UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

Report on Form 6-K dated January 25,

2024

(Commission File No. 1-13202)

Nokia Corporation

Karakaari 7

FI-02610 Espoo

Finland

(Translation of the registrant’s name into English and address of registrant’s principal executive office)

| Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: |

| |

|

|

| Form 20-F: x |

|

Form 40-F: ¨ |

Enclosures:

| ● | Stock Exchange Release: Proposals by the Board of Directors to Nokia Corporation’s

Annual General Meeting 2024 |

| Stock

exchange release

25 January 2024 |

1

(5) |

Nokia Corporation

Stock Exchange Release

25 January 2024 at 8:10 EET

Proposals by the Board of Directors

to Nokia Corporation’s Annual General Meeting 2024

Nokia Corporation’s

Annual General Meeting will be held on Wednesday 3 April 2024 at 13:00 (EEST) at Messukeskus, Helsinki Expo and Convention Centre,

Messuaukio 1, Helsinki, Finland. The Board submits the following proposals to the Annual General Meeting. Complete proposals are available

as of today at www.nokia.com/agm. The notice of the Annual General Meeting with more detailed information on the participation and voting

will be published separately at a later date on the company’s website and by a stock exchange release.

Authorization

of the Board of Directors to decide on the distribution of dividend and assets from the reserve for invested unrestricted equity

The Board of

Directors proposes to the Annual General Meeting to be authorized to decide in its discretion on the distribution of an aggregate maximum

of EUR 0.13 per share as dividend from the retained earnings and/or as assets from the reserve for invested unrestricted equity.

The authorization

will be used to distribute dividend and/or assets from the reserve for invested unrestricted equity in four installments during the period

of validity of the authorization unless the Board of Directors decides otherwise for a justified reason. The proposed total authorization

for asset distribution is in line with the Company’s dividend policy. The authorization would be valid until the opening of the

next Annual General Meeting.

The Board would

make separate resolutions on the amount and timing of each distribution of the dividend and/or assets from the reserve for invested unrestricted

equity so that the preliminary record and payment dates will be as set out below. The Company shall make a separate announcement of each

such Board resolution.

| Preliminary

record date |

Preliminary

payment date |

| 23

April 2024 |

3

May 2024 |

| 23

July 2024 |

1

August 2024 |

| 22

October 2024 |

31

October 2024 |

| 4

February 2025 |

13

February 2025 |

Each installment

based on the resolution of the Board of Directors will be paid to a shareholder registered in the Company’s shareholders’

register maintained by Euroclear Finland Oy on the record date of the relevant installment.

Board composition

and remuneration

Jeanette Horan

has informed the Board’s Corporate Governance and Nomination Committee that she will no longer be available to serve on the Nokia

Board of Directors after the Annual General Meeting. On the recommendation of the Corporate Governance and Nomination Committee, the

Board proposes to the Annual General Meeting that the number of Board members be ten (10). However, should any number of the candidates

proposed by the Board not be able to attend the Board, the proposed number of Board members shall be decreased accordingly.

www.nokia.com

| Stock

exchange release

25 January 2024 |

2 (5) |

On the recommendation

of the Corporate Governance and Nomination Committee, the Board of Directors further proposes to the Annual General Meeting that the

following current Board members be re-elected as members of the Nokia Board of Directors for a term ending at the close of the next Annual

General Meeting: Timo Ahopelto, Sari Baldauf, Elizabeth Crain, Thomas Dannenfeldt, Lisa Hook, Thomas Saueressig, Søren Skou, Carla

Smits-Nusteling and Kai Öistämö. In addition, it is proposed that Michael McNamara, former Executive Vice President and

Chief Information Officer of Target Corporation, be elected as a new member of the Board of Directors for a term until the close of the

next Annual General Meeting.

Resumes of

the Board candidates are presented in the Board’s proposal available as of today at www.nokia.com/agm.

