UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

April 22, 2015

AZZ incorporated

(Exact name of Registrant as specified in its charter)

|

| | |

TEXAS (State or Other Jurisdiction of Incorporation or Organization) | 1-12777 Commission File No. | 75-0948250 (I.R.S. Employer Identification Number) |

| | |

| One Museum Place, Suite 500 3100 West Seventh Street Fort Worth, TX 76107 (Address of principal executive offices, including zip code) | |

|

| |

Registrant’s Telephone Number, including Area Code: | (817) 810-0095 |

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition.

On April 22, 2015, AZZ incorporated (“AZZ”) issued a press release reporting AZZ’s fourth quarter and fiscal year 2015 financial results for the period ended February 28, 2015. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

The following exhibits are filed as part of this report.

|

| |

Exhibit 99.1 | Press Release of AZZ incorporated, dated April 22, 2015. |

FORWARD LOOKING STATEMENTS

Certain statements herein about our expectations of future events or results constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by terminology such as, “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial and economic data and management's views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward-looking statements. This Current Report on Form 8-K may contain forward-looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand and response to products and services offered by AZZ and its affiliates, including demand by the electrical power generation markets, electrical transmission and distribution markets, the nuclear power generation markets, the industrial markets, and the hot dip galvanizing markets; prices and raw material cost, including zinc and natural gas which are used in the hot dip galvanizing process; changes in the political stability and economic conditions of the various markets that AZZ and its affiliates serve, foreign and domestic, customer request delays of shipments, acquisition opportunities, currency exchange rates, adequacy of financing, and availability of experienced management employees to implement AZZ's growth strategy. AZZ has provided additional information regarding risks associated with the business in AZZ's Annual Report on Form 10-K for the fiscal year ended February 28, 2015 and other filings with the SEC, available for viewing on AZZ's website at www.azz.com and on the SEC's website at www.sec.gov. You are urged to consider these factors carefully in evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| AZZ incorporated |

DATE: April 22, 2015 |

By: /s/ Tara D. Mackey |

| Tara D. Mackey Chief Legal Officer and Corporate Secretary |

|

| | |

Exhibit No. | | Description |

99.1 | | Press Release of AZZ incorporated, dated April 22, 2015 |

AZZ incorporated Reports Financial Results for the Fourth Quarter and Fiscal Year 2015

Reports Fourth Quarter and Full Year Fiscal 2015 EPS of $0.63 and $2.52, Respectively

Annual Revenues of $816.7 million, up $65.0 million or 8.6% over Fiscal 2014

Fourth Quarter Revenues of $182.3 million, up $1.3 million or 0.7% over Prior Year

Annual Cash Flow from Operations up $10.9 million or 10.1% Compared to Prior Year

Company Reaffirms Previously Announced Fiscal Year 2016 Revenue and Earnings Guidance

April 22, 2015 - FORT WORTH, TX - AZZ incorporated (NYSE:AZZ), a global provider of galvanizing services, welding solutions, specialty electrical equipment and highly engineered services, today announced financial results for the three and twelve-month periods ended February 28, 2015.

Fourth Quarter and Fiscal Year Results

Revenues for the fourth quarter were $182.3 million compared to $181.0 million for the same quarter last year, an increase of 0.7 percent. Net income for the fourth quarter was $16.3 million, or $0.63 per diluted share, compared to net income of $10.2 million, or $0.40 per diluted share, for last year’s fourth fiscal quarter.

Earnings for the fourth quarter of fiscal 2015 were positively impacted by a favorable effective tax rate of 14.5% compared to 39.0% in the fourth quarter of the prior year. The full year fiscal 2015 effective tax rate was 27.9% compared to 36.5% in fiscal 2014.

For the twelve-month period, the Company reported revenues of $816.7 million compared to $751.7 million for the comparable period last year, an increase of 8.6 percent. Net income for the twelve months was $64.9 million, or $2.52 per diluted share, compared to $59.6 million, or $2.32 per diluted share in the comparable period of last year.

Our backlog at the end of the 2015 fiscal year was $332.6 million. Backlog at the end of the prior year was $325.0 million and $300.3 million at end of third quarter fiscal 2015. Incoming orders for the year were $824.3 million while shipments for the year totaled $816.7 million, resulting in a book to ship ratio of 101 percent. Of the backlog of $332.6 million, 24 percent will be delivered outside of the U.S.

Energy Segment

Revenues for the Energy Segment for the fourth quarter of fiscal 2015 were $97.2 million as compared to $103.5 million for the same quarter last year, decreasing 6.1 percent. Operating income for the segment increased 6.0 percent to $9.8 million compared to $9.2 million in the same period last year. Operating margins for the fourth quarter were 10.1 percent for the quarter as compared to 8.9 percent in the prior year period. For fiscal 2015, revenues increased 10.1 percent to $458.3 million and operating income decreased 13.1 percent to $38.7 million compared to $416.1 million and $44.5 million respectively, in the prior year period. Operating margins for the 2015 fiscal year were 8.4 percent as compared to 10.7 percent in the prior year period, and were affected by costs related to our previously announced realignment program and certain cost overruns on projects recognized in the second quarter of fiscal 2015.

