UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

Report on Form 6-K dated October 19,

2023

(Commission File No. 1-13202)

Nokia Corporation

Karakaari 7

FI-02610 Espoo

Finland

(Translation of the registrant’s name into

English and address of registrant’s principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F: x

Form 40-F: ¨

Enclosures:

| ● | Stock

Exchange Release: Inside Information: Nokia accelerates strategy execution, streamlines operational

model and takes action to protect profitability |

|

INSIDE

INFORMATION

19 October 2023 |

1 (3) |

Nokia Corporation

Inside Information

19 October 2023 at 8:00 EEST

Inside Information: Nokia accelerates

strategy execution, streamlines operational model and takes action to protect profitability

| ● | Empowers

its business groups to operate with more autonomy and agility, in order to speed up execution

of its strategy |

| ● | Embeds

sales teams into business groups to better seize growth opportunities and more closely align

customer needs to decision-making |

| ● | Announces

new program designed to lower cost base by EUR 800–1 200 million on a gross basis over

a three year period |

| ● | Reiterates

its long-term comparable operating margin target of at least 14% to be delivered by 2026,

as announced with Q3 results today |

Espoo, Finland – Nokia

today announces strategic and operational changes to its business and a program to reset its cost base. These actions will better position

the company for longer-term growth and enable it to navigate the current market uncertainty.

Nokia’s President and

CEO Pekka Lundmark said: “We continue to believe in the mid to long term attractiveness of our markets. Cloud Computing and AI

revolutions will not materialize without significant investments in networks that have vastly improved capabilities. However, while the

timing of the market recovery is uncertain, we are not standing still but taking decisive action on three levels: strategic, operational

and cost. First, we are accelerating our strategy execution by giving business groups more operational autonomy. Second, we are streamlining

our operating model by embedding sales teams into the business groups and third, we are resetting our cost-base to protect profitability.

I believe these actions will make us stronger and deliver significant value for our shareholders.”

Accelerating strategy execution

through operational autonomy

Nokia is accelerating its strategy

execution through providing its four business groups with increased operational autonomy and agility. This will enable the business groups

to better address opportunities in their distinctive markets with our existing and new customers. They will be empowered to faster diversify,

build new ecosystem partnerships, implement new business models and invest for technology leadership.

Streamlining operating model

to create dedicated sales teams

In 2021 Nokia created four P&L

responsible business groups structured around unique customer offerings supported by a shared sales organization. The next evolution

on this journey is to embed the sales and other go-to-market teams into each of the business groups.

Dedicated sales teams with a

strong product and customer connection will enable business groups to better seize growth opportunities with our existing and new customers

and diversify into enterprise, webscale and government sectors. This change will bring highly empowered teams in front of customers that

are able to make quicker decisions based on their needs. Sales teams will collaborate across Nokia to ensure customers continue to benefit

from the breadth of all Nokia offers.

www.nokia.com

|

INSIDE

INFORMATION

19 October 2023 |

2 (3) |

Nokia will also move to a leaner

corporate center that will provide strategic oversight and guidelines for instance for financial performance, portfolio development,

and compliance. The company will continue its strong commitment to long-term research through Nokia Bell Labs.

Resetting cost-base to protect

profitability

To address the market environment

Nokia will reduce its cost base and increase operational efficiency while protecting its R&D capacity and commitment to technology

leadership.

Nokia targets to lower its cost

base on a gross basis (i.e. before inflation) by between EUR 800 million and EUR 1 200 million by the end of 2026 compared to 2023, assuming

on-target variable pay in both periods. This represents a 10–15% reduction in personnel expenses. Nokia expects to act quickly

on the program with at least EUR 400 million of in-year savings in 2024 and a further EUR 300 million in 2025. The program is expected

to lead to a 72 000 – 77 000 employee organization compared to the 86 000 employees Nokia has today.

The exact scale of the program

will depend on the evolution of end market demand. The program is expected to deliver savings on a net basis but the magnitude will depend

on inflation. The cost savings are expected to primarily be achieved in Mobile Networks, Cloud and Network Services and Nokia’s

corporate functions. One-time restructuring charges and cash outflows of the program are expected to be similar to the annual cost savings

achieved.

