As filed with the Securities and Exchange Commission on January 10,

2024

Securities Act File No. [·]

Investment Company Act File No. 811-23157

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-2

(Check Appropriate Box or Boxes)

| x |

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| ¨ |

Pre-Effective Amendment No. |

| ¨ |

Post-Effective Amendment No. |

and/or

| x |

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

| x |

Amendment No. 5 |

| |

|

BROOKFIELD REAL ASSETS INCOME FUND INC.

(Exact Name of Registrant as Specified in Charter)

Brookfield Place, 250 Vesey Street

New York, New York 10281-1023

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including

Area Code: (212) 417-7049

Brian F. Hurley, Esq.

Brookfield Real Assets Income Fund Inc.

Brookfield Place, 250 Vesey Street

New York, New York 10281-1023

(Name and Address of Agent for Service)

| |

| Copies to: |

| |

Craig A. Ruckman, Esq.

Brookfield Public Securities Group LLC

Brookfield Place

250 Vesey Street

New York, New York 10281-1023 |

Michael R. Rosella, Esq.

Thomas D. Peeney, Esq.

Paul Hastings LLP

200 Park Avenue

New York, New York 10166

(212) 318-6800 |

| |

|

Approximate date of proposed public offering:

From time to time after the effective date of this registration statement.

| ¨ | Check

box if the only securities being registered on this Form are being offered pursuant

to dividend or interest reinvestment plans. |

| x | Check

box if any securities being registered on this Form will be offered on a delayed or

continuous basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities

Act”), other than securities offered in connection with a dividend reinvestment plan. |

| x | Check

box if this Form is a registration statement pursuant to General Instruction A.2 or

a post-effective amendment thereto. |

| ¨ | Check

box if this Form is a registration statement pursuant to General Instruction B or a

post-effective amendment thereto that will become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act. |

| ¨ | Check

box if this Form is a post-effective amendment to a registration statement filed pursuant

to General Instruction B to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act. |

It is proposed that this filing will become

effective (check appropriate box):

| ¨ | when

declared effective pursuant to Section 8(c) of the Securities Act. |

If appropriate, check the following box:

| ¨ | This

[post-effective] amendment designates a new effective date for a previously filed [post-effective

amendment] [registration statement]. |

| ¨ | This

Form is filed to register additional securities for an offering pursuant to Rule 462(b) under

the Securities Act, and the Securities Act registration statement number of the earlier effective

registration statement for the same offering is: |

| ¨ | This

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, and the Securities Act registration statement number of the earlier effective

registration statement for the same offering is: |

| ¨ | This

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, and the Securities Act registration statement number of the earlier effective

registration statement for the same offering is: |

Check each box that appropriately characterizes

the Registrant:

| x | Registered

Closed-End Fund (closed-end company that is registered under the Investment Company Act of

1940 (“Investment Company Act”)). |

| ¨ | Business

Development Company (closed-end company that intends or has elected to be regulated as a

business development company under the Investment Company Act). |

| ¨ | Interval

Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase

offers under Rule 23c-3 under the Investment Company Act). |

| x | A.2

Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form). |

| ¨ | Well-Known

Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| ¨ | Emerging

Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange

Act”)). |

| ¨ | If

an Emerging Growth Company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of Securities Act. |

| ¨ | New

Registrant (registered or regulated under the Investment Company Act for less than 12 calendar

months preceding this filing). |

THE REGISTRANT

HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT

SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE

WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS

THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this Prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

Subject to Completion,

Preliminary Base Prospectus dated January 10, 2024

BASE PROSPECTUS

dated [·], 2024

$400,000,000

Brookfield Real Assets Income Fund Inc.

COMMON SHARES

PREFERRED SHARES

SUBSCRIPTION RIGHTS TO PURCHASE COMMON SHARES

SUBSCRIPTION RIGHTS TO PURCHASE PREFERRED SHARES

Important note. As permitted by regulations adopted

by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual stockholder reports will no longer

be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s

website (https://publicsecurities.brookfield.com/en), and you will be notified by mail each time a report is posted and provided with

a website link to access the report. You may elect to receive all future reports in paper free of charge. If you invest through a financial

intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports.

If you invest directly with the Fund, you may call 1-855-777-8001 or send an email request to publicsecurities.enquiries@brookfield.com

to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper

will apply to all funds held in your account if you invest through your financial intermediary or all funds held within the fund complex

if you invest directly with the Fund.

Brookfield Real Assets Income Fund Inc., a Maryland

corporation (the “Fund”), is a diversified, closed-end management investment company registered under the Investment Company

Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is to seek high total return, primarily through

high current income and secondarily, through growth of capital. No assurance can be given that the Fund’s investment objective will

be achieved. Brookfield Public Securities Group LLC (“PSG,” or the “Adviser”) serves as investment adviser to

the Fund.

Under normal market conditions, the Fund will

invest at least 80% of its average daily net assets plus the amount of any borrowings for investment purposes (the “Managed Assets”)

in the securities and other instruments of companies and issuers in the “real assets” asset class, which includes real estate

securities, infrastructure securities; and natural resources securities (collectively, “Real Asset Companies and Issuers”).

The Fund may change the 80% Policy without stockholder approval upon at least 60 days’ prior written notice to stockholders. The

Fund normally expects to invest at least 65% of its Managed Assets in fixed income securities of Real Asset Companies and Issuers and

in derivatives and other instruments that have economic characteristics similar to such securities. Under normal market conditions, the

Fund will invest more than 25% of its total assets in the real estate industry. The policy of concentration is a fundamental policy. This

fundamental policy and the investment restrictions described in the Statement of Additional Information under the caption “Investment

Restrictions” cannot be changed without the approval of the holders of a majority of the Fund’s outstanding voting securities.

An investment in the Fund is not appropriate for all investors. No assurances can be given that the Fund’s objectives will be achieved.

The Fund may offer, from time to time, in one

or more offerings, common shares or preferred shares, each having a par value of $0.001 per share, or subscription rights to purchase

our common shares or preferred shares (the “Offer”). Shares may be offered at prices and on terms to be set forth in one or

more supplements to this Prospectus (each, a “Prospectus Supplement”). You should read this Prospectus and the applicable

Prospectus Supplement carefully before you invest in our shares.

Our shares may be offered through agents designated

from time to time by us, directly to purchasers, or through a combination of these methods. The Prospectus Supplement relating to the

offering will identify any agents involved in the sale of our shares, and will set forth any applicable purchase price, fee, commission,

or discount arrangement between us and any agents or the basis upon which such amount may be calculated. The Prospectus Supplement relating

to any sale of preferred shares will set forth the liquidation preference and information about the dividend period, dividend rate, any

call protection or non-call period and other matters. We may not sell any of our shares through agents without delivery of a Prospectus

Supplement describing the method and terms of the particular offering of our shares.