The Corporate

Governance and Nomination Committee will propose in the assembly meeting of the new Board of Directors on 3 April 2024 that Sari

Baldauf be re-elected as Chair of the Board and Søren Skou be re-elected as Vice Chair of the Board, subject to their election

to the Board of Directors.

On the recommendation

of the Corporate Governance and Nomination Committee, the Board proposes to the Annual General Meeting that the annual fees payable to

Board members for a term ending at the close of the next Annual General Meeting are kept at the current levels:

| ● | EUR

440 000 for the Chair of the Board; |

| ● | EUR

210 000 for the Vice Chair of the Board; |

| ● | EUR

185 000 for each member of the Board; |

| ● | EUR

30 000 each for the Chairs of the Audit Committee and the Personnel Committee and EUR 20

000 for the Chair of the Technology Committee as an additional annual fee; and |

| ● | EUR

15 000 for each member of the Audit Committee and Personnel Committee and EUR 10 000 for

each member of the Technology Committee as an additional annual fee. |

The Board has

resolved to establish a Strategy Committee to support the management in terms of the strategy work and to act as a preparatory body for

the Board. Consequently, on the recommendation of the Corporate Governance and Nomination Committee, the Board proposes that EUR 20 000

be paid for the Chair of the Strategy Committee and EUR 10 000 be paid for each member of the Strategy Committee

as an additional annual fee for the Committee’s first term commencing from the Annual General Meeting and ending at the close of

the next Annual General Meeting.

In line with

Nokia’s Corporate Governance Guidelines, the Board proposes that approximately 40% of the annual fee be paid in Nokia shares. The

rest of the annual fee would be paid in cash to cover taxes arising from the remuneration. The Directors shall retain until the end of

their directorship such number of shares that they have received as Board remuneration during their first three years of service on the

Board.

In addition,

the Board proposes that the meeting fees for Board and Committee meetings remain at their current level. The meeting fees are based on

travel required between the Board member’s home location and the location of a meeting and paid for a maximum of seven meetings

per term as follows:

www.nokia.com

| Stock

exchange release

25 January 2024 |

3 (5) |

| ● | EUR

5 000 per meeting requiring intercontinental travel; and |

| ● | EUR

2 000 per meeting requiring continental travel. |

Only one meeting

fee is paid if the travel entitling to the fee includes several meetings of the Board and the Committees. Moreover, it is proposed that

members of the Board shall be compensated for travel and accommodation expenses as well as other costs directly related to Board and

Committee work. The meeting fees, travel expenses and other expenses would be paid in cash.

Auditor

election and remuneration

On the recommendation

of the Audit Committee, the Board of Directors proposes to the Annual General Meeting that Deloitte Oy be re-elected as the auditor of

the Company for the financial year 2025.

It is also

proposed that the elected auditor for the financial year 2025 be reimbursed based on the invoice of the auditor and in compliance with

the purchase policy approved by the Audit Committee.

Sustainability

reporting assurer election and remuneration

Nokia will

publish a Sustainability Report for the first time as part of the Board Review in its Financial Statements 2024. Pursuant to the Finnish

Limited Liability Companies Act, Chapter 7, Section 6 a §, the Annual General Meeting shall elect an assurer of the sustainability

reporting. The Board of Directors proposes to the Annual General Meeting that the shareholders would elect the assurer carrying out the

assurance of the sustainability reporting of the Company, for each the financial year of the election and the financial year commencing

next after the election.

Therefore,

on the recommendation of the Audit Committee, the Board of Directors proposes to the Annual General Meeting that Authorized Sustainability

Audit Firm Deloitte Oy be elected as the sustainability reporting assurer for the financial years 2024 and 2025.

The Board of

Directors proposes to the Annual General Meeting that the assurer of the sustainability reporting elected for each financial year 2024

and 2025 be reimbursed based on the invoice and in compliance with the purchase policy approved by the Audit Committee.

Authorization

to the Board to issue shares and repurchase Company’s shares

The Board proposes

that the Annual General Meeting authorize the Board to resolve to issue in total a maximum of 530 million shares through issuance of

shares or special rights entitling to shares under Chapter 10, Section 1 of the Finnish Limited Liability Companies Act in one or

more issues during the effective period of the authorization. The Board may issue either new shares or treasury shares held by the Company.

