Filed by Berry Global Group, Inc.

Pursuant to Rule 425 under the Securities Act

of 1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Berry Global Group, Inc.

Commission File No.: 001-35672

To:

Berry’s Suppliers

Subject:

A New Chapter for Berry

Dear [●]

I’m excited to share some important news

about Berry. Today, we announced that Berry has entered into an agreement to combine with Amcor, creating a global leader in consumer

and healthcare packaging solutions with unprecedented innovation capabilities. You can read more about the announcement in our joint

press release: https://www.prnewswire.com/news-releases/amcor-and-berry-to-combine-in-an-all-stock-transaction-creating-a-global-leader-in-consumer-and-healthcare-packaging-solutions-302309723.html.

We

believe combining with Amcor will be a win for our customers and suppliers. Amcor is a global leader in developing high-quality,

responsible packaging solutions. Like us, Amcor prioritizes the customer experience, which reinforces our confidence in the power of this

partnership. With this combination, we will have a broader, more sustainable and more complete product offering. We will also have stronger

technology driven innovation capabilities and expertise, global reach and supply chain flexibility. In the future, we anticipate significant

opportunities for Berry and our valued supply chain as we create world class products for our customers and expand our global reach further.

Most importantly, this means we will be far better placed to help global and local customers grow faster.

Looking

ahead, we are targeting closing the transaction in the middle of calendar year 2025 following receipt of regulatory approvals,

shareholder approvals and other customary closing conditions. Following transaction close, the combined company will be led by Peter Konieczny,

the current CEO of Amcor. In the meantime, we will continue to operate as usual. Your Berry contact remains the same and all current contracts

will carry on in the normal course. As we begin integration planning work with Amcor, we will be in close coordination with you to ensure

we are positioning our combined company to continue meeting and exceeding your expectations. Should you have any questions, please feel

free to reach out to me.

Thank you for your partnership. We look forward to building on our

relationship as we enter this next stage of Berry’s evolution.

Sincerely,

INSERT

Important Information for Investors and Shareholders

This

communication does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation

of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. It does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the US Securities Act of 1933, as amended, and otherwise in accordance

with applicable law.

In

connection with the proposed transaction between Berry Global Group, Inc. (“Berry”) and Amcor plc (“Amcor”),

Berry and Amcor intend to file relevant materials with the Securities and Exchange Commission (the “SEC”), including,

among other filings, an Amcor registration statement on Form S-4 that will include a joint proxy statement of Berry and Amcor that also

constitutes a prospectus of Amcor with respect to Amcor’s ordinary shares to be issued in the proposed transaction, and a definitive

joint proxy statement/prospectus, which will be mailed to shareholders of Berry and Amcor (the “Joint Proxy Statement/Prospectus”).

Berry and Amcor may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the

Joint Proxy Statement/Prospectus or any other document which Berry or Amcor may file with the SEC. INVESTORS AND SECURITY HOLDERS OF BERRY

AND AMCOR ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the

registration statement and the Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Berry or Amcor

through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Berry will be available

free of charge on Berry’s website at berryglobal.com under the tab “Investors” and under the heading “Financials”

and subheading “SEC Filings.” Copies of the documents filed with the SEC by Amcor will be available free of charge on Amcor’s

website at amcor.com under the tab “Investors” and under the heading “Financial Information” and subheading “SEC

Filings.”

Certain Information Regarding Participants

Amcor,

Berry, and their respective directors and executive officers may be considered participants in the solicitation of proxies from the shareholders

of Berry and Amcor in connection with the proposed transaction. Information about the directors and executive officers of Berry is set

forth in its Annual Report on Form 10-K for the year ended September 30, 2023, which was filed with the SEC on November 17, 2023, its

proxy statement for its 2024 annual meeting, which was filed with the SEC on January 4, 2024, and its Current Reports on Form 8-K, which

were filed with the SEC on February 12, 2024, April 11, 2024, September 6, 2024 and November 4, 2024. Information about the directors

and executive officers of Amcor is set forth in its Annual Report on Form 10-K for the year ended June 30, 2024, which was filed with

the SEC on August 16, 2024 and its proxy statement for its 2024 annual meeting, which was filed with the SEC on September 24, 2024. To

the extent holdings of Berry’s or Amcor’s securities by its directors or executive officers have changed since the amounts

set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements

of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Berry and Amcor,

including a description of their direct or indirect interests, by security holdings or otherwise, and other information regarding the

potential participants in the proxy solicitations, which may be different than those of Berry’s stockholders and Amcor’s shareholders

generally, will be contained in the Joint Proxy Statement/Prospectus and other relevant materials to be filed with the SEC regarding the

proposed transaction. You may obtain these documents (when they become available) free of charge through the website maintained by the

SEC at http://www.sec.gov and from Berry’s or Amcor’s website as described above.