Galvanizing Services Segment

Revenues for the Company’s Galvanizing Services Segment for the fourth quarter were $85.1 million, compared to the $77.5 million in the same period last year, an increase of 9.8 percent. Operating income was $20.3 million as compared to $18.7 million in the prior period, an increase of 8.8 percent. Operating margins for the fourth quarter were 23.9 percent, compared to 24.1 percent in the same period last year. For fiscal 2015, revenues increased 6.8 percent to $358.3 million and operating income increased 0.9 percent to $88.6 million compared to $335.6 million and $87.8 million respectively, for the twelve months of the prior fiscal year. Operating margins for the 2015 fiscal year were 24.7 percent compared to 26.2 percent in the prior year period, and were negatively impacted by higher zinc costs and severe weather conditions.

Management Discussion

Tom Ferguson, president and chief executive officer of AZZ incorporated, commented, “We are pleased with the financial performance achieved during the quarter and fiscal year, resulting in record revenues, improving margins and strong cash flow, despite the operating challenges addressed during the year. Fiscal Year 2015 was AZZ’s 28th consecutive year of profitability, a testament to all the employees of AZZ.”

Mr. Ferguson, continued, “As I noted on the last call, our markets remained mixed during the fourth quarter and our Galvanizing and Energy businesses were impacted by severe weather conditions resulting in delays. Within the Energy segment, WSI was impacted by the refinery strikes that slightly reduced the amount of work completed during available turnarounds. We are seeing improvements in our quoting activity within our Energy business segment, resulting in improved backlog and we anticipate further improvements in our core markets during fiscal 2016. Although we are seeing a slight impact on a couple of our businesses due to lower oil prices and reduced rig count, we continue to see a number of opportunities for growth in most of our businesses. We remain focused on leveraging our sales teams across our Energy businesses in North America; aggressively expanding internationally; driving operational excellence and growing our galvanizing business, both organically and with targeted acquisitions.”

Mr. Ferguson, concluded, “The continued success of AZZ is due to the hard work, dedication, and the operational excellence displayed by our employees every day. I greatly appreciate their ongoing efforts. The Energy leadership team has made significant progress in accomplishing a number of strategic initiatives, which bolsters our confidence for continued growth in the coming years. The Galvanizing leadership team continues to excel and demonstrates both discipline and focus on providing our customers with industry leading service and support. We have a solid and balanced portfolio of products and innovative technologies; a respected position within our core markets; and loyal customers due to our commitment to superior service and quality products. I am confident that fiscal 2016 will be a solid year and I am reaffirming our previously issued guidance for fiscal 2016 EPS in the range of $2.75 to $3.25 per diluted share and revenues to be in the range of $875 million to $925 million.”

Conference Call

AZZ incorporated will conduct a conference call to discuss financial results for the fourth quarter and fiscal year 2015 at 11:00 A.M. ET on Wednesday, April 22, 2015. Interested parties can access the conference call by dialing (877) 317-6789 or (412) 317-6789 (international). The call will be web cast via the Internet at http://www.azz.com/investor-relations. A replay of the call will be available for three days at (877) 344-7529 or (412) 317-0088 (international), confirmation #10062911 or for 30 days at http://www.azz.com/investor-relations.

About AZZ incorporated

AZZ incorporated is a global provider of galvanizing services, welding solutions, specialty electrical equipment and highly engineered services to the markets of power generation, transmission, distribution and industrial in protecting metal and electrical systems used to build and enhance the world’s infrastructure. AZZ Galvanizing is a leading provider of metal finishing solutions for corrosion protection, including hot dip galvanizing to the North American steel fabrication industry. AZZ Energy is dedicated to delivering safe and reliable transmission of power from generation sources to end customers, and automated weld overlay solutions for corrosion and erosion mitigation to critical infrastructure in the energy markets worldwide.

Safe Harbor Statement

Certain statements herein about our expectations of future events or results constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by terminology such as, “may,” “should,” “expects,“ “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward-looking statements. This release may contain forward-looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand and response to products and services offered by AZZ, including demand by the power generation markets, electrical transmission and distribution markets, the industrial markets, and the hot dip galvanizing markets; prices and raw material cost, including zinc and natural gas which are used in the hot dip galvanizing process; changes in the political stability and economic conditions of the various markets that AZZ serves, foreign and domestic, customer requested delays of shipments, acquisition opportunities, currency exchange rates, adequacy of financing, and availability of experienced management and employees to implement AZZ’s growth strategy. AZZ has provided additional information regarding risks associated with the business in AZZ’s Annual Report on Form 10-K for the fiscal year ended February 28, 2015 and other filings with the SEC, available for viewing on AZZ’s website at www.azz.com and on the SEC’s website at www.sec.gov. You are urged to consider these factors carefully in evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

