UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024.

Commission File Number 33-65728

CHEMICAL AND MINING COMPANY OF CHILE INC.

(Translation of registrant’s name into English)

El Trovador 4285, Santiago, Chile (562) 2425-2000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F:_X_ Form 40-F

SQM AND CODELCO SIGN THE PARTNERSHIP AGREEMENT

Santiago, Chile. May 31, 2024 - Sociedad Química y Minera de Chile S.A. (“SQM”, the “Company”) (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM-A) informs that today, consistent with the information disclosed as a material fact on December 27, 2023, and on March 20, 2024, the Company entered into the Partnership Agreement (the “Agreement”) with the National Copper Corporation of Chile ("Codelco"). The Agreement establishes the rights and obligations of the parties to form their partnership for the development of mining and production activities aimed at the production of lithium, potassium and other products from the properties of the Chilean Production Development Corporation (“Corfo”) in the Salar de Atacama and their subsequent marketing (directly or through its subsidiaries or representative offices) (the “Business”), through the merger by incorporation of Codelco's subsidiary, Minera Tarar SpA, into the Company's subsidiary, SQM Salar S. A. (the “Joint Venture”), subject to the terms and conditions set forth in the Agreement.

The Agreement includes forms of agreements and documents to be entered into prior to the completion of the transaction, including the shareholders' agreement, the sales agreement for the Company's properties in the Salar de Maricunga, the license that the Company will grant to the Joint Venture over certain industrial property rights, the by-laws and powers of attorney of the Joint Venture, and the manner in which the Company will contribute to SQM Salar S.A. those assets and contracts of the Business that are not currently owned by SQM Salar S.A., among others.

A number of conditions precedent remain to be satisfied for the formation of the partnership. These include, among others, obtaining governmental approvals in Chile and abroad, the completion of the indigenous communities consultation process and that the request filed by Inversiones TLC SpA before the Chilean Financial Market Commission that the transaction be approved at a shareholders meeting of the Company by two-thirds of shares with right to vote is not accepted. The Agreement also establishes as a condition precedent that the Joint Venture and Corfo enter into the contracts to (i) increase of the authorized production quota of lithium that the Joint Venture can exploit from the Salar de Atacama between 2025 and 2030, and (ii) to establish the right to exploit lithium from the Salar de Atacama between 2031 and 2060. Should the conditions be met earlier, the closing will be no earlier than January 1, 2025. However, the parties believe that the conditions precedent may be met during the first half of 2025.

The Company and Codelco, aware of the responsibility that corresponds to companies in the promotion and protection of human rights and the creation of shared value with the communities of the territory where they develop the activities of the Partnership, are committed to implementing the best standards in their relationship with the Atacameño communities, with a focus on capacity building, promoting transparency and promoting the human rights of these communities.

Attached as Exhibits 99.1 and 99.2 hereto are summaries of the Agreement and the form of the shareholders’ agreement agreed between the parties. The redacted text of these documents in Spanish is available on the Company's website.

At this time, it is not possible to determine the financial impact that the execution of the Agreement may have beyond the information provided at the Extraordinary Shareholders’ Meeting on April 24, 2024.

Other Events

In connection with the foregoing press release issued by Sociedad Química y Minera de Chile S.A. (the “Company”) on May 31, 2024, the Company is filing free translations in English of the original Spanish versions of the Summary of the Partnership Agreement between the Company and Codelco as Exhibit 99.1 to this Report on Form 6-K, and the Summary of the Shareholders’ Agreement between the Company and Codelco as Exhibit 99.2 to this Report on Form 6-K (the "Summaries"). In the event of any conflict between the original Spanish version of the Agreements and the English translation, the Spanish version of the Summaries shall prevail.

Exhibits

About SQM

SQM is a global company listed on the New York Stock Exchange and the Santiago Stock Exchange (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM-A). SQM develops and produces diverse products for various industries essential to human progress such as health, nutrition, renewable energy and technology through innovation and technological advancement. Our goal is to maintain our world leadership position in the lithium, potassium nitrate, iodine and salts markets.

