CTO Realty Growth, Inc. (NYSE: CTO) (the “Company” or “CTO”) today

announced its operating results and earnings for the quarter ended

June 30, 2024.

Second Quarter and Recent

Highlights

- Reported Net

Loss per diluted share attributable to common stockholders of

$(0.03) for the quarter ended June 30, 2024.

- Reported Core

FFO per diluted share attributable to common stockholders of $0.45

for the quarter ended June 30, 2024.

- Reported AFFO

per diluted share attributable to common stockholders of $0.48 for

the quarter ended June 30, 2024.

- Received net

proceeds of $33.1 million from the completion of a follow-on public

offering of 1,718,417 shares of the Company’s 6.375% Series A

Cumulative Redeemable Preferred Stock.

- Received net

proceeds of $4.3 million from the issuance of 248,960 common shares

under the Company’s ATM offering program.

- Received

proceeds of $15.2 million as an early repayment of our Sabal

Pavilion seller-financing loan.

- The Company has

approximately $155 million of total liquidity as of June 30, 2024,

including $150 million of undrawn commitments on our Revolving

Credit Facility.

- Reported an

increase in Same-Property NOI of 2.0% as compared to the second

quarter of 2023 and an increase of 4.0% for the six months ended

June 30, 2024, as compared to the same period of 2023.

- Signed not open

pipeline represents $4.7 million, or 5.9%, of annual cash base rent

in place as of June 30, 2024.

- Increased full

year Core FFO guidance to $1.81 to $1.86 per diluted share and full

year AFFO guidance to $1.95 to $2.00 per diluted share,

representing increases of 11.9% and 11.0%, respectively, at the

midpoint of these ranges.

CEO Comments

“We are pleased that our strong leasing results

over the past year are starting to deliver meaningful Same-Property

NOI growth, including an increase of 4% for the first half of the

year,” said John P. Albright, President and Chief Executive Officer

of CTO Realty Growth. “The strength of our leasing continued this

quarter with an 8.8% leasing spread on comparable leases. Given our

solid earnings and increased investment activity outlook, we have

increased our full-year Core FFO and AFFO guidance by 11.9% and

11.0%, respectively, at the mid-points of the ranges, and are

looking forward to an active second half of 2024.”

Quarterly Financial Results

Highlights

The table below provides a summary of the

Company’s operating results for the three months ended June 30,

2024:

| |

|

Three Months Ended |

|

|

|

|

(in thousands, except per share data) |

June 30,2024 |

|

June 30,2023 |

|

Variance to ComparablePeriod in the Prior

Year |

|

|

Net Income Attributable to the Company |

$ |

1,183 |

|

|

$ |

1,800 |

|

|

$ |

(617 |

) |

|

|

(34.3 |

)% |

|

|

Net Income (Loss) Attributable to CommonStockholders |

$ |

(688 |

) |

|

$ |

605 |

|

|

$ |

(1,293 |

) |

|

|

(213.7 |

)% |

|

|

Net Income (Loss) Attributable to CommonStockholders per Common

Share - Diluted (1) |

$ |

(0.03 |

) |

|

$ |

0.03 |

|

|

$ |

(0.06 |

) |

|

|

(200.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core FFO Attributable to Common Stockholders (2) |

$ |

10,353 |

|

|

$ |

9,608 |

|

|

$ |

745 |

|

|

|

7.8 |

% |

|

|

Core FFO Attributable to Common Stockholdersper Common Share -

Diluted (2) |

$ |

0.45 |

|

|

$ |

0.43 |

|

|

$ |

0.02 |

|

|

|

4.7 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFO Attributable to Common Stockholders (2) |

$ |

11,051 |

|

|

$ |

10,781 |

|

|

$ |

270 |

|

|

|

2.5 |

% |

|

|

AFFO Attributable to Common Stockholdersper Common Share - Diluted

(2) |

$ |

0.48 |

|

|

$ |

0.48 |

|

|

$ |

— |

|

|

|

0.0 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends Declared and Paid - Preferred Stock |

$ |

0.40 |

|

|

$ |

0.40 |

|

|

$ |

— |

|

|

|

0.0 |

% |

|

| Dividends Declared

and Paid - Common Stock |

$ |

0.38 |

|

|

$ |

0.38 |

|

|

$ |

— |

|

|

|

0.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

The denominator for this measure excludes the impact of 3.6 million

and 3.3 million shares for the three months ended June 30, 2024 and

2023, respectively, related to the Company’s adoption of ASU

2020-06, effective January 1, 2022, which requires presentation on

an if-converted basis for its 2025 Convertible Senior Notes, as the

impact would be anti-dilutive. |

|

|

(2) |

See the “Non-GAAP Financial Measures” section and tables at the end

of this press release for a discussion and reconciliation of Net

Income (Loss) Attributable to the Company to non-GAAP financial

measures, including FFO Attributable to Common Stockholders, FFO

Attributable to Common Stockholders per Common Share - Diluted,

Core FFO Attributable to Common Stockholders, Core FFO Attributable

to Common Stockholders per Common Share - Diluted, AFFO

Attributable to Common Stockholders, and AFFO Attributable to

Common Stockholders per Common Share - Diluted. Further, the

weighted average shares used to compute per share amounts for Core

FFO Attributable to Common Stockholders per Common Share - Diluted

and AFFO Attributable to Common Stockholders per Common Share -

Diluted do not reflect any dilution related to the ultimate

settlement of the 2025 Convertible Senior Notes. |

|

|

|

|

|

Year-to-Date Financial Results

Highlights

The table below provides a summary of the

Company’s operating results for the six months ended June 30,

2024:

| |

|

Six Months Ended |

|

|

|

(in thousands, except per share data) |

June 30,2024 |

|

|

June 30,2023 |

|

Variance to ComparablePeriod in the Prior

Year |

|

|

Net Income (Loss) Attributable to the Company |

$ |

7,025 |

|

|

$ |

(4,193 |

) |

|

|

$ |

11,218 |

|

|

267.5 |

% |

|

|

Net Income (Loss) Attributable to CommonStockholders |

$ |

3,967 |

|

|

$ |

(6,583 |

) |

|

|

$ |

10,550 |

|

|

160.3 |

% |

|

|

Net Income (Loss) Attributable to CommonStockholders per Common

Share - Diluted (1) |

$ |

0.17 |

|

|

$ |

(0.29 |

) |

|

|

$ |

0.46 |

|

|

158.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core FFO Attributable to Common Stockholders (2) |

