Securities Registration: Employee Benefit Plan (s-8)

June 25 2021 - 3:17PM

Edgar (US Regulatory)

|

|

|

As filed with the Securities and Exchange Commission on June 25, 2021

|

|

File No._333-____________________

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Dominion Energy, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Virginia

|

54-1229715

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

120 Tredegar Street

Richmond, Virginia 23219

(804) 819-2000

(Address of principal executive offices, including zip code)

|

|

|

Dominion Energy, Inc. Deferred Compensation Plan

|

|

(Full Title of Plan)

|

Carlos M. Brown

Senior Vice President, General Counsel

and Chief Compliance Officer

Dominion Energy, Inc.

120 Tredegar Street,

Richmond, Virginia 23219

(804) 819-2000

(Name and address, including zip code, and telephone number, including area code, of agent of service)

With a Copy to:

Carter M. Reid

Dominion Energy, Inc.

120 Tredegar Street,

Richmond, Virginia 23219

(804) 819-2000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒Accelerated filer ☐

Non-accelerated filer ☐Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

Title of Securities to be Registered

|

Amount to be Registered

|

Proposed Maximum Offering Price Per Share

|

Proposed Maximum

Aggregate Offering

Price

|

Amount of

Registration Fee

|

|

Deferred Compensation Obligations (1)

|

$50,000,000

|

100%

|

$50,000,000 (2)

|

$5,455

|

|

(1)

|

The obligations under the Dominion Energy, Inc. Deferred Compensation Plan (the Plan) are unsecured obligations of Dominion Energy, Inc. to pay deferred compensation in the future in accordance with the terms of the Plan.

|

|

(2)

|

Pursuant to Rule 457, these prices are estimated solely for the purpose of calculating the registration fee. The amount of deferred compensation obligations registered hereunder is based on an estimate of the amount of compensation that participants may defer under the Plan.

|

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1.Plan Information.

Not required to be filed.

Item 2.Registrant Information and Employee Plan Annual Information.

Not required to be filed.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3.Incorporation of Documents by Reference.

The following documents filed by Dominion Energy, Inc. (Dominion Energy) with the Securities and Exchange Commission are incorporated herein by reference and made a part hereof:

|

|

•

|

Dominion Energy’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020,

|

|

|

•

|

Dominion Energy’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, and

|

In addition, all documents filed by Dominion Energy pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, after the date of the Prospectus and prior to the filing of a post-effective amendment that indicates that all securities offered hereby have been sold or that deregisters all such securities then remaining unsold, shall be deemed to be incorporated by reference into this registration statement and to be a part hereof from the date of filing such documents.

Item 4.Description of Securities.

The Securities being registered pursuant to the Plan represent obligations (the Obligations) of the Registrant to pay deferred compensation in the future in accordance with the terms of the Plan, which is filed as Exhibit 4.1 to this Registration Statement.

The Obligations are general unsecured obligations of the Registrant to pay deferred compensation in the future according to the Plan from the general assets of the Registrant or from an unsecured grantor trust established by the Registrant, and rank equally with other unsecured and unsubordinated indebtedness of the Registrant.

The amount of compensation to be deferred by each participant is determined in accordance with the Plan based on elections by the participant. Participants may also be credited with employer matching or nonelective contributions in accordance with the Plan’s terms. Amounts credited to a participant’s account are credited with deemed investment returns equal to the experience of selected investment funds offered under the Plan and elected by the participant. The Obligations are generally payable upon the earlier of an in-service date selected by the participant in accordance with the terms of the Plan or the participant’s separation from service from the Registrant and its subsidiaries, subject to exceptions for certain hardship withdrawals and distributions upon a change in control of the Registrant. The Obligations generally are payable in the form of a lump-sum distribution or (in the case of separation from service or change in control) in installments, at the election of the participant made in accordance with the terms of the Plan.

Participants or beneficiaries generally may not sell, transfer, anticipate, assign, hypothecate or otherwise dispose of any right or interest in the Plan. A participant may designate one or more beneficiaries to receive any portion of Obligations payable in the event of death. The Registrant reserves the right to amend or terminate the Plan at any time and for any reason.

Item 5.Interests of Named Experts and Counsel.

Not applicable.

Item 6.Indemnification of Directors and Officers.

Article VI of Dominion Energy’s Articles of Incorporation mandates indemnification of its directors and officers to the full extent permitted by the Virginia Stock Corporation Act (the Virginia Act) and any other applicable law. The Virginia Act permits a corporation to indemnify its directors and officers against liability incurred in all proceedings, including derivative proceedings, arising out of their service to the corporation or to other corporations or enterprises that the officer or director was serving at the request of the corporation, except in the case of willful misconduct or a knowing violation of a criminal law. Dominion Energy is required to indemnify its directors and officers in all such proceedings if they have not violated this standard. Dominion Energy has also entered into agreements relating to the advancement of expenses for certain of its directors and officers in advance of a final disposition of proceedings or the making of any determination of eligibility for indemnification pursuant to Dominion Energy’s Articles of Incorporation.

