New "State of Digital Lending" Report Reveals Over 50% of Organizations Struggle to Deliver Fast, Seamless Digital Lending Experiences

September 17 2024 - 3:05PM

Business Wire

MeridianLink, in Partnership with the Digital

Banking Report, Shares Insights on the State of Digital Lending

MeridianLink, Inc., a leading provider of modern software

platforms for financial institutions and consumer reporting

agencies, recently unveiled the “2024 State of Digital Lending”

report in collaboration with prominent industry expert, Jim Marous,

owner and publisher of The Digital Banking Report. The report

highlights that while there is a notable increase in mobile and

digital loan applications, with 65% of applications now submitted

via mobile — a significant rise from 54% in 2021, 44% in 2020, and

34% in 2019, financial institutions still find difficulty meeting

consumer expectations.

While over 50% of organizations claim to have a fully digital

lending process, many still struggle to deliver a fast and seamless

experience, especially to those consumers seeking a

“do-it-yourself” solution. Drawing on insights from leaders at

hundreds of banks and credit unions across the country, the report

underscores that simply offering the ability to apply for loans

digitally is no longer sufficient. Rather, institutions must

rethink their underlying processes to meet the modern consumer

expectations of a fast, frictionless digital lending experience

from start to finish.

“The landscape of lending is undergoing a profound

transformation, where leaders in the financial services industry

find themselves at a critical juncture. As we navigate this

shifting terrain, it is imperative that financial institutions

approach the future with a strategic mindset, embracing digital

lending as a catalyst for building resilience, and being future

ready,” said Marous. “With their deep understanding of the digital

lending landscape and their commitment to empowering financial

institutions, MeridianLink is uniquely positioned to guide

financial institutions through the complexities of this digital

transformation.”

Key findings from the report include:

- 90% of financial institutions now offer online and web loan

applications, yet only 65% provide a mobile application

process.

- Consumers to complete a loan application online has decreased,

dropping from 76% in 2021 to 57% in 2024, likely due to growing

regulatory and compliance requirements.

- 57% of institutions reported consumers can complete the entire

loan application online, though completion rates vary by loan

type.

- 81% of financial institutions said consumers complete credit

card applications online, 65% for auto loans, 35% for mortgages,

and 17% for small business loans.

“Financial institutions have made significant progress on their

digital capabilities in the last few years, particularly since the

pandemic, but these report findings make clear that there is more

work to be done to ensure every American has access to convenient,

safe, and seamless digital experiences,” said Devesh Khare, chief

product officer at MeridianLink. “MeridianLink is proud to empower

a broad cross-section of credit unions, banks, and mortgage lenders

to continue their digital progression journeys and support the

important work these institutions are doing to make digital banking

and lending services more accessible than ever before.”

As financial institutions continue to navigate the evolving

digital landscape, they will likely face challenges such as

navigating complex regulations, maintaining top-tier data privacy

and security, and implementing AI-driven automation. As the digital

lending landscape evolves, institutions that prioritize speed,

simplicity, and advanced functionality should be best positioned to

meet growing consumer demands.

Banks and credit unions struggling to manage these challenges

should consider a partner with expertise in both innovative

technologies for financial institutions and the regulation that

governs its use. This is not only an excellent risk mitigation

strategy but serves as a way to ensure the institution stays at the

forefront of technological developments in the industry. The report

found that, in general, financial institutions using partner

solutions to help meet consumers’ digital needs and requirements

will be more competitive than the organizations simply relying on

legacy banking tactics.

The “State of Digital Lending” report released by Digital

Banking Report is sponsored by and produced in collaboration with

MeridianLink. It is available for download free of charge here.

The “State of Digital Lending” Report Methodology

The Digital Banking Report conducted an online survey of 252

financial institutions worldwide, with North America representing a

substantial majority of the respondents, on the state of the

digital lending industry.

ABOUT MERIDIANLINK

MeridianLink®(NYSE: MLNK) empowers financial institutions and

consumer reporting agencies to drive efficient growth.

MeridianLink’s cloud-based digital lending, account opening,

background screening, and data verification solutions leverage

shared intelligence from a unified data platform, MeridianLink®

One, to enable customers of all sizes to identify growth

opportunities, effectively scale up, and support compliance

efforts, all while powering an enhanced experience for staff and

consumers alike.

For more than 25 years, MeridianLink has prioritized the

democratization of lending for consumers, businesses, and

communities. Learn more at www.meridianlink.com.

ABOUT DIGITAL BANKING REPORT

The Digital Banking Report provides the largest collection of

free, in-depth insights into how data, digital technologies,

innovation, and new competition are changing the banking

industry.

Curated by Jim Marous, a top five financial industry influencer,

the Digital Banking Report provides practical and unbiased guidance

for bank and credit union product managers, marketers, and C-level

executives. It equips them with the knowledge to enhance their

digital, online, and mobile offerings. Executives can access more

than 200 previously published reports in the digital archives.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240917632604/en/

PRESS CONTACT Sydney Wishnow meridianlinkPR@clyde.us

(508) 808-9060

INVESTOR RELATIONS CONTACT Gianna Rotellini

InvestorRelations@meridianlink.com (714) 332-6357

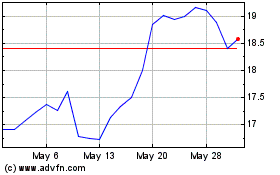

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Oct 2024 to Nov 2024

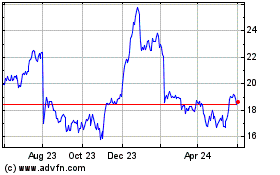

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Nov 2023 to Nov 2024