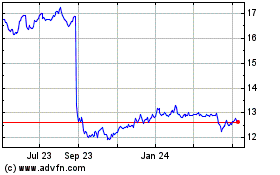

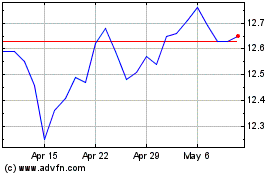

Our common shares are listed on the New York

Stock Exchange (“NYSE”) under the symbol “RA.” On January 8, 2024, the last reported sale price of our common

shares was $13.18 per share. The net asset value (“NAV”) of the Fund’s common shares at the close of business on January

8, 2024, was $14.84 per share. Shares of closed-end funds could trade at a discount to NAV. This creates a risk of loss for an investor

purchasing shares in a public offering.

Investing in our securities involves certain risks.

You could lose some or all of your investment. Shares of closed-end investment companies frequently trade at a discount to their NAV and

this may increase the risk of loss to purchasers of our securities. You should consider carefully these risks together with all of the

other information contained in this Prospectus and any Prospectus Supplement before making a decision to purchase our securities.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

(THE “SEC”) NOR ANY STATE SECURITY COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS

IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This Prospectus sets forth concisely information

about the Fund you should know before investing. Please read this Prospectus carefully before deciding whether to invest and retain it

for future reference. A Statement of Additional Information dated [·],

2024 (the “SAI”) has been filed with the SEC. A table of contents to the SAI is located on page 46 of this Prospectus.

This Prospectus incorporates by reference the entire SAI. The SAI is available along with other Fund-related materials at the SEC’s

public reference room in Washington, DC (call 1-202-551-8090 for information on the operation of the reference room), on the EDGAR database

on the SEC’s internet site (http://www.sec.gov), upon payment of copying fees by writing to the SEC’s Public Reference Section,

100 F Street, N.E., Washington, DC 20549-0102, or by electronic mail at publicinfo@sec.gov.

You may also request a free copy of the SAI, annual

and semi-annual reports to stockholders, when available, and additional information about the Fund, and may make other stockholder inquiries,

by calling 1-855-777-8001, by writing to the Fund or visiting the Fund’s website https://publicsecurities.brookfield.com/en

The securities do not represent a deposit or obligation

of, and are not guaranteed by or endorsed by, any bank or other insured depositary institution, and are not federally insured by the Federal

Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

You should rely only on the information contained

or incorporated by reference in this Prospectus. The Fund has not authorized any other person to provide you with different information.

If anyone provides you with different or inconsistent information, you should not rely on it. The Fund is not making an offer to sell

these securities in any jurisdiction where the offer or sale is not permitted.

TABLE OF CONTENTS

Page

Cautionary Notice Regarding Forward-Looking

Statements

This Prospectus, any accompanying Prospectus Supplement

and the SAI contain “forward-looking statements.” Forward-looking statements can be identified by the words “may,”

“will,” “intend,” “expect,” “estimate,” “continue,” “plan,” “anticipate,”

and similar terms and the negative of such terms. Such forward-looking statements may be contained in this Prospectus as well as in any

accompanying Prospectus Supplement. By their nature, all forward-looking statements involve risks and uncertainties, and actual results

could differ materially from those contemplated by the forward-looking statements. Several factors that could materially affect our actual

results are the performance of the portfolio of securities we hold, the price at which our shares will trade in the public markets and

other factors discussed in our periodic filings with the SEC. Currently known risk factors that could cause actual results to differ materially

from our expectations include, but are not limited to, the factors described in the “Risk Factors and Special Considerations”

section of this Prospectus. We urge you to review carefully that section for a more detailed discussion of the risks of an investment

in our securities.

Although we believe that the expectations expressed

in our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in our forward-looking

statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change

and are subject to inherent risks and uncertainties, such as those disclosed in the Fund’s Annual Report under the heading “Additional

Fund Information—Risk Factors and Special Considerations,” which is also incorporated by reference into this Prospectus and

any accompanying Prospectus Supplement. All forward-looking statements contained or incorporated by reference in this Prospectus or any

accompanying Prospectus Supplement are made as of the date of this Prospectus or the accompanying Prospectus Supplement, as the case may

be. Except for our ongoing obligations under the federal securities laws, we do not intend, and we undertake no obligation, to update

any forward-looking statement. The forward-looking statements contained in this Prospectus, any accompanying Prospectus Supplement and

the SAI are excluded from the safe harbor protection provided by section 27A of the Securities Act of 1933, as amended (the “Securities

Act”).

Prospectus Summary

The following summary is qualified in its entirety

by reference to the more detailed information appearing elsewhere or incorporated by reference in this Prospectus. It may not contain

all of the information that you should consider before investing in the securities offered by this Prospectus. Accordingly, you are encouraged

to carefully read the entire Prospectus, any related Prospectus Supplement, the SAI, and any documents incorporated by reference into

the above documents, as well as financial statements and related notes. As used in this Prospectus, the terms “the Fund,”

“our,” and “us” refer to the Brookfield Real Assets Income Fund Inc., a diversified, closed-end management investment

company organized as a corporation under the laws of the State of Maryland, unless the context suggests otherwise.

THE OFFER AT A GLANCE

Purpose of the Offer

We may offer, from time to time, in one or more

offerings or series, together or separately, up to $400,000,000 of our common shares, preferred shares or subscription rights to purchase

common shares or preferred shares, which we refer to, collectively, as the “securities.” We may sell our securities through

agents, underwriters or dealers, “at the market” to or through a market maker into an existing trading market or otherwise

directly to one or more purchasers, or through a combination of methods of sale. The identities of such agents, underwriters, dealers,

or market makers as the case may be, will be described in one or more supplements to this Prospectus. The securities may be offered at

prices and on terms to be described in one or more supplements to this Prospectus. In the event we offer common shares, the offering

price per share of our common shares exclusive of any underwriting commissions or discounts will not be less than the net asset value

(“NAV”) per share of our common shares at the time we make the offering except as permitted by applicable law. To the extent

that the Fund issues common shares and current stockholders do not participate, those current stockholders may experience a dilution

of their voting rights as new shares are issued to the public. Depending on the facts, any issuance of new common shares may also have

the effect of reducing any premium to per share net asset value at which the shares might trade and the market price at which the shares

might trade.

We may offer our securities directly to one or

more purchasers, through agents that we or they designate from time to time, or to or through underwriters or dealers. The Prospectus

Supplement relating to the relevant offering will identify any agents, underwriters, dealers involved in the sale of our securities, and

will set forth any applicable purchase price, fee, commission or discount arrangement between us and such agents or underwriters or among

underwriters or dealers and the basis upon which such amount may be calculated. See “Plan of Distribution.” Our securities

may not be sold through agents, underwriters or dealers without delivery or deemed delivery of a Prospectus and Prospectus Supplement

describing the method and terms of the applicable offering of our securities.

Use of Proceeds

The net proceeds of an offering will be invested

in accordance with the Fund’s investment objective and investment policies as set forth below. It is presently anticipated that

the Fund will be able to invest substantially all of the net proceeds of an offering in accordance with its investment objective and investment

policies within approximately three months of receipt by the Fund of the proceeds from the offering, depending on the amount and timing

of proceeds available to the Fund, as well as the availability of investments consistent with the Fund’s investment objective and

investment policies, and except to the extent proceeds are held in cash to pay dividends or expenses, or for temporary defensive purposes.

