Record quarterly revenue with full year revenue

growth of 21%

Onto Innovation Inc. (NYSE: ONTO) (“Onto Innovation,” “Onto,” or

the “Company”) today announced financial results for the fourth

quarter and full year 2024.

2024 Fourth Quarter Financial Highlights

- Record revenue of $264 million led by advanced nodes and

advanced packaging markets, delivering sixth consecutive quarter of

growth.

- GAAP gross margin of 50% and non-GAAP gross margin of 55%,

excluding acquisition and restructuring-related charges.

- GAAP operating income of $42 million and non-GAAP operating

income of $75 million.

- GAAP net income of $49 million and non-GAAP net income of $75

million.

- GAAP diluted earnings per share of $0.98; non-GAAP diluted

earnings per share of $1.51 above the high end of guidance

range.

- Cash from operations of $56 million, or 21% of revenue.

2024 Full Year Financial Highlights

- Total revenue of $987 million grew 21% over 2023.

- Cash generated from operations of $246 million improved by 43%

over 2023.

- Full year GAAP diluted earnings per share of $4.06 grew 65%

over 2023.

- Full year non-GAAP diluted earnings per share of $5.34 grew 43%

over 2023.

Fourth Quarter and Full Year Business Highlights

- AI packaging revenue grew 180% over 2023.

- Advanced nodes revenue improved for the fourth consecutive

quarter, with momentum expected to continue in 2025.

- New products released to support next generation 3D

interconnect technology and inspection tools for unpatterned wafer,

panel and compound semiconductor applications.

Michael Plisinski, chief executive officer of Onto Innovation,

commented, “Onto Innovation finished the year strongly, carried

forward by investments in AI, power semiconductors, and new gate

all around transistor technology. The current market momentum in AI

packaging and increased demand from the advanced nodes combined

with the new products we recently launched position us to continue

to address the challenges our customers face today and into the

future.”

Onto Innovation Inc.

Key Quarterly Financial

Data

(In thousands, except per

share amounts)

U.S. GAAP

December 28,

2024

September 28,

2024

December 30,

2023

Revenue

$

263,939

$

252,210

$

218,856

Gross profit margin

50

%

54

%

49

%

Operating income

$

42,460

$

53,072

$

28,230

Net income

$

48,817

$

53,051

$

30,309

Net income per diluted share

$

0.98

$

1.07

$

0.61

NON-GAAP

December 28,

2024

September 28,

2024

December 30,

2023

Revenue

$

263,939

$

252,210

$

218,856

Gross profit margin

55

%

55

%

52

%

Operating income

$

75,468

$

69,999

$

56,391

Net income

$

74,831

$

66,386

$

52,443

Net income per diluted share

$

1.51

$

1.34

$

1.06

Outlook

For the first fiscal quarter ending March 29, 2025, the Company

is providing the following guidance:

- Revenue is expected to be in the range of $260 to $274

million.

- GAAP diluted earnings per share is expected to be in the range

of $1.14 to $1.28.

- Non-GAAP diluted earnings per share is expected to be in the

range of $1.40 to $1.54.

Webcast & Conference Call Details

Onto Innovation will host a conference call at 4:30 p.m. Eastern

Time today, February 6, 2025, to discuss its fourth quarter 2024

and full year 2024 financial results and other matters in greater

detail. To participate in the call, please dial (888) 394-8218 or

International: +1 (646) 828-8193 and reference conference ID

1186967 at least five (5) minutes prior to the scheduled start

time. A live webcast will also be available at

www.ontoinnovation.com.

To listen to the live webcast, please go to the website at least

fifteen (15) minutes early to register, download and install any

necessary audio software. There will be a replay of the conference

call available for one year on the Company’s website at

www.ontoinnovation.com.

Discussion of Non-GAAP Financial Measures

In addition to information regarding the Company’s results as

determined in accordance with generally accepted accounting

principles in the United States (“GAAP”), the Company has provided

in this release non-GAAP financial measures, including non-GAAP

gross margin as a percentage of revenue, non-GAAP operating income,

non-GAAP operating expenses, non-GAAP net income, non-GAAP diluted

earnings per share and non-GAAP operating margin as a percentage of

revenue, which exclude amortization of intangibles, merger and

acquisition-related expenses and benefits, litigation expenses and

benefits and restructuring costs. Non-GAAP gross margin as a

percentage of revenue, non-GAAP operating income, non-GAAP

operating expenses, non-GAAP net income, non-GAAP diluted earnings

per share and non-GAAP operating margin as a percentage of revenue

can also exclude certain other gains and losses that are either

isolated or cannot be expected to occur again with any

predictability or otherwise are not representative of our ongoing

operations, tax provisions/benefits related to the previous items,

and significant discrete tax events. We exclude the above items

because they are outside of our normal operations and/or, in

certain cases, are difficult to forecast accurately for future

periods.

