UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to §240.14a-12 |

| Crown Castle Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Below

is the text of a press release issued by Crown Castle Inc. on March 5, 2024:

Crown

Castle Comments on Self-Serving, Unfounded Litigation Brought by Ted Miller

Attempted

Legal Maneuvers Seek To Interfere with CEO Search and Fiber Review

HOUSTON, TX

– March 5, 2024 – Crown Castle Inc. (NYSE: CCI) (“Crown Castle” or the “Company”) today commented

on the self-serving litigation brought by Ted Miller and Boots Capital Management.

The lawsuit

brought by Mr. Miller is without merit and underscores that his activism campaign against Crown Castle is focused on his own self interests.

These interests include, among other things, the appointment to the Board of himself and three of his handpicked nominees (including

his son-in-law), and getting himself installed as a paid executive of the Company (with the title of executive chairman) after spending

more than 22 years away. After previously calling for the Board to act with urgency, Mr. Miller is seeking as part of his litigation

a Court order to, among other things, impede progress on the Company’s ongoing CEO search and the strategic and operating review

of its fiber business.

In addition

to advancing a self-serving agenda, impeding value-creation work that Mr. Miller claims to support, and being premised on a host of misleading

assertions and outright inaccuracies, Mr. Miller’s litigation seeks inappropriately to weaponize the Delaware Court of Chancery’s

(the “Court”) recent decision in West Palm Beach Firefighters’ Pension Fund v. Moelis & Co. in an attempt

to gain an advantage in his proxy fight against the Company.

The facts are

these: with the advice of counsel, Crown Castle entered in a market-standard cooperation agreement with Elliott on December 19, 2023.

Subsequently, on February 23, 2024, the Court issued a decision in Moelis. On March 4, 2024, Crown Castle announced that the Company

and Elliott had agreed to amend certain provisions of the Cooperation Agreement to:

| · | Clarify

that the Board retains the power at any time to change its recommendation regarding any director

nominees, consistent with its fiduciary duties; |

| · | Eliminate

limitations on the sizes of the Board, the Fiber Review Committee and the CEO Search Committee;

and |

| · | Provide

that Elliott’s shares will vote pro rata with the votes of other stockholders instead

of requiring Elliott to vote its shares in favor of the Board’s recommendations. |

Contrary to

Mr. Miller’s misleading allegations and distinct from Moelis, Elliott did not control Crown Castle before or as a result

of the Cooperation Agreement. Today, the Crown Castle Board comprises 12 directors, 11 of whom are independent and only two of whom were

appointed with input from Elliott.

In truth,

Mr. Miller is the one who seeks to dominate Crown Castle by having the Company name him executive chairman and put two of his

associates and his son-in-law on the Board. It is Mr. Miller who effectively seeks to dictate the outcome of the strategic and

operating review of Crown Castle’s fiber business by forcing the Board to “onboard Boots advisors,” “assume

cost for Boots work product” (which Mr. Miller has stated amounts to approximately $5 million) and compensate the Boots team

in some unspecified way to ensure it is “aligned … for value achievement.”1

Mr. Miller seeks

this unjustified degree of control over Crown Castle despite owning far less than 1% of the Company, with the majority of his investment

position held in the form of call options with less than one year of duration.

The Board values

feedback from all its shareholders and incorporates such feedback and suggestions in its deliberations. As such, all feedback, including

the suggestions from Mr. Miller, are being considered as part of the Board’s strategic review, which is focused on generating long-term

value for all shareholders. Contrary to the Company’s goals, Mr. Miller’s proxy fight and his lawsuit seek above all else

to prioritize his own interests, regardless of the consequences for Crown Castle’s shareholders.

1

Project Boots Presentation, Slide 11, accessible at https://mma.prnewswire.com/media/2343199/Project_Boots_Presentation.pdf

ABOUT CROWN CASTLE

Crown Castle owns, operates and leases more than 40,000 cell towers and

approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S. market. This nationwide

portfolio of communications infrastructure connects cities and communities to essential data, technology and wireless service –

bringing information, ideas and innovations to the people and businesses that need them. For more information on Crown Castle, please

visit www.crowncastle.com.

CAUTIONARY LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements for purposes

of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. Statements that are not historical facts are

hereby identified as forward-looking statements. In addition, words such as “estimate,” “anticipate,”

“project,” “plan,” “intend,” “believe,” “expect,” “likely,”

“predicted,” “positioned,” “continue,” “target,” “seek,”

“focus” and any variations of these words and similar expressions are intended to identify forward-looking statements.

Examples of forward-looking statements include (1) statements and expectations regarding the process and outcomes of Company’s

Fiber Review Committee, including that it will help enhance and unlock shareholder value, (2) statements and expectations regarding

the process and outcomes of CEO Search Committee, including that it will conduct the search to identify Crown Castle’s next

CEO, (3) that the actions set forth in this press release best position the Company for long term success, including our

Board’s regular evaluation of all paths to enhance shareholder value, (4) that the Company will benefit from the experience

and insights of the newly appointed directors, and (5) that the Company will identify the best path forward to capitalize on

significant opportunities for growth in our industry. Such forward-looking statements should, therefore, be considered in light of

various risks, uncertainties and assumptions, including prevailing market conditions, risk factors described in “Item 1A. Risk

Factors” of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (“2023 Form 10-K”) and

other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those expected.

Our filings with the SEC are available through the SEC website

at www.sec.gov or through our investor relations website at investor.crowncastle.com.

We use our investor relations website to disclose information about us that may be deemed to be material. We encourage investors,

the media and others interested in us to visit our investor relations website from time to time to

review up-to-date information or to sign up for e-mail alerts to be notified when new or updated information is

posted on the site.

Important Stockholder Information

The Company intends to file a proxy statement and

a WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation

of proxies for its 2024 Annual Meeting. THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT,

THE ACCOMPANYING WHITE PROXY CARD, AND ANY AMENDMENTS AND SUPPLEMENTS TO THESE DOCUMENTS WHEN THEY BECOME AVAILABLE AS

THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the proxy statement, any amendments or supplements to the proxy statement,

and other documents as and when filed by the Company with the SEC without charge from the SEC’s website at www.sec.gov.

Participant Information

For participant information, see the Company’s

Schedule 14A filed with the SEC on February 14, 2024 and available here.

CONTACTS:

Dan Schlanger, CFO

Kris Hinson, VP & Treasurer

Crown Castle Inc.

713-570-3050

MEDIA:

Andy Brimmer / Adam Pollack

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

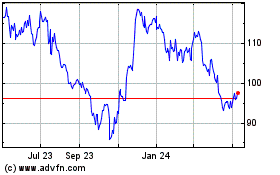

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

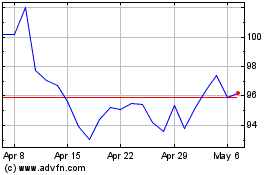

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024