THE FUND AT A GLANCE

Information Regarding the Fund

Brookfield Real Assets Income Fund Inc. (the “Fund”)

is a diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940

Act”). The Fund was formed from the reorganizations of three closed-end funds, as further described below, and commenced operations

on December 5, 2016. The Fund’s shares are listed on the New York Stock Exchange (“NYSE”) and trade under the ticker

symbol “RA.” The Fund was incorporated under the laws of the State of Maryland on October 6, 2015.

The Fund was formed from the reorganizations of

each of Brookfield Mortgage Opportunity Income Fund Inc. (NYSE: BOI), Brookfield High Income Fund Inc. (NYSE: HHY), and Brookfield Total

Return Fund Inc. (NYSE: HTR) (collectively, the “Target Funds”) into the Fund (each, a “Reorganization” and together,

the “Reorganizations”). As a result of the Reorganizations, common stockholders of HHY, HTR and BOI, respectively, received

an amount of RA common shares equal to the aggregate net asset value of their holdings of HHY, HTR and BOI common shares, as applicable,

as determined at the close of business on December 2, 2016. As a result of the Reorganizations, the assets of the Target Funds were

combined, and the stockholders of each Target Fund became stockholders of the Fund.

Following the Reorganizations, another fund, Brookfield

Global Listed Infrastructure Income Fund Inc. (NYSE: INF), was reorganized into the Fund (also, a “Reorganization”). As a

result of this Reorganization, common stockholders of INF received newly issued common shares of RA, par value $0.001 per share, the aggregate

net asset value (not the market value) of which will equal the aggregate net asset value (not the market value) of the common shares of

INF held immediately prior to the Reorganization, less the costs of such Reorganization.

The Fund is treated as the survivor of the Reorganizations

for accounting and performance reporting purposes. Accordingly, all performance and other information shown for the Fund is from its commencement

of operations date on December 5, 2016, and there is no historical performance or other information to present for the Target Funds.

Investment Objective

The Fund’s investment objective is to seek

high total return, primarily through high current income and secondarily, through growth of capital.

The Fund’s investment objective is not fundamental

and may be changed without stockholder approval. Stockholders will be provided with at least 60 days’ prior written notice of any

change in the Fund’s investment objective.

As a fundamental policy, the Fund will not purchase

a security if, as a result, with respect to 75% of its total assets, more than 5% of the Fund’s total assets would be invested in

securities of a single issuer or more than 10% of the outstanding voting securities of the issuer would be held by the Fund. This policy

may not be changed without a stockholder vote.

The Fund makes investments that will result in

the concentration (as that term is used in the 1940 Act) of its assets. Under normal market conditions, the Fund will invest more than

25% of its total assets in the real estate industry. The policy of concentration is a fundamental policy. This fundamental policy and

the investment restrictions described in the Statement of Additional Information under the caption “Investment Restrictions”

cannot be changed without the approval of the holders of a majority of the Fund’s outstanding voting securities. Such majority vote

requires the approval of the lesser of (i) 67% of the Fund’s shares represented at a meeting at which more than 50% of the

Fund’s shares outstanding are represented, whether in person or by proxy, or (ii) more than 50% of the outstanding shares.

Principal Investment Policies

The Fund seeks to achieve its investment objective

by investing primarily in the securities and other instruments of companies and issuers in the “real assets” asset class,

which includes real estate securities, infrastructure securities; and natural resources securities (“Real Asset Companies and Issuers”).

Under normal market conditions, the Fund will invest at least 80% of its average daily net assets plus the amount of any borrowings for

investment purposes (“Managed Assets”) in the securities and other instruments of Real Asset Companies and Issuers. The Fund

may change the 80% Policy without stockholder approval upon at least 60 days’ prior written notice to stockholders. The Fund normally

expects to invest at least 65% of its Managed Assets in fixed income securities of Real Asset Companies and Issuers and in derivatives

and other instruments that have economic characteristics similar to such securities. Real Asset Companies and Issuers includes the following

categories:

The Fund actively trades portfolio investments.

The Fund may invest in securities and instruments of companies of any size market capitalization. The Fund will invest in companies located

throughout the world and there is no limitation on the Fund’s investments in foreign securities or instruments or in emerging markets.

An “emerging market” country is any country that is included in the MSCI Emerging Markets Index. The amount invested outside

the United States may vary, and at any given time, the Fund may have a significant exposure to non-U.S. securities. The Fund may invest

in securities of foreign companies in the form of American Depositary Receipts (“ADRs”), Global Depositary Receipts (“GDRs”)

and European Depositary Receipts (“EDRs”). Generally, ADRs in registered form are dollar denominated securities designed for

use in the U.S. securities markets, which represent and may be converted into an underlying foreign security. GDRs, in bearer form, are

designated for use outside the United States. EDRs, in bearer form, are designed for use in the European securities markets.

The Fund has flexibility in the relative weightings

given to each of these categories. In addition, the Fund may, in the future, invest in additional investment categories other than those

listed herein, to the extent consistent with the Fund’s investment objective.

The Fund may, in the future, invest in additional

investment categories other than those listed herein, to the extent consistent with its investment objective. The Fund may invest without

limit in investment grade and below investment grade, high yield fixed income securities (commonly referred to as “junk bonds”).

The Fund may also invest in restricted (“144A”) or private securities, asset-backed securities (“ABS”), including

mortgage-related debt securities and other mortgage-related instruments (collectively, “Mortgage-Related Investments”), collateralized

loan obligations, bank loans (including covenant-lite obligations, participations, assignments, senior loans, delayed funding loans and

revolving credit facilities), exchange-traded notes, and securities issued and/or guaranteed by the U.S. Government, its agencies or instrumentalities

or sponsored corporations. The Fund considers Mortgage-Related Investments to consist of, but not be limited to, mortgage-backed securities

(“MBS”) of any kind; interests in loans and/or whole loan pools of mortgages, loans or other instruments used to finance long-term

infrastructure, industrial projects and public services; mortgage REITs; ABS that are backed by interest in real estate, land or other

types of assets; and securities and other instruments issued by mortgage servicers. The Fund’s investments in MBS may include Residential

Mortgage-Backed Securities (“RMBS”) or Commercial Mortgage-Backed Securities (“CMBS”). The Fund may invest in

fixed income securities and other debt instruments of any maturity and credit quality, including securities that are unrated. The securities

the Fund may invest in may have fixed, floating or variable rates. Under normal market conditions, the Fund will invest more than 25%

of its total assets in the real estate industry. For purposes of this limitation, obligations issued or guaranteed by the U.S. government

or its agencies or instrumentalities will not be considered members of any industry. The Fund will also invest in a variety of industries

related to real assets, including among others, infrastructure and natural resources, as described below.

The Fund defines a real estate security as any

company or issuer that (i) derives at least 50% of its revenues from the ownership, operation, development, construction, financing,

management or sale of commercial, industrial or residential real estate and similar activities, or (ii) commits at least 50% of its

assets to activities related to real estate.

