| | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549 |

| |

| SCHEDULE 13D |

| |

Under the Securities Exchange Act of 1934 (Amendment No. 4)* |

| |

| TERRAN ORBITAL CORPORATION |

(Name of Issuer) |

| |

| Common Stock, par value $0.0001 per share |

(Title of Class of Securities) |

| |

| 88105P103 |

(CUSIP Number) |

| |

John E. Stevens c/o Lockheed Martin Corporation 6801 Rockledge Drive Bethesda, MD 20817 (301) 897-6000 (Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communication) |

| |

March 1, 2024 (Date of Event which Requires Filing of this Statement) |

| |

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| | | | | | | | | | | | | | | | | | | | |

1 | NAMES OF REPORTING PERSONS | |

| | | | |

| | | Lockheed Martin Corporation | |

| | | | |

2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) ☐ |

| | | | (b) ☐ |

| | | | |

3 | SEC USE ONLY |

| | |

4 | SOURCE OF FUNDS (See Instructions) | |

| | | |

| | | OO | |

| | | | |

5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) | ☐ |

| | | | |

| | | | |

6 | CITIZENSHIP OR PLACE OF ORGANIZATION | |

| | | | |

| | | Maryland | |

| | | | |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH | 7 | SOLE VOTING POWER | |

| | | |

| | | 58,786,9031 | |

| | | |

| 8 | SHARED VOTING POWER | |

| | | |

| | | 12,694,916 | |

| | | |

9 | SOLE DISPOSITIVE POWER | |

| | | |

| | | 58,786,9031 | |

| | | |

10 | SHARED DISPOSITIVE POWER | |

| | | |

| | | 12,694,916 | |

| | | | | | |

11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

| | | 71,481,819 | |

| | | |

12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) | ☐ |

| | | |

| | | | |

13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) | |

| | | |

| | | 28.3%2 | |

| | | |

14 | TYPE OF REPORTING PERSON (See Instructions) | |

| | | |

| | | CO | |

| | | |

(1)Includes (a) 1,381,951 shares of Issuer common stock (“Common Stock”) currently issuable upon exercise of warrants with an exercise price of $10.00 per share, (b) 17,253,279 shares of Common Stock currently issuable upon exercise of warrants with an exercise price of $2.898 per share and (c) 39,364,732 shares of Common Stock currently issuable upon conversion of the Issuer’s 10% Senior Secured Convertible Notes due 2027 (the “Convertible Notes”), including interest paid in kind that has been added to the principal balance of the Convertible Notes, with a conversion price of $2.898 per share.

(2)This percentage is calculated assuming 194,461,361 shares of Common Stock are outstanding as of November 7, 2023 based upon the information disclosed in Terran Orbital Corporation’s Quarterly Report on Form 10-Q dated November 14, 2023 and, in accordance with Rule 13d-3(d)(1)(i) under the Act, assuming the conversion of all warrants and Convertible Notes owned by Lockheed Martin Corporation into shares of Common Stock.

| | | | | | | | | | | | | | | | | | | | |

1 | NAMES OF REPORTING PERSONS | |

| | | | |

| | | Astrolink International LLC | |

| | | | |

2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) ☐ |

| | | | (b) ☐ |

| | | | |

3 | SEC USE ONLY |

| | |

4 | SOURCE OF FUNDS (See Instructions) | |

| | | |

| | | OO | |

| | | | |

5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) | ☐ |

| | | | |

| | | | |

6 | CITIZENSHIP OR PLACE OF ORGANIZATION | |

| | | | |

| | | Delaware | |

| | | | |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH | 7 | SOLE VOTING POWER | |

| | | |

| | | 0 | |

| | | |

| 8 | SHARED VOTING POWER | |

| | | |

| | | 12,694,916 | |

| | | |

9 | SOLE DISPOSITIVE POWER | |

| | | |

| | | 0 | |

| | | |

10 | SHARED DISPOSITIVE POWER | |

| | | |

| | | 12,694,916 | |

| | | | | | |

11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

| | | 12,694,916 | |

| | | |

12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) | ☐ |

| | | |

| | | | |

13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) | |

| | | |

| | | 6.5%1 | |

| | | |

14 | TYPE OF REPORTING PERSON (See Instructions) | |

| | | |

| | | OO | |

| | | |

(1)This percentage is calculated assuming 194,461,361 shares of Common Stock are outstanding as of November 7, 2023 based upon the information disclosed in Terran Orbital Corporation’s Quarterly Report on Form 10-Q dated November 14, 2023.

