Filed by ONEOK, Inc. pursuant to

Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: EnLink Midstream, LLC

Commission File No. 001-36336

Date: January 22, 2025

The following joint press release was issued by ONEOK, Inc.

and EnLink Midstream, LLC on January 22, 2025.

Jan.

22, 2025

Leading

Independent Proxy Advisory Firms ISS and Glass Lewis Recommend EnLink Unitholders Vote “FOR”

Pending

ONEOK Acquisition

TULSA,

Okla. – Jan. 22, 2025 – ONEOK, Inc. (NYSE: OKE) (“ONEOK”) and EnLink Midstream, LLC (NYSE: ENLC) (“EnLink”)

today announced that the two leading independent proxy advisory firms, Institutional Shareholder Services Inc. (ISS) and Glass Lewis

& Co. (Glass Lewis), have recommended that EnLink unitholders vote in favor of ONEOK’s pending acquisition of the remaining

publicly held common units of EnLink at the upcoming Special Meeting of EnLink Unitholders (the “Special Meeting”).

The

Special Meeting is scheduled to take place at 10 a.m. Central Time (11 a.m. Eastern Time) on Jan. 30, 2025, and will be held virtually.

The

EnLink Board of Directors and the Conflicts Committee of the EnLink Board of Directors unanimously recommend that unitholders vote “FOR” all

proposals provided in detail in the definitive proxy statement related to the Special Meeting.

Completion

of the acquisition is subject to the approval of a majority of the outstanding EnLink common units (including common units owned by ONEOK)

and other customary closing conditions. No ONEOK shareholder vote is required to complete the transaction.

The

transaction is expected to close soon after the Special Meeting, subject to the satisfaction or waiver of all other closing conditions.

EnLink

unitholders who need assistance voting or have questions regarding the Special Meeting may contact EnLink’s proxy solicitor:

Leading Independent Proxy Advisory Firms ISS and Glass Lewis Recommend

EnLink Unitholders Vote “FOR” Pending ONEOK Acquisition

Jan. 22, 2025

Page 2

Innisfree

M&A Incorporated

501

Madison Avenue, 20th Floor

New

York, New York 10022

Unitholders

may call 866-239-1762 (toll-free from the U.S. and Canada) or +1-412-232-3651 (from other countries).

FORWARD-LOOKING

STATEMENTS:

This

communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included

in this communication that address activities, events or developments that ONEOK or EnLink expects, believes or anticipates will or may

occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,”

“believe,” “expect,” “anticipate,” “potential,” “opportunity,” “create,”

“intend,” “could,” “would,” “may,” “plan,” “will,” “guidance,”

“look,” “goal,” “target,” “future,” “build,” “focus,” “continue,”

“strive,” “allow” or the negative of such terms or other variations thereof and words and terms of similar substance

used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence

of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited

to, statements regarding the proposed transaction, the expected closing of the proposed transaction and the timing thereof, and descriptions

of ONEOK, EnLink and their combined operations after giving effect to the proposed transaction. There are a number of risks and uncertainties

that could cause actual results to differ materially from the forward-looking statements included in this communication. These include

the risk that ONEOK will not be able to successfully integrate EnLink’s business; the risk that cost savings, synergies and growth

from the proposed transaction may not be fully realized or may take longer to realize than expected; the risk that the credit ratings

following the proposed transaction may be different from what ONEOK expects; the risk that a condition to closing of the proposed transaction

may not be satisfied, that a party may terminate the merger agreement relating to the proposed transaction or that the closing of the

proposed transaction might be delayed or not occur at all; the possibility that EnLink unitholders may not approve the proposed transaction;

the risk of potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement

or completion of the proposed transaction; risks related to the occurrence of any other event, change or circumstance that could give

rise to the termination of the merger agreement related to the proposed transaction; the risk that changes in ONEOK’s capital structure

could have adverse effects on the market value of its securities; risks related to the ability of the parties to retain customers and

retain and hire key personnel and maintain relationships with their suppliers and customers and on each of the companies’ operating

results and business generally; the risk that the proposed transaction could distract ONEOK’s and EnLink’s respective management

teams from ongoing business operations or cause either of the companies to incur substantial costs; risks related to the impact of any

economic downturn and any substantial decline in commodity prices; the risk of changes in governmental regulations or enforcement practices,

especially with respect to environmental, health and safety matters; and other important factors that could cause actual results to differ

materially from those projected. All such factors are difficult to predict and are beyond ONEOK’s or EnLink’s control, including

those detailed in ONEOK’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are

available on ONEOK’s website at www.oneok.com and on the website of the SEC at www.sec.gov, and those detailed in

EnLink’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on EnLink’s

website at www.enlink.com and on the website of the SEC at www.sec.gov. All forward-looking statements are based on assumptions

that ONEOK and EnLink believe to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of

the date on which such statement is made, neither ONEOK nor EnLink undertakes any obligation to correct or update any forward-looking

statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

Leading Independent Proxy Advisory Firms ISS and Glass Lewis Recommend

EnLink Unitholders Vote “FOR” Pending ONEOK Acquisition

Jan. 22, 2025

Page 3

NO

OFFER OR SOLICITATION:

This

communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any

securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No

offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of

1933, as amended.