For purposes of selecting investments in real

estate securities, the Fund defines the real estate sector broadly. It includes, but is not limited to, the following:

| · | real estate investment trusts (“REITs”); |

| · | real estate operating companies (“REOCs”); |

| · | brokers, developers and builders of residential, commercial, and industrial properties; |

| · | property management firms; |

| · | finance, mortgage, and mortgage servicing firms; |

| · | construction supply and equipment manufacturing companies; |

| · | firms dependent on real estate holdings for revenues and profits, including lodging, leisure, timber,

mining and agriculture companies; and |

| · | debt securities, including securitized obligations, which are predominantly (i.e., at least 50%)

supported by real estate assets. |

REITs are companies that own interests in real

estate or in real estate related loans or other interests, and their revenue primarily consists of rent derived from owned, income producing

real estate properties and capital gains from the sale of such properties. A REIT in the United States is generally not taxed on income

distributed to stockholders so long as it meets tax-related requirements, including the requirement that it distribute substantially all

of its taxable income to its stockholders. Dividends from REITs are not “qualified dividends” and therefore are taxed as ordinary

income rather than at the reduced capital gains rate. REIT-like entities are organized outside of the United States and maintain operations

and receive tax treatment similar to that of U.S. REITs. The Fund retains the ability to invest in real estate companies of any size market

capitalization. The Fund will not invest in real estate directly.

REOCs are real estate companies that have not

elected to be taxed as REITs and therefore are not required to distribute taxable income and have fewer restrictions on what they can

invest in.

The Fund defines an infrastructure security as,

any company or issuer that (i) derives at least 50% of its revenue or profits, either directly or indirectly, from infrastructure

assets, or (ii) commits at least 50% of its assets to activities related to infrastructure.

For purposes of selecting investments in infrastructure

securities, the Fund defines the infrastructure sector broadly. It includes, but is not limited to, the physical structures, networks

and systems of transportation, energy, water and sewage, and communication. Infrastructure assets include the following:

| · | toll roads, bridges and tunnels; |

| · | electricity generation and transmission and distribution lines; |

| · | gathering, treating, processing, fractionation, transportation and storage of hydrocarbon products; |

| · | water and sewage treatment and distribution pipelines; |

| · | communication towers and satellites; |

| · | other companies with direct and indirect involvement in infrastructure through the development, construction

or operation of infrastructure assets. |

Infrastructure securities also include master

limited partnerships (“MLPs”).

An MLP is a publicly traded company organized

as a limited partnership or limited liability company and treated as a partnership for federal income tax purposes. MLPs may derive income

and gains from the exploration, development, mining or production, processing, refining, transportation (including pipelines transporting

gas, oil, or products thereof), or the marketing of any mineral or natural resources. MLPs generally have two classes of owners, the general

partner and limited partners. The general partner of an MLP is typically owned by one or more of the following: a major energy company,

an investment fund, or the direct management of the MLP. The general partner may be structured as a private or publicly traded corporation

or other entity. The general partner typically controls the operations and management of the MLP through an up to 2% equity interest in

the MLP plus, in many cases, ownership of common units and subordinated units. Limited partners own the remainder of the partnership,

through ownership of common units, and have a limited role in the partnership’s operations and management. From time to time, the

energy sector will experience volatility as a result of fluctuations in the price of oil and such volatility may continue in the future.

As a result, MLPs that invest in the oil industry are subject to greater volatility than MLPs that do not invest in the oil sector.

From time to time, the Fund may invest in stapled

securities to gain exposure to certain infrastructure companies. A stapled security is a security that is comprised of two parts that

cannot be separated from one another. The two parts of a stapled security are a unit of a trust and a share of a company. The resulting

security is influenced by both parts, and must be treated as one unit at all times, such as when buying or selling a security. The value

of stapled securities and the income derived from them may fall as well as rise. Stapled securities are not obligations of, deposits in,

or guaranteed by, the Fund. The listing of stapled securities on a domestic or foreign exchange does not guarantee a liquid market for

stapled securities.

The Fund defines a natural resources security

as, any company or issuer that derives at least 50% of its revenues, profits or value, either directly or indirectly, from natural resources

assets including, but not limited to:

| · | timber and agriculture assets and securities; |

| · | commodities and commodity-linked assets and securities, including, but not limited to, precious metals,

such as gold, silver and platinum, ferrous and nonferrous metals, such as iron, aluminum and copper, metals such as uranium and titanium,

hydrocarbons such as coal, oil and natural gas, timberland, undeveloped real property and agricultural commodities; and |

| · | energy, including the exploration, production, processing and manufacturing of hydrocarbon-related and

chemical-related products. |

Commodities are assets that have tangible properties,

such as oil, coal, natural gas, agricultural products, industrial metals, livestock and precious metals. In order to gain exposure to

the commodities markets without investing directly in physical commodities, the Fund may invest in commodity index-linked notes. Commodity

index-linked notes are derivative debt instruments with principal and/or coupon payments linked to the performance of commodity indices.

These notes are sometimes referred to as “structured notes” because the terms of these notes may be structured by the issuer

and the purchaser of the note. The value of these notes will rise or fall in response to changes in the underlying commodity index and

will be subject to credit and interest rate risks that typically affect debt securities.

The Fund may also invest up to 35% of its Managed

Assets in equities, including common stock, preferred stock, convertible stock, and open-end and closed-end investment companies, including

exchange-traded products. The Fund may invest up to 20% of its Managed Assets in fixed income securities other than those of Real Asset

Companies and Issuers, including in treasury inflation protection securities and other inflation-linked fixed income securities.

The Adviser will determine the Fund’s strategic

allocation with respect to its debt and equity investments as well as its strategic allocation with respect to its investment sub-portfolios.

The Fund intends to use leverage to seek to achieve

its investment objective. The Fund currently anticipates obtaining leverage through reverse repurchase agreements and through borrowings

from banks and/or other financial institutions. As a non-fundamental policy that may be changed by the Fund’s Board of Directors

(the “Board” or the “Board of Directors”), the Fund may issue preferred shares or borrow money and issue debt

securities (“traditional leverage”) with an aggregate liquidation preference and aggregate principal amount up to 331/3%

of the Fund’s total assets. The use of borrowing techniques, preferred shares, debt or effective leverage (defined below) to leverage

the common shares will involve greater risk to common stockholders. The Fund will monitor interest rates and market conditions and anticipates

that it will leverage the common shares at some point in the future if the Fund’s Board determines that it is in the best interest

of the Fund and its common stockholders. In addition, the Fund may enter into reverse repurchase agreements, swaps, futures, securities

lending, or short sales, that may provide leverage (collectively referred to as “effective leverage”). Such effective leverage

will be considered leverage for the Fund’s leverage limits.

