Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

FORM 20-F/A

|

o

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

OR

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

|

|

|

|

|

OR

|

|

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

OR

|

|

|

|

|

o

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number: 001-34129

|

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. —

ELETROBRAS

|

|

(exact name of registrant as specified in its charter)

|

|

BRAZILIAN ELECTRIC POWER COMPANY

|

|

(translation of registrant’s name into English)

|

|

|

|

Federative Republic of Brazil

|

|

(jurisdiction of incorporation or organization)

|

|

|

|

Avenida Presidente Vargas, 409 — 9th floor, Edifício Herm. Stoltz — Centro, CEP 20071-003, Rio de Janeiro, RJ, Brazil

|

|

(address of principal executive offices)

|

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Name of each exchange on which registered

|

|

|

|

|

|

American Depositary Shares, evidenced by American Depositary Receipts, each representing one Common Share

|

|

New York Stock Exchange

|

|

|

|

|

|

Common Shares, no par value*

|

|

New York Stock Exchange

|

|

|

|

|

|

American Depositary Shares, evidenced by American Depositary Receipts, each representing one Class B Preferred Share

|

|

New York Stock Exchange

|

|

|

|

|

|

Preferred Shares, no par value*

|

|

New York Stock Exchange

|

*

Not for trading but only in connection with the registration of the American Depositary Shares pursuant to the requirements of the SEC.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None.

Table of Contents

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None.

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2017 was:

|

|

1,087,050,297 Common Shares

|

|

|

146,920 Class A Preferred Shares

|

|

|

265,436,883 Class B Preferred Shares

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o

Yes

x

No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o

Yes

x

No

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days

x

Yes

o

No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o

Yes

x

No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

x

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

|

|

Emerging growth company

o

|

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards* provided pursuant to Section 13(a) of the Exchange Act.

o

*The term ‘‘new or revised financial accounting standard’’ refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP

o

|

|

IFRS

x

|

|

Other

o

|

Indicate by check mark which financial statement item the registrant has elected to follow.

o

Item 17

x

Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act.).

o

Yes

x

No

Table of Contents

Explanatory Note — Amendment

This Amendment amends our Annual Report on Form 20-F for the year ended December 31, 2017 (“Annual Report”) dated April 30, 2018, as filed with the U.S. Securities and Exchange Commission on April 30, 2018 and is being filed solely for the purpose of including the 2017 financial statements of Companhia de Transmissão de Energia Elétrica Paulista — CTEEP as Companhia de Transmissão de Energia Elétrica Paulista — CTEEP met the criteria set forth in Rule 3-09 of Regulation S-X in 2017 and 2016.

This Amendment speaks as of the initial filing date of the Annual Report. Other than as expressly set forth above, no part of the Annual Report is being amended. Accordingly, other than as discussed above, this Amendment does not purport to amend, update or restate any other information or disclosure included in the Annual Report or reflect any events that have occurred after the initial filing date of the Annual Report. As a result, our Annual Report on Form 20-F for the fiscal year ended December 31, 2017 continues to speak as of April 30, 2018 or, to the extent applicable, such other date as may be indicated in the Annual Report.

Table of Contents

PART III

ITEM 17. FINANCIAL STATEMENTS

See “Item 18, Financial Statements.”

ITEM 18. FINANCIAL STATEMENTS

In 2017 and 2016, our affiliate CTEEP — Companhia de Transmissão de Energia Elétrica Paulista was a significant associate under Rule 3-09 of Regulation S-X. In 2015, none of our affiliated entities was a significant entity under Rule 3-09 of Regulation S-X. In 2017, KPMG is referring to other auditors for Norte Energia S.A.. In 2016 and 2015, KPMG is referring to other auditors for Madeira Energia S.A. and Norte Energia S.A. These audit reports are referred to in the report of our external auditors, KPMG Auditores Independentes, with respect to our consolidated financial statements as of and for the year ended December 31, 2017. Please see attached the financial statements of CTEEP — Companhia de Transmissão de Energia Elétrica Paulista as of December 31, 2017 and for the years ended December 31, 2017, 2016 and 2015.

1

Table of Contents

ITEM 19. EXHIBITS

|

2.1

|

|

Second Amended and Restated Deposit Agreement between Centrais Elétricas Brasileiras S.A. — Eletrobras and Citibank S.A., incorporated herein by reference from our Form F-6, filed on August 1, 2017, file N. 333-219600.

|

|

|

|

|

|

2.2

|

|

The total amount of long-term debt securities of our company and our subsidiaries under any one instrument does not exceed 10% of the total assets of our company and our subsidiaries on a consolidated basis. We agree to furnish copies of any or all such instruments to the SEC upon request.

|

|

|

|

|

|

3.2

|

|

By-Laws of Centrais Elétricas Brasileiras S.A. — Eletrobras (English translation), dated November 30, 2017, incorporated by reference to Exhibit 3.2 to our Annual Report on Form 20-F (File No. 001-34129), filed on April 30, 2018.

|

|

|

|

|

|

4.1

|

|

Itaipu treaty signed by Brazil and Paraguay — Law No. 5,899 of July 5, 1973, incorporated herein by reference from our Registration Statement on Form 20-F, filed July 21, 2008, File No. 001-34129.