SCHEDULE 13D

This Amendment No. 4 to Schedule 13D (this “Amendment”) amends and supplements the Schedule 13D originally filed with the U.S. Securities and Exchange Commission on November 9, 2022 (the “Schedule 13D”), as amended, relating to common stock, $0.0001 par value per share (the “Common Stock”), of Terran Orbital Corporation, a Delaware corporation (the “Issuer”). Capitalized terms used herein without definition shall have the meanings set forth in the Schedule 13D. Except as otherwise provided herein, each Item of the Schedule 13D remains unchanged.

Item 2. Identity and Background

Item 2 of the Schedule 13D is hereby amended by incorporating herein by reference the information set forth on the updated Schedule I attached hereto.

Item 3. Source and Amount of Funds and Other Consideration

Item 3 of the Schedule 13D is hereby amended and supplemented by adding the following:

The description of the Proposed Transaction set forth and defined in Item 4 of this Schedule 13D, is incorporated by reference in its entirety into this Item 3. It is anticipated that funding for the consideration payable will be obtained through the Reporting Persons’ existing resources, including cash on hand.

Item 4. Purpose of Transaction

Item 4 of the Schedule 13D is hereby amended by adding the following:

On March 1, 2024, Lockheed Martin Corporation (“LMC”) submitted a letter (the “Proposal”) to the Issuer outlining a non-binding proposal for LMC to acquire, in a merger transaction, all of the Common Stock for $1.00 per share in cash (the “Proposed Transaction”).

The terms and signing of the Proposed Transaction remain subject to certain conditions, including completion of a due diligence review, negotiation and agreement of transaction structure and transaction documents, and approval of the Proposed Transaction by LMC and by the Issuer’s board of directors and shareholders. No assurance can be given that definitive transaction agreements with respect to the Proposal will be entered into, the terms or conditions of any such agreements, or whether the Proposed Transaction will eventually be consummated. The Reporting Persons do not intend to update additional disclosures regarding the Proposal unless and until a definitive agreement has been reached, or unless disclosure is otherwise required under applicable U.S. securities laws.

If the Proposed Transaction is consummated, the Common Stock is expected to be delisted from the New York Stock Exchange and deregistered under the Act.

LMC may at any time, or from time to time: amend, pursue, or choose not to pursue the Proposed Transaction; change the terms of the Proposed Transaction contemplated by the

Proposal, including the price, conditions, or scope of the Proposed Transaction; take any action in or out of the ordinary course of business to facilitate or increase the likelihood of consummation of the Proposed Transaction; otherwise seek control or seek to influence the management and policies of the Issuer; or change their intentions with respect to any such matters.

The foregoing description of the Proposal is qualified by reference to the Proposal, a copy of which is filed as Exhibit 99.7 to this Schedule 13D and incorporated by reference herein.

Item 5. Interest in Securities of the Issuer

Item 5(a)—(c) of the Schedule 13D are each hereby amended and restated in their entirety as follows:

(a) – (b) The information contained in rows 7, 8, 9, 10, 11 and 13 on each of the cover pages of this Amendment and in the footnotes thereto is incorporated herein by reference. None of the Related Parties beneficially own any shares of Common Stock.

(c) The information in Item 4 of this Amendment is incorporated herein by reference. None of the Reporting Persons or the Related Parties have engaged in any transaction in shares of Common Stock in the 60 days prior to the filing of this Amendment.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Item 6 of the Schedule 13D is hereby amended and supplemented by incorporating by reference the response to Item 4 of this Amendment and Exhibit 99.7 hereto.

Item 7. Material to be Filed as Exhibits

Item 7 of the Schedule 13D is hereby amended and supplemented as follows:

After reasonable inquiry and to the best of its knowledge and belief, the undersigned hereby certify that the information set forth in this statement is true, complete and correct.

Date: March 1, 2024

| | | | | | | | | | | |

| | Lockheed Martin Corporation | |

| | | |

| By: | /s/ H. Edward Paul III | |

| | Name: | H. Edward Paul III | |

| | Title: | Vice President and Controller | |

| | | |

| | | |

| | Astrolink International LLC | |

| | | |

| By: | /s/ H. Edward Paul III | |

| Name: | H. Edward Paul III | |

| Title: | Vice President | |

Schedule I

The name, present principal occupation or employment and citizenship of each of the executive officers and directors of LMC and Astrolink is set forth below. The business address of each individual is c/o Lockheed Martin Corporation, 6801 Rockledge Drive, Bethesda, MD 20817.