The 1940 Act generally prohibits the Fund from

engaging in most forms of leverage (including the use of bank loans or other credit facilities, and loans of portfolio securities) unless

immediately after the issuance of the leverage the Fund has satisfied the asset coverage test with respect to senior securities representing

indebtedness prescribed by the 1940 Act; that is, the value of the Fund’s total assets less all liabilities and indebtedness not

represented by senior securities (for these purposes, “total assets”) is at least 300% of the senior securities representing

indebtedness (effectively limiting the use of leverage through senior securities representing indebtedness to 331/3%

of the Fund’s total assets in accordance with the 1940 Act). In addition, the Fund is not permitted to declare any cash dividend

or other distribution on Shares unless, at the time of such declaration, this asset coverage test is satisfied. For the purpose of borrowing

money, “asset coverage” means the ratio that the value of the Fund’s total assets, minus liabilities other than borrowings,

bears to the aggregate amount of all borrowings. Certain trading practices and investments may be considered to be borrowings and thus

subject to the 1940 Act restrictions. On the other hand, certain practices and investments may involve leverage but are not considered

to be borrowings under the 1940 Act, such as the purchasing of securities on a when-issued or delayed delivery basis, entering into reverse

repurchase agreements, credit default swaps or futures contracts, engaging in short sales and writing options on portfolio securities,

so long as the Fund complies with an applicable exemption in Rule 18f-4. Borrowing, especially when used for leverage, may cause

the value of the Fund’s shares to be more volatile than if the Fund did not borrow. This is because borrowing tends to magnify the

effect of any increase or decrease in the value of the Fund’s portfolio holdings. Borrowed money thus creates an opportunity for

greater gains, but also greater losses. To the extent that the Fund engages in borrowings, it may prepay a portion of the principal amount

of the borrowing to the extent necessary in order to maintain the required asset coverage. Failure to maintain certain asset coverage

requirements could result in an event of default.

The Adviser utilizes a fundamental, bottom-up,

value-based selection methodology, taking into account short-term considerations, such as temporary market mispricing, and long-term considerations,

such as values of assets and cash flows. Founded in 1989, the Adviser is an indirect wholly-owned subsidiary of Brookfield Asset Management

ULC, an unlimited liability company formed under the laws of British Columbia, Canada (“BAM ULC”). Brookfield Corporation,

a publicly traded company (NYSE: BN; TSX: BN), holds a 75% interest in BAM ULC, while Brookfield Asset Management Ltd., a publicly traded

company (NYSE: BAM; TSX: BAMA) (“Brookfield Asset Management”), holds a 25% interest in BAM ULC. Brookfield Asset Management

is a leading global alternative asset manager focused on real estate, renewable power, infrastructure and private equity, with assets

under management of approximately $[·] billion as of [·]. In addition to the Fund, the Adviser’s clients include financial

institutions, public and private pension plans, insurance companies, endowments and foundations, sovereign wealth funds and high net-worth

investors. The Adviser specializes in global listed real assets strategies and its investment philosophy incorporates a value-based approach

towards investment. The Adviser also provides advisory services to several other registered investment companies. As of [·], the

Adviser and its affiliates had approximately $[·] billion in assets under management. The Adviser’s principal offices are located

at Brookfield Place, 250 Vesey Street, New York, New York 10281-1023.

Distributions and Dividends

The Fund intends to distribute to common stockholders

all or a portion of its net investment income monthly and net realized capital gains, if any, at least annually. Under normal market conditions,

the Fund intends to distribute substantially all of its distributable cash flows, less Fund expenses, to stockholders monthly. The Fund

intends to pay common stockholders annually all, or at least 90%, of its investment company taxable income. Various factors will affect

the level of the Fund’s investment company taxable income, such as its asset mix. Distributions may be paid to the holders of the

Fund’s shares of common shares if, as and when authorized by the Board of Directors and declared by the Fund out of assets legally

available therefor. To permit the Fund to maintain more stable monthly distributions, it may from time to time distribute less than the

entire amount of income earned in a particular period, with the undistributed amount being available to supplement future distributions.

As a result, the distributions paid by the Fund for any particular monthly period may be more or less than the amount of income actually

earned during that period. Because the Fund’s income will fluctuate and the Fund’s distribution policy may be changed by the

Board of Directors at any time, there can be no assurance that the Fund will pay distributions or dividends. Distributions are subject

to re-characterization for federal income tax purposes after the end of the fiscal year.

In the event that the total distributions on the

Fund’s shares exceed the Fund’s current and accumulated earnings and profits allocable to such shares, the excess distributions

will generally be treated as a tax free return of capital (to the extent of the stockholder’s tax basis in the shares). A return

of capital is a return to investors of a portion of their original investment in the Fund rather than income or capital gain. Stockholders

should not assume that the source of a distribution from the Fund is net profit or income. Distributions sourced from paid-in capital

should not be considered the current yield or the total return from an investment in the Fund. The amount treated as a tax free return

of capital will reduce a stockholder’s adjusted tax basis in the shares of common shares (but not below zero), thereby increasing

the stockholder’s potential taxable gain or reducing the potential loss on the sale of the shares.

Distributions paid by the Fund will be reinvested

in additional shares of the Fund, unless a stockholder elects to receive all distributions in cash.

Market Price of Shares

In addition to net asset value, the market price

of the common shares may be affected by such factors as the Fund’s dividend and distribution levels (which are affected by expenses)

and stability, market liquidity, market supply and demand, unrealized gains, general market and economic conditions and other factors.

The common shares are designed primarily for long-term

investors, and you should not purchase common shares of the Fund if you intend to sell them shortly after purchase.

Plan of Distribution

We may sell our securities from time to time on

an immediate, continuous or delayed basis, in one or more offerings under this Prospectus and any applicable Prospectus Supplement in

any one or more of the following ways (1) directly to one or more purchasers, (2) through agents for the period of their appointment,

(3) to underwriters as principals for resale to the public, (4) to dealers as principals for resale to the public, (5) through,

in the case of our common shares, “at-the-market” transactions or (6) pursuant to our Dividend Reinvestment Plan.

The securities may be sold from time to time in

one or more transactions at a fixed price or fixed prices, which may change; at prevailing market prices at the time of sale; prices related

to prevailing market prices; at varying prices determined at the time of sale; or at negotiated prices. The applicable Prospectus Supplement

will describe the method of distribution of our securities offered therein. Each Prospectus Supplement relating to an offering of our

securities will state the terms of the offering.

Risk Factors and Special Considerations

You should carefully consider the following principal

risk factors, as well as the other information in this Prospectus, before making an investment in the Fund under this Offer.

Market Discount Risk. Whether investors

will realize gains or losses upon the sale of the Fund’s common shares will depend upon the market price of the shares at the time

of sale, which may be less or more than the Fund’s NAV per share. Since the market price of the Fund’s common shares will

be affected by various factors such as the Fund’s dividend and distribution levels (which are in turn affected by expenses), dividend

and distribution stability, NAV, market liquidity, the relative demand for and supply of the common shares in the market, unrealized gains,

general market and economic conditions and other factors beyond the control of the Fund, it is impossible to predict whether the Fund’s

common shares will trade at, below or above NAV or at, below or above the public offering price.

Health Crisis Risk. An outbreak of an infectious

respiratory illness, COVID-19, caused by a novel coronavirus has resulted in travel restrictions, disruption of healthcare systems, prolonged

quarantines, cancellations, supply chain disruptions, lower consumer demand, layoffs, ratings downgrades, defaults and other significant

economic impacts. Certain markets have experienced temporary closures, extreme volatility, severe losses, reduced liquidity and increased

trading costs. In particular, COVID-19 has resulted in substantial market volatility and global business disruption, impacting the global

economy and the financial health of individual companies in significant and unforeseen ways. The duration and future impact of COVID-19

are currently unknown, which may exacerbate other types of risks that apply to the Fund and negatively impact Fund performance and the

value of your investment in the Fund. It is not possible to determine the ultimate impact of COVID-19 at this time. Further, the extent

and strength of any economic recovery after the COVID-19 pandemic abates is uncertain and subject to various factors and conditions, including

the emergence of other infectious illness outbreaks that may have similar impacts. Accordingly, an investment in the Fund is subject to

an elevated degree of risk as compared to other market environments.