|

|

|

|

|

|

8.1

|

|

List of subsidiaries, incorporated by reference to Exhibit 8.1 to our Annual Report on Form 20-F (File No. 001-34129), filed on April 30, 2018.

|

|

|

|

|

|

12.1

|

|

Rule 13a-14(a)/15d-14(a) Certification of Chief Executive Officer of Centrais Elétricas Brasileiras S.A. — Eletrobras.

|

|

|

|

|

|

12.2

|

|

Rule 13a-14(a)/15d-14(a) Certification of Chief Financial Officer of Centrais Elétricas Brasileiras S.A. — Eletrobras.

|

|

|

|

|

|

13.1

|

|

Section 906 Certification of Chief Executive Officer of Centrais Elétricas Brasileiras S.A. — Eletrobras.

|

|

|

|

|

|

13.2

|

|

Section 906 Certification of Chief Financial Officer of Centrais Elétricas Brasileiras S.A. — Eletrobras.

|

2

Table of Contents

SIGNATURES

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this Amendment to its Annual Report on its behalf.

|

|

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. —

ELETROBRAS

|

|

|

|

|

|

June 21, 2018

|

By:

|

/s/ Wilson Pinto Ferreira Junior

|

|

|

|

Name:

|

Wilson Pinto Ferreira Junior

|

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

|

|

By:

|

/s/ Armando Casado de Araújo

|

|

|

|

Name:

|

Armando Casado de Araújo

|

|

|

|

Title:

|

Chief Financial and Investor Relations Officer

|

3

Table of Contents

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. — ELETROBRAS

AND SUBSIDIARIES

CONSOLIDATED FINANCIAL STATEMENTS

Contents

|

Report of Independent Registered Public Accounting Firm of CTEEP - Companhia de Transmissão de Energia Elétrica Paulista dated April 27, 2018

|

F-2

|

|

Consolidated balance sheets as of December 31, 2017, 2016 and 2015

|

F-4

|

|

Consolidated statements of profit or loss for the years ended December 31, 2017, 2016 and 2015

|

F-6

|

|

Consolidated statements of comprehensive income for the years ended December 31, 2017, 2016 and 2015

|

F-7

|

|

Consolidated statements of changes in equity for the years ended December 31, 2017, 2016 and 2015

|

F-8

|

|

Consolidated statements of cash flows for the years ended December 31, 2017, 2016 and 2015

|

F-10

|

|

Notes to the consolidated financial statements

|

F-12

|

F-

1

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista S.A.

We have audited the accompanying consolidated balance sheets of

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista S.A. as of December 31, 2017 and 2016, and the related consolidated statements of profit or loss, comprehensive income, changes in equity, and cash flows each of the two years in the period ended December 31, 2017. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Company’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista S.A. at December 31, 2017 and 2016 and the consolidated results of its operations and its cash flows for each of the two years in the period ended December 31, 2017, in conformity with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board.

/s/ ERNST & YOUNG

Auditores Independentes S.S.

We have served as the Company’s auditor since 2016.

São Paulo, Brazil

April 27, 2018

F-

2

Table of Contents

CTEEP — Companhia de Transmissão

de Energia

Elétrica Paulista

Consolidated Financial Statements prepared in accordance with the International Financial Reporting Standards (IFRS).

December 31, 2017, 2016 and 2015 (unaudited), with Report of Independent Registered Public Accounting Firm

F-

3

Table of Contents

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista

Balance sheets

December 31, 2017, 2016 and 2015

In thousands of reais, unless otherwise stated

|

Assets

|

|

Note

|

|

2017

|

|

2016

|

|

2015

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

5

|

|

6,585

|

|

4,524

|

|

6,135

|

|

|

Short-term deposits

|

|

6

|

|

610,066

|

|

336,138

|

|

440,054

|

|

|

Accounts receivables (concession asset)

|

|

7

|

|

1,924,928

|

|

1,221,016

|

|

319,961

|

|

|

Inventories

|

|

|

|

37,639

|

|

37,723

|

|

40,476

|

|

|

Taxes and recoverable taxes

|

|

9

|

|

14,162

|

|

8,563

|

|

5,763

|

|

|

Derivative financial instruments

|

|

30

|

|

2,611

|

|

—

|

|

—

|

|

|

Receivables from subsidiaries

|

|

29

|

|

908

|

|

18,071

|

|

29,200

|

|

|

Prepaid expenses

|

|

|

|

4,607

|

|

10,303

|

|

6,057

|

|

|

Others

|

|

|

|

42,203

|

|

44,006

|

|

51,180

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,643,709

|

|

1,680,344

|

|

898,826

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

|

Restricted cash

|

|

14

|

|

35,674

|

|

12,002

|

|

12,059

|

|

|

Accounts receivables (concession asset)