As announced with Q3 results

today, Nokia reiterates its long-term comparable operating margin target of at least 14% to be delivered by 2026.

“The most difficult business

decisions to make are the ones that impact our people. We have immensely talented employees at Nokia and we will support everyone that

is affected by this process. Resetting the cost-base is a necessary step to adjust to market uncertainty and to secure our long-term

profitability and competitiveness. We remain confident about opportunities ahead of us,” said President and CEO Pekka Lundmark.

Nokia will hold an investor

and analyst progress update event on 12 December 2023 at its headquarters in Espoo, Finland. At the event Nokia will go into more

detail on the evolution of its operating model along with an update on the progress of Mobile Networks and Cloud and Network Services.

These proposed changes are subject

to local consultation requirements with employee representatives and Nokia’s social partners where applicable.

About Nokia

At Nokia, we create technology

that helps the world act together.

As a B2B technology innovation

leader, we are pioneering networks that sense, think and act by leveraging our work across mobile, fixed and cloud networks. In addition,

we create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs.

Service providers, enterprises

and partners worldwide trust Nokia to deliver secure, reliable and sustainable networks today – and work with us to create the

digital services and applications of the future.

www.nokia.com

|

INSIDE

INFORMATION

19 October 2023 |

3 (3) |

Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: press.services@nokia.com

Kaisa Antikainen, Communications Manager

Nokia

Investor Relations

Phone: +358 40 803 4080

Email: investor.relations@nokia.com

Forward-looking statements

Certain statements herein

that are not historical facts are forward-looking statements. These forward-looking statements reflect Nokia's current expectations and

views of future developments and include statements regarding: A) expectations, plans, benefits or outlook related to our strategies,

product launches, growth management, licenses, sustainability and other ESG targets, operational key performance indicators and decisions

on market exits; B) expectations, plans or benefits related to future performance of our businesses (including the expected impact, timing

and duration of potential global pandemics and the general or regional macroeconomic conditions on our businesses, our supply chain and

our customers’ businesses) and any future dividends and other distributions of profit; C) expectations and targets regarding financial

performance and results of operations, including market share, prices, net sales, income, margins, cash flows, the timing of receivables,

operating expenses, provisions, impairments, taxes, currency exchange rates, hedging, investment funds, inflation, product cost reductions,

competitiveness, revenue generation in any specific region, and licensing income and payments; D) ability to execute, expectations, plans

or benefits related to changes in organizational structure and operating model; E) impact on revenue with respect to litigation/renewal

discussions; and F) any statements preceded by or including "continue", “believe”, “commit”, “estimate”,

“expect”, “aim”, “influence”, "will”, “target”, “likely”, “intend”,

“may”, “could”, “would” or similar expressions. These forward-looking statements are subject to a

number of risks and uncertainties, many of which are beyond our control, which could cause our actual results to differ materially from

such statements. These statements are based on management’s best assumptions and beliefs in light of the information currently

available to them. These forward-looking statements are only predictions based upon our current expectations and views of future events

and developments and are subject to risks and uncertainties that are difficult to predict because they relate to events and depend on

circumstances that will occur in the future. Factors, including risks and uncertainties that could cause these differences, include those

risks and uncertainties specified in our 2022 annual report on Form 20-F published on 2 March 2023 under Operating and financial

review and prospects – Risk factors.

www.nokia.com

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant, Nokia Corporation, has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| Date: October 19, 2023 | Nokia

Corporation |

| |

By: |

/s/ Esa Niinimäki |

| |

Name: |

Esa Niinimäki |

| |

Title: |

Chief Legal Officer |

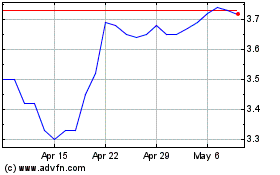

Nokia (NYSE:NOK)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nokia (NYSE:NOK)

Historical Stock Chart

From Jan 2024 to Jan 2025