For further information, contact:

Gerardo Illanes / gerardo.illanes@sqm.com

Irina Axenova / irina.axenova@sqm.com

Isabel Bendeck / isabel.bendeck@sqm.com

For media inquiries, contact:

Maria Ignacia Lopez / ignacia.lopez@sqm.com

Pablo Pisani / pablo.pisani@sqm.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “plan,” “believe,” “estimate,” “expect,” “strategy,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make concerning the implementation of the partnership with Codelco, the development of Salar Futuro Project, Company’s capital expenditures, financing sources, Sustainable Development Plan, business and demand outlook, future economic performance, anticipated sales volumes, profitability, revenues, expenses, or other financial items, anticipated cost synergies and product or service line growth.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are estimates that reflect the best judgment of SQM management based on currently available information. Because forward-looking statements relate to the future, they involve a number of risks, uncertainties and other factors that are outside of our control and could cause actual results to differ materially from those stated in such statements, including our ability to successfully implement the partnership with Codelco. Therefore, you should not rely on any of these forward-looking statements. Readers are referred to the documents filed by SQM with the United States Securities and Exchange Commission, including the most recent annual report on Form 20-F for the year ended December 31, 2023, which identifies other important risk factors that could cause actual results to differ from those contained in the forward-looking statements. All forward-looking statements are based on information available to SQM on the date hereof and SQM assumes no obligation to update such statements, whether as a result of new information, future developments or otherwise, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| |

| CHEMICAL AND MINING COMPANY OF CHILE INC. |

| (Registrant) |

| Date: May 31, 2024 | /s/ Gerardo Illanes |

| By: Gerardo Illanes |

| CFO |

Persons who are to respond to the collection of information contained SEC 1815 (04-09) in this form are not required to respond unless the form displays currently valid OMB control number.

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

Exhibit 99.1

Partnership Agreement

This document contains a summary of the Partnership Agreement (the "Agreement") that Sociedad Química y Minera de Chile S.A. ("SQM", the “Company”) and the National Copper Corporation of Chile ("CODELCO") have entered into to regulate the various aspects of a partnership for the joint exploitation of lithium and other products in the Salar de Atacama (the "Partnership").

This document is a summary of the Agreement, a redacted Spanish language version of which is available on the SQM website. Capitalized terms that are not defined in this document or in the press release of which this summary is a part, will be defined in accordance with the terms of the Agreement.

1. The Agreement regulates the terms and conditions for the Partnership to become effective by establishing the events that must occur at closing and what each party must do until that date.

Thereunder, subject to the satisfaction of the conditions precedent hereinafter set forth, on the closing date (the "Effective Date"):

(a) Minera Tarar SpA will merge into SQM Salar S.A. with a new name to be defined and in the form of a joint stock company (the "Joint Venture"). For these purposes, the parties must ensure that the shareholders of both companies adopt the shareholders' resolutions (whether at a meeting or otherwise) necessary to, among other things, approve the merger and the new by-laws of the Joint Venture;

(b) the parties shall execute the Shareholders' Agreement in the form of annexed to the Agreement;

(c) SQM will sell to Codelco its properties in the Salar de Maricunga at their book value (approximately US$18,000) according to terms of the sales contract annexed to the Agreement;

(d) SQM will grant to the Joint Venture a license over certain industrial property related to the Business and existing at the signing of the Agreement, which will be non-exclusive, non-transferable, perpetual and irrevocable. The same right, plus additional rights related to know-how and advisory service, will be granted by the Joint Venture to Codelco and its subsidiaries and by the Joint Venture to SQM and its subsidiaries;

(e) the Joint Venture and SQM will sign an off-take contract for potassium on such terms as the parties negotiate in good faith in accordance with the basic principles annexed to the Agreement; and

(f) the Joint Venture and SQM shall execute the transitional services and supply agreement under the terms of the document annexed to the Agreement.

This means that all acts and contracts will be performed, executed or become effective as of the Effective Date, and if this does not happen, none of them will be performed, executed or become effective.

2. Conditions Precedent:

Regarding the formation of the Partnership, the Agreement contemplates a series of conditions precedent, including, among others, the following:

(a) That the request made by Inversiones TLC SpA dated May 21, 2024 to the Chilean Financial Market Commission that the transaction be approved at a shareholders meeting of the Company by two-thirds of the shares with right to vote has not been accepted and that no authority has issued an order preventing the Partnership from becoming effective;

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

(b) Representations and warranties made by the parties to the Agreement are true as of the dates defined by the Agreement;

(c) Absence of a Material Adverse Effect;

(d) The conclusion of the indigenous communities consultation process regarding certain aspects of the CORFO-SQM Contracts, the Amendments to the CORFO-SQM Contracts and the CORFO-Tarar Contracts (each as defined below);