|

|

7

|

|

11,213,952

|

|

10,225,808

|

|

3,526,968

|

|

|

Receivables - State Finance Department

|

|

8

|

|

1,312,791

|

|

1,150,358

|

|

965,920

|

|

|

Deferred income and social contribution taxes

|

|

28

|

|

—

|

|

—

|

|

183,809

|

|

|

Guarantees and restricted deposits

|

|

10

|

|

66,414

|

|

70,175

|

|

66,268

|

|

|

Inventories

|

|

|

|

37,034

|

|

32,512

|

|

29,675

|

|

|

Others

|

|

|

|

1,513

|

|

1,570

|

|

9,835

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,667,378

|

|

11,492,425

|

|

4,794,534

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments in associates

|

|

11

|

|

1,880,845

|

|

1,826,930

|

|

1,572,640

|

|

|

Property, plant and equipment

|

|

12

|

|

22,879

|

|

25,457

|

|

23,194

|

|

|

Intangible assets

|

|

13

|

|

37,362

|

|

41,843

|

|

49,509

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,941,086

|

|

1,894,230

|

|

1,645,343

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,608,464

|

|

13,386,655

|

|

6,439,877

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

|

17,252,173

|

|

15,066.999

|

|

7,338,703

|

|

The accompanying notes are an integral part of these financial statements.

F-

4

Table of Contents

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista

Balance sheets

December 31, 2017, 2016 and 2015

In thousands of reais, unless otherwise stated

|

Liabilities

|

|

Note

|

|

2017

|

|

2016

|

|

2015

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

Loans and financing

|

|

14

|

|

268,588

|

|

71,679

|

|

71,070

|

|

|

Debentures

|

|

15

|

|

182,852

|

|

192,368

|

|

180,782

|

|

|

Trade accounts payable

|

|

|

|

69,923

|

|

41,482

|

|

34,950

|

|

|

Taxes and contributions

|

|

16

|

|

90,502

|

|

30,053

|

|

28,417

|

|

|

Taxes in installments - Law No. 11941

|

|

17

|

|

57,997

|

|

17,540

|

|

16,200

|

|

|

Regulatory charges

|

|

19

|

|

16,550

|

|

12,751

|

|

21,821

|

|

|

Interest on capital and dividends payable

|

|

23(b)

|

|

3,112

|

|

139,946

|

|

2,156

|

|

|

Provisions

|

|

20

|

|

36,344

|

|

33,610

|

|

29,757

|

|

|

Payables - Funcesp

|

|

21

|

|

2,056

|

|

5,495

|

|

6,144

|

|

|

Others

|

|

|

|

61,180

|

|

53,047

|

|

31,014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

789,104

|

|

597,971

|

|

422,311

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans and financing

|

|

14

|

|

690,541

|

|

432,472

|

|

485,239

|

|

|

Debentures

|

|

15

|

|

801,007

|

|

313,931

|

|

359,573

|

|

|

Taxes in installments - Law No. 11941

|

|

17

|

|

—

|

|

119,857

|

|

126,897

|

|

|

Deferred PIS and COFINS

|

|

18

|

|

1,147,381

|

|

989,445

|

|

149,022

|

|

|

Deferred income and social contribution taxes

|

|

28

|

|

2,418,125

|

|

2,106,603

|

|

35,801

|

|

|

Regulatory charges payable

|

|

19

|

|

54,250

|

|

32,509

|

|

31,194

|

|

|

Provisions

|

|

20

|

|

121,553

|

|

153,035

|

|

189,612

|

|

|

General Reversal Reserve (RGR)

|

|

22

|

|

24,053

|

|

24,053

|

|

24,053

|

|

|

Others

|

|

|

|

6,503

|

|

—

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,263,413

|

|

4,171,905

|

|

1,401,391

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

|

Capital

|

|

23(a)

|

|

3,590,020

|

|

2,372,437

|

|

2,215,291

|

|

|

Capital reserves

|

|

23(c)

|

|

666

|

|

1,217,583

|

|

1,277,356

|

|

|

Future capital increases

|

|

|

|

—

|

|

666

|

|

666

|

|

|

Reserves

|

|

23(d)

|

|

7,309,338

|

|

6,527,704

|

|

1,842,892

|

|

|

Proposed additional dividends

|

|

23(b)

|

|

84,693

|

|

—

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,984,717

|

|

10,118,390

|

|

5,336,205

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interests

|

|

|

|

214,939

|

|

178,733

|

|

178,796

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,199,656

|

|

10,297,123

|

|

5,515,001

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

|

|

17,252,173

|

|

15,066,999

|

|

7,338,703

|

|

The accompanying notes are an integral part of these financial statements.