$ |

21,090 |

|

|

$ |

18,475 |

|

|

|

$ |

2,615 |

|

|

14.2 |

% |

|

|

Core FFO Attributable to Common Stockholdersper Common Share -

Diluted (2) |

$ |

0.93 |

|

|

$ |

0.82 |

|

|

|

$ |

0.11 |

|

|

13.4 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFO Attributable to Common Stockholders (2) |

$ |

22,699 |

|

|

$ |

20,644 |

|

|

|

$ |

2,055 |

|

|

10.0 |

% |

|

|

AFFO Attributable to Common Stockholders perCommon Share - Diluted

(2) |

$ |

1.00 |

|

|

$ |

0.91 |

|

|

|

$ |

0.09 |

|

|

9.9 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends Declared and Paid - Preferred Stock |

$ |

0.80 |

|

|

$ |

0.80 |

|

|

|

$ |

— |

|

|

0.0 |

% |

|

|

Dividends Declared and Paid - Common Stock |

$ |

0.76 |

|

|

$ |

0.76 |

|

|

|

$ |

— |

|

|

0.0 |

% |

|

|

|

|

|

|

(1) |

The denominator

for this measure excludes the impact of 3.6 million and 3.3 million

shares for the six months ended June 30, 2024 and 2023,

respectively, related to the Company’s adoption of ASU 2020-06,

effective January 1, 2022, which requires presentation on an

if-converted basis for its 2025 Convertible Senior Notes, as the

impact would be anti-dilutive. |

|

|

(2) |

See the “Non-GAAP

Financial Measures” section and tables at the end of this press

release for a discussion and reconciliation of Net Income (Loss)

Attributable to the Company to non-GAAP financial measures,

including FFO Attributable to Common Stockholders, FFO Attributable

to Common Stockholders per Common Share - Diluted, Core FFO

Attributable to Common Stockholders, Core FFO Attributable to

Common Stockholders per Common Share - Diluted, AFFO Attributable

to Common Stockholders, and AFFO Attributable to Common

Stockholders per Common Share - Diluted. Further, the weighted

average shares used to compute per share amounts for Core FFO

Attributable to Common Stockholders per Common Share - Diluted and

AFFO Attributable to Common Stockholders per Common Share - Diluted

do not reflect any dilution related to the ultimate settlement of

the 2025 Convertible Senior Notes. |

|

|

|

|

|

Investments

During the three months ended June 30, 2024, the

Company invested $1.5 million into 1.4 acres of land for future

development within the West Broad Village property, which was

previously acquired in October of 2022.

During the six months ended June 30, 2024, the

Company invested $72.5 million into two retail properties totaling

319,066 square feet and one vacant land parcel, and originated one

$10.0 million first mortgage structured investment. These

investments represent a weighted average going-in cash yield of

8.2%.

Dispositions

During the three months ended June 30, 2024, the

Company received proceeds of $15.2 million as an early repayment of

our Sabal Pavilion seller-financing loan.

During the six months ended June 30, 2024, the

Company sold one retail property for $20.0 million at an exit cash

cap rate of 8.2%, generating a gain of $4.6 million.

Portfolio Summary

The Company’s income property portfolio consisted of the

following as of June 30, 2024:

|

Asset Type |

|

# of Properties |

|

Square Feet |

|

Wtd. Avg. RemainingLease Term |

|

|

Single Tenant |

|

6 |

|

252 |

|

5.7 years |

|

|

Multi-Tenant |

|

14 |

|

3,643 |

|

5.0 years |

|

|

Total / Wtd. Avg. |

|

20 |

|

3,895 |

|

4.9 years |

|

|

|

|

|

Square Feet in thousands. |

|

|

|

|

|

Property Type |

|

# of Properties |

|

Square Feet |

|

% of Cash Base Rent |

|

|

Retail |

|

15 |

|

2,467 |

|

62.5 |

% |

|

|

Office |

|

1 |

|

210 |

|

4.5 |

% |

|

|

Mixed-Use |

|

4 |

|

1,218 |

|

33.0 |

% |

|

|

|

|

|

Square Feet in thousands. |

|

|

|

Leased Occupancy |

94.6 |

% |

|

| Occupancy |

92.6 |

% |

|

| |

Same Property Net Operating

Income

During the second quarter of 2024, the Company’s

Same-Property NOI totaled $14.9 million, an increase of 2.0% over

the comparable prior year period, as presented in the following

table:

| |

Three Months Ended |

|

|

|

| |

June 30,2024 |

|

June 30,2023 |

|

Variance to ComparablePeriod in the Prior

Year |

|

|

Single Tenant |

$ |

1,292 |

|

|

$ |

1,191 |

|

|

$ |

101 |

|

|

|

8.5 |

% |

|

|

Multi-Tenant |

|

13,587 |

|

|

|

13,391 |

|

|

|

196 |

|

|

|

1.5 |

% |

|

|

Total |

$ |

14,879 |

|

|

$ |

14,582 |

|

|

$ |

297 |

|

|

|

2.0 |

% |

|

|

|

|

|

$ in thousands. |

|

| |

|

During the six months ended June 30, 2024, the

Company’s Same-Property NOI totaled $30.0 million, an increase of

4.0% over the comparable prior year period, as presented in the

following table:

| |

Six Months Ended |

|

|

|

| |

June 30,2024 |

|

June 30,2023 |

|

Variance to ComparablePeriod in the Prior

Year |

|

|

Single Tenant |

$ |

2,439 |

|

|

$ |

2,140 |

|

|

$ |

299 |

|

|

|

14.0 |

% |

|

|

Multi-Tenant |

|

27,554 |

|

|

|

26,696 |

|

|

|

858 |

|

|

|

3.2 |

% |

|

|

Total |

$ |

29,993 |

|

|

$ |

28,836 |

|

|

$ |

1,157 |

|

|

|

4.0 |

% |

|

|

|

|

|

$ in thousands. |

|

|

|

|

Leasing Activity

During the quarter ended June 30, 2024, the

Company signed 16 leases totaling 78,593 square feet. On a

comparable basis, which excludes vacancy existing at the time of

acquisition, CTO signed 11 leases totaling 57,878 square feet at an

average cash base rent of $23.34 per square foot compared to a

previous average cash base rent of $21.45 per square foot,

representing 8.8% comparable growth.

