Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 14 2024 - 6:00AM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File Number: 001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th floor, Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil.

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

| Material Fact November | 2024 |

| | |

Azul Announces Outlook for 2024 and

2025

São Paulo, 14 November 2024 -

Azul S.A., “Azul”, (B3: AZUL4, NYSE: AZUL), the largest airline in Brazil by departures and cities served, announces today

an update to its expected results for 2024, and introduces 2025 outlook, as follows:

| 2024 Forward Outlook |

Previous Outlook |

Updated Outlook |

| Total ASK vs. 2023 |

+7% |

+6% |

| EBITDA |

Above R$6 billion |

Above R$6 billion |

| 2025 Forward Outlook |

|

New Outlook |

| EBITDA |

|

~R$7.4 billion |

| Net working capital |

|

~R$0.8 billion |

| Aircraft ownership |

|

~R$4.1 billion |

| Capex |

|

~R$1.7 billion |

| Recurring cash flow |

|

~R$2.3 billion |

| Interest |

|

~R$1.2 billion |

| Free cash flow to firm |

|

~R$1.1 billion |

| 1. | | Azul expects to increase capacity by approximately 6% in 2024 compared to 2023. The adjustment

in year-over-year capacity growth is mainly due to the reduction in our domestic capacity as a result of the devastating floods in Rio

Grande do Sul, the temporary reduction in our international capacity in the first half of the year; and manufacturers’ new aircraft

delivery delays. |

| 2. | | Azul estimates 2024 EBITDA to be above R$6.0 billion, as a result of the robust demand environment

in both domestic and international markets, the positive trend in fuel prices and a higher number of fuel-efficient aircraft entering

the fleet. |

| 3. | | Azul estimates 2025

EBITDA to be R$7.4 billion, mainly due to strong travel demand, a rational competitive environment, and robust growth in our business

units. In addition, the restructured financing plan, focused on improving liquidity and cash generation and reducing leverage, will allow

Azul to achieve the results mentioned on the 2025 forward outlook above. |

All other projections contained in other materials

are no longer valid. The Company also informs that, on this date, the projections previously disclosed in other materials and in its Reference

Form regarding Leverage and Revenue are also being discontinued.

Projections and outlooks for the future are based on

the opinions and estimates of management on the date on which such statements are made and constitute mere forecasts and are not guarantees

of future performance. Due to the risks and uncertainties inherent in the market in which the Company is positioned, the current economic

scenario, the effects of future regulations and competition, results may differ considerably from those forecast in these projections.

Azul will keep investors and the general market

updated on relevant information related to matters covered by this Material Fact.

| Material Fact November | 2024 |

| | |

About Azul

Azul S.A.

(B3: AZUL4, NYSE: AZUL), the largest airline in Brazil by departures and cities served, offers approximately 1,000 daily flights to over

160 destinations. With an operating fleet of over 180 aircraft and more than 16,000 Crewmembers, the Company has a network of 300 non-stop

routes. Azul was named by Cirium (leading aviation data analysis company) as the most on-time airline in the world in 2022 and the second

most on-time airline in 2023. In 2020, Azul was awarded best airline in the world by TripAdvisor, first time a Brazilian Flag Carrier

earns number one ranking in the Traveler’s Choice Awards. For more information, visit https://ri.voeazul.com.br.

Contact:

Investor Relations

Tel: +55 11 4831 2880

invest@voeazul.com.br

Media Relations

Tel: +55 11 4831 1245

imprensa@voeazul.com.br

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 14, 2024

Azul S.A.

By: /s/ Alexandre Wagner Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer

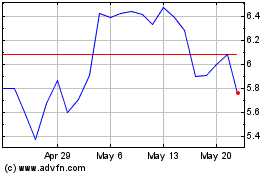

Azul (NYSE:AZUL)

Historical Stock Chart

From Nov 2024 to Dec 2024

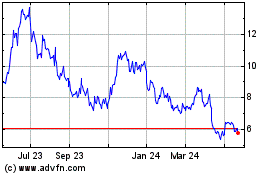

Azul (NYSE:AZUL)

Historical Stock Chart

From Dec 2023 to Dec 2024