(e) The subscription by SQM and CORFO of the amendments (the "Amendments to the CORFO-SQM Contracts") that SQM and Codelco want to introduce to the existing contracts between CORFO and the Company (the "CORFO-SQM Contracts") and that regulate the exploitation of the Salar de Atacama until the year 2030, especially with respect to the increase of the production quota by 300,000 metric of lithium carbonate equivalent (LCE). The Amendments to the CORFO-SQM Contracts have been agreed to by CORFO, Codelco and SQM and can only be modified with their consent;

(f) The execution by Minera Tarar and CORFO of the new contracts that will regulate the exploitation of the Salar de Atacama from 2031 to 2060 (the "CORFO-Tarar Contracts"). The CORFO-Tarar Contracts have been agreed to by CORFO, Codelco and SQM and can only be modified with their consent;

(g) The approval of the Amendments to the CORFO-SQM Contracts and the CORFO-Tarar Contracts by the General Comptroller of the Republic of Chile;

(h) Obtaining authorizations from the Chilean Nuclear Energy Commission (“CCHEN”) in connection with the execution of the Amendments to the CORFO-SQM Contracts and the CORFO-Tarar Contracts on terms acceptable to both parties;

(i) The notification and approval without conditions, or with mitigation measures acceptable to SQM and Codelco, by antitrust authorities in Chile and abroad;

(j) The notification and approval without conditions, or with mitigation measures acceptable to SQM and Codelco, by foreign authorities that regulate foreign investment in those countries, if necessary;

(k) The conclusion of the internal reorganization process of SQM Salar S.A., whereby SQM contributes to SQM Salar S.A. those assets, contracts, employees and resources related to the Business that do not belong to SQM Salar S.A. as of this date, in order to concentrate in such company all assets, contracts, subsidiaries, employees and other resources necessary for the full development of the Business; and

(l) The termination of the SEC's ongoing investigation of SQM on the terms defined in the Agreement;

3. Actions after the Closing:

The Agreement also regulates certain acts that must take place after the Effective Date, in particular the application for Chinese Governmental approvals to contribute the shares of company which owns the Sichuan plant to the Joint Venture.

4. Other stipulations:

The Agreement includes:

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

(a) obligations of the parties in connection with the satisfaction of the conditions precedent to the occurrence of the Effective Date;

(b) representations and warranties made by SQM with respect to itself, SQM Salar S.A. and its subsidiaries, including their assets, liabilities and businesses;

(c) representations and warranties of Codelco with respect to itself and Minera Tarar SpA, including its assets, liabilities and business;

(d) affirmative and negative covenants of the parties with respect to themselves and the management of SQM Salar S.A. and Minera Tarar SpA between the signing and the Effective Date;

(e) obligations of each party to indemnify the other party for any damages caused by (i) certain inaccuracies in the representations and warranties, (ii) some breaches of the obligations (iii) certain risks that SQM and Codelco take upon themselves. These indemnification obligations are subject to certain limitations; and

(f) regulation of the development of the Salar Futuro Project.

5. Economic aspects of the Partnership

The Agreement establishes the economic conditions of the Partnership during the First Period (2025-20230) and Second Period (2031-2060) in relation to (a) the lithium profit quota assigned to Codelco during the First Period, (b) the additional lithium production quota of 300,000 metric tons for the First Period, (c) the exploitation of the Business during the Second Period, (d) the working capital as of the last day of the calendar year prior to the Effective Date (Account Payable to SQM), (e) the specific tax on mining activity (IEAM) (including Retained Receivables), (f) projected Capex between the signing of the Agreement and the Effective Date and (g) the results of operations of the owner of the Sichuan facility from the Effective Date to the date such facility is contributed to the Joint Venture or sold.

| | | | | |

1. Profit Distribution for the First Period | During the First Period, profits will be distributed: a) Codelco (as holder of Series A Shares) will receive an amount equal to the proportion of the adjusted financial profit of the lithium business equivalent to 33,500 metric tons of lithium carbonate equivalent (MT of LCE), with respect to the total tons of LCE sold in each fiscal year. This profit does not include the benefit of the fixed 6.8% mentioned in paragraph b) below. b) SQM (as holder of Series B Shares) will receive an amount equal to the proportion of the adjusted financial profit of the lithium business not distributed to holders of Series A Shares, corresponding to the remainder of the MT of LCE of the current quota and the 165,000 MT of LCE of the additional quota, plus the benefit generated by the reduced lease fee payment of 6.8% fixed for a determined number of MT of LCE per year as established in the CORFO-SQM Contracts, plus the total financial profit related to non-lithium products. c) In the event that the remaining 135,000 MT of LCE of the additional quota is partially or totally sold to third parties, the financial profits corresponding to such tons will be distributed to Series A and Series B Shares in proportion to the total number of shares. |

