SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 29, 2015

CURTISS-WRIGHT CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

1-134

|

13-0612970

|

|

State or Other

Jurisdiction of

Incorporation or

Organization

|

Commission File

Number

|

IRS Employer

Identification No.

|

|

13925 Ballantyne Corporate Place, Suite 400

Charlotte, North Carolina

|

28277 |

| Address of Principal Executive Offices |

Zip Code |

Registrant's telephone number, including area code: (704) 869-4600

--------------

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECTION 2 – FINANCIAL INFORMATION

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On Wednesday, April 29, 2015, the Company issued a press release announcing financial results for the first quarter ended March 31, 2015. A copy of this press release and slide presentation are attached hereto as Exhibits 99.1 and 99.2. A conference call and webcast presentation will be held on April 30, 2015 at 9:00 am EST for management to discuss the Company's first quarter 2015 performance as well as expectations for 2015 financial performance. David C. Adams, Chairman and CEO, and Glenn E. Tynan, Vice President and CFO, will host the call.

The financial press release, access to the webcast and the accompanying financial presentation will be posted on Curtiss-Wright's website at www.curtisswright.com. For those unable to participate, a webcast replay will be available for 90 days on the Company's website beginning one hour after the call takes place. A conference call replay will also be available for seven days.

Conference Call Replay:

Domestic (855) 859-2056

International (404) 537-3406

Passcode 24369815

The information contained in this Current Report, including Exhibits 99.1 and 99.2, are being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this report shall not be incorporated by reference into any filing of the registrant with the SEC, whether made before or after the date hereof, regardless of any general incorporation language in such filings.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(a) Not applicable.

(b) Not applicable.

(c) Exhibits.

99.1 Press Release dated April 29, 2015

99.2 Presentation shown during investor and securities analyst webcast on April 30, 2015

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

CURTISS-WRIGHT CORPORATION

By: /s/ Glenn E. Tynan

Glenn E. Tynan

Vice-President and

Chief Financial Officer

Date: April 29, 2015

EXHIBIT INDEX

|

Exhibit

Number

|

|

Description

|

|

| |

|

|

|

|

99.1

|

|

Press Release dated April 29, 2015

|

|

|

99.2

|

|

Presentation shown during investor and securities analyst webcast on April 30, 2015

|

|

EXHIBIT 99.1

Curtiss-Wright Reports First Quarter Financial Results

CHARLOTTE, N.C., April 29, 2015 (GLOBE NEWSWIRE) -- Curtiss-Wright Corporation (NYSE:CW) reported financial results for the first quarter ended March 31, 2015.

First Quarter 2015 Operating Highlights from Continuing Operations

-

Net sales increased 1% to $546 million, from $543 million in 2014; Organic sales up 3%;

-

Operating income increased 19% to $73 million, from $61 million in 2014;

-

Operating margin increased 210 basis points to 13.3%, from 11.2% in 2014;

-

Net earnings from continuing operations increased 19% to $43 million, or $0.89 per diluted share, from $36 million, or $0.74 per diluted share, in 2014;

-

New orders totaled $629 million, up 8% from 2014, primarily due to higher demand within the defense markets, driving book-to-bill to 1.15; and

-

Backlog of approximately $1.65 billion was nearly unchanged from December 31, 2014.

"We were pleased with our solid first quarter results, which were driven by 3% organic sales growth, and improved organic operating income and margin growth in our commercial businesses, generating $0.89 in diluted earnings per share," said David C. Adams, Chairman and CEO of Curtiss-Wright Corporation. "This performance reflects our drive for operating margin expansion as we continue to leverage the scale and critical mass of One Curtiss-Wright.

"Our first quarter results in the Power segment reflect the receipt of a termination change order on the former Progress Energy U.S. AP1000 plant, which ceased construction years ago due to state funding constraints. This order, originally anticipated in the second quarter, provided a one-time net benefit of $0.10 to the current quarter diluted EPS results. We are maintaining our current full-year diluted EPS guidance of $3.80 to $3.90, and anticipate solid margin improvement in all three segments during the second half of 2015.