Shares and special rights entitling to shares may be issued in deviation from the shareholders’ pre-emptive rights within the limits

set by law. The authorization may be used to develop the Company’s capital structure, diversify the shareholder base, finance or

carry out acquisitions or other arrangements, to settle the Company’s equity-based incentive plans or for other purposes resolved

by the Board. It is proposed that the authorization be effective until 2 October 2025 and terminate the authorization for issuance

of shares and special rights entitling to shares resolved at the Annual General Meeting on 4 April 2023.

www.nokia.com

| Stock

exchange release

25 January 2024 |

4 (5) |

The Board also

proposes that the Board be authorized to resolve to repurchase a maximum of 530 million shares. The repurchases would reduce distributable

funds of the Company. The shares may be repurchased otherwise than in proportion to the shares held by the shareholders (directed repurchase).

Shares may be repurchased to be cancelled, held to be reissued, transferred further or for other purposes resolved by the Board. It is

proposed that the authorization be effective until 2 October 2025 and terminate the authorization for repurchasing the Company’s

shares granted by the Annual General Meeting on 4 April 2023 to the extent that the Board has not previously resolved to repurchase

shares based on such authorization.

530 million

shares correspond to less than 10 percent of the Company’s total number of shares. The Board shall resolve on all other matters

related to the issuance or repurchase of Nokia shares in accordance with the resolution by the Annual General Meeting.

Amendment

of the Articles of Association

The Board of

Directors proposes to the Annual General Meeting that the Articles of Association of the Company be amended by i) updating the object

of the Company (Article 2); updating the government authority that approves auditors and adding the obligation to elect a sustainability

reporting assurer (Article 7); amending the article on General Meetings by updating the general meeting formats to include also

virtual general meeting as an option (Article 9) and updating the matters that the Annual General Meeting decides on (Article 12).

Other matters

to be addressed by the Annual General Meeting

Furthermore,

the Annual General Meeting would address adopting the Company’s financial statements for the financial year 2023, discharging the

members of the Board of Directors and the President and Chief Executive Officer from liability for the financial year 2023, adopting

the updated Remuneration Policy for the Company’s governing bodies and adopting the Remuneration Report 2023.

The Remuneration

Report for 2023 and the “Nokia in 2023” annual report, which includes the Company’s Annual Accounts, the review by

the Board of Directors and the auditor’s report, are expected to be published and available at www.nokia.com/agm in week 9 of 2024.

The updated Remuneration Policy is expected to be published and available at www.nokia.com/agm in week 6 of 2024. The Remuneration Policy

and the Remuneration Report for 2023 will also be published by a stock exchange release.

About Nokia

At Nokia, we

create technology that helps the world act together.

As a B2B technology

innovation leader, we are pioneering networks that sense, think and act by leveraging our work across mobile, fixed and cloud networks.

In addition, we create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs.

Service providers,

enterprises and partners worldwide trust Nokia to deliver secure, reliable and sustainable networks today – and work with us to

create the digital services and applications of the future.

Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: press.services@nokia.com

Kaisa Antikainen, Communications Manager

www.nokia.com

| Stock

exchange release

25 January 2024 |

5 (5) |

Nokia

Investor Relations

Phone: +358 40 803 4080

Email: investor.relations@nokia.com

www.nokia.com

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant, Nokia Corporation, has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date: January 25, 2024 |

|

Nokia Corporation |

| |

| |

By: |

/s/ Esa Niinimäki |

| |

Name: |

Esa Niinimäki |

| |

Title: |

Chief Legal Officer |

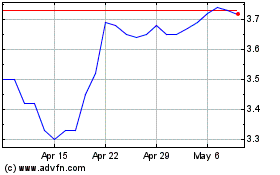

Nokia (NYSE:NOK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Dec 2023 to Dec 2024