|

| |

Contact: | Paul Fehlman, Senior Vice President - Finance and CFO |

| AZZ incorporated 817-810-0095 |

| Internet: www.azz.com |

| |

| Lytham Partners 602-889-9700 |

| Joe Dorame or Robert Blum |

| Internet: www.lythampartners.com |

---Financial tables on the following page---

AZZ incorporated

Condensed Consolidated Statement of Income

(in thousands except per share amounts) |

| | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| February 28, 2015 | | February 28, 2014 | | February 28, 2015 | | February 28, 2014 |

| (unaudited) | | (unaudited) | | | | |

| | | | | | | |

Net sales | $182,311 | | $181,011 | | $816,687 | | $751,723 |

Costs of Sales | 134,879 | | 135,287 | | 610,991 | | 546,018 |

Operating Income | 47,432 | | 45,724 | | 205,696 | | 205,705 |

| | | | | | | |

Selling, General and Administrative | 24,339 | | 24,613 | | 98,871 | | 105,591 |

Operating Income | 23,093 | | 21,111 | | 106,825 | | 100,114 |

| | | | | | | |

Interest Expense | 4,030 | | 4,663 | | 16,561 | | 18,407 |

Net (Gain) Loss on Sales or Insurance Settlement of Property, Plant and Equipment | (1,330) | | 217 | | (2,525) | | (8,039) |

Other (Income), net | 1,350 | | (549) | | 2,659 | | (4,165) |

Income before income taxes | 19,043 | | 16,780 | | 90,130 | | 93,911 |

Income Tax Expense | 2,759 | | 6,538 | | 25,187 | | 34,314 |

Net income | $16,284 | | $10,242 | | $64,943 | | $59,597 |

Net income per share | | | | | | | |

Basic | $0.63 | | $0.40 | | $2.53 | | $2.34 |

Diluted | $0.63 | | $0.40 | | $2.52 | | $2.32 |

Diluted average shares outstanding | 25,794 | | 25,721 | | 25,778 | | 25,693 |

Segment Reporting

(in thousands)

|

| | | | | | | | |

| Three Months Ended | | Twelve Months Ended | |

| February 28, 2015 | | February 28, 2014 | | February 28, 2015 | | February 28, 2014 | |

| (unaudited) | | (unaudited) | | | | | |

| | | | | |

Net Sales: | | | | | | | | |

Energy | $97,206 | | $103,470 | | $458,339 | | $416,106 | |

Galvanizing Services | 85,105 | | 77,541 | | 358,348 | | 335,617 | |

| $182,311 | | $181,011 | | $816,687 | | $751,723 | |

| | | | | | | | |

Segment Operating Income : | | | | | | | | |

Energy | $9,805 | | $9,249 | | $38,703 | | $44,513 | |

Galvanizing Services | 20,337 | | 18,699 | | 88,562 | | 87,808 | |

Corporate | (7,049) | | (6,837) | | (20,440) | | (32,207) | |

Total Segment Operating Income | $23,093 | | $21,111 | | $106,825 | | $100,114 | |

Condensed Consolidated Balance Sheet

(in thousands)

|

| | | |

| February 28, 2015 | | February 28, 2014 |

| | | |

| | | |

Assets: | | | |

Current Assets | $298,634 | | $296,181 |

Net Property, Plant and Equipment | 196,583 | | 197,639 |

Other Assets, Net | 441,697 | | 459,433 |

Total Assets | $936,914 | | $953,253 |

| | | |

Liabilities and Shareholders’ Equity: | | | |

Current Liabilities | $149,142 | | $144,016 |

Long Term Debt Due After One Year | 315,982 | | 384,768 |

Long Term Liabilities Due After One Year | 0 | | 9,121 |

Other Liabilities | 51,738 | | 39,435 |

Shareholders’ Equity | 420,052 | | 375,913 |

Total Liabilities and Shareholders’ Equity | $936,914 | | $953,253 |

Condensed Consolidated Statements of Cash Flows

(in thousands)

|

| | | |

| Twelve Months Ended |

| February 28, 2015 | | February 28, 2014 |

| | | |

| | | |

Net cash provided by (used in) operating activities | $118,157 | | $107,275 |

Net cash provided by (used in) investing activities | (39,565) | | (310,969) |

Net cash provided by (used in) financing activities | (82,414) | | 176,333 |

Effect of exchange rate changes on cash | (1,216) | | (672) |

Net increase (decrease) in cash and cash equivalents | ($5,038) | | ($28,033) |

Cash and cash equivalents at beginning of period | 27,565 | | 55,598 |

Cash and cash equivalents at end of period | $22,527 | | $27,565 |

--END--

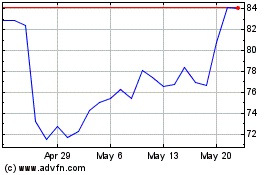

AZZ (NYSE:AZZ)

Historical Stock Chart

From Sep 2024 to Oct 2024

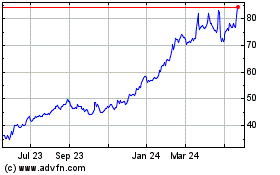

AZZ (NYSE:AZZ)

Historical Stock Chart

From Oct 2023 to Oct 2024