"Further, as part of our commitment to buyback at least $200 million in stock in 2015, we repurchased approximately $47 million in stock in the first quarter. Overall, we believe that our steadfast commitment to improving profitability, generating strong free cash flow and maintaining a balanced capital allocation strategy will continue to enhance shareholder value."

First Quarter 2015 Operating Results from Continuing Operations

|

(In thousands) |

1Q-2015 |

1Q-2014 |

% Change |

|

Sales |

$ 546,199 |

$ 542,959 |

1% |

|

Operating income |

72,835 |

61,034 |

19% |

|

Operating margin |

13.3% |

11.2% |

210 bps |

Sales

Sales of $546 million in the first quarter increased $3 million, or 1%, compared to the prior year period, driven by solid 3% organic growth (excluding effects of foreign currency translation, acquisitions and divestitures) across all three segments, offset by 2% in unfavorable foreign currency translation.

From an end market perspective, first quarter sales to the commercial markets decreased 1%, while sales to the defense markets increased 4%, compared to the prior year period. Please refer to the accompanying tables for a breakdown of sales by end market.

Operating Income

Operating income in the first quarter was $73 million, an increase of approximately $12 million or 19% compared to the prior year period. This improvement was primarily driven by the one-time benefit of the termination change order, as well as solid organic growth in the Commercial/Industrial segment. On an organic basis, operating income improved 16%, excluding $2 million in foreign currency translation.

Operating margin was 13.3%, an increase of 210 basis points over the prior year period, reflecting higher operating income in all three segments and the benefits of our ongoing margin improvement initiatives. On an organic basis, operating margin improved 150 basis points to 12.7%.

Non-segment operating expense

Non-segment costs were slightly higher as compared with the prior year period, primarily due to higher foreign exchange transactional losses partially offset by lower pension costs.

Net Earnings

First quarter net earnings increased 19% from the comparable prior year period. Interest expense of approximately $9 million was in-line with the prior year period. Our effective tax rate for the current quarter was 32.8%, an increase from 30.1% in the prior year period, driven by a decline in the manufacturing deduction as well as the mix of domestic income.

Free Cash Flow

|

(In thousands) |

1Q-2015 |

1Q-2014 |

|

Net cash used for operating activities |

$ (171,091) |

$ (14,593) |

|

Capital expenditures |

(9,096) |

(18,365) |

|

Free cash flow |

$ (180,187) |

$ (32,958) |

|

Pension payment |

145,000 |

7,800 |

|

Adjusted free cash flow |

$ (35,187) |

$ (25,158) |

Free cash flow, defined as cash flow from operations less capital expenditures, was ($180 million) for the first quarter of 2015, compared to ($33 million) in the prior year period, or a decrease of $147 million. Adjusted free cash flow, defined as free cash flow excluding pension contributions of $145 million and $8 million from current and prior year periods, respectively, decreased $10 million to approximately ($35) million, primarily due to higher tax payments in the current year period, partially offset by higher cash earnings. Capital expenditures of $9 million were $9 million lower in the first quarter of 2015, as the prior year period included investments in facility expansions that did not recur this year.

Other Items – Discontinued Operations

During the first quarter of 2015, the Company recorded an after-tax book charge on its discontinued operations of approximately $27 million, or $0.57 diluted earnings per share.

Other Items – Share Repurchase

Beginning in January 2015, the Company began to repurchase shares under its previously announced $200 million share repurchase program, which it expects to complete by year-end.

During the first quarter, the Company repurchased approximately 673,500 shares of its common stock for approximately $47 million.

Full-Year 2015 Guidance

The Company is maintaining its full-year 2015 financial guidance as follows:

|

|

2015 Guidance |

Chg vs. 2014 |

|

Total sales |

$2.28 - $2.33 billion |

2% - 4% |

|

Operating income |

$303 - $312 million |

7% - 10% |

|

Operating margin |

13.3% - 13.4% |

+ 70 - 80 bps |

|

Interest expense |

$37 - 38 million |

|

|

Effective tax rate |

~32% |

|

|

Diluted earnings per share |

$3.80 - $3.90 |

10% - 13% |

|

Diluted shares outstanding |

47.8 million |

|

|

Free cash flow |

$100 - $120 million |

|

|

Adjusted free cash flow * |

$245 - $265 million |

|

Notes: A more detailed breakdown of our 2015 guidance by segment and by market can be found in the attached accompanying schedules.