Cautionary Statement Regarding Forward-Looking Statements

This

communication contains certain statements that are “forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act. Some of these forward-looking statements can be identified by words like “anticipate,”

“approximately,” “believe,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “intend,” “may,” “outlook,” “plan,” “potential,” “possible,”

“predict,” “project,” “target,” “seek,” “should,” “will,” or “would,”

the negative of these words, other terms of similar meaning or the use of future dates. Such statements, including projections as to the

anticipated benefits of the proposed transaction, the impact of the proposed transaction on Berry’s and Amcor’s business and

future financial and operating results and prospects, the amount and timing of synergies from the proposed transaction, the terms and

scope of the expected financing in connection with the proposed transaction, the aggregate amount of indebtedness of the combined company

following the closing of the proposed transaction and the closing date for the proposed transaction, are based on the current estimates,

assumptions and projections of the management of Berry and Amcor, and are qualified by the inherent risks and uncertainties surrounding

future expectations generally, all of which are subject to change. Actual results could differ materially from those currently anticipated

due to a number of risks and uncertainties, many of which are beyond Berry’s and Amcor’s control. None of Berry, Amcor or

any of their respective directors, executive officers, or advisors, provide any representation, assurance or guarantee that the occurrence

of the events expressed or implied in any forward-looking statements will actually occur, or if any of them do occur, what impact they

will have on the business, results of operations or financial condition of Berry or Amcor. Should any risks and uncertainties develop

into actual events, these developments could have a material adverse effect on Berry’s and Amcor’s businesses, the proposed

transaction and the ability to successfully complete the proposed transaction and realize its expected benefits. Risks and uncertainties

that could cause results to differ from expectations include, but are not limited to, the occurrence of any event, change or other circumstance

that could give rise to the termination of the merger agreement; the risk that the conditions to the completion of the proposed transaction

(including shareholder and regulatory approvals) are not satisfied in a timely manner or at all; the risks arising from the integration

of the Berry and Amcor businesses; the risk that the anticipated benefits of the proposed transaction may not be realized when expected

or at all; the risk of unexpected costs or expenses resulting from the proposed transaction; the risk of litigation related to the proposed

transaction; the risks related to disruption of management’s time from ongoing business operations as a result of the proposed transaction;

the risk that the proposed transaction may have an adverse effect on the ability of Berry and Amcor to retain key personnel and customers;

general economic, market and social developments and conditions; the evolving legal, regulatory and tax regimes under which Berry and

Amcor operate; potential business uncertainty, including changes to existing business relationships, during the pendency of the proposed

transaction that could affect Berry’s and/or Amcor’s financial performance; and other risks and uncertainties identified

from time to time in Berry’s and Amcor’s respective filings with the SEC, including the Joint Proxy Statement/Prospectus to

be filed with the SEC in connection with the proposed transaction. While the list of risks presented here is, and the list of risks presented

in the Joint Proxy Statement/Prospectus will be, considered representative, no such list should be considered to be a complete statement

of all potential risks and uncertainties, and other risks may present significant additional obstacles to the realization of forward-looking

statements. Forward-looking statements included herein are made only as of the date hereof and neither Berry nor Amcor undertakes any

obligation to update any forward-looking statements, or any other information in this communication, as a result of new information, future

developments or otherwise, or to correct any inaccuracies or omissions in them which become apparent. All forward-looking statements in

this communication are qualified in their entirety by this cautionary statement.

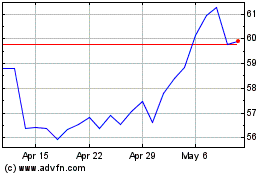

Berry Global (NYSE:BERY)

Historical Stock Chart

From Oct 2024 to Nov 2024

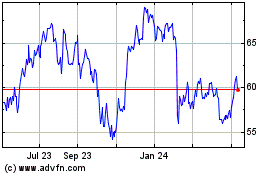

Berry Global (NYSE:BERY)

Historical Stock Chart

From Nov 2023 to Nov 2024