A summary of the Company’s overall leasing

activity for the quarter ended June 30, 2024, is as follows:

| |

Square Feet |

|

Wtd. Avg.Lease Term |

|

Cash Rent perSquare Foot |

|

TenantImprovements |

|

LeasingCommissions |

|

|

New Leases |

31 |

|

8.1 years |

|

$ |

33.28 |

|

$ |

865 |

|

$ |

515 |

|

|

Renewals & Extensions |

48 |

|

4.0 years |

|

|

21.06 |

|

|

10 |

|

|

57 |

|

|

Total / Wtd. Avg. |

79 |

|

6.0 years |

|

$ |

25.87 |

|

$ |

875 |

|

$ |

572 |

|

| |

|

|

In thousands except for per square foot and weighted average lease

term data. Comparable leases compare leases signed on a space for

which there was previously a tenant. Overall leasing activity does

not include lease termination agreements or lease amendments

related to tenant bankruptcy proceedings. |

|

| |

|

During the six months ended June 30, 2024, the

Company signed 34 leases totaling 182,707 square feet. On a

comparable basis, which excludes vacancy existing at the time of

acquisition, CTO signed 26 leases totaling 152,577 square feet at

an average cash base rent of $25.05 per square foot compared to a

previous average cash base rent of $17.77 per square foot,

representing 41.0% comparable growth.

A summary of the Company’s overall leasing

activity for the six months ended June 30, 2024, is as follows:

|

|

Square Feet |

|

Wtd. Avg.Lease Term |

|

Cash Rent perSquare Foot |

|

TenantImprovements |

|

LeasingCommissions |

|

|

New Leases |

101 |

|

10.9 years |

|

$ |

28.29 |

|

$ |

5,707 |

|

$ |

1,648 |

|

|

Renewals & Extensions |

82 |

|

3.9 years |

|

|

24.48 |

|

|

25 |

|

|

97 |

|

|

Total / Wtd. Avg. |

183 |

|

8.0 years |

|

$ |

26.58 |

|

$ |

5,732 |

|

$ |

1,745 |

|

| |

|

|

In thousands except for per square foot and weighted average lease

term data. Comparable leases compare leases signed on a space for

which there was previously a tenant. Overall leasing activity does

not include lease termination agreements or lease amendments

related to tenant bankruptcy proceedings. |

|

| |

|

Capital Markets and Balance

Sheet

During the quarter ended June 30, 2024, the

Company completed the following notable capital markets

activities:

- Issued 248,960

common shares under its ATM offering program at a weighted average

gross price of $17.62 per share, for total net proceeds of $4.3

million.

- Completed a

follow-on public offering of 1,718,417 shares of the Company’s

6.375% Series A Cumulative Redeemable Preferred Stock. The Company

received net proceeds of $33.1 million, after deducting the

underwriting discount and offering expenses payable by the Company,

which proceeds were used to pay down our Revolving Credit

Facility.

- As of June 30,

2024, the Company has $150 million of undrawn commitments on our

Revolving Credit Facility, and $4.8 million of cash on hand for

total liquidity of $154.8 million.

The following table provides a summary of the

Company’s long-term debt, as of June 30, 2024:

|

|

Component of Long-Term Debt |

|

Principal |

|

Maturity Date |

|

Interest Rate |

|

Wtd. Avg. Rate as of June 30, 2024 |

|

|

2025 Convertible Senior Notes |

|

$ |

51.0 million |

|

April 2025 |

|

3.875% |

|

3.88% |

|

|

2026 Term Loan (1) |

|

|

65.0 million |

|

March 2026 |

|

SOFR + 10 bps +[1.25% - 2.20%] |

|

2.87% |

|

|

Mortgage Note (2) |

|

|

17.8 million |

|

August 2026 |

|

4.060% |

|

4.06% |

|

|

Revolving Credit Facility (3) |

|

|

150.0 million |

|

January 2027 |

|

SOFR + 10 bps +[1.25% - 2.20%] |

|

5.07% |

|

|

2027 Term Loan (4) |

|

|

100.0 million |

|

January 2027 |

|

SOFR + 10 bps +[1.25% - 2.20%] |

|

2.95% |

|

|

2028 Term Loan (5) |

|

|

100.0 million |

|

January 2028 |

|

SOFR + 10 bps +[1.20% - 2.15%] |

|

5.33% |

|

|

Total Long-Term Debt |

|

$ |

483.8 million |

|

|

|

|

|

4.23% |

|

| |

|

|

|

(1) |

The Company utilized interest rate swaps on the $65.0 million 2026

Term Loan balance to fix SOFR and achieve a weighted average fixed

swap rate of 1.27% plus the 10 bps SOFR adjustment plus the

applicable spread. |

|

|

(2) |

Mortgage note assumed in connection with the acquisition of Price

Plaza Shopping Center located in Katy, Texas. |

|

|

(3) |

The Company utilized interest rate swaps on $150.0 million of the

Credit Facility balance to fix SOFR and achieve a weighted average

fixed swap rate of 3.47% plus the 10 bps SOFR adjustment plus the

applicable spread. |

|

|

(4) |

The Company utilized interest rate swaps on the $100.0 million 2027

Term Loan balance to fix SOFR and achieve a fixed swap rate of

1.35% plus the 10 bps SOFR adjustment plus the applicable

spread. |

|

|

(5) |

The Company utilized interest rate swaps on the $100.0 million 2028

Term Loan balance to fix SOFR and achieve a weighted average fixed

swap rate of 3.78% plus the 10 bps SOFR adjustment plus the

applicable spread. |

|

| |

|

|

As of June 30, 2024, the Company’s net debt to

Pro Forma EBITDA was 7.5 times, and as defined in the Company’s

credit agreement, the Company’s fixed charge coverage ratio was 2.7

times. As of June 30, 2024, the Company’s net debt to total

enterprise value was 47.8%. The Company calculates total enterprise

value as the sum of net debt, par value of its 6.375% Series A

preferred equity, and the market value of the Company's outstanding

common shares.

Dividends

On May 28, 2024, the Company announced a cash

dividend on its common stock and Series A Preferred Stock for the

second quarter of 2024 of $0.38 per share and $0.40 per share,

respectively, payable on June 28, 2024 to stockholders of record as

of the close of business on June 13, 2024. The second quarter 2024

common stock cash dividend represents a payout ratio of 84.4% and

79.2% of the Company’s second quarter 2024 Core FFO Attributable to

Common Stockholders per Common Share - Diluted and AFFO

Attributable to Common Stockholders per Common Share - Diluted,

respectively.

2024 Outlook

The Company has increased its Core FFO and AFFO

outlook for 2024 and has revised certain assumptions to take into

account the Company’s year-to-date performance and revised

expectations regarding the Company’s acquisition activities. The

Company’s outlook for 2024 assumes continued stability in economic

activity, stable or positive business trends related to each of our

tenants and other significant assumptions.