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

| | | | | |

2. Participation in the additional quota | The financial profit associated with the additional quota will be distributed as follows: a) The profit from the first 165,000 MT of LCE will be used to compensate SQM for the annual production that will be attributed to Codelco in the First Period. b) The profit from the remaining 135,000 MT of LCE will be distributed to Series A and Series B Shares in proportion to the total number of shares. |

3. Profit sharing in the first half of 2031 | During the first half of 2031, the profits corresponding to the First Period that have not been distributed as of December 31, 2030 will be determined and distributed. Additionally, and if applicable, an amount will be distributed against retained earnings or fiscal 2031 income to Series B Shares to recognize those tons produced attributable to its quota that are in foreign subsidiaries and have not been sold to third parties at the end of the First Period subject to a maximum limit. |

4. Profit Distribution in the Second Period | Except as indicated for the first half of the year 2031, considering that the Series A and B Shares are transformed into a single series of common shares, with equal economic rights paid as the dividend indicated in the previous number, from that date dividends are distributed in proportion to the number of shares, except for the dividends to Series C, D and E Shares. |

5. Working Capital | The Joint Venture's consolidated working capital (i.e., operating assets less operating liabilities) as of the Effective Date will be transformed into a debt of the Joint Venture to SQM. |

6. IEAM and retained receivables | Certain asset accounts of SQM Salar are classified as Retained Receivables that are not part of the Partnership and must be paid to SQM. Likewise, any collection rights that SQM Salar has, or in the future will have, for the application of the IEAM in years ended on or before the Reference Date are not considered part of the Partnership, nor will any drawings after the Reference Date that were made with reference to amounts accrued in years prior to this date (which must be indemnified) be part of the Partnership. The associated recoveries for purposes of the IEAM will be distributed between SQM and Codelco as holders of the Series D and C Shares according to the participations in the fiscal years in which the amount drawn by the SII was accrued. |

7. Capex and Capex Adjustment | SQM will instruct SQM Salar and the Business Subsidiaries to make investments in fixed assets (CAPEX) in accordance with the investment budget for the years 2024 and 2025. If the total amount invested in 2024 is more or less than the amount specified in the Agreement, the adjustments will be made in accordance with the terms of the Agreement. |

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

Exhibit 99.2

Summary of the Shareholders' Agreement

This document contains a summary of the Shareholders' Agreement (the "Shareholders’ Agreement") that Sociedad Química y Minera de Chile S.A. ("SQM") and National Copper Corporation of Chile ("Codelco") have agreed to in the framework of their partnership for the joint exploitation of lithium and other products in the Salar de Atacama (the "Joint Venture").

This document is a summary of the Shareholders' Agreement, a redacted Spanish language version of which is available on the SQM website. Capitalized terms that are not defined in this document or in the press release of which this summary is a part, will be defined in accordance with the terms of the Shareholders' Agreement.

| | | | | |

Subject (section) | Summary |

1. Joint Venture Partnership Agreement | The Joint Venture will be a joint stock company resulting from the merger by incorporation of Minera Tarar SpA into SQM Salar S.A., governed by its bylaws, the Code of Commerce and the Shareholders' Agreement to be signed by the parties. Any of the shareholders may request, as from the date on which all preferences of the series of shares terminate in full, that the Joint Venture be transformed into a corporation, which without being an open corporation, incorporates in its bylaws rules equivalent to those of an open corporation, and provides its shareholders with information equivalent to that which open corporations are required to provide to their shareholders, to the Chilean Financial Market Commission and to the general public from time to time. |

2. Business Section 4.1 | Joint Venture between Codelco and SQM in order to carry out the extractive and productive activities aimed at producing the Business Products and their subsequent commercialization (directly or through its subsidiaries or representative offices), which are derived from the exploration and exploitation of the Properties. |

