Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

January 16 2024 - 4:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 6)*

MariaDB plc

(Name of Issuer)

Ordinary Shares, $0.01 nominal value per share

(Title of Class of Securities)

G5920M100

(CUSIP Number)

| Murat Akuyev, General Counsel |

Kevin Sullivan |

| Runa Capital, Inc. |

Heidi Steele |

| 459 Hamilton Ave, Ste. 306 |

McDermott Will & Emery LLP |

| Palo Alto, CA 94301 |

444 West Lake Street, Suite 4000 |

| 646.629.9838 |

Chicago, IL 60606 |

| |

312.371.2000 |

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

January 10, 2024

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or

13d-1(g), check the following box ☒

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d -7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE 13D/A

| |

|

|

| CUSIP No. G5920M100 |

|

Page 2 of 9 Pages |

| |

|

|

| 1 |

NAME OF REPORTING PERSON. S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY) |

|

|

| |

|

|

|

| |

Runa Capital Fund II, L.P. |

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

☐ |

| |

|

(b) |

☒ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

|

| |

|

|

|

| |

PF |

|

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

|

|

|

| |

Cayman Islands |

|

|

| |

7 |

SOLE VOTING POWER |

| NUMBER |

|

|

| OF |

|

0 |

| SHARES |

8 |

SHARED VOTING POWER |

| BENEFICIALLY |

|

|

| OWNED |

|

2,557,043 |

| BY |

9 |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

0 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

|

| |

|

2,557,043 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

|

|

|

| |

2,557,043 |

|

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

|

|

|

| |

3.8%(1) |

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

|

| |

|

|

|

| |

PN |

|

|

| |

|

|

|

|

|

|

|

| 1 | Based

on 67,738,634 ordinary shares, nominal value $0.01 per share (“Ordinary Shares”), outstanding as of December 27, 2023, as

disclosed in the Issuer’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”)

on December 29, 2023. |

| |

|

|

| CUSIP No. G5920M100 |

|

Page 3 of 9 Pages |

| |

|

|

| 1 |

NAME OF REPORTING PERSON. S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY) |

|

|

| |

|

|

|

| |

Runa Capital II (GP) |

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

☐ |

| |

|

(b) |

☒ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

|

| |

|

|

|

| |

PF |

|

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

|

|

|

| |

Cayman Islands |

|

|

| |

7 |

SOLE VOTING POWER |

| NUMBER |

|

|

| OF |

|

0 |

| SHARES |

8 |

SHARED VOTING POWER |

| BENEFICIALLY |

|

|

| OWNED |

|

2,557,043 |

| BY |

9 |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

0 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

|

| |

|

2,557,043 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

|

|

|

| |

2,557,043 |

|

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

|

|

|

| |

3.8%1 |

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

|

| |

|

|

|

| |

OO (Cayman Islands exempted company) |

|

|

| |

|

|

|

|

|

|

|

| 1 | Based

on 67,738,634 Ordinary Shares outstanding as of December 27, 2023, as disclosed in the Issuer’s Annual Report on Form 10-K filed

with the SEC on December 29, 2023. |

| |

|

|

| CUSIP No. G5920M100 |

|

Page 4 of 9 Pages |

| |

|

|

| 1 |

NAME OF REPORTING PERSON. S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY) |

|

|

| |

|

|

|

| |

Runa Capital Opportunity Fund I, L.P. |

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

☐ |

| |

|

(b) |

☒ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

|

| |

|

|

|

| |

PF |

|

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

|

|

|

| |

Cayman Islands |

|

|

| |

7 |

SOLE VOTING POWER |

| NUMBER |

|

|

| OF |

|

0 |

| SHARES |

8 |

SHARED VOTING POWER |

| BENEFICIALLY |

|

|

| OWNED |

|

1,992,618 |

| BY |

9 |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

0 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

|

| |

|

1,992,618 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

|

|

|

| |

1,992,618 |

|

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

|

|

|

| |

2.9%1 |

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

|

| |

|

|

|

| |

PN |

|

|

| |

|

|

|

|

|

|

|

| 1 | Based

on 67,738,634 Ordinary Shares outstanding as of December 27, 2023, as disclosed in the Issuer’s Annual Report on Form 10-K filed

with the SEC on December 29, 2023. |

| |

|

|

| CUSIP No. G5920M100 |

|

Page 5 of 9 Pages |

| |

|

|

| 1 |

NAME OF REPORTING PERSON. S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY) |