F-

5

Table of Contents

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista

Statements of profit or loss

Years ended December 31, 2017, 2016 and 2015

In thousands of reais, unless otherwise stated

|

|

|

Note

|

|

2017

|

|

2016

|

|

2015

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net operating revenue

|

|

24.1

|

|

2,701,193

|

|

7,785,616

|

|

1,287,130

|

|

|

Cost of infrastructure implementation, operation and maintenance services

|

|

25

|

|

(593,278

|

)

|

(499,623

|

)

|

(575,326

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

|

2,107,915

|

|

7,285,993

|

|

711,804

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (expenses)

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses

|

|

25

|

|

(122,112

|

)

|

(126,924

|

)

|

(196,991

|

)

|

|

Management fees

|

|

25

|

|

(8,282

|

)

|

(5,661

|

)

|

(4,991

|

)

|

|

Others operating income (expenses), net

|

|

27

|

|

(55,006

|

)

|

(27,939

|

)

|

(36,190

|

)

|

|

Share of profit in associates

|

|

11

|

|

124,806

|

|

267,706

|

|

161,306

|

|

|

|

|

|

|

(60,594

|

)

|

107,182

|

|

(76,866

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before financial income (expenses) and income taxes

|

|

|

|

2,047,321

|

|

7,393,175

|

|

634,938

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance income

|

|

26

|

|

123,673

|

|

76,684

|

|

151,711

|

|

|

Finance expenses

|

|

26

|

|

(189,889

|

)

|

(186,613

|

)

|

(177,067

|

)

|

|

|

|

|

|

(66,216

|

)

|

(109,929

|

)

|

(25,356

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income tax and social contribution

|

|

|

|

1,981,105

|

|

7,283,246

|

|

609,582

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax and social contribution

|

|

|

|

|

|

|

|

|

|

|

Current

|

|

28

|

|

(354,491

|

)

|

(79,301

|

)

|

(85,804

|

)

|

|

Deferred

|

|

28

|

|

(241,154

|

)

|

(2,254,611

|

)

|

(6,592

|

)

|

|

|

|

|

|

(595,645

|

)

|

(2,333,912

|

)

|

(92,396

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income for the year

|

|

|

|

1,385,460

|

|

4,949,334

|

|

517,186

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

|

|

|

|

|

Controlling shareholders

|

|

|

|

1,365,512

|

|

4,932,312

|

|

504,430

|

|

|

Non-controlling interests

|

|

|

|

19,948

|

|

17,022

|

|

12,756

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share

|

|

23(e)

|

|

8,28985

|

|

30,20956

|

|

3,12807

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share

|

|

23(e)

|

|

8,28898

|

|

30,01340

|

|

3,07192

|

|

The accompanying notes are an integral part of these financial statements.

F-

6

Table of Contents

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista

Statements of comprehensive income

Years ended December 31, 2017, 2016 and 2015

In thousands of Brazilian reais — R$, unless otherwise stated

|

|

|

2017

|

|

2016

|

|

2015

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Net income for the year

|

|

1,385,460

|

|

4,949,334

|

|

517,186

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income

|

|

—

|

|

—

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income for the year

|

|

1,385,460

|

|

4,949,334

|

|

517,186

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

|

|

|

Controlling shareholders

|

|

1,365,512

|

|

4,932,312

|

|

504,430

|

|

|

Non-controlling interests

|

|

19,948

|

|

17,022

|

|

12,756

|

|

The accompanying notes are an integral part of these financial statements.

F-

7

Table of Contents

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista

Statements of changes in equity

Years ended December 31, 2017, 2016 and 2015

In thousands of reais, unless otherwise stated

|

|

|

|

|

|

|

|

|

|

|

Earnings reserves

|

|

|

|

|

|

|

|

|

|

|

|

|

Note

|

|

Capital

|

|

Capital

reserves

|

|

Future

capital

contribution

|

|

Legal

reserve

|

|

Statutory

reserve

|

|

Retained profits

reserve

|

|

Special income

reserve

|

|

Retained

earnings

|

|

Additional

dividends

proposed

|

|

Total

|

|

Non-

controlling

interests

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2014 (unaudited)

|

|

|

|

2,215,291

|

|

1,277,356

|

|

666

|

|

253,032

|

|

191,906

|

|

1,226,794

|

|

—

|

|

—

|

|

—

|

|

5,165,045

|

|

63,567

|

|

5,228,612

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unclaimed interest on equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

570

|

|

—

|

|

570

|

|

—

|

|

570

|

|

|

Unclaimed dividends

|

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,025

|

|

—

|

|

1,025

|

|

—

|

|

1,025

|

|

|

Additionally investments from non-controlling shareholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

102,473

|

|

102,473

|

|

|

|

|

Net income for the year

|

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

504,430

|

|

—

|

|

504,430

|

|

12,756

|

|

517,186

|

|

|

Allocation of income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal reserve

|

|

|

|

—

|

|

—

|

|

—

|

|

25,222

|

|

—

|

|

—

|

|

—

|

|

(25,222

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Statutory reserve

|

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

29,623

|

|

—

|

|

—

|

|

(29,623

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Retained profits reserve

|

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

116,315

|

|

—

|

|

(116,315

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Interim dividends (R$2.0765735 per share)

|

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(334,865

|

)

|

—

|

|

(334,865

|

)

|

—

|

|

(334,865

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2015 (unaudited)

|

|

|

|

2,215,291

|

|

1,277,356

|

|

666

|

|

278,254

|

|

221,529

|

|

1,343,109

|

|

—

|

|

—

|

|

—

|

|

5,336,205

|

|

178,796

|

|

5,515,001

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital increase

|

|

23(a)

|

|

157,146

|

|

(59,773

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

97,373

|

|

—

|

|

97,373

|

|

|

Additionally investments from non-controlling shareholders

|

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(17,085

|

)