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

| | | | | |

3. Stocks and Series Section 1.4.2 | During the First Period (2025-2030): The capital of the Joint Venture will be divided into 100,000,004 shares, distributed in five series of shares: 50,000,001 Series A Shares, 49,999,999 Series B Shares, 2 Series C Shares, 1 Series D Share and 1 Series E Share. Codelco will own all of the 50,000,001 Series A Shares and 2 Series C Shares. SQM will own all of the 49,999,999 Series B Shares, the Series D Share and the Series E Share. The Series A Shares and Series B Shares will have distinct voting rights until December 31, 2030, when each share, whether Series A or Series B, will have one vote. The economic rights of the Series A Shares and Series B Shares will last until the distribution of the dividend corresponding to the 2030 fiscal year, during 2031. After that date, the Series A Shares and Series B Shares will become common shares on a 1:1 ratio. Series C, Series D and Series E Shares have no voting rights except with respect to modifications or cancellations of their preference and are cancelled at the end of the cause that originated their preference. Shares of these series are not transferable. Series C and Series D Shares are created solely for the purpose of distributing the benefits associated with the recovery of specific tax on mining activity (IEAM); Series E, on the other hand, is created solely for the purpose of contributing the Sichuan Plant or the price received for its sale, and the reimbursement of taxes payable as a consequence of such contribution or sale. The respective shares will be cancelled without further notice when the circumstances giving rise to each of these series cease to exist. |

4. Joint Venture Management Section 4.1 Section 4.2.12 Section 4.3.4 Section 4.5 | The Joint Venture shall at all times be managed in accordance with the general principle that it constitutes an economically and administratively independent entity, separate and distinct from each of its Shareholders, with its own corporate interest, which shall never be subordinated to the interest of any one or more of its Shareholders considered individually, and that there shall be a fully autonomous management of the Joint Venture. For purposes of the management of the Joint Venture, the Shareholders' Agreement provides that certain matters are matters of policy and must be agreed upon by the parties or unanimously by the shareholders or directors ("Matters Subject to Policy"). |

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

| | | | | |

5. First Period Board of Directors (2025-2030) Section 4.2.1.1 Section 4.2.2.1 Section 4.2.3.1 | Composed of 6 members, 3 of which will be appointed by Codelco and the remaining 3 will be appointed by SQM. The Chairman shall be elected from among the directors elected by Codelco and the Vice Chairman shall be elected from among the directors elected by SQM. None of them shall have a tie-breaking vote. In the event of a tie in matters submitted to the decision of the Board of Directors that are not Reserved Matters of the Board of Directors, the majority of votes of the directors elected by SQM present at the meeting will determine the matter. |

6. Second Period Board of Directors (2031-2060) Section 4.2.1.2 Section 4.2.2.2.2 Section 4.2.3.2 | Composed of 7 members elected according to the general shareholder voting rules. The Chairman shall be appointed by Codelco and the Vice Chairman shall be appointed by SQM. None of them shall have a tie-breaking vote. Decisions shall be adopted by the affirmative vote of a majority of the directors entitled to vote, except for Reserved Matters of the Board of Directors, which shall require the approval of at least 5 directors entitled to vote. |

7. Reserved Matters of the Board of Directors Section 4.2.12 | Incorporation of subsidiaries and disposal of shares of subsidiaries of the Joint Venture;

1. Formation of subsidiaries and the disposal of subsidiary shares of the Joint Venture;

2. Partnerships with third parties;

3. Development of new businesses (whether or not included in the corporate purpose);

4. The cessation of the production of any of the Products of the Business sold by the Joint Venture at that time;

5. The granting of real or personal guarantees to secure obligations (a) of third parties when such obligations are not the subject of a shareholders' meeting, or (b) of the Joint Venture or its subsidiaries;

6. Execution of acts or execution of contracts free of charge;

7. Acquisition of fixed assets with an individual or annual value greater than the amount established in the Shareholders’ Agreement, except in the case of replacement of plant and equipment to be replaced and contemplated in the budget;

8. Disposal of assets included in the fixed assets with an individual or annual value greater than the amount established in the Shareholders’ Agreement, except in the case of sales of obsolete assets or assets that the Joint Venture no longer uses and that are contemplated in the budget;

|

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

| | | | | |

| 9. Execution of acts or execution, modification or early termination of contracts that imply payments to or by the Joint Venture for amounts greater, annually or during the life of the contract, than those established in the Shareholders’ Agreement or contracts with a term greater than that established in the Shareholders’ Agreement and that cannot be terminated early by the Joint Venture without penalty with an advance notice of no more than three months, except for contracts under market conditions and subject to maximum terms or volumes;

10. The approval of the request for liquidation or reorganization of the Joint Venture or of any of its subsidiaries;

11. The issuance of shares and the approval of the minimum placement price of the shares representing a capital increase of the Joint Venture or its subsidiaries, including for workers' compensation plans;

12. The filing of claims against third parties or the acceptance of claims filed against the Joint Venture or its subsidiaries, as well as transactions in respect of disputes, judicial or extrajudicial, in each case when the dispute is for undetermined amounts or equal to or greater than the amount agreed upon by the parties in the Shareholders’ Agreement;