In addition, Article VI of Dominion Energy’s Articles of Incorporation limits the liability of its directors and officers to the full extent permitted by the Virginia Act as now and hereafter in effect. The Virginia Act places a limit on the liability of a director or officer in derivative or shareholder proceedings equal to the lesser of (i) the amount specified in the corporation’s articles of incorporation or a shareholder-approved bylaw; or (ii) the greater of (a) $100,000 or (b) twelve months of cash compensation received by the director or officer. The limit does not apply in the event the director or officer has engaged in willful misconduct or a knowing violation of a criminal law or a federal or state securities law. The effect of Dominion Energy’s Articles of Incorporation, together with the Virginia Act, is to eliminate liability of directors and officers for monetary damages in derivative or shareholder proceedings so long as the required standard of conduct is met.

Dominion Energy has purchased directors’ and officers’ liability insurance policies. Within the limits of their coverage, the policies insure (1) the directors and officers of Dominion Energy against certain losses resulting from claims against them in their capacities as directors and officers to the extent that such losses are not indemnified by Dominion Energy and (2) Dominion Energy to the extent that it indemnifies such directors and officers for losses as permitted under the laws of Virginia.

Item 7.Exemption from Registration Claimed.

Not applicable.

Item 8.Exhibits:

Exhibits

Item 9.Undertakings.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such information in this registration statement;

PROVIDED, however, that paragraphs a(1)(i) and a(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934) that are incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of this offering.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant's annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8, and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Richmond, the Commonwealth of Virginia, on the 25th day of June, 2021.

|

|

|

|

|

DOMINION ENERGY, INC.

|

|

|

|

|

By:

|

/s/ Robert M. Blue

|

|

|

Robert M. Blue

Chair, President and

Chief Executive Officer

|

POWER OF ATTORNEY

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities stated below and on the 25th day of June, 2021. The officers and directors whose signatures appear below hereby constitute Carlos M. Brown, Carter M. Reid, or Karen W. Doggett, any one of whom may act, as their true and lawful attorneys-in-fact, with full power to sign on their behalf individually and in each capacity stated below and file all amendments and post-effective amendments to the registration statement making such changes in the registration statement as the registrant deems appropriate, and generally to do all things in their name in their capacities as officers and directors to enable the registrant to comply with the provisions of the Securities Act of 1933 and all requirements of the Securities and Exchange Commission.

|

|

|

|

|

Signature

|

|

Title

|

|

|

|

|

|

/s/ Robert M. Blue

|

|

Chair, President and Chief Executive Officer

|

|

Robert M. Blue

|

|

(Principal Executive Officer)

|

|

|

|

|

|

/s/ James A. Bennett

|

|

Director

|

|

James A. Bennett

|

|

|

|

|

|

|

|

/s/ Helen E. Dragas

|

|

Director

|

|

Helen E. Dragas

|

|

|

|

|

|

|

|

/s/ James O. Ellis, Jr.

|

|

Director

|

|

James O. Ellis, Jr.

|

|

|

|

|

|

|

|

/s/ D. Maybank Hagood

|

|

Director

|

|

D. Maybank Hagood

|

|

|

|

|

|

|

|

/s/ Ronald W. Jibson

|

|

Director

|

|

Ronald W. Jibson

|

|

|

|

|

|

|

|

/s/ Mark J. Kington

|

|

Director

|

|

Mark J. Kington

|

|

|

|

|

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

|

|

|

|

/s/ Joseph M. Rigby

|

|

Director

|

|

Joseph M. Rigby

|

|

|

|

|

|

|

|

/s/ Pamela J. Royal

|

|

Director

|

|

Pamela J. Royal

|

|

|

|

|

|

|

|

/s/ Robert H. Spilman, Jr.

|

|

Director

|

|

Robert H. Spilman, Jr.

|

|

|

|

|

|

|

|

/s/ Susan N. Story

|

|

Director

|

|

Susan N. Story

|

|

|

|

|

|

|

|

/s/ Michael E. Szymanczyk

|

|

Director

|

|

Michael E. Szymanczyk

|

|

|

|

|

|

|

|

/s/ James R. Chapman

|

|

Executive Vice President, Chief Financial Officer and Treasurer

|

|

James R. Chapman

|

|

(Principal Financial Officer)

|

|

|

|

|

|

/s/ Michele L. Cardiff

|

|

Senior Vice President, Controller and Chief Accounting Officer

|

|

Michele L. Cardiff

|

|

(Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

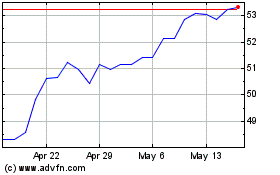

Dominion Energy (NYSE:D)

Historical Stock Chart

From Mar 2024 to Apr 2024

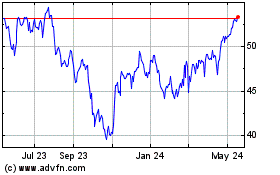

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2023 to Apr 2024