false

0000773141

0000773141

2024-03-01

2024-03-01

0000773141

MDC:ClassCommonStock0.0001ParValuePerShareMember

2024-03-01

2024-03-01

0000773141

MDC:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockMember

2024-03-01

2024-03-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 1, 2024

M.D.C. Holdings, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-8951 |

|

84-0622967 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

4350

South Monaco Street, Suite

500

Denver, Colorado |

|

80237 |

| (Address of principal executive offices) |

|

(Zip Code) |

(303) 773-1100

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, $.01 par value |

|

MDC |

|

New York Stock Exchange |

| 6% Senior Notes due January 2043 |

|

MDC 43 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

The waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, as amended (the “HSR Act”), for Sekisui House, Ltd.’s (“Sekisui House”)

pending acquisition of M.D.C. Holdings, Inc. (“MDC”) expired at 11:59 p.m. on March 1, 2024. The HSR Act imposes waiting

periods on certain transactions to allow for antitrust review before those transactions can close. The expiration of the waiting period

under the HSR Act satisfies one of the conditions to the closing of the pending acquisition, which remains subject to other customary

closing conditions, including receipt of shareholder approval.

Forward-Looking Statements

This communication includes certain disclosures which

contain “forward-looking statements” within the meaning of the federal securities laws, including but not limited to those

statements related to the proposed transaction, including financial estimates and statements as to the expected timing, completion and

effects of the proposed transaction. These forward-looking statements may be identified by terminology such as “likely,” “predicts,”

“continue,” “anticipates,” “believes,” “confident,” “could,” “estimates,”

“expects,” “intends,” “target,” “potential,” “may,” “will,” “might,”

“plans,” “path,” “should,” “approximately,” “our planning assumptions,” “forecast,”

“outlook” or the negative of such terms and other comparable terminology. These forward-looking statements, including statements

regarding the proposed transaction, are based largely on information currently available and management's current expectations and assumptions,

and involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements to

be materially different from those expressed or implied by the forward-looking statements. Although we believe that the expectations reflected

in the forward-looking statements contained in this communication are reasonable, we cannot guarantee future results. There is no assurance

that our expectations will occur or that our estimates or assumptions will be correct, and we caution investors and all others not to

place undue reliance on such forward-looking statements.

Important factors, risks and uncertainties and other

factors that may cause actual results to differ materially from such plans, estimates or expectations include but are not limited to:

(i) the completion of the proposed transaction on the anticipated terms and timing, including obtaining required stockholder and regulatory

approvals, and the satisfaction of other conditions to the completion of the proposed transaction; (ii) potential litigation relating

to the proposed transaction that could be instituted against MDC or its directors, managers or officers, including the effects of any

outcomes related thereto; (iii) the risk that disruptions from the proposed transaction will harm MDC’s business, including current

plans and operations, including during the pendency of the proposed transaction; (iv) the ability of MDC to retain and hire key personnel;

(v) the diversion of management’s time and attention from ordinary course business operations to completion of the proposed transaction

and integration matters; (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion

of the proposed transaction; (vii) legislative, regulatory and economic developments; (viii) potential business uncertainty, including

changes to existing business relationships, during the pendency of the proposed transaction that could affect MDC’s financial performance;

(ix) certain restrictions during the pendency of the proposed transaction that may impact MDC’s ability to pursue certain business

opportunities or strategic transactions; (x) unpredictability and severity of catastrophic events, including but not limited to acts

of terrorism, outbreaks of war or hostilities or the COVID-19 pandemic, as well as management’s response to any of the aforementioned

factors; (xi) the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result

of unexpected factors or events; (xii) the occurrence of any event, change or other circumstance that could give rise to the termination

of the proposed transaction, including in circumstances requiring MDC to pay a termination fee; (xiii) those risks and uncertainties

set forth under the headings “Forward Looking Statements” and “Risk Factors” in MDC’s most recent Annual

Report on Form 10-K, as such risk factors may be amended, supplemented or superseded from time to time by other reports filed by MDC

with the SEC from time to time, which are available via the SEC’s website at www.sec.gov; and (xiv) those risks that are described

in the preliminary proxy statement that was filed with the SEC and is available from the sources indicated below.