The Company’s increased outlook for 2024 is as

follows:

| |

| |

Revised Outlook Range for 2024 |

|

Change from Prior Outlook |

|

| |

Low |

|

High |

|

Low |

|

High |

|

|

Core FFO per Diluted Share |

$ |

1.81 |

to |

$ |

1.86 |

|

$ |

0.21 |

to |

$ |

0.18 |

|

| AFFO per Diluted Share |

$ |

1.95 |

to |

$ |

2.00 |

|

$ |

0.21 |

to |

$ |

0.18 |

|

| |

The Company’s 2024 guidance includes but is not

limited to the following assumptions:

- Same-Property

NOI growth of 2% to 4%, including the known impact of bad debt

expense, occupancy loss and costs associated with tenants in

bankruptcy, and/or tenant lease defaults, and before any impact

from potential 2024 income property acquisitions and/or

dispositions.

- General and

administrative expenses within a range of $15.2 million to $16.2

million.

- Weighted average

diluted shares outstanding of 22.9 million shares.

- Year-end 2024

leased occupancy projected to be within a range of 95% to 96%

before any impact from potential 2024 income property acquisitions

and/or dispositions.

- Investment,

including structured investments, between $200 million and $250

million at a weighted average initial cash yield between 8.50% and

9.00%.

- Disposition of assets between $50

million and $75 million at a weighted average exit cash yield

between 7.50% and 8.25%

Earnings Conference Call &

Webcast

The Company will host a conference call to

present its operating results for the quarter ended June 30, 2024,

on Friday, July 26, 2024, at 9:00 AM ET.

A live webcast of the call will be available on

the Investor Relations page of the Company’s website at

www.ctoreit.com or at the link provided in the event details below.

To access the call by phone, please go to the registration link

provided in the event details below and you will be provided with

dial-in details.

Event Details:

|

Webcast: |

https://edge.media-server.com/mmc/p/n6cuxiih |

|

Registration: |

https://register.vevent.com/register/BI83b768fbc540495da856dfd974c470c9 |

|

|

We encourage participants to register and dial

into the conference call at least fifteen minutes ahead of the

scheduled start time. A replay of the earnings call will be

archived and available online through the Investor Relations

section of the Company’s website at www.ctoreit.com.

About CTO Realty Growth,

Inc.

CTO Realty Growth, Inc. is a publicly traded

real estate investment trust that owns and operates a portfolio of

high-quality, retail-based properties located primarily in higher

growth markets in the United States. CTO also externally manages

and owns a meaningful interest in Alpine Income Property Trust,

Inc. (NYSE: PINE), a publicly traded net lease REIT.

We encourage you to review our most recent

investor presentation and supplemental financial information, which

is available on our website at www.ctoreit.com.

Safe Harbor

Certain statements contained in this press

release (other than statements of historical fact) are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements can typically be identified by words such as “believe,”

“estimate,” “expect,” “intend,” “anticipate,” “will,” “could,”

“may,” “should,” “plan,” “potential,” “predict,” “forecast,”

“project,” and similar expressions, as well as variations or

negatives of these words.

Although forward-looking statements are made

based upon management’s present expectations and reasonable beliefs

concerning future developments and their potential effect upon the

Company, a number of factors could cause the Company’s actual

results to differ materially from those set forth in the

forward-looking statements. Such factors may include, but are not

limited to: the Company’s ability to remain qualified as a REIT;

the Company’s exposure to U.S. federal and state income tax law

changes, including changes to the REIT requirements; general

adverse economic and real estate conditions; macroeconomic and

geopolitical factors, including but not limited to inflationary

pressures, interest rate volatility, distress in the banking

sector, global supply chain disruptions, and ongoing geopolitical

war; credit risk associated with the Company investing in

structured investments; the ultimate geographic spread, severity

and duration of pandemics such as the COVID-19 Pandemic and its

variants, actions that may be taken by governmental authorities to

contain or address the impact of such pandemics, and the potential

negative impacts of such pandemics on the global economy and the

Company’s financial condition and results of operations; the

inability of major tenants to continue paying their rent or

obligations due to bankruptcy, insolvency or a general downturn in

their business; the loss or failure, or decline in the business or

assets of PINE; the completion of 1031 exchange transactions; the

availability of investment properties that meet the Company’s

investment goals and criteria; the uncertainties associated with

obtaining required governmental permits and satisfying other

closing conditions for planned acquisitions and sales; and the

uncertainties and risk factors discussed in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 and

other risks and uncertainties discussed from time to time in the

Company’s filings with the U.S. Securities and Exchange

Commission.

There can be no assurance that future

developments will be in accordance with management’s expectations

or that the effect of future developments on the Company will be

those anticipated by management. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. The Company undertakes

no obligation to update the information contained in this press

release to reflect subsequently occurring events or

circumstances.

Non-GAAP Financial Measures

Our reported results are presented in accordance

with accounting principles generally accepted in the United States

of America (“GAAP”). We also disclose Funds From Operations

(“FFO”), Core Funds From Operations (“Core FFO”), Adjusted Funds

From Operations (“AFFO”), Pro Forma Earnings Before Interest,

Taxes, Depreciation and Amortization (“Pro Forma EBITDA”), and

Same-Property Net Operating Income (“Same-Property NOI”), each of

which are non-GAAP financial measures. We believe these non-GAAP

financial measures are useful to investors because they are widely

accepted industry measures used by analysts and investors to

compare the operating performance of REITs.

FFO, Core FFO, AFFO, Pro Forma EBITDA, and

Same-Property NOI do not represent cash generated from operating

activities and are not necessarily indicative of cash available to

fund cash requirements; accordingly, they should not be considered

alternatives to net income as a performance measure or cash flows

from operating activities as reported on our statement of cash

flows as a liquidity measure and should be considered in addition

to, and not in lieu of, GAAP financial measures.

We compute FFO in accordance with the definition

adopted by the Board of Governors of the National Association of

Real Estate Investment Trusts, or NAREIT.

