DT Midstream, Inc. (NYSE: DTM) today announced that it has

successfully closed on the acquisition of a portfolio of three

FERC-regulated natural gas transmission pipelines from ONEOK, Inc.

(NYSE: OKE), effective as of 11:59 p.m. CT on Dec. 31, 2024, for a

total cash consideration of $1.2 billion.

“The bolt-on acquisition of these premier pipelines is fully

aligned with our pure play natural gas strategy,” said David

Slater, DT Midstream President and CEO. “This acquisition also

increases the revenue contribution from our pipeline segment,

supported by take-or-pay contracts with strong credit quality

utility customers.”

“We are happy to have on board the team members that support

these assets, both in field operations and in DT Midstream’s new

Tulsa office,” added Slater.

DT Midstream has acquired 100% operating ownership in Guardian

Pipeline, Midwestern Gas Transmission and Viking Gas Transmission.

The acquired pipelines have a total capacity of more than 3.7 Bcf/d

with approximately 1,300 miles across seven states in the

attractive Midwest market region.

About DT MidstreamDT Midstream (NYSE: DTM) is

an owner, operator and developer of natural gas interstate and

intrastate pipelines, storage and gathering systems, compression,

treatment and surface facilities. The company transports clean

natural gas for utilities, power plants, marketers, large

industrial customers and energy producers across the Southern,

Northeastern and Midwestern United States and Canada. The

Detroit-based company offers a comprehensive, wellhead-to-market

array of services, including natural gas transportation, storage

and gathering. DT Midstream is transitioning towards net zero

greenhouse gas emissions by 2050, including a goal of achieving 30%

of its carbon emissions reduction by 2030.

Forward-looking StatementsThis release contains

statements which, to the extent they are not statements of

historical or present fact, constitute “forward-looking statements”

under the securities laws. These forward-looking statements are

intended to provide management’s current expectations or plans for

our future operating and financial performance, business prospects,

outcomes of regulatory proceedings, market conditions, and other

matters, based on what we believe to be reasonable assumptions and

on information currently available to us.

Forward-looking statements can be identified by the use of words

such as “believe,” “expect,” “expectations,” “plans,” “strategy,”

“prospects,” “estimate,” “project,” “target,” “anticipate,” “will,”

“should,” “see,” “guidance,” “outlook,” “confident” and other words

of similar meaning. The absence of such words, expressions or

statements, however, does not mean that the statements are not

forward-looking. In particular, express or implied statements

relating to future earnings, cash flow, results of operations, uses

of cash, tax rates and other measures of financial performance,

future actions, conditions or events, potential future plans,

strategies or transactions of DT Midstream, and other statements

that are not historical facts, are forward-looking statements.

Forward-looking statements are not guarantees of future results

and conditions, but rather are subject to numerous assumptions,

risks, and uncertainties that may cause actual future results to be

materially different from those contemplated, projected, estimated,

or budgeted. Many factors may impact forward-looking statements of

DT Midstream including, but not limited to, the following: changes

in general economic conditions, including increases in interest

rates and associated Federal Reserve policies, a potential economic

recession, and the impact of inflation on our business; industry

changes, including the impact of consolidations, alternative energy

sources, technological advances, infrastructure constraints and

changes in competition; global supply chain disruptions; actions

taken by third-party operators, processors, transporters and

gatherers; changes in expected production from Expand Energy and

other third parties in our areas of operation; demand for natural

gas gathering, transmission, storage, transportation and water

services; the availability and price of natural gas to the consumer

compared to the price of alternative and competing fuels; our

ability to successfully and timely implement our business plan; our

ability to complete organic growth projects on time and on budget;

our ability to finance, complete, or successfully integrate

acquisitions; the price and availability of debt and equity

financing; our ability to realize the anticipated benefits of the

transaction described herein (“Transaction”), and our ability to

manage the risks of the Transaction; restrictions in our existing

and any future credit facilities and indentures; the effectiveness

of our information technology and operational technology systems

and practices to detect and defend against evolving cyber attacks

on United States critical infrastructure; changing laws regarding

cybersecurity and data privacy, and any cybersecurity threat or

event; operating hazards, environmental risks, and other risks

incidental to gathering, storing and transporting natural gas;

geologic and reservoir risks and considerations; natural disasters,

adverse weather conditions, casualty losses and other matters

beyond our control; the impact of outbreaks of illnesses, epidemics

and pandemics, and any related economic effects; the impacts of

geopolitical events, including the conflicts in Ukraine and the

Middle East; labor relations and markets, including the ability to

attract, hire and retain key employee and contract personnel; large

customer defaults; changes in tax status, as well as changes in tax

rates and regulations; the effects and associated cost of

compliance with existing and future laws and governmental

regulations, such as the Inflation Reduction Act; changes in

environmental laws, regulations or enforcement policies, including

laws and regulations relating to climate change and greenhouse gas

emissions; ability to develop low carbon business opportunities and

deploy greenhouse gas reducing technologies; changes in insurance

markets impacting costs and the level and types of coverage

available; the timing and extent of changes in commodity prices;

the success of our risk management strategies; the suspension,

reduction or termination of our customers’ obligations under our

commercial agreements; disruptions due to equipment interruption or

failure at our facilities, or third-party facilities on which our

business is dependent; the effects of future litigation; and the

risks described in our Annual Report on Form 10-K for the year

ended December 31, 2023 and our reports and registration statements

filed from time to time with the SEC.

The above list of factors is not exhaustive. New factors emerge

from time to time. We cannot predict what factors may arise or how

such factors may cause actual results to vary materially from those

stated in forward-looking statements, see the discussion under the

section entitled “Risk Factors” in our Annual Report for the year

ended December 31, 2023, filed with the SEC on Form 10-K and any

other reports filed with the SEC. Given the uncertainties and risk

factors that could cause our actual results to differ materially

from those contained in any forward-looking statement, you should

not put undue reliance on any forward-looking statements.

Any forward-looking statements speak only as of the date on

which such statements are made. We are under no obligation to, and

expressly disclaim any obligation to, update or alter our

forward-looking statements, whether as a result of new information,

subsequent events or otherwise.

Investor Relations

Todd Lohrmann, DT Midstream, 313.774.2424

investor_relations@dtmidstream.com

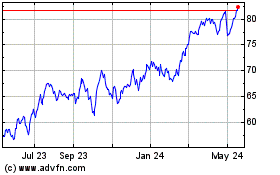

ONEOK (NYSE:OKE)

Historical Stock Chart

From Dec 2024 to Jan 2025

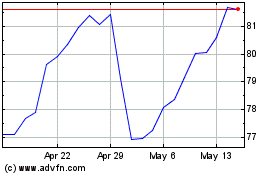

ONEOK (NYSE:OKE)

Historical Stock Chart

From Jan 2024 to Jan 2025