Effective January 30, 2015, Curtiss-Wright elected to make a $145 million contribution to its corporate defined benefit pension plan, which is expected to significantly reduce annual pension expense and annual cash contributions going forward.

*Adjusted free cash flow guidance excludes the aforementioned pension contribution of $145 million.

First Quarter 2015 Segment Performance

Commercial/Industrial

|

(In thousands) |

1Q-2015 |

1Q-2014 |

% Change |

|

Sales |

$ 297,887 |

$ 300,953 |

(1%) |

|

Operating income |

43,289 |

38,496 |

12% |

|

Operating margin |

14.5% |

12.8% |

170 bps |

Sales for the first quarter were approximately $298 million, a decrease of $3 million, or 1%, over the comparable prior year period. Organic sales increased 2% over the prior year period, excluding $9 million in unfavorable foreign currency translation. Within the commercial aerospace market, we experienced higher sales of OEM actuation systems and sensors and controls products, primarily on the Boeing 737 and Airbus A380 programs, offset by lower sales for surface treatment services primarily due to unfavorable foreign currency translation. In the general industrial market, lower international project sales of severe-service industrial valves serving the energy markets and unfavorable foreign currency translation were partially offset by higher domestic sales of industrial vehicle products.

Operating income in the first quarter was $43 million, an increase of $5 million, or 12%, from the comparable prior year period, while operating margin increased 170 basis points to 14.5%. The improvement in operating income and operating margin was primarily driven by higher sales of industrial vehicle products, as well as the benefit of our ongoing margin improvement initiatives. We also experienced higher profitability for surface treatment services and industrial valves products, despite lower sales volumes, due to ongoing cost reduction initiatives.

Defense

|

(In thousands) |

1Q-2015 |

1Q-2014 |

% Change |

|

Sales |

$ 113,500 |

$ 112,371 |

1% |

|

Operating income |

18,027 |

15,784 |

14% |

|

Operating margin |

15.9% |

14.0% |

190 bps |

Sales for the first quarter were approximately $113 million, an increase of $1 million, or 1%, over the comparable prior year period. Organic sales increased 4% over the prior year period, excluding $4 million in unfavorable foreign currency translation. Our results reflect strong ground defense sales, driven by higher demand for turret drive stabilization systems from international customers and improved domestic Abrams platform sales. Those gains were offset by lower demand on several military helicopter programs, including the Apache and Chinook platforms.

Operating income in the first quarter was $18 million, an increase of approximately $2 million, or 14%, compared to the prior year period, while operating margin improved 190 basis points to 15.9%. This improvement in operating income and operating margin was primarily driven by higher sales of embedded computing products and the benefits of our ongoing margin improvement initiatives, largely offset by higher estimated costs on certain long-term development contracts. In addition, favorable foreign currency translation added approximately $2 million to current quarter results.

Power

|

(In thousands) |

1Q-2015 |

1Q-2014 |

% Change |

|

Sales |

$ 134,812 |

$ 129,635 |

4% |

|

Operating income |

19,512 |

14,275 |

37% |

|

Operating margin |

14.5% |

11.0% |

350 bps |

Sales for the first quarter were approximately $135 million, an increase of approximately $5 million, or 4%, compared to the prior year period. Within the power generation market, our results reflect the benefit of the non-recurring termination order on the former Progress Energy domestic AP1000 plant. This improvement was partially offset by lower China AP1000 program revenues compared to the prior year period, as well as lower aftermarket sales supporting domestic nuclear operating reactors, as a result of ongoing deferred spending on maintenance and upgrades. Within the naval defense market, we experienced higher sales of pumps and generators supporting the Virginia-class submarine program, which were mainly offset by decreased production on the Ford-class aircraft carrier program.

Operating income in the first quarter was approximately $20 million, a 37% increase from the comparable prior year period, while operating margin increased 350 basis points to 14.5%. This improvement in operating income and operating margin was primarily driven by the aforementioned termination change order on the domestic AP1000 program.