Lockheed Martin Corporation

| | | | | | | | | | | | | | |

| Name of Executive Officer | | Principal Occupation or Employment | | Citizenship |

| Timothy S. Cahill | | President, Missiles and Fire Control | | United States |

| Stephanie C. Hill | | President, Rotary and Mission Systems | | United States |

| Maryanne R. Lavan | | Senior Vice President, General Counsel and Corporate Secretary | | United States |

| Robert M. Lightfoot, Jr. | | President, Space | | United States |

| Jesus Malave | | Chief Financial Officer | | United States |

| H. Edward Paul III | | Vice President and Controller | | United States |

Maria A. Ricciardone | | Vice President, Treasurer and Investor Relations | | United States |

| Frank A. St. John | | Chief Operating Officer | | United States |

| James D. Taiclet | | Chairman, President and Chief Executive Officer | | United States |

| Gregory M. Ulmer | | President, Aeronautics | | United States |

| | | | | | | | | | | | | | |

| Name of Director | | Principal Occupation or Employment | | Citizenship |

| Daniel F. Akerson | | Retired Chairman and CEO, General Motors Company | | United States |

| David B. Burritt | | President and CEO, United States Steel Corporation | | United States |

| Bruce A. Carlson | | Retired United States Air Force General | | United States |

| John M. Donovan | | Retired CEO, AT&T Communications, LLC | | United States |

| Joseph F. Dunford, Jr. | | Senior Managing Director and Partner of Liberty Strategic Capital | | United States |

| James O. Ellis, Jr. | | Retired President and CEO, Institute of Nuclear Power Operations | | United States |

| Thomas J. Falk | | Retired Chairman and CEO, Kimberly-Clark Corporation | | United States |

| Ilene S. Gordon | | Retired Chairman and CEO, Ingredion Incorporated | | United States |

| Vicki A. Hollub | | President and CEO, Occidental Petroleum Corporation | | United States |

| Jeh C. Johnson | | Partner at Paul, Weiss, Rifkind, Wharton & Garrison LLP | | United States |

| Debra L. Reed-Klages | | Retired Chairman, President and CEO, Sempra Energy | | United States |

| Patricia E. Yarrington | | Retired Chief Financial Officer, Chevron Corporation | | United States |

Astrolink International LLC

| | | | | | | | | | | | | | |

| Name of Executive Officer | | Principal Occupation or Employment | | Citizenship |

| J. Chris Moran | | Vice President and General Manager, Lockheed Martin Ventures, Lockheed Martin Corporation | | United States |

| John E. Stevens | | Vice President, Associate General Counsel, Lockheed Martin Corporation | | United States |

| H. Edward Paul III | | Vice President and Controller, Lockheed Martin Corporation | | United States |

Maria A. Ricciardone | | Vice President, Treasurer and Investor Relations, Lockheed Martin Corporation | | United States |

| Scott M. Weiner | | Vice President, Corporate Development, Lockheed Martin Corporation | | United States |

March 1, 2024

Jefferies LLC

520 Madison Avenue

New York, NY 10022

Attention: Jeff McGrath, Greg Valentine

Re: Non-binding Proposal in Response to Process Letter

Ladies and Gentlemen:

Pursuant to the process letter dated February 14, 2024, Lockheed Martin Corporation (“Lockheed Martin”) is pleased to submit to you a non-binding proposal to acquire all the outstanding shares of common stock and warrants of Terran Orbital Corporation (“Terran” or the “Company”) for cash (the “Transaction”), as described in more detail below. We would like to thank the Terran and Jefferies teams for the continued constructive engagement during our due diligence process to date, including the management presentation, site tour, support of functional diligence workstreams and responsiveness to our requests.

Terran represents an attractive opportunity for Lockheed Martin, and we are treating the potential Transaction as a strategic priority. Terran’s superior capabilities and business momentum align with one of Lockheed Martin Space’s strategic growth priorities and the Transaction would accelerate that strategy.