|

(17,085

|

)

|

|

Net income for the year

|

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

4,932,312

|

|

—

|

|

4,932,312

|

|

17,022

|

|

4,949,334

|

|

|

Allocation of income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal reserve

|

|

23(b)

|

|

—

|

|

—

|

|

—

|

|

196,234

|

|

—

|

|

—

|

|

—

|

|

(196,234

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Statutory reserve

|

|

23(b)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

15,715

|

|

—

|

|

—

|

|

(15,715

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Earnings retention reserve

|

|

23(b)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

148,639

|

|

—

|

|

(148,639

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Special unrealized earnings reserve

|

|

23(b)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

4,324,224

|

|

(4,324,224

|

)

|

—

|

|

|

|

|

|

|

|

|

Interim dividends (R$1,502543 per share)

|

|

23(b)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(247,500

|

)

|

—

|

|

(247,500

|

)

|

—

|

|

(247,500

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2016

|

|

|

|

2,372,437

|

|

1,217,583

|

|

666

|

|

474,488

|

|

237,244

|

|

1,491,748

|

|

4,324,224

|

|

—

|

|

—

|

|

10,118,390

|

|

178,733

|

|

10,297,123

|

|

The accompanying notes are an integral part of these financial statements.

F-

8

Table of Contents

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista

Statements of changes in equity

Years ended December 31, 2017, 2016 and 2015

In thousands of reais, unless otherwise stated

|

|

|

|

|

|

|

|

|

|

|

Earnings reserves

|

|

|

|

|

|

|

|

|

|

|

|

|

Note

|

|

Capital

|

|

Capital

reserves

|

|

Future

capital

contribution

|

|

Legal

reserve

|

|

Statutory

reserve

|

|

Retained profits

reserve

|

|

Special income

reserve

|

|

Retained

earnings

|

|

Additional

dividends

proposed

|

|

Total

|

|

Non-

controlling

interests

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital increase

|

|

23(a)

|

|

1,217,583

|

|

(1,216,917

|

)

|

(666

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Forfeited interest on capital

|

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

671

|

|

—

|

|

671

|

|

—

|

|

671

|

|

|

Forfeited dividends

|

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

544

|

|

—

|

|

544

|

|

—

|

|

544

|

|

|

Additionally investments from non-controlling shareholders

|

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

16,258

|

|

16,258

|

|

|

Net income for the year

|

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1, 365,512

|

|

—

|

|

1,365,512

|

|

19,948

|

|

1,385,460

|

|

|

Realization of unrealized earnings reserve

|

|

23(d)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(582,631

|

)

|

582,631

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Allocation of income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal reserve

|

|

23(b)

|

|

—

|

|

—

|

|

—

|

|

68,275

|

|

—

|

|

—

|

|

—

|

|

(68,275

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Statutory reserve

|

|

23(b)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

259,447

|

|

—

|

|

—

|

|

(259,447

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Special unrealized earnings reserve

|

|

23(b)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,036,543

|

|

(1,036,543

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Interim dividends (R$0,819569 per share)

|

|

23(b)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(135,000

|

)

|

—

|

|

(135,000

|

)

|

—

|

|

(135,000

|

)

|

|

Interim dividends (R$2,218299 per share)

|

|

23(b)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(365,400

|

)

|

—

|

|

(365,400

|

)

|

—

|

|

(365,400

|

)

|

|

Additional dividends proposed

|

|

23(b)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(84,693

|

)

|

84,693

|

|

—

|

|

—

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2017

|

|

|

|

3,590,020

|

|

666

|

|

—

|

|

542,763

|

|

496,691

|

|

1,491,748

|

|

4,778,136

|

|

—

|

|

84,693

|

|

10,984,717

|

|

214,939

|

|

11,199,656

|

|

The accompanying notes are an integral part of these financial statements.

F-

9

Table of Contents

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista

Statements of cash flows

Years ended December 31, 2017, 2016 and 2015

In thousands of reais, unless otherwise stated

|

|

|

2017

|

|

2016

|

|

2015

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from operating activities

|

|

|

|

|

|

|

|

|

Net income for the year

|

|

1,385,460

|

|

4,949,334

|

|

517,186

|

|

|

Adjustments to reconcile net income to cash provided by operating activities

|

|

|

|

|

|

|

|

|

Gain on recognition of Law No. 12783 - SE

|

|

—

|

|

(7,318,492

|

)

|

—

|

|

|

Deferred PIS and COFINS (note 18)

|

|

87,778

|

|

840,423

|

|

31,050

|

|

|

Depreciation and amortization (note 25)

|

|

9,627

|

|

9,061

|

|

8,525

|

|

|

Deferred income tax and social contribution taxes

|

|

241,154

|

|

2,254,611

|

|

6,592

|

|

|

Provision for contingencies (note 20 (a))

|

|

(49,821

|

)

|

(64,041

|

)

|

37,136

|

|

|

Net book value of PP&E written off (notes 12 and 13)

|

|

510

|

|

5,340

|

|

375

|

|

|

Tax benefit - merged goodwill (note 28)