Conference Call Information

The Company will host a conference call to discuss first quarter 2015 financial results and updates to 2015 guidance at 9:00 a.m. EDT on Thursday, April 30, 2015. A live webcast of the call and the accompanying financial presentation will be made available on the internet by visiting the Investor Relations section of the Company's website at www.curtisswright.com.

(Tables to Follow)

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS (UNAUDITED) |

|

($'s in thousands, except per share data) |

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

Change |

|

|

2015 |

2014 |

$ |

% |

|

Product sales |

$ 445,687 |

$ 436,227 |

$ 9,460 |

2% |

|

Service sales |

100,512 |

106,732 |

(6,220) |

(6%) |

|

Total net sales |

546,199 |

542,959 |

3,240 |

1% |

|

|

|

|

|

|

|

Cost of product sales |

293,009 |

288,934 |

4,075 |

1% |

|

Cost of service sales |

62,094 |

69,411 |

(7,317) |

(11%) |

|

Total cost of sales |

355,103 |

358,345 |

(3,242) |

(1%) |

|

|

|

|

|

|

|

Gross profit |

191,096 |

184,614 |

6,482 |

4% |

|

|

|

|

|

|

|

Research and development expenses |

15,262 |

16,877 |

(1,615) |

(10%) |

|

Selling expenses |

31,088 |

32,631 |

(1,543) |

(5%) |

|

General and administrative expenses |

71,911 |

74,072 |

(2,161) |

(3%) |

|

|

|

|

|

|

|

Operating income |

72,835 |

61,034 |

11,801 |

19% |

|

|

|

|

|

|

|

Interest expense |

(8,996) |

(9,055) |

59 |

1% |

|

Other income, net |

481 |

112 |

369 |

NM |

|

|

|

|

|

|

|

Earnings before income taxes |

64,320 |

52,091 |

12,229 |

23% |

|

Provision for income taxes |

21,097 |

15,661 |

5,436 |

35% |

|

Earnings from continuing operations |

$ 43,223 |

$ 36,430 |

$ 6,793 |

19% |

|

|

|

|

|

|

|

Loss from discontinued operations, net of tax |

$ (27,232) |

$ (1,266) |

$ (25,966) |

NM |

|

|

|

|

|

|

|

Net earnings |

$ 15,991 |

$ 35,164 |

$ (19,173) |

(55%) |

|

|

|

|

|

|

|

Basic earnings per share |

|

|

|

|

|

Earnings from continuing operations |

$ 0.91 |

$ 0.76 |

|

|

|

Earnings from discontinued operations |

(0.57) |

(0.03) |

|

|

|

Total |

$ 0.34 |

$ 0.73 |

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

|

|

|

|

Earnings from continuing operations |

$ 0.89 |

$ 0.74 |

|

|

|

Earnings from discontinued operations |

(0.56) |

(0.02) |

|

|

|

Total |

$ 0.33 |

$ 0.72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends per share |

$ 0.13 |

$ 0.13 |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

Basic |

47,724 |

47,982 |

|

|

|

Diluted |

48,732 |

49,130 |

|

|

|

|

|

|

|

|

|

NM- not meaningful |

|

|

|

|

|

|

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

|

($'s in thousands, except par value) |

|

|

|

|

|

|

|

March 31,

2015 |

December 31,

2014 |

Change

% |

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ 215,594 |

$ 450,116 |

(52%) |

|

Receivables, net |

496,019 |

495,480 |

0% |

|

Inventories, net |

390,188 |

388,670 |

0% |

|

Deferred tax assets, net |

45,953 |

44,311 |

4% |

|

Assets held for sale |

92,169 |

147,347 |

(37%) |

|

Other current assets |

100,925 |

45,151 |

124% |

|

Total current assets |

1,340,848 |

1,571,075 |

(15%) |

|

Property, plant, and equipment, net |

439,305 |