NAREIT defines FFO as GAAP net income or loss

adjusted to exclude real estate related depreciation and

amortization, as well as extraordinary items (as defined by GAAP)

such as net gain or loss from sales of depreciable real estate

assets, impairment write-downs associated with depreciable real

estate assets and impairments associated with the implementation of

current expected credit losses on commercial loans and investments

at the time of origination, including the pro rata share of such

adjustments of unconsolidated subsidiaries. The Company also

excludes the gains or losses from sales of assets incidental to the

primary business of the REIT which specifically include the sales

of mitigation credits, subsurface sales, investment securities, and

land sales, in addition to the mark-to-market of the Company’s

investment securities and interest related to the 2025 Convertible

Senior Notes, if the effect is dilutive. To derive Core FFO, we

modify the NAREIT computation of FFO to include other adjustments

to GAAP net income related to gains and losses recognized on the

extinguishment of debt, amortization of above- and below-market

lease related intangibles, and other unforecastable market- or

transaction-driven non-cash items, as well as adding back the

interest related to the 2025 Convertible Senior Notes, if the

effect is dilutive. To derive AFFO, we further modify the NAREIT

computation of FFO and Core FFO to include other adjustments to

GAAP net income related to non-cash revenues and expenses such as

straight-line rental revenue, non-cash compensation, and other

non-cash amortization. Such items may cause short-term fluctuations

in net income but have no impact on operating cash flows or

long-term operating performance. We use AFFO as one measure of our

performance when we formulate corporate goals.

To derive Pro Forma EBITDA, GAAP net income or

loss attributable to the Company is adjusted to exclude real estate

related depreciation and amortization, as well as extraordinary

items (as defined by GAAP) such as net gain or loss from sales of

depreciable real estate assets, impairment write-downs associated

with depreciable real estate assets, impairments associated with

the implementation of current expected credit losses on commercial

loans and investments at the time of origination, including the pro

rata share of such adjustments of unconsolidated subsidiaries,

non-cash revenues and expenses such as straight-line rental

revenue, amortization of deferred financing costs, above- and

below-market lease related intangibles, non-cash compensation,

other non-recurring items such as termination fees, forfeitures of

tenant security deposits, and certain adjustments to reconciliation

estimates related to reimbursable revenue for recently acquired

properties, and other non-cash income or expense. The Company also

excludes the gains or losses from sales of assets incidental to the

primary business of the REIT which specifically include the sales

of mitigation credits, subsurface sales, investment securities, and

land sales, in addition to the mark-to-market of the Company’s

investment securities. Cash interest expense is also excluded from

Pro Forma EBITDA, and GAAP net income or loss is adjusted for the

annualized impact of acquisitions, dispositions and other similar

activities.

To derive Same-Property NOI, GAAP net income or

loss attributable to the Company is adjusted to exclude real estate

related depreciation and amortization, as well as extraordinary

items (as defined by GAAP) such as net gain or loss from sales of

depreciable real estate assets, impairment write-downs associated

with depreciable real estate assets, impairments associated with

the implementation of current expected credit losses on commercial

loans and investments at the time of origination, including the pro

rata share of such adjustments of unconsolidated subsidiaries,

non-cash revenues and expenses such as straight-line rental

revenue, amortization of deferred financing costs, above- and

below-market lease related intangibles, non-cash compensation,

other non-recurring items such as termination fees, forfeitures of

tenant security deposits, and certain adjustments to reconciliation

estimates related to reimbursable revenue for recently acquired

properties, and other non-cash income or expense. Interest expense,

general and administrative expenses, investment and other income or

loss, income tax benefit or expense, real estate operations

revenues and direct cost of revenues, management fee income, and

interest income from commercial loans and investments are also

excluded from Same-Property NOI. GAAP net income or loss is further

adjusted to remove the impact of properties that were not owned for

the full current and prior year reporting periods presented. Cash

rental income received under the leases pertaining to the Company’s

assets that are presented as commercial loans and investments in

accordance with GAAP is also used in lieu of the interest income

equivalent.

FFO is used by management, investors and

analysts to facilitate meaningful comparisons of operating

performance between periods and among our peers primarily because

it excludes the effect of real estate depreciation and amortization

and net gains or losses on sales, which are based on historical

costs and implicitly assume that the value of real estate

diminishes predictably over time, rather than fluctuating based on

existing market conditions. We believe that Core FFO and AFFO are

additional useful supplemental measures for investors to consider

because they will help them to better assess our operating

performance without the distortions created by other non-cash

revenues or expenses. We also believe that Pro Forma EBITDA is an

additional useful supplemental measure for investors to consider as

it allows for a better assessment of our operating performance

without the distortions created by other non-cash revenues,

expenses or certain effects of the Company’s capital structure on

our operating performance. We use Same-Property NOI to compare the

operating performance of our assets between periods. It is an

accepted and important measurement used by management, investors

and analysts because it includes all property-level revenues from

the Company’s properties, less operating and maintenance expenses,

real estate taxes and other property-specific expenses (“Net

Operating Income” or “NOI”) of properties that have been owned and

stabilized for the entire current and prior year reporting periods.

Same-Property NOI attempts to eliminate differences due to the

acquisition or disposition of properties during the particular

period presented, and therefore provides a more comparable and

consistent performance measure for the comparison of the Company’s

properties. FFO, Core FFO, AFFO, Pro Forma EBITDA, and

Same-Property NOI may not be comparable to similarly titled

measures employed by other companies.