|

|

37

|

|

36

|

|

29,887

|

|

|

Amortization of concession asset in acquisition of subsidiary (note 11 (a))

|

|

2,490

|

|

2,490

|

|

2,491

|

|

|

Realization of losses in jointly-controlled subsidiary (note 11 (a))

|

|

(2,195

|

)

|

(2,276

|

)

|

(2,340

|

)

|

|

Gain on acquisition of control

|

|

(5,042

|

)

|

—

|

|

—

|

|

|

Share of profit of an associate (note 11)

|

|

(124,806

|

)

|

(267,706

|

)

|

(161,306

|

)

|

|

Interest and foreign exchange and monetary gain (loss) on assets and liabilities

|

|

145,426

|

|

177,749

|

|

168,466

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,690,618

|

|

586,529

|

|

638,062

|

|

|

|

|

|

|

|

|

|

|

|

(Increase) decrease in assets

|

|

|

|

|

|

|

|

|

Restricted cash

|

|

(7,631

|

)

|

57

|

|

(369

|

)

|

|

Accounts receivable - Infrastructure investment

|

|

(247,126

|

)

|

(171,902

|

)

|

(278,685

|

)

|

|

Accounts receivable - RBSE received

|

|

(823,381

|

)

|

—

|

|

—

|

|

|

Accounts receivable - financial asset

|

|

(28,564

|

)

|

(173,304

|

)

|

346,312

|

|

|

Accounts receivable - operation and maintenance

|

|

(53,851

|

)

|

66,079

|

|

(16,614

|

)

|

|

Inventories

|

|

(4,438

|

)

|

(84

|

)

|

13,538

|

|

|

Receivables — State Finance Department

|

|

(162,433

|

)

|

(184,438

|

)

|

(163,818

|

)

|

|

Taxes and recoverable taxes

|

|

(3,316

|

)

|

(2,800

|

)

|

28,799

|

|

|

Prepaid expenses

|

|

5,696

|

|

(4,246

|

)

|

(5,109

|

)

|

|

Guarantees and restricted deposits

|

|

6,761

|

|

222

|

|

(3,915

|

)

|

|

Others

|

|

3,777

|

|

14,292

|

|

34,704

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,314,506

|

)

|

(456,124

|

)

|

(45,157

|

)

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in liabilities

|

|

|

|

|

|

|

|

|

Trade account payable

|

|

24,598

|

|

6,532

|

|

(40,520

|

)

|

|

Taxes and contributions

|

|

59,683

|

|

1,636

|

|

1,896

|

|

|

Taxes in installments - Law No. 11941

|

|

(86,777

|

)

|

(16,927

|

)

|

(15,603

|

)

|

|

Regulatory charges

|

|

20,423

|

|

(11,856

|

)

|

(12,886

|

)

|

|

Provisions

|

|

2,668

|

|

3,853

|

|

2,288

|

|

|

Payables - Funcesp

|

|

(3,439

|

)

|

(649

|

)

|

769

|

|

|

Others

|

|

11,157

|

|

22,032

|

|

14,798

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28,313

|

|

4,621

|

|

(49,258

|

)

|

|

|

|

|

|

|

|

|

|

|

Net cash from operating activities

|

|

404,525

|

|

135,026

|

|

543,647

|

|

The accompanying notes are an integral part of these financial statements.

F-

10

Table of Contents

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista

Statements of cash flows

Years ended December 31, 2017, 2016 and 2015

In thousands of reais, unless otherwise stated

|

|

|

2017

|

|

2016

|

|

2015

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash flows from investing activities

|

|

|

|

|

|

|

|

|

Short-term investments

|

|

(237,724

|

)

|

103,916

|

|

39,547

|

|

|

Property, plant and equipment (note 12)

|

|

(1,553

|

)

|

(5,767

|

)

|

(2,184

|

)

|

|

Intangible assets (note 13)

|

|

(4,039

|

)

|

(5,721

|

)

|

(1,335

|

)

|

|

Investments (note 11)

|

|

(119,113

|

)

|

(2,394

|

)

|

(103,364

|

)

|

|

Net cash acquired in business combinations

|

|

479

|

|

—

|

|

—

|

|

|

Dividends received (note 11 (a))

|

|

—

|

|

28,050

|

|

15,945

|

|

|

|

|

|

|

|

|

|

|

|

Cash from (used in) investing activities

|

|

(361,950

|

)

|

118,084

|

|

(51,391

|

)

|

|

|

|

|

|

|

|

|

|

|

Net cash flows from financing activities

|

|

|

|

|

|

|

|

|

Transactions with non-controlling interests

|

|

(19,948

|

)

|

(17,085

|

)

|

102,473

|

|

|

Proceeds from loans (notes 14 and 15)

|

|

962,500

|

|

150,407

|

|

103,877

|

|

|

Repayment of loans (principal) (notes 14 and 15)

|

|

(250,123

|

)

|

(245,851

|

)

|

(141,636

|

)

|

|

Repayment of loans (interest) (notes 14 and 15)

|

|

(96,725

|

)

|

(129,855

|

)

|

(190,630

|

)

|

|

Payment of capital

|

|

—

|

|

97,373

|

|

—

|

|

|

Dividends and interest on equity paid (note 23 (b))

|

|

(636,118

|

)

|

(109,710

|

)

|

(364,901

|

)

|

|

|

|

|

|

|

|

|

|

|

Cash used in financing activities

|

|

(40,414

|

)

|

(254,721

|

)

|

(490,817

|

)