458,919 |

(4%) |

|

Goodwill |

983,996 |

998,506 |

(1%) |

|

Other intangible assets, net |

337,007 |

349,227 |

(3%) |

|

Other assets |

24,243 |

21,784 |

11% |

|

Total assets |

$ 3,125,399 |

$ 3,399,511 |

(8%) |

|

|

|

|

|

|

Liabilities |

|

|

|

|

Current liabilities: |

|

|

|

|

Current portion of long-term and short term debt |

$ 965 |

$ 1,069 |

(10%) |

|

Accounts payable |

131,887 |

152,266 |

(13%) |

|

Accrued expenses |

109,893 |

145,938 |

(25%) |

|

Income taxes payable |

5,543 |

22,472 |

(75%) |

|

Deferred revenue |

150,655 |

176,693 |

(15%) |

|

Liabilities held for sale |

29,138 |

35,392 |

(18%) |

|

Other current liabilities |

55,260 |

38,163 |

45% |

|

Total current liabilities |

483,341 |

571,993 |

(15%) |

|

Long-term debt |

965,189 |

953,279 |

1% |

|

Deferred tax liabilities, net |

105,328 |

51,554 |

104% |

|

Accrued pension and other postretirement benefit costs |

68,860 |

226,687 |

(70%) |

|

Long-term portion of environmental reserves |

14,024 |

14,911 |

(6%) |

|

Other liabilities |

87,950 |

102,654 |

(14%) |

|

Total liabilities |

1,724,692 |

1,921,078 |

(10%) |

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

Common stock, $1 par value |

49,190 |

49,190 |

0% |

|

Additional paid in capital |

153,432 |

158,043 |

(3%) |

|

Retained earnings |

1,479,107 |

1,469,306 |

1% |

|

Accumulated other comprehensive loss |

(182,481) |

(128,411) |

42% |

|

Less: cost of treasury stock |

(98,541) |

(69,695) |

41% |

|

Total stockholders' equity |

1,400,707 |

1,478,433 |

(5%) |

|

|

|

|

|

|

Total liabilities and stockholders' equity |

$ 3,125,399 |

$ 3,399,511 |

(8%) |

|

|

|

|

|

|

NM-not meaningful |

|

|

|

|

|

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

|

SEGMENT INFORMATION (UNAUDITED) |

|

($'s in thousands) |

|

|

|

|

|

Three Months Ended

March 31, |

|

|

2015 |

2014 |

Change

% |

|

Sales: |

|

|

|

|

Commercial/Industrial |

$ 297,887 |

$ 300,953 |

(1%) |

|

Defense |

113,500 |

112,371 |

1% |

|

Power |

134,812 |

129,635 |

4% |

|

|

|

|

|

|

Total sales |

$ 546,199 |

$ 542,959 |

1% |

|

|

|

|

|

|

Operating income (expense): |

|

|

|

|

Commercial/Industrial |

$ 43,289 |

$ 38,496 |

12% |

|

Defense |

18,027 |

15,784 |

14% |

|

Power |

19,512 |

14,275 |

37% |

|

|

|

|

|

|

Total segments |

$ 80,828 |

$ 68,555 |

18% |

|

Corporate and other |

(7,993) |

(7,521) |

(6%) |

|

|

|

|

|

|

Total operating income |

$ 72,835 |

$ 61,034 |

19% |

|

|

|

|

|

|

|

|

|

|

|

Operating margins: |

|

|

|

|

Commercial/Industrial |

14.5% |

12.8% |

|

|

Defense |

15.9% |

14.0% |

|

|

Power |

14.5% |

11.0% |

|

|

Total Curtiss-Wright |

13.3% |

11.2% |

|

|

|

|

|

|

|

Segment margins |

14.8% |

12.6% |

|

|

|

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

|

SALES BY END MARKET (UNAUDITED) |

|

($'s in thousands) |

|

|

|

|

|

Three Months Ended

March 31, |

|

|

2015 |

2014 |

Change

$ |

Change

% |

|

Defense markets: |

|

|

|

|

|

Aerospace |

$ 71,346 |

$ 71,605 |

$ (259) |

--% |

|

Ground |

18,655 |

13,858 |

4,797 |

35% |

|

Naval |

89,062 |

87,886 |

1,176 |

1% |

|

Other |

2,726 |

957 |

1,769 |

NM |

|

Total Defense |

$ 181,789 |