These risks, as well

as other risks associated with the proposed transaction, are more fully discussed in the preliminary proxy statement filed with the SEC

in connection with the proposed transaction. There can be no assurance that the proposed transaction will be completed, or if it is completed,

that it will close within the anticipated time period. These factors should not be construed as exhaustive and should be read in conjunction

with

the other forward-looking statements. The forward-looking

statements relate only to events as of the date on which the statements are made. MDC undertakes no duty to update publicly any forward-looking

statements except as required by law, whether as a result of new information, future events or otherwise. If one or more of these or other

risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from

what we may have expressed or implied by these forward-looking statements. We caution that you should not place undue reliance on any

of our forward-looking statements. You should specifically consider the factors identified in this communication that could cause actual

results to differ. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for us to predict those events

or how they may affect MDC.

Important Information for Investors and Stockholders

This communication is being made in connection with

the proposed transaction involving MDC, Sekisui House and the other parties to the Merger Agreement. MDC has filed a preliminary proxy

statement and certain other documents, and may file additional relevant materials, regarding the proposed transaction with the SEC. The

Company filed the preliminary proxy statement with the SEC on February 23, 2024. This communication is not a substitute for the proxy

statement or any other document that MDC may file with the SEC or send to its stockholders in connection with the proposed transaction.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. These materials are not

yet final and will be amended. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, STOCKHOLDERS ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT

FILED WITH THE SEC (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND

IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The preliminary proxy statement and any other

relevant materials in connection with the proposed transaction and any other documents filed by MDC with the SEC, may be obtained free

of charge at the SEC’s website (http://www.sec.gov), at MDC’s website (https://ir.richmondamerican.com/sec-filings) or upon

written request to MDC at 4350 South Monaco Street, Suite 500, Denver, CO 80237.

Participants in the Solicitation

MDC and its directors, executive officers and certain

other employees may be deemed to be participants in the solicitation of proxies from stockholders of MDC in connection with the proposed

transaction. Information about MDC’s directors and executive officers is set forth in the sections entitled “Proposal One

Election of Directors,” “Executive Officers,” “2022 Director Compensation ” and “Transactions with

Related Persons” of MDC’s proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on March

1, 2023. Additional information regarding the identity of the participants, and their respective direct and indirect interests in the

proposed transaction, by security holdings or otherwise, is set forth in the sections entitled “The Merger—Interests of the

Directors and Executive Officers of MDC in the Merger” and “Security Ownership of Certain Beneficial Owners and Management”

of MDC’s preliminary proxy statement on Schedule 14A filed with the SEC on February 23, 2024. You may obtain free copies of these

documents using the sources indicated above.

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

M.D.C. HOLDINGS, INC. |

|

| |

|

|

|

Date: March 4, 2024 |

By |

/s/ Joseph H. Fretz |

|

| |

|

Joseph H. Fretz |

|

| |

|

Vice President, Secretary and Corporate Counsel |

|

v3.24.0.1

Cover

|

Mar. 01, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 01, 2024

|

| Entity File Number |

1-8951

|

| Entity Registrant Name |

M.D.C. Holdings, Inc.

|

| Entity Central Index Key |

0000773141

|

| Entity Tax Identification Number |

84-0622967

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4350

South Monaco Street

|

| Entity Address, Address Line Two |

Suite

500

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80237

|

| City Area Code |

303

|

| Local Phone Number |

773-1100

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Class A common stock, $0.0001 par value per share |

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

MDC

|

| Security Exchange Name |

NYSE

|

| Warrants, each whole warrant exercisable for one share of common stock |

|

| Title of 12(b) Security |

6% Senior Notes due January 2043

|

| Trading Symbol |

MDC 43

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MDC_ClassCommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MDC_WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

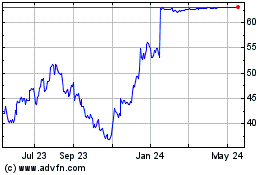

M D C (NYSE:MDC)

Historical Stock Chart

From Nov 2024 to Dec 2024

M D C (NYSE:MDC)

Historical Stock Chart

From Dec 2023 to Dec 2024