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents

|

|

2,061

|

|

(1,611

|

)

|

1,439

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of year

|

|

4,524

|

|

6,135

|

|

4,696

|

|

|

Cash and cash equivalents at the end of year

|

|

6,585

|

|

4,524

|

|

6,135

|

|

|

|

|

|

|

|

|

|

|

|

Changes in cash and cash equivalents

|

|

2,061

|

|

(1,611

|

)

|

1,439

|

|

Income and social contribution taxes paid by the CTEEP in 2017 totaled R$293,095 (in 2016 totaled R$61,867 and in 2015 (unaudited) totaled R$66,776).

The accompanying notes are an integral part of these financial statements.

F-

11

Table of Contents

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista

Notes to the financial statements

Year ended December 31, 2017, 2016 and 2015 (unaudited)

In thousands of reais, unless stated otherwise

1.

Operations

1.1

Corporate profile

CTEEP - Companhia de Transmissão de Energia Elétrica Paulista and its subsidiaries (“CTEEP” or “Company”) is a publicly-held company authorized to operate as an electric power public service concessionaire, and is principally engaged in the planning, infrastructure implementation, and operation and maintenance of subordinated power transmission systems. In performing its operating activities, the Company is required to invest funds and manage research & development programs on power transmission and other activities related to the available technology. These activities are regulated and supervised by the National Electric Power Agency (“ANEEL”).

The Company derived from a partial spin-off of Companhia Energética de São Paulo (“CESP”) and started to operate on April 1, 1999. In November 10, 2001, the Company merged EPTE - Empresa Paulista de Transmissão de Energia Elétrica S.A. (“EPTE”), which was originated from the partial spin-off of Eletropaulo - Eletricidade de São Paulo S.A.

In a privatization auction held on June 28, 2006 at São Paulo Stock Exchange — BOVESPA (currently “B3 S.A. - Brasil, Bolsa, Balcão), in accordance with Invitation to Bid SF/001/2006, the State Government of São Paulo, then the controlling shareholder, sold their 31,341,890,064 common shares in CTEEP, corresponding to 50.10% of the common shares issued by CTEEP. The winning bidder was Interconexión Eléctrica S.A. E.S.P.

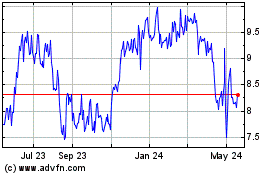

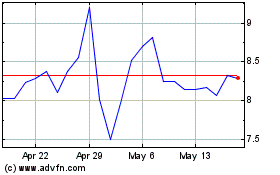

The Company’s shares are traded on B3 S.A. - Brasil, Bolsa, Balcão (“B3”). Additionally, CTEEP has an American Depositary Receipts (ADRs) program - Rule 144 A in the United States. The depositary of the ADRs is JPMorgan Chase Bank and the custodian is Banco Santander (Brasil) S.A.

The Company has adopted B3’s Corporate Governance Practices - Level 1 since September 2002. The commitments undertaken as a result of this adhesion ensure greater transparency from the Company towards the market, investors and shareholders, thus facilitating the monitoring of Management’s actions.

The Company is a member of the Brasil 100 Index (IBrX 100), Mid Large Cap Index (MLCX), Index of Shares with Differentiated Corporate Governance (IGCX), Trade Corporate Governance Index (IGCT), Electric Power Index (IEE), BM&FBOVESPA Public Utility Index (UTIL), and

BM&FBOVESPA Dividends Index (IDIV).

F-

12

Table of Contents

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista

Notes to the financial statements

Year ended December 31, 2017, 2016 and 2015 (unaudited)

In thousands of reais, unless stated otherwise

1.2

Concessions

CTEEP is entitled to explore, either directly or indirectly, the following concession arrangements of utility concession arrangements for electric power transmission:

|

|

|

|

|

Equity

|

|

|

|

|

|

Periodic Tariff

Review

|

|

|

|

Allowed Annual Revenue

(“RAP”)

|

|

|

Concession

operator

|

|

Contract

|

|

interests

- (%)

|

|

Term

(years)

|

|

Maturity

|

|

Term

|

|

Next

|

|

Index

|

|

R$

thousand

|

|

Base month

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CTEEP (*)

|

|

059/2001

|

|

|

|

30

|

|

12.31.42

|

|

5 years

|

|

2018

|

|

IPCA

|

|

2,536,919

|

|

06/17

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subsidiaries

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Serra do Japi

|

|

143/2001

|

|

100

|

|

30

|

|

12.20.31

|

|

n/a

|

|

n/a

|

|

IGPM

|

|

21,026

|

|

0617

|

|

|

IEMG

|

|

004/2007

|

|

100

|

|

30

|

|

04.23.37

|

|

5 years

|

|

2022

|

|

IPCA

|

|

17,229

|

|

06/17

|

|

|

IENNE (**)