$ 174,306 |

$ 7,483 |

4% |

|

|

|

|

|

|

|

Commercial markets: |

|

|

|

|

|

Commercial Aerospace |

$ 101,020 |

$ 103,098 |

$ (2,078) |

(2%) |

|

Power Generation |

113,235 |

109,086 |

4,149 |

4% |

|

General Industrial |

150,155 |

156,469 |

(6,314) |

(4%) |

|

Total Commercial |

$ 364,410 |

$ 368,653 |

$ (4,243) |

(1%) |

|

|

|

|

|

|

|

Total Curtiss-Wright |

$ 546,199 |

$ 542,959 |

$ 3,240 |

1% |

|

|

|

|

|

|

|

NM- not meaningful |

|

|

|

|

Use of Non-GAAP Financial Information

The Corporation supplements our financial information determined under U.S. generally accepted accounting principles (GAAP) with certain non-GAAP financial information. We believe that these non-GAAP measures provide investors with additional insight into the company's ongoing business performance. These non-GAAP measures should not be considered in isolation or as a substitute for the related GAAP measures, and other companies may define such measures differently. We encourage investors to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. The following definitions are provided:

Organic Revenue and Organic Operating income

The Corporation discloses organic revenue and organic operating income because the Corporation believes it provides investors with insight as to the Company's ongoing business performance. Organic revenue and organic operating income are defined as revenue and operating income excluding the impact of foreign currency fluctuations and contributions from acquisitions made during the last twelve months.

|

|

Three Months Ended

March 31,

2015 vs 2014 |

|

|

Commercial/Industrial |

Defense |

Power |

Total Curtiss-Wright |

|

|

Sales |

Operating

income |

Sales |

Operating

income |

Sales |

Operating

income |

Sales |

Operating

income |

|

Organic |

2% |

12% |

4% |

(0%) |

4% |

38% |

3% |

16% |

|

Acquisitions |

0% |

(0%) |

0% |

0% |

0% |

(1%) |

0% |

(0%) |

|

Foreign Currency |

(3%) |

(0%) |

(3%) |

14% |

(0%) |

(0%) |

(2%) |

3% |

|

Total |

(1%) |

12% |

1% |

14% |

4% |

37% |

1% |

19% |

Free Cash Flow

The Corporation discloses free cash flow because the Corporation believes it measures cash flow available for investing and financing activities. Free cash flow is defined as net cash flow provided by operating activities less capital expenditures. Free cash flow represents cash generated after paying for interest on borrowings, income taxes, capital expenditures, and working capital requirements, but before repaying outstanding debt and investing cash or utilizing debt credit lines to acquire businesses and make other strategic investments.

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

|

NON-GAAP FINANCIAL DATA (UNAUDITED) |

|

($'s in thousands) |

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

2015 |

2014 |

|

|

|

|

|

Net cash used by operating activities |

$ (171,091) |

$ (14,593) |

|

Capital expenditures |

(9,096) |

(18,365) |

|

Free cash flow |

$ (180,187) |

$ (32,958) |

|

|

|

|

|

Pension Payment |

145,000 |

7,800 |

|

|

|

|

|

Adjusted free cash flow |

$ (35,187) |

$ (25,158) |

|

|

|

|

|

Cash conversion * |

(81%) |

(69%) |

|

|

|

|

|

*Cash conversion is calculated as free cash flow from operations divided by earnings from continuing operations |