High Yield (“Junk”) Securities

Risk. Investors should recognize that below investment grade and unrated securities in which the Fund will invest subject Fund stockholders

to greater levels of credit risk, call risk and liquidity risk than funds that do not invest in such securities. Generally, lower rated

or unrated securities of equivalent credit quality offer a higher return potential than higher rated securities but involve greater volatility

of price and greater risk of loss of income and principal, including the possibility of a default or bankruptcy of the issuers of such

securities. Lower rated securities and comparable unrated securities will likely have larger uncertainties or major risk exposure to adverse

conditions and are predominantly speculative. The occurrence of adverse conditions and uncertainties would likely reduce the value of

securities held by the Fund, with a commensurate effect on the value of the Fund’s common shares.

Distressed Securities Risk. An investment

in the securities of financially distressed issuers can involve substantial risks. These securities may present a substantial risk of

default or may be in default at the time of investment. The Fund may incur additional expenses to the extent it is required to seek recovery

upon a default in the payment of principal or interest on its portfolio holdings. In any reorganization or liquidation proceeding relating

to a portfolio company, the Fund may lose its entire investment or may be required to accept cash or securities with a value less than

its original investment. Among the risks inherent in investments in a troubled entity is the fact that it frequently may be difficult

to obtain information as to the true financial condition of such issuer. The Adviser’s judgment about the credit quality of the

issuer and the relative value and liquidity of its securities may prove to be wrong.

Collateralized Loan Obligation (“CLO”)

Risk. CLOs and other similarly structured securities are types of asset-backed securities. The cash flows from the CLO trust are split

into two or more portions, called tranches, varying in risk and yield. The riskiest portion is the “equity” tranche which

bears the bulk of defaults from the loans in the trust and serves to protect the other, more senior tranches from default in all but the

most severe circumstances. Since it is partially protected from defaults, a senior tranche from a CLO trust typically has higher ratings

and lower yields than the underlying securities, and can be rated investment grade. Despite the protection from the equity tranche, CLO

tranches can experience substantial losses due to actual defaults, increased sensitivity to defaults due to collateral default and disappearance

of protecting tranches, market anticipation of defaults and aversion to CLO securities as a class. The risks of an investment in a CLO

depend largely on the collateral and the class of the CLO in which the Fund invests. Normally, CLOs and other similarly structured securities

are privately offered and sold, and thus are not registered under the securities laws. As a result, investments in CLOs may be characterized

by the Fund as illiquid securities; however, an active dealer market, or other relevant measures of liquidity, may exist for CLOs allowing

a CLO potentially to be deemed liquid by the Adviser under liquidity policies approved by the Fund’s Board of Directors. In addition

to the risks associated with debt instruments (e.g., interest rate risk and credit risk), CLOs carry additional risks including,

but not limited to: (i) the possibility that distributions from collateral securities will not be adequate to make interest or other

payments; (ii) the quality of the collateral may decline in value or default; (iii) the possibility that the Fund may invest

in CLOs that are subordinate to other classes; and (iv) the complex structure of the security may not be fully understood at the

time of investment and may produce disputes with the issuer or unexpected investment results.

Mortgage and Asset-Backed Securities. The

Fund may invest in a variety of mortgage related and other asset-backed securities, including both commercial and residential mortgage

securities and other mortgage backed instruments issued on a public or private basis. Mortgage backed securities represent the right to

receive a portion of principal and/or interest payments made on a pool of residential or commercial mortgage loans. When interest rates

fall, borrowers may refinance or otherwise repay principal on their mortgages earlier than scheduled. When this happens, certain types

of mortgage backed securities will be paid off more quickly than originally anticipated and the Fund will have to invest the proceeds

in securities with lower yields. This risk is known as “prepayment risk.” When interest rates rise, certain types of mortgage

backed securities will be paid off more slowly than originally anticipated and the value of these securities will fall. This risk is known

as “extension risk.” Because of prepayment risk, mortgage backed securities react differently to changes in interest rates

than other fixed income securities. Small movements in interest rates (both increases and decreases) may quickly and significantly reduce

the value of certain mortgage backed securities.

Residential Mortgage Backed Securities Risk.

The investment characteristics of RMBS differ from those of traditional debt securities. The major differences include the fact that,

on certain RMBS, prepayments of principal may be made at any time. Prepayment rates are influenced by changes in current interest rates

and a variety of economic, geographic, social and other factors and cannot be predicted with certainty. Subordinated classes of collateralized

mortgage obligations are entitled to receive repayment of principal in many cases only after all required principal payments have been

made to more senior classes and also have subordinated rights as to receipt of interest distributions. Such subordinated classes are subject

to a greater risk of non-payment than are senior classes of collateralized mortgage obligations guaranteed by an agency or instrumentality

of the U.S. Government.

Commercial Mortgage Backed Securities Risk.

CMBS may involve the risks of delinquent payments of interest and principal, early prepayments and potentially unrecoverable principal

loss from the sale of foreclosed property. Subordinated classes of CMBS are entitled to receive repayment of principal only after all

required principal payments have been made to more senior classes and also have subordinated rights as to receipt of interest distributions.

Such subordinated classes are subject to a greater risk of non-payment than are senior classes.

Prepayment or Call Risk. For certain types

of MBS, prepayments of principal may be made at any time. Prepayment rates are influenced by changes in current interest rates and a variety

of economic, geographic, social and other factors and cannot be predicted with certainty. During periods of declining mortgage interest

rates, prepayments on MBS generally increase. If interest rates in general also decline, the amounts available for reinvestment by the

Fund during such periods are likely to be reinvested at lower interest rates than the Fund was earning on the MBS that were prepaid, resulting

in a possible decline in the Fund’s income and distributions to stockholders. If interest rates fall, it is possible that issuers

of fixed income securities with high interest rates will prepay or “call” their securities before their maturity date. Under

certain interest rate or prepayment scenarios, the Fund may fail to recoup fully its investment in such securities.

Inflation, Interest Rate and Bond Market

Risk. Inflation risk is the risk that the value of assets or income from investments will be worth less in the future as inflation

decreases the value of money. As inflation increases, the real value of the Fund’s shares and distributions thereon can decline.

Inflation risk is linked to increases in the prices of goods and services and a decrease in the purchasing power of money. Since the beginning

of 2021, inflation has risen at its highest rate in four decades in the U.S. Inflation may reduce the intrinsic value of an investment

in the Fund. While the Biden Administration and the Federal Reserve have made efforts to reduce the effects of inflation on the U.S. economy

and financial markets, the mitigating effects of such efforts are uncertain. The value of certain fixed income securities in the Fund’s

portfolio could be affected by interest rate fluctuations. Generally, when market interest rates fall, fixed rate securities prices rise,

and vice versa. Interest rate risk is the risk that the securities in the Fund’s portfolio will decline in value because of increases

in market interest rates. The prices of longer-term securities fluctuate more than prices of shorter -term securities as interest rates

change. These risks may be greater in a market environment where certain interest rates approach unusually low levels.

