Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 05 2024 - 5:11AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF FEBRUARY 2024

Commission File Number: 333-04906

SK Telecom Co., Ltd.

(Translation of registrant’s name into English)

65, Euljiro, Jung-gu

Seoul 04539, Korea

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Changes of 15% or More in Revenue or Profit

|

|

|

|

|

|

|

|

|

The preliminary results shown below may differ from the final results, which remain subject to audit by the external auditor of SK Telecom Co., Ltd. (the “Company”).

The preliminary results shown below may differ from the final results, which remain subject to audit by the external auditor of SK Telecom Co., Ltd. (the “Company”). |

| 1. Basis: Consolidated |

2. Details of Changes (in thousands of Won,

except percentages) |

|

Current Fiscal

Year |

|

Previous Fiscal

Year |

|

Amount Increased/

Decreased |

|

Increase/Decrease Rate

(%) |

| Operating Revenue |

|

17,608,511,084 |

|

17,304,973,291 |

|

303,537,793 |

|

1.8 |

| Operating Income |

|

1,753,204,333 |

|

1,612,069,519 |

|

141,134,814 |

|

8.8 |

| Profit from Continuing Operations Before

Income Tax |

|

1,488,179,211 |

|

1,236,152,084 |

|

252,027,127 |

|

20.4 |

| Profit for the Period |

|

1,145,937,032 |

|

947,830,928 |

|

198,106,104 |

|

20.9 |

3. Financial Position (in thousands of Won, except

percentages) |

|

Current Fiscal Year |

|

Previous Fiscal Year |

| Total Assets |

|

30,119,228,260 |

|

31,308,260,984 |

| Total Liabilities |

|

17,890,829,299 |

|

19,153,066,586 |

| Total Shareholders’ Equity |

|

12,228,398,961 |

|

12,155,194,398 |

| Capital Stock |

|

30,492,716 |

|

30,492,716 |

| Ratio of Total Shareholders’ Equity to

Capital Stock (%) |

|

40,102.7 |

|

39,862.6 |

| 4. Main Reasons for Changes in Revenue or Profit/Loss |

|

• Increases in profit for the period and profit from continuing operations before income tax due

to, among other things, the effect of gains relating to equity method investments including dividend payments from entities in which the Company holds ownership interests |

| 5. Date of the resolution by the Board of Directors |

|

February 2, 2024 |

| • Attendance of external

directors |

|

Present: 5 Absent : 0 |

| • Attendance of audit

committee member that is not an external director |

|

— |

| 6. Other important matters relating to an investment decision |

|

• The preliminary results set forth in this report have been prepared on a consolidated basis in

accordance with International Financial Reporting Standards as adopted in Korea.

• The preliminary results set forth in this report may be subject to change based on the results of

the audit by the Company’s external auditor and the approval at the general shareholders’ meeting. |

2

|

|

|

|

|

|

|

|

|

|

|

| Additional Disclosure |

|

| |

|

Basis |

|

Current Fiscal Year |

|

|

Previous Fiscal Year |

|

| Equity attributable to the owners of the

parent company (in thousands of Won) |

|

Consolidated |

|

|

11,389,045,844 |

|

|

|

11,318,318,732 |

|

| Ratio of Equity attributable to the

owners of the parent company to Capital Stock (%) |

|

Consolidated |

|

|

37,350.1 |

|

|

|

37,118.1 |

|

| Operating Revenue (in thousands of

Won) |

|

Separate |

|

|

12,589,219,907 |

|

|

|

12,414,587,521 |

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| SK TELECOM CO., LTD. |

| (Registrant) |

|

| By: /s/ Hee Jun Chung |

| (Signature) |

| Name: Hee Jun Chung |

| Title: Vice President |

Date: February 5, 2024

4

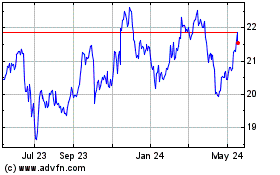

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Dec 2024 to Jan 2025

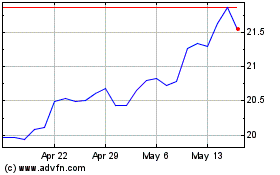

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Jan 2024 to Jan 2025