We utilize several different financial measures, both GAAP and

non-GAAP, in analyzing and assessing the overall performance of our

business, in making operating decisions, forecasting and planning

for future periods, and determining payments under compensation

programs. We consider the use of the non-GAAP measures to be

helpful in assessing the performance of the ongoing operations of

our business. We believe that disclosing non-GAAP financial

measures provides useful supplemental data that, while not a

substitute for financial measures prepared in accordance with GAAP,

allows for greater transparency in the review of our financial and

operational performance. We also believe that disclosing non-GAAP

financial measures provides useful information to investors and

others in understanding and evaluating our operating results and

future prospects in the same manner as management and in comparing

financial results across accounting periods and to those of peer

companies. More specifically, management adjusts for the excluded

items for the following reasons:

Amortization of intangibles: we do not acquire businesses and

assets on a predictable cycle. The amount of purchase price

allocated to the purchased intangible assets and the term of

amortization can vary significantly and are unique to each

acquisition or purchase. We believe that excluding amortization of

purchased intangible assets allows the users of our financial

statements to better review and understand the historic and current

results of our operations, and also facilitates comparisons to peer

companies.

Merger or acquisition related expenses and benefits: we incur

expenses or benefits with respect to certain items associated with

our mergers and acquisitions, such as transaction and integration

costs, change in control payments, adjustments to the fair value of

assets, etc. We exclude such expenses or benefits as they are

related to acquisitions and have no direct correlation to the

operation of our ongoing business.

Restructuring expenses: we incur restructuring and impairment

charges on individual or groups of employed assets, which arise

from unforeseen circumstances and/or often occur outside of the

ordinary course of our ongoing business. Although these events are

reflected in our GAAP financials, these transactions may limit the

comparability of our ongoing operations with prior and future

periods.

Litigation expenses and benefits: we may incur charges or

benefits as well as legal costs in connection with litigation and

other contingencies unrelated to our core operations. We exclude

these charges or benefits, when significant, as well as legal costs

associated with significant legal matters, because we do not

believe they are reflective of ongoing business and operating

results.

Income tax expense: we estimate the tax effect of the items

identified to determine a non-GAAP annual effective tax rate

applied to the pretax amount to calculate the non-GAAP provision

for income taxes. We also adjust for items for which the nature

and/or tax jurisdiction requires the application of a specific tax

rate or treatment.

From time to time in the future, there may be other items

excluded if we believe that doing so is consistent with the goal of

providing useful information to investors and management.

There are limitations in using non-GAAP financial measures

because the non-GAAP financial measures are not prepared in

accordance with GAAP and may be different from non-GAAP financial

measures used by other companies. The non-GAAP financial measures

are limited in value because they exclude certain items that may

have a material impact on our reported financial results. The

presentation of this additional information is not meant to be

considered in isolation or as a substitute for the directly

comparable financial measures prepared in accordance with GAAP.

Investors should review the reconciliation of the non-GAAP

financial measures to their most directly comparable GAAP financial

measures as provided in the tables accompanying this press

release.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

(the “Act”) which include, but are not limited to, statements

regarding Onto Innovation’s business momentum and future growth;