Variable and Floating Rate Securities Risk.

Variable and floating rate securities provide for adjustment in the interest rate paid on the obligations. The terms of such obligations

typically provide that interest rates are adjusted based upon an interest or market rate adjustment as provided in the respective obligations.

The adjustment intervals may be regular, and range from daily up to annually, or may be event-based, such as based on a change in the

prime rate. Variable rate obligations typically provide for a specified periodic adjustment in the interest rate, while floating rate

obligations typically have an interest rate which changes whenever there is a change in the external interest or market rate. Because

of the interest rate adjustment feature, variable and floating rate securities provide the Fund with a certain degree of protection against

rises in interest rates, although the Fund will participate in any declines in interest rates as well. Generally, changes in interest

rates will have a smaller effect on the market value of variable and floating rate securities than on the market value of comparable fixed-income

obligations. Thus, investing in variable and floating rate securities generally allows less opportunity for capital appreciation and depreciation

than investing in comparable fixed-income securities.

Corporate Bonds Risk. Corporate debt securities

are subject to the risk of the issuer’s inability to meet principal and interest payments on the obligation and may also be subject

to price volatility due to such factors as interest rate sensitivity, market perception of the creditworthiness of the issuer and general

market liquidity. When interest rates rise, the value of corporate debt can be expected to decline. Debt securities with longer maturities

tend to be more sensitive to interest rate movements than those with shorter maturities.

Credit Risk. Credit risk is the risk that

one or more bonds in the Fund’s portfolio will (1) decline in price due to deterioration of the issuer’s or underlying

pool’s financial condition or other events or (2) fail to pay interest or principal when due. The prices of non-investment

grade quality securities (that is, securities rated Ba or lower by Moody’s or BB or lower by S&P or Fitch) are generally more

sensitive to negative developments, such as a general economic downturn or an increase in delinquencies in the pool of underlying mortgages

that secure an MBS, than are the prices of higher grade securities. Non-investment grade quality securities are regarded as having predominantly

speculative characteristics with respect to the issuer’s or pool’s capacity to pay interest and repay principal when due and

as a result involve a greater risk of default. The market for lower-graded securities may also have less information available than the

market for other securities.

Bank Loan Risk. Bank loans (including senior

loans) are usually rated below investment grade. The market for bank loans may be subject to irregular trading activity, wide bid/ask

spreads and extended trade settlement periods. Investments in bank loans are typically in the form of an assignment or participation.

Investors in a loan participation assume the credit risk associated with the borrower and may assume the credit risk associated with an

interposed financial intermediary. Accordingly, if a lead lender becomes insolvent or a loan is foreclosed, the Fund could experience

delays in receiving payments or suffer a loss. In an assignment, the Fund effectively becomes a lender under the loan agreement with the

same rights and obligations as the assigning bank or other financial intermediary.

Accordingly, if the loan is foreclosed, the Fund

could become part owner of any collateral, and would bear the costs and liabilities associated with owning and disposing of the collateral.

Due to their lower place in the borrower’s capital structure and possible unsecured status, junior loans involve a higher degree

of overall risk than senior loans of the same borrower. In addition, the floating rate feature of loans means that bank loans will not

generally experience capital appreciation in a declining interest rate environment. Declines in interest rates may also increase prepayments

of debt obligations and require the Fund to invest assets at lower yields.

The Fund may also invest in covenant-lite obligations.

Covenant-lite obligations contain fewer maintenance covenants than other obligations, or no maintenance covenants, and may not include

terms that allow the lender to monitor the performance of the borrower and declare a default if certain criteria are breached. Covenant-lite

loans may carry more risk than traditional loans as they allow individuals and corporations to engage in activities that would otherwise

be difficult or impossible under a covenant-heavy loan agreement. In the event of default, covenant-lite loans may exhibit diminished

recovery values as the lender may not have the opportunity to negotiate with the borrower prior to default.

Leverage Risk. The Fund currently intends

to use leverage to seek to achieve its investment objectives. The borrowing of money or issuance of debt securities and preferred stock

represents the leveraging of the Fund’s common stock. In addition, the Fund may also leverage its common stock through investment

techniques, such as reverse repurchase agreements, writing credit default swaps, futures or engaging in short sales. Leverage creates

risks which may adversely affect the return for the holders of common stock.

Leverage is a speculative technique that could

adversely affect the returns to common stockholders. Leverage can cause the Fund to lose money and can magnify the effect of any losses.

To the extent the income or capital appreciation derived from securities purchased with funds received from leverage exceeds the cost

of leverage, the Fund’s return will be greater than if leverage had not been used. Conversely, if the income or capital appreciation

from the securities purchased with such funds is not sufficient to cover the cost of leverage or if the Fund incurs capital losses, the

return of the Fund will be less than if leverage had not been used, and therefore the amount available for distribution to common stockholders

as dividends and other distributions will be reduced or potentially eliminated (or, in the case of distributions, will consist of return

of capital).

The Fund will pay (and the common stockholders

will bear) all costs and expenses relating to the Fund’s use of leverage, which will result in the reduction of the NAV of the common

stock.

Recent Market, Economic and Social Developments

Risk. Periods of market volatility remain, and may continue to occur in the future, in response to various political, social and economic

events both within and outside the United States. These conditions have resulted in, and in many cases continue to result in, greater

price volatility, less liquidity, widening credit spreads and a lack of price transparency, with many securities remaining illiquid and

of uncertain value. Such market conditions may adversely affect the Fund, including by making valuation of some of the Fund’s securities

uncertain and/or result in sudden and significant valuation increases or declines in the Fund’s holdings. If there is a significant

decline in the value of the Fund’s portfolio, this may impact the asset coverage levels for the Fund’s outstanding leverage.

Risks resulting from any future debt or other

economic crisis could also have a detrimental impact on the global economic recovery, the financial condition of financial institutions

and the Fund’s business, financial condition and results of operation. Market and economic disruptions have affected, and may in

the future affect, consumer confidence levels and spending, personal bankruptcy rates, levels of incurrence and default on consumer debt

and home prices, among other factors. To the extent uncertainty regarding the U.S. or global economy negatively impacts consumer confidence

and consumer credit factors, the Fund’s business, financial condition and results of operations could be significantly and adversely

affected. Downgrades to the credit ratings of major banks could result in increased borrowing costs for such banks and negatively affect

the broader economy. Moreover, Federal Reserve policy, including with respect to certain interest rates, may also adversely affect the

value, volatility and liquidity of dividend- and interest-paying securities. Market volatility, rising interest rates and/or unfavorable

economic conditions could impair the Fund’s ability to achieve its investment objective.

