Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

June 10 2024 - 8:15AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

FOMENTO ECONÓMICO MEXICANO, S.A.B. DE C.V.

(Exact name of Registrant as specified in its charter)

Mexican Economic Development, Inc.

(Translation of Registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, Nuevo León 64410

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports

under cover of Form 20-F or Form 40-F:

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the

information contained in this

Form, the registrant is also thereby furnishing

the information to the

Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes ¨

No x

If "Yes" is marked, indicate below the

file number assigned to the registrant in

connection with Rule 12g3-2(b): 82-_____________

CONTENTS

Exhibit 99.1. Press release from Fomento Económico Mexicano, S.A.B. de C.V. (FEMSA), dated June 10, 2024,regarding accelerated share repurchase.

This report on Form 6-K shall be deemed to be

incorporated by reference into the Offer to Purchase, dated June 4, 2024,relating to the previously announced cash tender offer by FEMSA.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the

registrant has duly caused this report to be signed

on its behalf of the

undersigned, thereunto duly authorized.

| |

FOMENTO ECONÓMICO MEXICANO, S.A. DE C.V. |

| |

|

| |

By: /s/ Martin Felipe Arias Yaniz |

| |

Martin Felipe Arias Yaniz |

| |

Director of Finance and Corporate Development |

| Date: June, 10, 2024 |

|

|

Exhibit 99.1

FEMSA completes Accelerated

Share Repurchase Agreement, and announces new Agreement

Monterrey, Mexico, June 10, 2024 —

Fomento Económico Mexicano, S.A.B. de C.V. (“FEMSA”

or the “Company”) (NYSE: FMX; BMV: FEMSAUBD, FEMSAUB) announces today that it has entered into a new derivative instrument

in the form of an accelerated share repurchase transaction (“ASR”) to repurchase the Company’s American Depositary Shares

(“ADSs”)1. Under the terms of this new ASR, FEMSA has agreed to repurchase up to USD $600 million of its ADSs.

The total number of ADSs ultimately repurchased under this ASR will be based on the daily volume-weighted average price of the Company’s

ADSs during the term of the ASR and subject to certain limitations. The final settlement of the ASR is expected to be completed, at the

latest, in the fourth quarter of 2024.

Additionally, the Company announces the completion of the ASR announced

in March 2024, which final delivery of the shares repurchased thereunder was on May 28, 2024. The Company repurchased a total of approximately

3.2 million ADSs at an average price of USD $123.27 per ADS, for a total amount of USD $400 million.

###

About FEMSA

FEMSA is a company that creates economic and social value through companies

and institutions and strives to be the best employer and neighbor to the communities in which it operates. It participates in the retail

industry through a Proximity Americas Division operating OXXO, a small-format store chain, and other related retail formats, and Proximity

Europe which includes Valora, our European retail unit which operates convenience and foodvenience formats. In the retail industry it

also participates though a Health Division, which includes drugstores and related activities and Digital@FEMSA, which includes Spin by

OXXO and Spin Premia, among other digital financial services initiatives. In the beverage industry, it participates through Coca-Cola

FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume. Across its business units, FEMSA has more than 392,000

employees in 18 countries. FEMSA is a member of the Dow Jones Sustainability MILA Pacific Alliance, the FTSE4Good Emerging Index and the

Mexican Stock Exchange Sustainability Index: S&P/BMV Total México ESG, among other indexes that evaluate its sustainability

performance.

1 ADS

underlying units consist of ten FEMSA BD Units, each representing one Series B Share, two Series D-B Shares and two Series D-L Shares,

without par value.

Investor Contact

(52) 818-328-6000 investor@femsa.com.mx femsa.gcs-web.com |

|

Media Contact

(52) 555-249-6843 comunicacion@femsa.com.mx femsa.com |

|

June 10, 2024 | Page 1 |

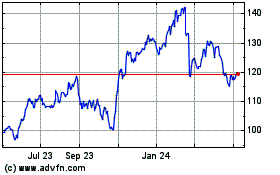

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

From Oct 2024 to Nov 2024

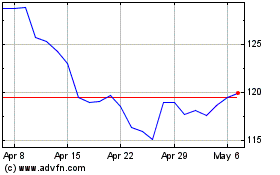

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

From Nov 2023 to Nov 2024