|

|

|

CURTISS-WRIGHT CORPORATION |

|

2015 Earnings Guidance (from Continuing Operations) |

|

As of April 29, 2015 |

|

($'s in millions, except per share data) |

|

|

|

|

|

2014 Pro |

2015 Guidance |

|

|

Forma |

Low |

High |

|

Sales: |

|

|

|

|

Commercial/Industrial |

$ 1,228 |

$ 1,265 |

$ 1,285 |

|

Defense |

490 |

500 |

515 |

|

Power |

525 |

515 |

530 |

|

Total sales |

$ 2,243 |

$ 2,280 |

$ 2,330 |

|

|

|

|

|

|

Operating income: |

|

|

|

|

Commercial/Industrial |

$ 179 |

$ 188 |

$ 191 |

|

Defense |

83 |

90 |

93 |

|

Power |

51 |

59 |

61 |

|

Total segments |

313 |

337 |

345 |

|

Corporate and other |

(30) |

(33) |

(33) |

|

Total operating income |

$ 282 |

$ 303 |

$ 312 |

|

|

|

|

|

|

Interest expense |

$ (36) |

$ (37) |

$ (38) |

|

Earnings before income taxes |

247 |

267 |

274 |

|

Provision for income taxes |

(77) |

(85) |

(88) |

|

Net earnings |

$ 170 |

$ 181 |

$ 187 |

|

|

|

|

|

|

Reported diluted earnings per share |

$ 3.46 |

$ 3.80 |

$ 3.90 |

|

Diluted shares outstanding |

49.0 |

47.8 |

47.8 |

|

Effective tax rate |

31.2% |

32.0% |

32.0% |

|

|

|

Operating margins: |

|

|

|

|

Commercial/Industrial |

14.5% |

14.8% |

14.9% |

|

Defense |

16.9% |

18.0% |

18.1% |

|

Power |

9.8% |

11.4% |

11.5% |

|

Total operating margin |

12.6% |

13.3% |

13.4% |

|

|

|

|

|

|

Note: Full year amounts may not add due to rounding |

|

|

|

|

CURTISS-WRIGHT CORPORATION |

|

2015 Sales Growth Guidance by End Market (from Continuing Operations) |

|

As of April 29, 2015 |

|

|

|

|

|

|

2015 % Change (vs 2014) |

|

|

Low |

High |

|

|

|

|

|

Defense Markets |

|

|

|

Aerospace |

(2%) |

2% |

|

Ground |

26% |

30% |

|

Navy |

(2%) |

2% |

|

Total Defense (Including Other Defense) |

2% |

4% |

|

|

|

|

|

Commercial Markets |

|

|

|

Commercial Aerospace |

(2%) |

2% |

|

Power Generation |

(2%) |

2% |

|

General Industrial |

5% |

9% |

|

Total Commercial |

2% |

4% |

|

|

|

|

|

Total Curtiss-Wright Sales |

2% |

4% |

|

|

|

|

|

Note: Full year amounts may not add due to rounding |

About Curtiss-Wright Corporation

Curtiss-Wright Corporation (NYSE:CW) is a global innovative company that delivers highly engineered, critical function products and services to the commercial, industrial, defense and energy markets. Building on the heritage of Glenn Curtiss and the Wright brothers, Curtiss-Wright has a long tradition of providing reliable solutions through trusted customer relationships. The company employs approximately 9,000 people worldwide. For more information, visit www.curtisswright.com.

Certain statements made in this release, including statements about future revenue, financial performance guidance, quarterly and annual revenue, net income, operating income growth, future business opportunities, cost saving initiatives, the successful integration of our acquisitions, the successful sale of our businesses held for sale, and future cash flow from operations, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements present management's expectations, beliefs, plans and objectives regarding future financial performance, and assumptions or judgments concerning such performance. Any discussions contained in this press release, except to the extent that they contain historical facts, are forward-looking and accordingly involve estimates, assumptions, judgments and uncertainties. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Such risks and uncertainties include, but are not limited to: a reduction in anticipated orders; an economic downturn; changes in competitive marketplace and/or customer requirements; a change in government spending; an inability to perform customer contracts at anticipated cost levels; and other factors that generally affect the business of aerospace, defense contracting, electronics, marine, and industrial companies. Such factors are detailed in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2014, and subsequent reports filed with the Securities and Exchange Commission.

This press release and additional information are available at www.curtisswright.com.

CONTACT: Jim Ryan

(973) 541-3766

Jim.Ryan@curtisswright.com

EXHIBIT 99.2

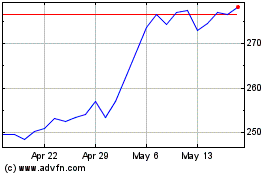

Curtiss Wright (NYSE:CW)

Historical Stock Chart

From Oct 2024 to Nov 2024

Curtiss Wright (NYSE:CW)

Historical Stock Chart

From Nov 2023 to Nov 2024