Geopolitical Risk. Occurrence of global

events such as war, terrorist attacks, natural disasters, country instability, infectious disease epidemics, pandemics and other public

health issues, market instability, debt crises and downgrades, embargoes, tariffs, sanctions and other trade barriers and other governmental

trade or market control programs, the potential exit of a country from its respective union and related geopolitical events, may result

in market volatility and may have long-lasting impacts on both the U.S. and global financial markets. Additionally, those events, as well

as other changes in foreign and domestic political and economic conditions, could adversely affect individual issuers or related groups

of issuers, securities markets, interest rates, secondary trading, credit ratings, inflation, investor sentiment and other factors affecting

the value of the Fund’s investments.

Common Stock Risk. Common stock of an issuer

in the Fund’s portfolio may decline in price for a variety of reasons, including if the issuer fails to make anticipated dividend

payments. Common stock in which the Fund will invest is structurally subordinated to preferred stock, bonds and other debt instruments

in a company’s capital structure, in terms of priority to corporate income, and therefore will be subject to greater dividend risk

than preferred stock or debt instruments of such issuers. In addition, while common stock has historically generated higher average returns

over time than fixed income securities, common stock has also experienced significantly more volatility in those returns.

Preferred Securities Risk. There are special

risks associated with investing in preferred securities, including:

| · | Deferral and Omission. Preferred securities may include provisions that permit the issuer, at its

discretion, to defer or omit distributions for a stated period without any adverse consequences to the issuer. |

| · | Subordination. Preferred securities are subordinated to bonds and other debt instruments in a company’s

capital structure in terms of priority to corporate income and liquidation payments, and therefore will be subject to greater credit risk

than more senior debt instruments. |

| · | Liquidity. Preferred securities may be substantially less liquid than many other securities, such

as common stock or U.S. government securities. |

| · | Limited Voting Rights. Generally, preferred securities offer no voting rights with respect

to the issuing company unless preferred dividends have been in arrears for a specified number of periods, at which time the preferred

security holders may elect a number of directors to the issuer’s board. |

| · | Special Redemption Rights. In certain varying circumstances, an issuer of preferred securities

may redeem the securities prior to a specified date. As with call provisions, a redemption by the issuer may negatively impact the return

of the security held by the Fund. |

Convertible Securities Risk. Convertible

securities generally offer lower interest or dividend yields than non-convertible securities of similar quality. The market values of

convertible securities tend to decline as interest rates increase and, conversely, to increase as interest rates decline. In the absence

of adequate anti-dilutive provisions in a convertible security, dilution in the value of the Fund’s holding may occur in the event

the underlying stock is subdivided, additional equity securities are issued for below market value, a stock dividend is declared or the

issuer enters into another type of corporate transaction that has a similar effect.

Foreign Securities Risk. Investments in

foreign securities involve certain considerations and risks not ordinarily associated with investments in securities of U.S. issuers.

Foreign companies are not generally subject to the same accounting, auditing and financial standards and requirements as those applicable

to U.S. companies. Foreign securities exchanges, brokers and listed companies may be subject to less government supervision and regulation

than exists in the United States. Dividend and interest income may be subject to withholding and other foreign taxes, which may adversely

affect the net return on such investments. There may be difficulty in obtaining or enforcing a court judgment abroad, and it may be difficult

to effect repatriation of capital invested in certain countries.

In addition, with respect to certain countries,

there are risks of expropriation, confiscatory taxation, political or social instability or diplomatic developments that could affect

assets of the Fund held in foreign countries.

Emerging Markets Risk. The Fund may invest

in securities of companies in an “emerging market.” An “emerging market” country is any country that is considered

to be an emerging or developing country by the World Bank. Investments in emerging market securities involve a greater degree of risk

than, and special risks in addition to the risks associated with, investments in domestic securities or in securities of foreign, developed

countries. Foreign investment risk may be particularly high to the extent that the Fund invests in securities of issuers based or doing

business in emerging market countries or invests in securities denominated in the currencies of emerging market countries. Investing in

securities of issuers based or doing business in emerging markets entails all of the risks of investing in securities of foreign issuers

noted above, but to a heightened degree.

Foreign Currency Risk. The Fund may invest

in companies whose securities are denominated or quoted in currencies other than U.S. dollars or have significant operations or markets

outside of the United States. In such instances, the Fund will be exposed to currency risk, including the risk of fluctuations in the

exchange rate between U.S. dollars (in which the Fund’s shares are denominated and the distributions are paid by the Fund) and such

foreign currencies. Therefore, to the extent the Fund does not hedge its foreign currency risk or the hedges are ineffective, the value

of the Fund’s assets and income could be adversely affected by currency rate movements.

REIT Risk. An investment in a REIT may

be subject to risks similar to those associated with direct ownership of real estate, including losses from casualty or condemnation and

environmental liabilities, and changes in local and general economic conditions, market value, supply and demand, interest rates, zoning

laws, regulatory limitations on rents, property taxes and operating expenses. In addition, an investment in a REIT is subject to additional

risks, such as poor performance by the manager of the REIT, adverse changes to the tax laws, changes in the cost or availability of credit,

or the failure by the REIT to qualify for tax-free pass-through of income under the Internal Revenue Code of 1986, as amended (the “Code),

and to the risk of general declines in stock prices. In addition, some REITs have limited diversification because they invest in a limited

number of properties, a narrow geographic area, or a single type of property. Also, the organizational documents of a REIT may contain

provisions that make changes in control of the REIT difficult and time-consuming. As a stockholder in a REIT, the Fund, and indirectly

the Fund’s stockholders, would bear its ratable share of the REIT’s expenses and would at the same time continue to pay its

own fees and expenses.

Special Risks of Derivative Transactions.

The Fund may participate in derivative transactions. Such transactions entail certain execution, market, counterparty liquidity, hedging

and tax risks. Participation in the options or futures markets, in currency transactions and in other derivatives transactions involves

investment risks and transaction costs to which the Fund would not be subject absent the use of these strategies. If the Adviser’s

prediction of movements in the direction of the securities, foreign currency, interest rate or other referenced instruments or markets

is inaccurate, the consequences to the Fund may leave the Fund in a worse position than if it had not used such strategies. Valuation

may be more difficult in times of market turmoil since many investors and market makers may be reluctant to purchase complex instruments

or quote prices for them.

Counterparty Risk. The Fund will be subject

to credit risk with respect to the counterparties to the derivative contracts purchased by the Fund. If a counterparty becomes bankrupt

or otherwise fails to perform its obligations due to financial difficulties, the Fund may experience significant delays in obtaining any

recovery in bankruptcy or other reorganization proceedings. The Fund may obtain only a limited recovery, or may obtain no recovery, in

such circumstances. The counterparty risk for cleared derivatives is generally lower than for uncleared over-the-counter derivative transactions

since generally a clearing organization becomes substituted for each counterparty to a cleared derivative contract and, in effect, guarantees

the parties’ performance under the contract as each party to a trade looks only to the clearing organization for performance of

financial obligations under the derivative contract. However, there can be no assurance that a clearing organization, or its members,

will satisfy its obligations to the Fund.

Liquidity Risk. Although both over-the-counter

and exchange-traded derivatives markets may experience the lack of liquidity, over-the-counter non-standardized derivative transactions

are generally less liquid than cleared or exchange-traded instruments. The illiquidity of the derivatives markets may be due to various