|

CTO Realty Growth, Inc.Consolidated

Balance Sheets(In thousands, except share

and per share data) |

|

| |

|

| |

As of |

|

|

|

(Unaudited) June 30, 2024 |

|

December 31,2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Real

Estate: |

|

|

|

|

|

|

|

|

|

Land, at Cost |

$ |

236,207 |

|

|

$ |

222,232 |

|

|

|

Building and Improvements, at Cost |

|

601,584 |

|

|

|

559,389 |

|

|

|

Other Furnishings and Equipment, at Cost |

|

872 |

|

|

|

857 |

|

|

|

Construction in Process, at Cost |

|

4,824 |

|

|

|

3,997 |

|

|

|

Total Real Estate, at Cost |

|

843,487 |

|

|

|

786,475 |

|

|

|

Less, Accumulated Depreciation |

|

(63,547 |

) |

|

|

(52,012 |

) |

|

|

Real Estate—Net |

|

779,940 |

|

|

|

734,463 |

|

|

| Land and

Development Costs |

|

300 |

|

|

|

731 |

|

|

|

Intangible Lease Assets—Net |

|

95,054 |

|

|

|

97,109 |

|

|

|

Investment in Alpine Income Property Trust, Inc. |

|

36,561 |

|

|

|

39,445 |

|

|

|

Mitigation Credits |

|

355 |

|

|

|

1,044 |

|

|

|

Commercial Loans and Investments |

|

50,323 |

|

|

|

61,849 |

|

|

| Cash and

Cash Equivalents |

|

4,794 |

|

|

|

10,214 |

|

|

|

Restricted Cash |

|

1,363 |

|

|

|

7,605 |

|

|

|

Refundable Income Taxes |

|

85 |

|

|

|

246 |

|

|

| Deferred

Income Taxes—Net |

|

2,147 |

|

|

|

2,009 |

|

|

| Other

Assets |

|

38,846 |

|

|

|

34,953 |

|

|

|

Total Assets |

$ |

1,009,768 |

|

|

$ |

989,668 |

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts Payable |

$ |

1,787 |

|

|

$ |

2,758 |

|

|

|

Accrued and Other Liabilities |

|

14,713 |

|

|

|

18,373 |

|

|

|

Deferred Revenue |

|

5,371 |

|

|

|

5,200 |

|

|

|

Intangible Lease Liabilities—Net |

|

13,421 |

|

|

|

10,441 |

|

|

|

Long-Term Debt |

|

482,661 |

|

|

|

495,370 |

|

|

|

Total Liabilities |

|

517,953 |

|

|

|

532,142 |

|

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

Preferred Stock – 100,000,000 shares authorized; $0.01 par value,

6.375%Series A Cumulative Redeemable Preferred Stock, $25.00 Per

ShareLiquidation Preference, 4,697,225 shares issued and

outstanding at June 30,2024 and 2,978,808 shares issued and

outstanding at December 31, 2023 |

|

47 |

|

|

|

30 |

|

|

|

Common Stock – 500,000,000 shares authorized; $0.01 par value,

23,115,110shares issued and outstanding at June 30, 2024 and

22,643,034 shares issuedand outstanding at December 31,

2023 |

|

231 |

|

|

|

226 |

|

|

|

Additional Paid-In Capital |

|

207,882 |

|

|

|

168,435 |

|

|

|

Retained Earnings |

|

268,269 |

|

|

|

281,944 |

|

|

|

Accumulated Other Comprehensive Income |

|

15,386 |

|

|

|

6,891 |

|

|

|

Total Stockholders’ Equity |

|

491,815 |

|

|

|

457,526 |

|

|

|

Total Liabilities and Stockholders’ Equity |

$ |

1,009,768 |

|

|

$ |

989,668 |

|

|

|

|

|

|

CTO Realty Growth, Inc.Consolidated

Statements of Operations (Unaudited)(In thousands, except

share, per share and dividend data) |

|

| |

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30,2024 |

|

|

June 30,2023 |

|

|

June 30,2024 |

|

|

June 30,2023 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Properties |

$ |

25,878 |

|

|

$ |

22,758 |

|

|

$ |

50,501 |

|

|

$ |

45,190 |

|

|

|

Management Fee Income |

|

1,131 |

|

|

|

1,102 |

|

|

|

2,236 |

|

|

|

2,200 |

|

|

|

Interest Income From Commercial Loans andInvestments |

|

1,441 |

|

|

|

1,056 |

|

|

|

2,792 |

|

|

|

1,851 |

|

|

|

Real Estate Operations |

|

395 |

|

|

|

1,131 |

|

|

|

1,443 |

|

|

|

1,523 |

|

|

|

Total Revenues |

|

28,845 |

|

|

|

26,047 |

|

|

|

56,972 |

|

|

|

50,764 |

|

|

| Direct

Cost of Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Properties |

|

(8,080 |

) |

|

|

(6,670 |

) |

|

|

(14,833 |

) |

|

|

(13,823 |

) |

|

|

Real Estate Operations |

|

(259 |

) |

|

|

(639 |

) |

|

|

(1,078 |

) |

|

|

(724 |

) |

|

|

Total Direct Cost of Revenues |

|

(8,339 |

) |

|

|

(7,309 |

) |

|

|

(15,911 |

) |

|

|

(14,547 |

) |

|

| General

and Administrative Expenses |

|

(3,459 |

) |

|

|

(3,327 |

) |

|

|

(7,675 |

) |

|

|

(7,054 |

) |

|

|

Provision for Impairment |

|

(67 |

) |

|

|

— |

|

|

|

(115 |

) |

|

|

(479 |

) |

|

|

Depreciation and Amortization |

|

(11,549 |

) |

|

|

(10,829 |

) |

|

|

(22,480 |

) |

|

|

(21,145 |

) |

|

|

Total Operating Expenses |

|

(23,414 |

) |

|

|

(21,465 |

) |

|

|

(46,181 |

) |

|

|

(43,225 |

) |

|

| Gain on

Disposition of Assets |

|

— |

|

|

|

1,101 |

|

|

|

9,163 |

|

|

|

1,101 |

|

|

|

Other Gain |

|

— |

|

|

|

1,101 |

|

|

|

9,163 |

|

|

|

1,101 |

|

|

|

Total Operating Income |

|

5,431 |

|

|

|

5,683 |

|

|

|

19,954 |

|

|

|

8,640 |

|

|

|

Investment and Other Income (Loss) |

|

1,429 |

|

|

|

1,811 |

|

|

|

(1,830 |

) |

|

|

(2,480 |

) |

|

| Interest

Expense |

|

(5,604 |

) |

|

|

(5,211 |

) |

|

|

(11,133 |

) |

|

|

(9,843 |

) |

|

|

Income Before Income Tax Benefit (Expense) |

|

1,256 |

|

|

|

2,283 |

|

|

|

6,991 |

|

|

|

(3,683 |

) |

|

| Income

Tax Benefit (Expense) |

|

(73 |

) |

|

|

(483 |

) |

|

|

34 |

|

|

|

(510 |

) |

|

|

Net Income (Loss) Attributable to the Company |

|

1,183 |

|

|

|

1,800 |

|

|

|

7,025 |

|

|

|

(4,193 |

) |

|

|

Distributions to Preferred Stockholders |

|

(1,871 |

) |

|

|

(1,195 |

) |

|

|

(3,058 |

) |

|

|

(2,390 |

) |

|

|

Net Income (Loss) Attributable to CommonStockholders |

$ |

(688 |

) |

|

$ |

605 |

|

|

$ |

3,967 |

|

|

$ |

(6,583 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per

Share Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Net Income (Loss) Attributableto Common

Stockholders |

$ |

(0.03 |

) |

|

|

0.03 |

|

|

|

0.17 |

|

|

|

(0.29 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

Average Number of Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

22,787,252 |

|

|

|

22,482,957 |

|

|

|

22,669,246 |

|

|

|

22,593,280 |

|

|

|

Diluted |

|

22,828,148 |

|

|

|

22,482,957 |

|

|

|

22,674,796 |

|

|

|

22,593,280 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends Declared and Paid - Preferred Stock |

