loanDepot Expands equityFREEDOM Portfolio With 10- and 30-Year Home Equity Loan Terms

February 12 2025 - 10:07AM

Business Wire

Continued growth of product suite allows

millions of homeowners to tap into their most important source of

funding: home equity

loanDepot, Inc. ("LDI" or "Company") (NYSE: LDI), a leading

provider of products and services that power the homeownership

journey, has expanded its equityFREEDOM portfolio to provide nearly

50 million American homeowners with access to their tappable home

equity.1 The expansion adds 10- and 30-year fixed-term options to

the Company’s existing 20-year fixed-rate home equity loan,

complementing its first- and second-lien home equity lines of

credit (HELOCs).

With 75 percent of existing mortgages carrying rates below five

percent,2 homeowners are reluctant to sacrifice their current

mortgage to move or refinance. These home equity loan term options

provide additional ways for homeowners to leverage this powerful

financial tool to lower borrowing costs without affecting their

current mortgage rate.

"Homeowners today enjoy unprecedented levels of equity, and by

continuing to expand our home equity lending options, we’re giving

them the flexibility they need to find the best solution for their

circumstances," said LDI President Jeff Walsh. "We are a fully

integrated one-stop-shop for all things home equity that helps

support our customers’ entire homeownership journey and provides

more options to help achieve their financial goals."

American homeowners, who are carrying a record $35 trillion in

home equity,3 can use their home equity wisely for large expenses

such as home renovations, college tuition, or to consolidate high

interest credit card debt. Access to home equity is one of the most

significant benefits of homeownership, as it can lower the cost of

borrowing for large expenses. And, in many cases, the interest may

be tax deductible.4

The equityFREEDOM application takes just minutes. loanDepot’s

home equity loan lets customers access the equity in their homes in

a lump sum in one of three, fully amortizing loan terms while the

HELOC offers flexible terms including a three-year draw period,

and, in most states, a 10-year interest-only payment period

followed by a 20-year amortizing repayment term.5 Each product

allows homeowners to borrow up to $400,000, based on their credit

profile and their home’s combined loan-to-value ratio (CLTV). There

are no prepayment penalties and, in many cases, borrowers may not

need a new home appraisal.

To learn more about loanDepot’s equityFREEDOM suite of home

equity lending products CLICK HERE.

About loanDepot

At loanDepot (NYSE: LDI), we know home means everything. That’s

why we are on a mission to support homeowners with a suite of

products and services that fuel the American Dream. Our portfolio

of digital-first home purchase, home refinance and home equity

lending products make homeownership more accessible, achievable,

and rewarding, especially for the increasingly diverse communities

of first-time homebuyers we serve. Headquartered in Southern

California with local market offices nationwide, loanDepot and its

sister real estate and home services company, mellohome, are

dedicated to helping customers put down roots and bring dreams to

life – all while building stronger communities and a better

tomorrow.

_______________ 1

https://ir.theice.com/press/news-details/2024/ICE-Mortgage-Monitor-Historically-Strong-Home-Price-Growth-Pushes-U.S.-Mortgage-Holders-Tappable-Equity-to-Record-11T/default.aspx

2

https://www.realtor.com/news/trends/majority-americans-still-feel-locked-in-by-mortgage-rates/#:~:text=%E2%80%9CAltogether%2C%20this%20means%20that%20more,rate%20for%20a%20higher%20one

3 https://fred.stlouisfed.org/series/OEHRENWBSHNO 4 loanDepot

encourages consumers to consult tax advisors for applicable

requirements and details. 5 In Texas, loanDepot’s HELOC includes a

three-year interest only period followed by a 27-year repayment

period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212427358/en/

Media Contact Jonathan Fine VP, Public Relations (781)

248-3963 jfine@loandepot.com

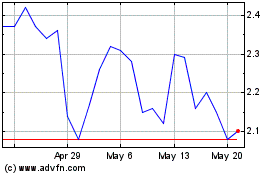

loanDepot (NYSE:LDI)

Historical Stock Chart

From Jan 2025 to Feb 2025

loanDepot (NYSE:LDI)

Historical Stock Chart

From Feb 2024 to Feb 2025