|

|

| |

|

|

|

| |

Runa Capital Opportunity I (GP) |

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

☐ |

| |

|

(b) |

☒ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

|

| |

|

|

|

| |

PF |

|

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

|

|

|

| |

Cayman Islands |

|

|

| |

7 |

SOLE VOTING POWER |

| NUMBER |

|

|

| OF |

|

0 |

| SHARES |

8 |

SHARED VOTING POWER |

| BENEFICIALLY |

|

|

| OWNED |

|

2,711,969 |

| BY |

9 |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

0 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

|

| |

|

2,711,969 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

|

|

|

| |

2,711,969 |

|

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

|

|

|

| |

4.0%1 |

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

|

| |

|

|

|

| |

OO (Cayman Islands exempted company) |

|

|

| |

|

|

|

|

|

|

|

| 1 | Based

on 67,738,634 Ordinary Shares outstanding as of December 27, 2023, as disclosed in the Issuer’s Annual Report on Form 10-K filed

with the SEC on December 29, 2023. |

| |

|

|

| CUSIP No. G5920M100 |

|

Page 6 of 9 Pages |

| |

|

|

| 1 |

NAME OF REPORTING PERSON. S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY) |

|

|

| |

|

|

|

| |

Runa Ventures I Limited |

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

☐ |

| |

|

(b) |

☒ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

|

| |

|

|

|

| |

PF |

|

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

|

|

|

| |

Bermuda |

|

|

| |

7 |

SOLE VOTING POWER |

| NUMBER |

|

|

| OF |

|

0 |

| SHARES |

8 |

SHARED VOTING POWER |

| BENEFICIALLY |

|

|

| OWNED |

|

719,351 |

| BY |

9 |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

0 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

|

| |

|

719,351 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

|

|

|

| |

719,351 |

|

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

|

|

|

| |

1.1%1 |

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

|

| |

|

|

|

| |

OO (Bermuda company) |

|

|

| |

|

|

|

|

|

|

|

| 1 |

Based on 67,738,634 Ordinary Shares outstanding as of December 27,

2023, as disclosed in the Issuer’s Annual Report on Form 10-K filed with the SEC on December 29, 2023. |

| |

|

|

| CUSIP No. G5920M100 |

|

Page 7 of 9 Pages |

| |

|

|

Item 1. Security and Issuer

This Amendment No. 6 (the “Amendment”) hereby amends the

Schedule 13D filed by the Reporting Persons with the Securities and Exchange Commission (the “SEC”) on September 12, 2023

(the “Original Schedule 13D”), as amended by Amendment No. 1 to the Original Schedule 13D filed by the Reporting Persons with

the SEC on September 18, 2023 (the “Amendment No. 1”), Amendment No. 2 to the Original Schedule 13D filed by the Reporting

Persons with the SEC on September 21, 2023 (“Amendment No. 2”), Amendment No. 3 to the Original Schedule 13D filed by the

Reporting Persons with the SEC on September 25, 2023 (the “Amendment No. 3”), Amendment No. 4 to the Original Schedule 13D

filed by the Reporting Persons with the SEC on September 29, 2023 (the “Amendment No. 4”) and Amendment No. 5 to the Original

Schedule 13D filed by the Reporting Persons with the SEC on October 13, 2023 (the “Amendment No. 5”, and together with the

Amendment, Amendment No. 1, Amendment No. 2, Amendment No. 3, Amendment No. 4, the “Schedule 13D”). The Amendment relates

to the ordinary shares (the “Ordinary Shares”) of MariaDB plc (the “Issuer” or the “Company”). The

address of the Issuer is 699 Veterans Blvd., Redwood City, CA 94063 and its jurisdiction of incorporation is Ireland. The Reporting Persons

previously reported their beneficial ownership of Ordinary Shares on a Schedule 13G filed with the Securities and Exchange Commission

on February 7, 2023. The Reporting Persons have filed this Schedule 13D to provide the flexibility to potentially engage in the future

in one or more of the activities described below in Item 4. Capitalized terms used but not defined herein have the meanings given to such

terms in the Schedule 13D. Except as set forth herein, the Schedule 13D is unmodified.

Item 4. Purpose of the Transaction

Item 4 of the Schedule 13D is amended to add the following:

On January 10, 2024, the Company entered into

an amendment (the “First Amendment”) of the Note issued to RP Ventures LLC on October 10, 2023. The First Amendment extends

(i) the maturity date of the Note from January 10, 2024 to January 31, 2024, and (ii) the exclusivity period under the Note from January

10, 2024 to January 31, 2024, pursuant to which the Company is restricted from pursuing or accepting any offer with respect to any recapitalization,

reorganization, merger, business combination, purchase, sale, loan, notes issuance, issuance of other indebtedness or other financing

or similar transaction, or to any acquisition by any person or group, which would result in any person or group becoming the beneficial

owner of 2% or more of any class of equity interests or voting power or consolidated net income, revenue or assets, of the Company, in

each case other than with RP Ventures LLC, Runa Capital Fund II, L.P. or Runa affiliates.

