Keysight Technologies Announces Pricing of Public Offering of Senior Unsecured Notes

October 02 2024 - 3:05PM

Business Wire

Keysight Technologies, Inc. (NYSE: KEYS) (“Keysight”) today

announced the pricing of an underwritten, registered public

offering of its senior unsecured fixed rate notes in an aggregate

principal amount of $600,000,000 (the “Offering”). The notes will

mature in 2034 and will bear interest at an annual rate of 4.950

percent. The offering is expected to close on October 9, 2024,

subject to customary closing conditions.

Keysight intends to use the net proceeds from the Offering for

general corporate purposes, including to repay its outstanding $600

million of 4.55% senior notes due October 30, 2024.

BNP Paribas Securities Corp., Citigroup Global Markets Inc. and

BofA Securities, Inc. are the joint lead book-running managers for

the Offering. Barclays Capital Inc. and J.P. Morgan Securities LLC

are also book-running managers for the Offering.

The Offering is being made pursuant to an effective shelf

registration statement filed with the Securities and Exchange

Commission (“SEC”) and will be made only by means of a prospectus

supplement relating to such Offering and the accompanying base

shelf prospectus, copies of which may be obtained by contacting:

BNP Paribas Securities Corp., 787 Seventh Avenue, 3rd Floor, New

York, NY 10019, telephone: (800) 854-5674 or by emailing

DL.US.Syndicate.Support@us.bnpparibas.com; Citigroup Global Markets

Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue,

Edgewood, NY 11717, telephone: (800) 831-9146 or by emailing

prospectus@citi.com; BofA Securities, Inc., Prospectus Department,

NC1-022-02-25, 201 North Tryon Street, Charlotte, NC 28255-0001,

telephone: (800) 294-1322 or by emailing

dg.prospectus_requests@bofa.com; Barclays Capital Inc., c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, telephone: (888) 603-5847 or by emailing

barclaysprospectus@broadridge.com; or J.P. Morgan Securities LLC,

High Grade Syndicate Desk, 383 Madison Avenue, 3rd Floor, New York,

NY 10179, telephone: (212) 834-4533 or by emailing

JPMorganPostSale@broadridge.com. These documents have been filed

with the SEC and are available at the SEC’s website at

www.sec.gov.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy any of the securities, nor shall

there be any sale of these securities, in any state or jurisdiction

in which such an offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of

any such state or jurisdiction.

About Keysight Technologies

At Keysight (NYSE: KEYS), we inspire and empower innovators to

bring world-changing technologies to life. As an S&P 500

company, we’re delivering market-leading design, emulation, and

test solutions to help engineers develop and deploy faster, with

less risk, throughout the entire product lifecycle. We’re a global

innovation partner enabling customers in communications, industrial

automation, aerospace and defense, automotive, semiconductor, and

general electronics markets to accelerate innovation to connect and

secure the world.

Forward-Looking Statements

This communication contains forward-looking statements as

defined in the Securities Exchange Act of 1934 and is subject to

the safe harbors created therein. The words “intend,” “will,” and

similar expressions, as they relate to Keysight, are intended to

identify forward-looking statements. These forward-looking

statements involve risks and uncertainties that could significantly

affect the expected results and are based on certain key

assumptions of Keysight’s management and on currently available

information. Due to such uncertainties and risks, no assurances can

be given that such expectations or assumptions will prove to have

been correct, and readers are cautioned not to place undue reliance

on such forward-looking statements, which speak only as of the date

hereof. Keysight undertakes no responsibility to publicly update or

revise any forward-looking statement. The forward-looking

statements contained herein include, but are not limited to,

Keysight’s expectations regarding the completion and timing of the

proposed offering and use of proceeds. Such risks and uncertainties

include, but are not limited to, market conditions and the

satisfaction of customary closing conditions related to the

proposed offering.

In addition to the risks above, other risks that Keysight faces

include those detailed in Keysight’s filings with the SEC,

including Keysight’s annual report on Form 10-K for the period

ended October 31, 2023 and Keysight’s quarterly reports on Form

10-Q for the periods ended April 30, 2024 and July 31, 2024.

Source: IR-KEYS

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002938705/en/

INVESTOR CONTACT: Jason Kary +1 707-577-6916

jason.kary@keysight.com

MEDIA CONTACT: Claire Rowberry + 1 339-200-9518

claire.rowberry@non.keysight.com

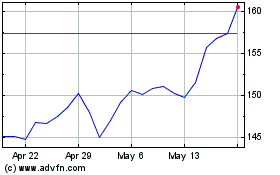

Keysight Technologies (NYSE:KEYS)

Historical Stock Chart

From Oct 2024 to Nov 2024

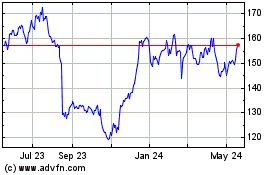

Keysight Technologies (NYSE:KEYS)

Historical Stock Chart

From Nov 2023 to Nov 2024