$ |

0.40 |

|

|

$ |

0.40 |

|

|

$ |

0.80 |

|

|

$ |

0.80 |

|

|

|

Dividends Declared and Paid - Common Stock |

$ |

0.38 |

|

|

$ |

0.38 |

|

|

$ |

0.76 |

|

|

$ |

0.76 |

|

|

|

|

|

|

CTO Realty Growth, Inc.Non-GAAP Financial

MeasuresSame-Property NOI

Reconciliation(Unaudited)(In thousands) |

|

| |

|

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

June 30,2024 |

|

June 30,2023 |

|

June 30,2024 |

|

June 30,2023 |

|

|

Net Income (Loss) Attributable to the Company |

$ |

1,183 |

|

|

$ |

1,800 |

|

|

$ |

7,025 |

|

|

$ |

(4,193 |

) |

|

|

|

Gain on Disposition of Assets, Net of Tax |

|

— |

|

|

|

(1,101 |

) |

|

|

(9,163 |

) |

|

|

(1,101 |

) |

|

|

|

Provision for Impairment |

|

67 |

|

|

|

— |

|

|

|

115 |

|

|

|

479 |

|

|

|

|

Depreciation and Amortization |

|

11,549 |

|

|

|

10,829 |

|

|

|

22,480 |

|

|

|

21,145 |

|

|

|

|

Amortization of Intangibles to Lease Income |

|

(244 |

) |

|

|

(627 |

) |

|

|

(718 |

) |

|

|

(1,306 |

) |

|

|

|

Straight-Line Rent Adjustment |

|

346 |

|

|

|

(122 |

) |

|

|

1,039 |

|

|

|

129 |

|

|

|

|

COVID-19

Rent Repayments |

|

— |

|

|

|

(17 |

) |

|

|

— |

|

|

|

(43 |

) |

|

|

|

Accretion of Tenant Contribution |

|

13 |

|

|

|

38 |

|

|

|

26 |

|

|

|

76 |

|

|

|

|

Interest

Expense |

|

5,604 |

|

|

|

5,211 |

|

|

|

11,133 |

|

|

|

9,843 |

|

|

|

|

General

and Administrative Expenses |

|

3,459 |

|

|

|

3,327 |

|

|

|

7,675 |

|

|

|

7,054 |

|

|

|

|

Investment and Other Income (Loss) |

|

(1,429 |

) |

|

|

(1,811 |

) |

|

|

1,830 |

|

|

|

2,480 |

|

|

|

|

Income

Tax Benefit (Expense) |

|

73 |

|

|

|

483 |

|

|

|

(34 |

) |

|

|

510 |

|

|

|

|

Real

Estate Operations Revenues |

|

(395 |

) |

|

|

(1,131 |

) |

|

|

(1,443 |

) |

|

|

(1,523 |

) |

|

|

|

Real

Estate Operations Direct Cost of Revenues |

|

259 |

|

|

|

639 |

|

|

|

1,078 |

|

|

|

724 |

|

|

|

|

Management Fee Income |

|

(1,131 |

) |

|

|

(1,102 |

) |

|

|

(2,236 |

) |

|

|

(2,200 |

) |

|

|

|

Interest

Income From Commercial Loans and Investments |

|

(1,441 |

) |

|

|

(1,056 |

) |

|

|

(2,792 |

) |

|

|

(1,851 |

) |

|

|

|

Other

Non-Recurring Items (1) |

|

(303 |

) |

|

|

— |

|

|

|

(553 |

) |

|

|

— |

|

|

|

|

Less:

Impact of Properties Not Owned for the Full Reporting Period |

|

(2,731 |

) |

|

|

(778 |

) |

|

|

(5,469 |

) |

|

|

(1,387 |

) |

|

| Same-Property

NOI |

$ |

14,879 |

|

|

$ |

14,582 |

|

|

$ |

29,993 |

|

|

$ |

28,836 |

|

|

| |

|

|

(1) |

Includes non-recurring items including termination fees,

forfeitures of tenant security deposits, and certain adjustments to

estimates related to recently acquired property CAM

reconciliations. |

|

|

|

|

|

|

CTO Realty Growth, Inc.Non-GAAP Financial

MeasuresFunds from Operations, Core Funds from

Operations, and Adjusted Funds from

OperationsAttributable to Common

Stockholders(Unaudited)(In thousands, except per share

data) |

|

|

|

|

|

| |

|

Three MonthsEnded |

|

Six MonthsEnded |

|

|

|

|

June 30,2024 |

|

June 30,2023 |

|

June 30,2024 |

|

June 30,2023 |

|

|

Net Income (Loss) Attributable to the Company |

$ |

1,183 |

|

|

$ |

1,800 |

|

|

$ |

7,025 |

|

|

$ |

(4,193 |

) |

|

|

|

Add Back: Effect of Dilutive Interest Related to 2025 Notes

(1) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

Net Income (Loss) Attributable to the Company, If-Converted |

$ |

1,183 |

|

|

$ |

1,800 |

|

|

$ |

7,025 |

|

|

$ |

(4,193 |

) |

|

|

|

Depreciation and Amortization of Real Estate |

|

11,532 |

|

|

|

10,816 |

|

|

|

22,447 |

|

|

|

21,118 |

|

|

|

|

Gain on

Disposition of Assets, Net of Tax |

|

— |

|

|

|

(824 |

) |

|

|

(9,163 |

) |

|

|

(824 |

) |

|

|

|

Gain on

Disposition of Other Assets |

|

(139 |

) |

|

|

(490 |

) |

|

|

(370 |

) |

|

|

(813 |

) |

|

|

|

Provision for Impairment |

|

67 |

|

|

|

— |

|

|

|

115 |

|

|

|

479 |

|

|

|

|

Realized

and Unrealized Loss (Gain) on Investment Securities |

|

(663 |

) |

|

|

1,174 |

|

|

|

3,376 |

|

|

|

6,092 |

|

|

|

|

Extinguishment of Contingent Obligation |

|

— |

|

|

|

(2,300 |

) |

|

|

— |

|

|

|

(2,300 |

) |

|

|

Funds from Operations |

$ |

11,980 |

|

|

$ |

10,176 |

|

|

$ |

23,430 |

|

|

$ |

19,559 |

|

|

|

|

Distributions to Preferred Stockholders |

|

(1,871 |

) |

|

|

(1,195 |

) |

|

|

(3,058 |

) |

|

|

(2,390 |

) |

|

|

Funds From Operations Attributable to Common Stockholders |

$ |

10,109 |

|

|

$ |

8,981 |

|

|

$ |

20,372 |

|

|

$ |

17,169 |

|

|

|

|

Amortization of Intangibles to Lease Income |

|

244 |

|

|

|

627 |

|

|

|

718 |

|

|

|

1,306 |

|

|

|

|

Less:

Effect of Dilutive Interest Related to 2025 Notes (1) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

Core Funds From Operations Attributable to Common Stockholders |

$ |

10,353 |

|

|

$ |

9,608 |

|

|

$ |

21,090 |

|

|

$ |

18,475 |

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Straight-Line Rent Adjustment |

|

(346 |

) |

|

|

122 |

|

|

|

(1,039 |

) |

|

|

(129 |

) |

|

|

|

COVID-19

Rent Repayments |

|

— |

|

|

|

17 |

|

|

|

— |

|

|

|

43 |

|

|

|

|

Other

Depreciation and Amortization |

|

(3 |

) |

|

|

(57 |

) |

|

|

(7 |

) |

|

|

(116 |

) |

|

|

|

Amortization of Loan Costs, Discount on Convertible Debt,

andCapitalized Interest |

|

297 |

|

|

|

229 |

|

|

|

518 |

|

|

|

437 |

|

|

|

|

Non-Cash

Compensation |

|

750 |

|

|

|

862 |

|

|

|

2,137 |

|

|

|

1,934 |

|

|

| Adjusted Funds

From Operations Attributable to Common Stockholders |

$ |

11,051 |

|

|

$ |

10,781 |

|

|

$ |

22,699 |

|

|

$ |

20,644 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO

Attributable to Common Stockholders per Common Share -

Diluted(1) |

$ |

0.44 |

|

|

$ |

0.40 |

|

|

$ |

0.90 |

|

|

$ |

0.76 |

|

|

|

|

Core FFO

Attributable to Common Stockholders per Common Share -Diluted

(1) |

$ |

0.45 |

|

|

$ |

0.43 |

|

|

$ |

0.93 |

|

|

$ |

0.82 |

|

|

|

|

AFFO

Attributable to Common Stockholders per Common Share -

Diluted(1) |

$ |

0.48 |

|

|

$ |

0.48 |

|

|

$ |

1.00 |

|

|

$ |

0.91 |

|

|

|

|

|

|

|

(1) |

For the three and six months ended June 30, 2024 and 2023, interest

related to the 2025 Convertible Senior Notes was excluded from net

income (loss) attributable to the Company to derive FFO, as the

impact to net income (loss) attributable to common stockholders

would be anti-dilutive. Further, the weighted average shares used

to compute per share amounts for FFO Attributable to Common

Stockholders per Common Share – Diluted, Core FFO Attributable to

Common Stockholders per Common Share - Diluted, and AFFO

Attributable to Common Stockholders per Common Share - Diluted do

not reflect any dilution related to the ultimate settlement of the

2025 Convertible Senior Notes. |

|

|

|

|

|

|

CTO Realty Growth, Inc.Non-GAAP Financial

MeasuresReconciliation of Net Debt to Pro Forma

EBITDA(Unaudited)(In thousands) |

|

| |

|

|

|

|

Three Months EndedJune 30, 2024 |

|

| Net Income

Attributable to the Company |

$ |

1,183 |

|

|

|

|

Depreciation and Amortization of Real Estate |

|

11,532 |

|

|

|

|

Gain on

Disposition of Other Assets |

|

(139 |

) |

|

|

|

Provision for Impairment |

|

67 |

|

|

|

|

Unrealized Gain on Investment Securities |

|

(663 |

) |

|

|

|

Distributions to Preferred Stockholders |

|

(1,871 |

) |

|

|

|

Amortization of Intangibles to Lease Income |

|

244 |

|

|

|

|

Straight-Line Rent Adjustment |

|

(346 |

) |

|

|

|

Other

Depreciation and Amortization |

|

(3 |

) |

|

|

|

Amortization of Loan Costs, Discount on Convertible Debt, and

Capitalized Interest |

|

297 |

|

|

|

|

Non-Cash

Compensation |

|

750 |

|

|

|

|

Other

Non-Recurring Items (1) |

|

(303 |

) |

|

|

|

Interest

Expense, Net of Amortization of Loan Costs and Discount on

ConvertibleDebt |

|

5,308 |

|

|

| EBITDA |

$ |

16,056 |

|

|

|

|

|

|

|

|

|

| Annualized

EBITDA |

$ |

64,224 |

|

|

|

|

Pro

Forma Annualized Impact of Current Quarter Investments and

Dispositions, Net(2) |

|

(244 |

) |

|

| Pro Forma

EBITDA |

$ |

63,980 |

|

|

| |

|

|

|

|

|

| Total Long-Term

Debt |

$ |

482,661 |

|

|

|

|

Financing Costs, Net of Accumulated Amortization |

|

1,048 |

|

|

|

|

Unamortized Convertible Debt Discount |

|

125 |

|

|

|

|

Cash and

Cash Equivalents |

|

(4,794 |

) |

|

| Net Debt |

$ |

479,040 |

|

|

| |

|

|

|

|

|

|

|

Net Debt

to Pro Forma EBITDA |

|

7.5 |

x |

|

| |

|

|

(1) |

Includes non-recurring items including termination fees,

forfeitures of tenant security deposits, and certain adjustments to

estimates related to recently acquired property CAM

reconciliations. |

|

|

(2) |

Reflects the pro forma annualized impact on Annualized EBITDA of

the Company’s investments and disposition activity during the three

months ended June 30, 2024. |

|

| |

|

|

|

Contact: |

Philip R. Mays |

|

|

Senior Vice President, Chief Financial Officer & Treasurer |

|

|

(407) 904-3324 |

|

|

pmays@ctoreit.com |

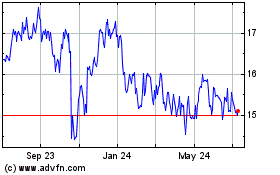

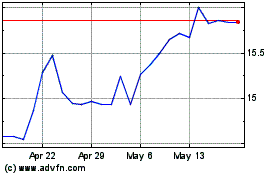

Alpine Income Property (NYSE:PINE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Alpine Income Property (NYSE:PINE)

Historical Stock Chart

From Nov 2023 to Nov 2024