The Company agreed to pay RP Ventures LLC a nonrefundable

funding fee of $75,000 relating to the First Amendment. Except for the foregoing, no material changes were made to the Note.

The foregoing description of the First Amendment is qualified in its

entirety by reference to the full text of the First Amendment, a copy of which is attached hereto as Exhibit 99.11 and is incorporated

herein by reference.

| |

|

|

| CUSIP No. G5920M100 |

|

Page 8 of 9 Pages |

| |

|

|

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is amended to add the

following:

The information set forth

in Item 4 is incorporated herein by reference.

Item 7. Materials to be Filed as Exhibits

| 99.1 |

|

Joint Filing Agreement (previously filed with the Original Schedule 13D) |

| 99.2 |

|

Letter to the Issuer dated September 7, 2023 (previously filed with the Original Schedule 13D) |

| 99.3 |

|

Statement Under Irish Takeover Rules Regarding Possible Offer for MariaDB plc (previously filed with the Amendment No. 1 to Schedule 13D) |

| 99.4 |

|

Letter to the Issuer dated September 20, 2023 (previously filed with Amendment No. 2) |

| 99.5 |

|

Commitment Letter, dated September 22, 2023, by and between Runa Capital Fund II, L.P., represented by its general partner Runa Capital II (GP), and MariaDB plc (previously filed with Amendment No. 3) |

| 99.6 |

|

Statement by Runa Regarding Corporate Governance Concerns at MariaDB plc and Shareholder Engagement (previously filed with Amendment No. 4) |

| 99.7 |

|

Statement Regarding Possible Offer for MariaDB plc (previously filed with Amendment No. 4) |

| 99.8 |

|

Opening Position Disclosure Under Rule 8.1(a) and (b) of The Irish Takeover Panel Act, 1997, Takeover Rules, 2022 by an Offeror or an Offeree (previously filed with Amendment No. 4) |

| 99.9 |

|

Senior Secured Promissory Note, dated October 10, 2023, by MariaDB plc in favor of RP Ventures LLC (previously filed with Amendment No. 5) |

| 99.10 |

|

Statement by Runa Capital II (GP) No Intention to Make an Offer for MariaDB plc and Potential Bridge Loan of up to US$26.5 Million (previously filed with Amendment No. 5) |

| 99.11 |

|

First Amendment to Senior Secured Promissory Note, dated January 10, 2024, by and among MariaDB plc, RP Ventures LLC, and the other note

parties thereto (incorporated herein by reference to Exhibit 10.1 to the Current Report on Form 8-K filed by the Issuer with the Securities

and Exchange Commission on January 11, 2024). |

SCHEDULE 13D/A

| |

|

|

| CUSIP No. G5920M100 |

|

Page 9 of 9 Pages |

| |

|

|

SIGNATURE

After reasonable inquiry and to the best of the knowledge and belief

of the undersigned, the undersigned certifies that the information set forth in this Amendment to the Statement on Schedule 13D is true,

complete and correct.

| January 16, 2024 |

|

| |

|

| |

Runa Capital Fund II, L.P. |

| |

|

| |

By: Runa Capital II (GP) |

| |

(General Partner) |

| |

|

| |

By: |

/s/ Gary Carr |

| |

Name: |

Gary Carr |

| |

Title: |

Director |

| |

|

|

| |

Runa Capital II (GP) |

| |

|

| |

By: |

/s/ Gary Carr |

| |

Name: |

Gary Carr |

| |

Title: |

Director |

| |

|

|

| |

Runa Capital Opportunity Fund I, L.P. |

| |

|

| |

By: Runa Capital Opportunity I (GP) |

| |

(General Partner) |

| |

|

| |

By: |

/s/ Gary Carr |

| |

Name: |

Gary Carr |

| |

Title: |

Director |

| |

|

|

| |

Runa Capital Opportunity I (GP) |

| |

|

| |

By: |

/s/ Gary Carr |

| |

Name: |

Gary Carr |

| |

Title: |

Director |

| |

|

|

| |

Runa Ventures I Limited |

| |

|

| |

By: Runa Capital Opportunity I (GP) |

| |

(Managing Shareholder) |

| |

|

| |

By: |

/s/ Gary Carr |

| |

Name: |

Gary Carr |

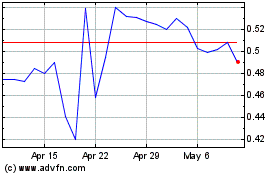

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Mar 2024 to Apr 2024

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Apr 2023 to Apr 2024