technology development, product introduction and acceptance of Onto

Innovation’s products and services; Onto Innovation’s manufacturing

practices and ability to deliver both products and services

consistent with its customers’ demands and expectations and

strengthen its market position; Onto Innovation’s expectations

regarding the semiconductor market outlook; Onto Innovation’s

future quarterly financial outlook; as well as other matters that

are not purely historical data. Onto Innovation wishes to take

advantage of the “safe harbor” provided for by the Act and cautions

that actual results may differ materially from those projected as a

result of various factors, including risks and uncertainties, many

of which are beyond Onto Innovation’s control. Such factors

include, but are not limited to, the Company’s ability to leverage

its resources to improve its position in its core markets; its

ability to weather difficult economic environments; its ability to

open new market opportunities and target high-margin markets; the

strength/weakness of the back-end and/or front-end semiconductor

market segments; fluctuations in customer capital spending; the

Company’s ability to effectively manage its supply chain and

adequately source components from suppliers to meet customer

demand; the effects of political, economic, legal, and regulatory

changes or conflicts on the Company's global operations; its

ability to adequately protect its intellectual property rights and

maintain data security; the effects of natural disasters or public

health emergencies on the global economy and on the Company’s

customers, suppliers, employees, and business; its ability to

effectively maneuver global trade issues and changes in trade and

export regulations, tariffs and license policies; the Company’s

ability to maintain relationships with its customers and manage

appropriate levels of inventory to meet customer demands; and the

Company’s ability to successfully integrate acquired businesses and

technologies. Additional information and considerations regarding

the risks faced by Onto Innovation are available in Onto

Innovation’s Form 10-K report for the year ended December 30, 2023,

and other filings with the Securities and Exchange Commission. As

the forward-looking statements are based on Onto Innovation’s

current expectations, the Company cannot guarantee any related

future results, levels of activity, performance, or achievements.

Onto Innovation does not assume any obligation to update the

forward-looking information contained in this press release, except

as required by law.

About Onto Innovation

Onto Innovation is a leader in process control, combining global

scale with an expanded portfolio of leading-edge technologies that

include: unpatterned wafer quality; 3D metrology spanning chip

features from nanometer scale transistors to large die

interconnects; macro defect inspection of wafers and packages;

metal interconnect composition; factory analytics; and lithography

for advanced semiconductor packaging. Our breadth of offerings

across the entire semiconductor value chain combined with our

connected thinking approach results in a unique perspective to help

solve our customers’ most difficult yield, device performance,

quality, and reliability issues. Onto Innovation strives to

optimize customers’ critical path of progress by making them

smarter, faster and more efficient. With headquarters and

manufacturing in the U.S., Onto Innovation supports customers with

a worldwide sales and service organization. Additional information

can be found at www.ontoinnovation.com.

Source: Onto Innovation Inc. ONTO-I

(Financial tables follow)

ONTO INNOVATION INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands) -

(Unaudited)

December 28,

December 30,

2024

2023

ASSETS

Current assets

Cash, cash equivalents and marketable

securities

$

852,328

$

697,811

Accounts receivable, net

308,142

226,556

Inventories

286,979

327,773

Prepaid expenses and other current

assets

30,073

31,127

Total current assets

1,477,522

1,283,267

Net property, plant and equipment

123,868

103,611

Goodwill and intangibles, net

457,437

483,186

Other assets

58,264

39,648

Total assets

$

2,117,091

$

1,909,712

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities

Accounts payable and accrued

liabilities

$

106,236

$

91,931

Other current liabilities

63,853

55,795

Total current liabilities

170,089

147,726

Other non-current liabilities

21,120

25,451

Total liabilities

191,209

173,177

Stockholders’ equity

1,925,882

1,736,535

Total liabilities and stockholders’

equity

$

2,117,091

$

1,909,712

ONTO INNOVATION INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share amounts) - (Unaudited)

Three Months Ended

Twelve Months Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Revenue

$

263,939

$

218,856

$

987,321

$

815,868

Cost of revenue

131,531

110,890

472,013

395,614

Gross profit

132,408

107,966

515,308

420,254

Operating expenses:

Research and development

34,892

24,021

116,767

104,442

Sales and marketing

19,409

15,349

76,155

61,765

General and administrative

25,548

27,017

85,846

83,147

Amortization

10,099

13,349

49,437

54,822

Total operating expenses

89,948

79,736

328,205

304,176

Operating income

42,460

28,230

187,103

116,078

Interest income, net

8,965

6,456

33,489

20,356

Other expense, net

(154

)

(860

)

(145

)

(3,852

)

Income before provision for income

taxes

51,271

33,826

220,447

132,582

Provision for income taxes

2,454

3,517

18,777

11,423

Net income

$

48,817

$

30,309

$

201,670

$

121,159

Earnings per share:

Basic

$

0.99

$

0.62

$

4.09

$

2.47

Diluted

$

0.98

$

0.61

$

4.06

$

2.46

Weighted average shares outstanding:

Basic

49,374

49,151

49,343

48,971

Diluted

49,630

49,562

49,660

49,318

ONTO INNOVATION INC.