Additional

Information And Where To Find It:

In

connection with the proposed transaction, ONEOK filed with the SEC a registration statement on Form S-4 (the “Registration Statement”)

to register the shares of ONEOK’s common stock to be issued pursuant to the proposed transaction, which includes a prospectus of

ONEOK and a proxy statement of EnLink (the “proxy statement/prospectus”). Each of ONEOK and EnLink may also file other documents

with the SEC regarding the proposed transaction. This document is not a substitute for the Registration Statement, proxy statement/prospectus

or any other document which ONEOK or EnLink has filed or may file with the SEC in connection with the proposed transaction. BEFORE MAKING

ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY

OTHER RELEVANT DOCUMENTS THAT HAVE BEEN OR MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS,

CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED TRANSACTION, THE RISKS RELATED THERETO, AND RELATED MATTERS. The Registration Statement was declared effective by the SEC on

December 30, 2024, and EnLink mailed the definitive proxy statement/prospectus to its unitholders on or about December 31, 2024. Investors

and security holders will be able to obtain free copies of the Registration Statement and the definitive proxy statement/prospectus,

as each may be amended or supplemented from time to time, and other relevant documents filed by ONEOK and EnLink with the SEC (when available)

through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by ONEOK, including

the definitive proxy statement/prospectus, are available free of charge from ONEOK’s website at www.oneok.com under the

“Investors” tab. Copies of documents filed with the SEC by EnLink, including the definitive proxy statement/prospectus, are

available free of charge from EnLink’s website at www.enlink.com under the “Investors” tab.

Participants

in the Solicitation:

ONEOK,

EnLink and certain of their (or EnLink’s managing member’s) respective directors and executive officers may be deemed to

be participants in the solicitation of proxies in respect of the proposed transaction. Information about ONEOK’s directors and

executive officers is available in ONEOK’s Annual Report on Form 10-K for the 2023 fiscal year filed with the SEC on

February 27, 2024, and its revised definitive proxy statement for the 2024 annual meeting of shareholders filed with the SEC on

May 1, 2024, and in the proxy statement/prospectus. Information about the directors and executive officers of EnLink’s managing

member is available in its Annual Report on Form 10-K for the 2023 fiscal year filed with the SEC on February 21, 2024,

and in the proxy statement/prospectus. Other information regarding the participants in the solicitations and a description of their direct

and indirect interests, by security holdings or otherwise, is set forth in the Registration Statement, the proxy statement/prospectus

and other relevant materials when filed with the SEC regarding the proposed transaction when they become available. Investors should

read the proxy statement/prospectus carefully before making any voting or investment decisions. Copies of the documents filed with the

SEC by ONEOK and EnLink are available free of charge through the website maintained by the SEC at www.sec.gov. Additionally,

copies of documents filed with the SEC by ONEOK, including the proxy statement/prospectus, are available free of charge from ONEOK’s

website at www.oneok.com and copies of documents filed with the SEC by EnLink, including the proxy statement/prospectus, are available

free of charge from EnLink’s website at www.enlink.com.

Leading Independent Proxy Advisory Firms ISS and Glass Lewis Recommend

EnLink Unitholders Vote “FOR” Pending ONEOK Acquisition

Jan. 22, 2025

Page 4

ABOUT

ONEOK:

At

ONEOK (NYSE: OKE), we deliver energy products and services vital to an advancing world. We are a leading midstream operator that provides

gathering, processing, fractionation, transportation and storage services. Through our more than 50,000-mile pipeline network, we transport

the natural gas, natural gas liquids (NGLs), refined products and crude oil that help meet domestic and international energy demand,

contribute to energy security and provide safe, reliable and responsible energy solutions needed today and into the future. As one of

the largest diversified energy infrastructure companies in North America, ONEOK is delivering energy that makes a difference in the lives

of people in the U.S. and around the world.

ONEOK

is an S&P 500 company headquartered in Tulsa, Oklahoma.

For

information about ONEOK, visit the website: www.oneok.com. For the latest news about ONEOK, find us on LinkedIn, Facebook, X and Instagram.

ABOUT

ENLINK MIDSTREAM:

Headquartered

in Dallas, EnLink Midstream (NYSE: ENLC) provides integrated midstream infrastructure services for natural gas, crude oil, and NGLs,

as well as CO2 transportation for carbon capture and sequestration (CCS). Our large-scale, cash-flow-generating asset platforms

are in premier production basins and core demand centers, including the Permian Basin, Louisiana, Oklahoma, and North Texas. EnLink is

focused on maintaining the financial flexibility and operational excellence that enables us to strategically grow and create sustainable

value. Visit http://www.EnLink.com to learn how EnLink connects energy to life.

CONTACTS:

ONEOK,

Inc.

Investor

Relations:

Megan

Patterson

918-561-5325

ONEOKInvestorRelations@oneok.com

Media

Relations:

Alicia

Buffer

918-861-3749

alicia.buffer@oneok.com

EnLink

Midstream, LLC

Investor

Relations:

Brian

Brungardt

214-721-9353

brian.brungardt@enlink.com

Media

Relations:

Megan

Wright

214-721-9694

megan.wright@enlink.com

###

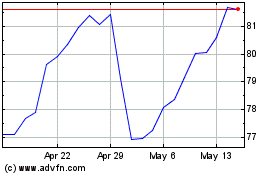

ONEOK (NYSE:OKE)

Historical Stock Chart

From Dec 2024 to Jan 2025

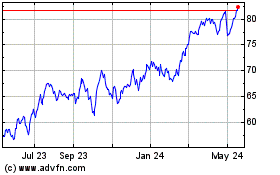

ONEOK (NYSE:OKE)

Historical Stock Chart

From Jan 2024 to Jan 2025