration.

| FOR |

ABSTAIN |

AGAINST |

|

|

| q |

q |

q |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

| Signature (Capacity) |

|

Date |

| |

|

|

| |

|

|

| |

|

|

| Signature (Joint Owner) (Capacity/Title) |

|

Date |

| NOTE: Please sign exactly as your name(s) appear(s) on stock certificates or on the label affixed hereto. When signing as attorney, executor, administrator or other fiduciary, please give full title as such. Joint owners must each sign personally. ALL HOLDERS MUST SIGN. If a corporation or partnership, please sign in full corporate or partnership name by an authorized officer and give full title as such. |

PLEASE SIGN, DATE AND PROMPTLY RETURN THIS PROXY

IN THE ENCLOSED RETURN ENVELOPE THAT IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES.

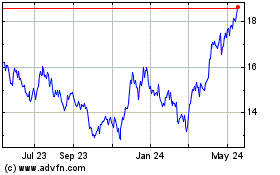

ASA Gold and Precious Me... (NYSE:ASA)

Historical Stock Chart

From Oct 2024 to Nov 2024

ASA Gold and Precious Me... (NYSE:ASA)

Historical Stock Chart

From Nov 2023 to Nov 2024