NON-GAAP FINANCIAL

SUMMARY

(In thousands, except

percentage and per share amounts) - (Unaudited)

Three Months Ended

Twelve Months Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Revenue

$

263,939

$

218,856

$

987,321

$

815,868

Gross profit

$

143,886

$

112,751

$

529,466

$

427,439

Gross margin as percentage of revenue

55

%

52

%

54

%

52

%

Operating expenses

$

68,418

$

56,360

$

262,170

$

231,996

Operating income

$

75,468

$

56,391

$

267,296

$

195,443

Operating margin as a percentage of

revenue

29

%

26

%

27

%

24

%

Net income

$

74,831

$

52,443

$

265,023

$

183,857

Net income per diluted share

$

1.51

$

1.06

$

5.34

$

3.73

RECONCILIATION OF GAAP GROSS

PROFIT,

OPERATING EXPENSES OPERATING

INCOME, GROSS MARGIN AND OPERATING MARGIN TO NON-GAAP

GROSS PROFIT, OPERATING

EXPENSES, OPERATING INCOME, GROSS MARGIN AND OPERATING

MARGIN

(In thousands, except

percentages) - (Unaudited)

Three Months Ended

Twelve Months Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

U.S. GAAP gross profit

$

132,408

$

107,966

$

515,308

$

420,254

Pre-tax non-GAAP items:

Merger and acquisition related

expenses

(15

)

37

90

158

Restructuring expenses

11,493

4,748

14,068

7,027

Non-GAAP gross profit

143,886

112,751

529,466

427,439

U.S. GAAP gross margin as a percentage of

revenue

50

%

49

%

52

%

52

%

Non-GAAP gross margin as a percentage of

revenue

55

%

52

%

54

%

52

%

U.S. GAAP operating expenses

$

89,948

$

79,736

$

328,205

$

304,176

Pre-tax non-GAAP items:

Merger and acquisition related

expenses

5,468

214

7,562

2,449

Restructuring expenses

5,963

346

9,009

3,572

Litigation expenses

—

9,467

27

11,337

Amortization of intangibles

10,099

13,349

49,437

54,822

Non-GAAP operating expenses

68,418

56,360

262,170

231,996

Non-GAAP operating income

$

75,468

$

56,391

$

267,296

$

195,443

U.S. GAAP operating margin as a percentage

of revenue

16

%

13

%

19

%

14

%

Non-GAAP operating margin as a percentage

of revenue

29

%

26

%

27

%

24

%

ONTO INNOVATION INC.

RECONCILIATION OF GAAP NET

INCOME TO

NON-GAAP NET INCOME AND

NON-GAAP NET INCOME PER DILUTED SHARE

(In thousands, except share

and per share data) - (Unaudited)

Three Months Ended

Twelve Months Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

U.S. GAAP net income

$

48,817

$

30,309

$

201,670

$

121,159

Pre-tax non-GAAP items:

Merger and acquisition related

expenses

5,453

251

7,652

2,607

Restructuring expenses

17,456

5,094

23,077

10,599

Litigation expenses

—

9,467

27

11,337

Amortization of intangibles

10,099

13,349

49,437

54,822

Net tax provision adjustments

(6,994

)

(6,027

)

(16,840

)

(16,667

)

Non-GAAP net income

$

74,831

$

52,443

$

265,023

$

183,857

Non-GAAP net income per diluted share

$

1.51

$

1.06

$

5.34

$

3.73

ONTO INNOVATION INC

SUPPLEMENTAL INFORMATION -

RECONCILIATION OF FIRST QUARTER 2025

GAAP TO NON-GAAP

GUIDANCE

Low

High

Estimated GAAP net income per diluted

share

$

1.14

$

1.28

Estimated non-GAAP items:

Amortization of intangibles

0.22

0.22

Merger and acquisition related

expenses

0.01

0.01

Restructuring expenses

0.07

0.07

Net tax provision adjustments

(0.04

)

(0.04

)

Estimated non-GAAP net income per diluted

share

$

1.40

$

1.54

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206103321/en/

For more information, please contact: Sidney Ho +1 408.376.9163

sidney.ho@ontoinnovation.com

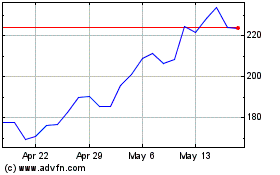

Onto Innovation (NYSE:ONTO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Onto Innovation (NYSE:ONTO)

Historical Stock Chart

From Feb 2024 to Feb 2025