Lockheed Martin and Terran established a strategic relationship as part of Lockheed Martin’s investment in Terran’s Series A round in 2017. Over the past seven years, we have been impressed with Terran as a provider of vertically integrated, full-spectrum satellite solutions to government and commercial customers. The Company’s track record of supporting 80+ missions over the past 10 years for government and commercial customers with complex mission requirements remains highly differentiated. Lockheed Martin’s longstanding working relationship with Terran and our position as Terran’s largest customer, underpins our confidence in the parties’ strong cultural alignment and our ability to expeditiously and successfully integrate Terran and its people with Lockheed Martin.

We have invested significant resources conducting our due diligence inclusive of a detailed review of the forward revenue projections and are substantially finished with our process.

Lockheed Martin continues to be Terran's largest revenue generating customer accounting for the majority of the backlog (81% as of December 31st, 2022). In addition to being the largest historical revenue generating customer we are confident that we will continue to be the largest revenue generating customer for Terran for the foreseeable future. As a result, we are uniquely qualified to assess the Company’s near and long-term outlook and accurately ascribe fair value to Terran’s business for all its stakeholders. This letter formally conveys to you the following non-binding proposal.

Non-Binding Proposal

Lockheed Martin is prepared to offer the following:

•$1.00 in cash for each share of Terran common stock outstanding1

•Over $70 million in aggregate cash for Terran's outstanding warrants2

•Assumption or repayment of Terran's existing debt liabilities of $313 million as of September 30, 2023.

Given Lockheed Martin’s unparalleled understanding of the Company and our position as Terran’s most significant revenue generating customer, we are confident our proposal delivers compelling value for all Terran stakeholders and provides greater value to such stakeholders than Terran’s prospects as a standalone company. Stockholders, warrant holders and debt holders would receive immediate liquidity and certain value, and Terran employees and customers would benefit from the resources and stability available under Lockheed Martin’s ownership.

Transaction Premium

Offer consideration to common stockholders reflects:

•38% premium to $0.72 closing stock price after Terran’s strategic alternatives announcement on December 11, 2023

•11% premium to 30-day VWAP of $0.90 measured as of February 29, 2024

Our offer to common stockholders reflects a premium to these share prices despite the fact that Lockheed Martin also expects to pay out over $70 million to Terran’s warrant holders, a new obligation that principally arises from Terran’s 2023 fundraising efforts that is triggered by the Transaction. These warrants represent a significant liability constituting 31% of Terran’s current market capitalization. Additionally, the Transaction would result in full compensation to Terran’s debt holders for the principal value of the Company’s obligations.

The Transaction would not be subject to any financing contingencies. Our proposal is subject to the satisfactory completion of outstanding confirmatory diligence, negotiation of mutually agreeable definitive transaction documents, and final receipt of necessary corporate approvals. The transaction would be further subject to customary and typical closing conditions. Based on the information available to us, we expect limited regulatory risk to the Transaction. We believe Lockheed Martin is well positioned to negotiate and complete the Transaction in an expedited manner.

We are committed to an acquisition of Terran and stand ready to work with you to negotiate a mutually acceptable transaction on an expedited timeline. To that end, we believe with the Company’s full attention, the Transaction could be announced quickly.

This letter does not create any legally binding or enforceable obligations. No such obligations shall be imposed on either party unless and until a definitive agreement is signed by both Terran and Lockheed Martin.

We look forward to discussing a potential transaction with Terran and executing a definitive agreement expeditiously.

1 Based on approximately 223 million common stock and dilutive stock-based compensation outstanding as of February 2024.

2 Reflects estimated Black Scholes value for approximately 103 million outstanding warrants as of February 2024, which includes Public Warrants, warrants issued as part of Registered Direct Offering (May 2023), Confidentially Marketed Public Offering (September 2023) and to other lenders as disclosed in Terran’s public filings. Estimated value based on available market inputs at time of this letter.

Sincerely,

/s/ Scott M. Weiner

_______________________________

Scott M. Weiner

Vice President Corporate Development

Lockheed Martin Corporation

CC: Stephen Edelman, Brian Link (Citi)

Elizabeth Donley (Hogan Lovells)

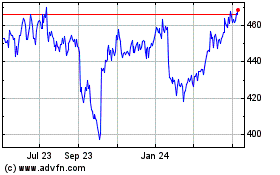

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

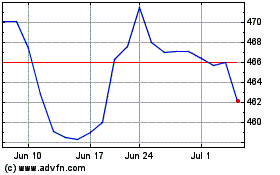

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024