Marcus & Millichap’s IPA Capital Markets Arranges $75 Million Financing for Midtown Manhattan Office-to-Residential Conversion Project

September 19 2024 - 4:15PM

Business Wire

IPA Capital Markets, a division of Marcus & Millichap

(NYSE:MMI), specializing in capital markets services for major

private and institutional clients, has secured $75 million in

acquisition financing for the former Pfizer headquarters in New

York City. Located at 219 E 42nd St., the property will be combined

with the adjacent building at 235 E 42nd St. and converted into a

free-market, Class-A, luxury multifamily apartment building.

“When these two buildings are combined, it will add more than

800 units to the project totaling to over 1,400 units, making it

the largest office-to-residential conversion in New York City’s

history,” said Max Herzog, IPA Capital Markets.

The New York-based IPA Capital Markets team of Herzog, Marko

Kazanjian, Andrew Cohen and Max Hulsh secured the financing with

Northwind Group on behalf of David Werner Real Estate Investments

and Metro Loft Management.

Herzog added: “The shortage of free-market multifamily units in

Manhattan, coupled with David Werner’s acquisition of the property

at a favorable basis and Metro Loft’s expertise in

office-to-residential conversions helped our team generate

significant interest from lenders in providing the acquisition

bridge loan. This led to IPA Capital Markets managing a smooth and

efficient financing process, ultimately securing strong terms for

DWREI and Metro Loft.”

Located in Midtown East, the property will be converted from a

10-story, 291,000-gross-square-foot office building into a

29-story, approximately 540,000 square-foot, luxury multifamily

rental property with 660 units ranging from studios to

three-bedroom loft-style layouts.

About IPA Capital Markets

IPA Capital Markets is a division of Marcus & Millichap

(NYSE: MMI). IPA Capital Markets provides major private and

institutional clients with commercial real estate capital markets

financing solutions, including debt, mezzanine financing, preferred

and joint venture equity, and sponsor equity. For more information,

please visit institutionalpropertyadvisors.com/capital-markets

About Marcus & Millichap, Inc. (NYSE: MMI)

Marcus & Millichap, Inc. is a leading brokerage firm

specializing in commercial real estate investment sales, financing,

research and advisory services with offices throughout the United

States and Canada. As of December 31, 2023, the company had 1,783

investment sales and financing professionals in over 80 offices who

provide investment brokerage and financing services to sellers and

buyers of commercial real estate. The company also offers market

research, consulting and advisory services to clients. Marcus &

Millichap closed 7,546 transactions in 2023, with a sales volume of

approximately $43.6 billion. For additional information, please

visit www.MarcusMillichap.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240919676375/en/

Gina Relva, VP of Public Relations

Gina.Relva@MarcusMillichap.com

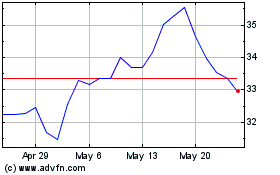

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Nov 2024 to Dec 2024

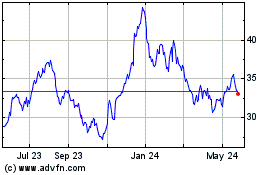

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Dec 2023 to Dec 2024