|

|

001/2008

|

|

100

|

|

30

|

|

03.16.38

|

|

5 years

|

|

2018

|

|

IPCA

|

|

42,908

|

|

06/17

|

|

|

Pinheiros

|

|

012/2008

|

|

100

|

|

30

|

|

10.15.38

|

|

5 years

|

|

2019

|

|

IPCA

|

|

10,911

|

|

06/17

|

|

|

Pinheiros

|

|

015/2008

|

|

100

|

|

30

|

|

10.15.38

|

|

5 years

|

|

2019

|

|

IPCA

|

|

34,363

|

|

06/17

|

|

|

Pinheiros

|

|

018/2008

|

|

100

|

|

30

|

|

10.15.38

|

|

5 years

|

|

2019

|

|

IPCA

|

|

5,823

|

|

06/17

|

|

|

Evrecy

|

|

020/2008

|

|

100

|

|

30

|

|

07.17.25

|

|

4 years

|

|

2018

|

|

IGPM

|

|

12,837

|

|

06/17

|

|

|

Serra do Japi

|

|

026/2009

|

|

100

|

|

30

|

|

11.18.39

|

|

5 years

|

|

2020

|

|

IPCA

|

|

34,590

|

|

06/17

|

|

|

Pinheiros

|

|

021/2011

|

|

100

|

|

30

|

|

12.09.41

|

|

5 years

|

|

2022

|

|

IPCA

|

|

5,293

|

|

06/17

|

|

|

Itaúnas

|

|

018/2017

|

|

100

|

|

30

|

|

02.10.47

|

|

5 years

|

|

2022

|

|

IPCA

|

|

47,200

|

|

RAP bid

|

|

|

IE Tibagi

|

|

026/2017

|

|

100

|

|

30

|

|

08.11.47

|

|

5 years

|

|

2023

|

|

IPCA

|

|

18,371

|

|

RAP bid

|

|

|

IE Itaquerê

|

|

027/2017

|

|

100

|

|

30

|

|

08.11.47

|

|

5 years

|

|

2023

|

|

IPCA

|

|

46,183

|

|

RAP bid

|

|

|

IE Itapura

|

|

042/2017

|

|

100

|

|

30

|

|

08.11.47

|

|

5 years

|

|

2023

|

|

IPCA

|

|

10,729

|

|

RAP bid

|

|

|

IE Aguapeí

|

|

046/2017

|

|

100

|

|

30

|

|

08.11.47

|

|

5 years

|

|

2023

|

|

IPCA

|

|

53,678

|

|

RAP bid

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jointly-controlled subsidiaries

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IESul

|

|

013/2008

|

|

50

|

|

30

|

|

10.15.38

|

|

5 years

|

|

2019

|

|

IPCA

|

|

5,860

|

|

06/17

|

|

|

IESul

|

|

016/2008

|

|

50

|

|

30

|

|

10.15.38

|

|

5 years

|

|

2019

|

|

IPCA

|

|

12,301

|

|

06/17

|

|

|

IEMadeira

|

|

013/2009

|

|

51

|

|

30

|

|

02.25.39

|

|

5 years

|

|

2019

|

|

IPCA

|

|

276,527

|

|

06/17

|

|

|

IEMadeira (***)

|

|

015/2009

|

|

51

|

|

30

|

|

02.25.39

|

|

5 years

|

|

2019

|

|

IPCA

|

|

238,991

|

|

06/17

|

|

|

IEGaranhuns

|

|

022/2011

|

|

51

|

|

30

|

|

12.09.41

|

|

5 years

|

|

2022

|

|

IPCA

|

|

81,551

|

|

06/17

|

|

|

Paraguaçu

|

|

003/2017

|

|

50

|

|

30

|

|

02.10.47

|

|

5 years

|

|

2022

|

|

IPCA

|

|

106,613

|

|

RAP bid

|

|

|

Aimorés

|

|

004/2017

|

|

50

|

|

30

|

|

02.10.47

|

|

5 years

|

|

2022

|

|

IPCA

|

|

71,425

|

|

RAP bid

|

|

|

ERB1

|

|

022/2017

|

|

50

|

|

30

|

|

08.11.47

|

|

5 years

|

|

2023

|

|

IPCA

|

|

267,317

|

|

RAP bid

|

|

(*) RAP for SE assets: R$1,552,426 as of June 2017.

(**) In September 2017, CTEEP acquired the equity interest held by other shareholders (75%) and became the holder of 100% of IENNE’s equity (note 11).

(***) In May 2014, the facilities under Concession Agreement 015/2009 for the jointly-controlled entity IEMadeira were completed and delivered to the National Electric System Operator (“ONS”) for testing. In June 2014, considering the existence of systemic and third-party restrictions, ONS issued the Partial Release Agreement (“TLP”) for provisional commercial operation. Currently, facilities are operating with tests yet to be completed:

F-

13

Table of Contents

CTEEP — Companhia de Transmissão de Energia Elétrica Paulista

Notes to the financial statements

Year ended December 31, 2017, 2016 and 2015 (unaudited)

In thousands of reais, unless stated otherwise