13. Any action that has the effect or purpose of obtaining, modifying or terminating the authorizations granted by Chilean Nuclear Energy Commission (“CCHEN”) to the Joint Venture;

14. Matters relating to technical definitions with respect to the Salar Futuro Project that have some degree of relevance according to criteria to be defined in the agreement;

15. The approval of acts or contracts with companies controlled by the State of Chile for relevant amounts or terms to be agreed upon in the Shareholders’ Agreement;

16. The execution, modification or early termination of the CORFO-SQM Contracts or CORFO-Tarar Contracts, as well as the waiver of any right or the exercise of any option set forth therein;

17. The approval of customary transaction policies, or other general exceptions to the approval procedures for related party transactions; and

18. The granting of powers of attorney to enter into any of the acts or contracts listed above.

|

8. Liability of the parties for the acts of their directors Section 4.2.9 | In the event that any of the directors elected by a party fails to comply with the rules of the Shareholders’ Agreement, the shareholder who appointed them shall be deemed to have failed to comply with their obligations under the Shareholders’ Agreement, without prejudice to the shareholder's obligation to replace such director as soon as possible. |

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

| | | | | |

9. Decisions of shareholders' meetings during the First Period Section 4.3.1 | Except for those matters in which the law requires, or the shareholders have agreed, a supermajority, decisions shall be adopted with the affirmative vote of shares representing an absolute majority of the voting shares of the Joint Venture. For the calculation of quorums and majorities during the First Period, the special rules of the Shareholders’ Agreement shall be followed, under which Series B has a majority of the votes in the Joint Venture. |

10. Decisions of shareholders' meetings during the Second Period Section 4.3.1 | Except for those matters in which the law requires, or the shareholders have agreed, a supermajority, decisions shall be adopted with the affirmative vote of the majority of the voting shares of the Joint Venture. |

11. Reserved Matters of shareholders' meetings Section 4.3.4 | They shall require the approval of two-thirds of the voting shares of the Joint Venture. 1.Amendments to the bylaws of the Joint Venture or its subsidiaries; 2.Issuance of securities convertible into shares of the Joint Venture or its subsidiaries; 3.The approval of non-cash contributions (except for the one established to pay the Series E Share) and the payment of non-cash dividends or distributions; 4.The acquisition of own shares issued by the Joint Venture or any of its subsidiaries; and 5.Matters listed in Article 67 of the Corporations Law with respect to the Joint Venture or any of its subsidiaries. |

12. Disagreement in the Board of Directors Section 4.4 | The Shareholders’ Agreement defines what is meant by "Disagreement" in the Board and the mechanism for resolving it. |

13. Management Section 4.2.7 Section 4.6 | 1.First Period: SQM directors will appoint the Chief Executive Officer and Codelco directors will appoint the Chief Financial Officer. 2.Second Period: The Chief Executive Officer and the Chief Financial Officer shall be appointed by a majority vote of the Board of Directors. 3.Compliance Manager: appointed at the recommendation of the Audit Committee. |

14. Technical Committee Section 4.7 | The Joint Venture will have a Salar Futuro Technical Committee, with 2 members nominated by the directors elected by Codelco and 2 members nominated by the directors elected by SQM. |

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

| | | | | |

15. Audit Committee Section 4.6 | The Joint Venture will have an Audit Committee composed of 3 directors that will perform the functions referred to in Article 50 bis of Law 18,046 and the corresponding functions in relation to the compliance programs of the parties. The majority of the members of the Audit Committee will be directors appointed by the shareholder that does not consolidate the results of the Joint Venture. |

16. Corporate governance of subsidiaries Section 4.11 | The subsidiaries of the Joint Venture will have corporate governance consistent with the corporate governance of the Joint Venture. |

17. Dividend policy Section 5.2 Section 5.3 Section 5.4 Section 5.5 | The Joint Venture will have as its dividend policy during the First Period, the distribution of the total profit of the Company (adjusted as detailed in the Shareholders’ Agreement), according to the following rules: (a) Codelco will receive an amount equal to the proportion of the adjusted financial profit of the lithium business equivalent to 33,500 MT of LCE, with respect to the total MT of LCE sold each year. This profit does not include the benefit of the fixed 6.8% mentioned in (b) below. (b) SQM will receive an amount equal to the proportion of the adjusted financial profit of the lithium business not distributed to the Series A Shares, corresponding to the remainder of the MT of the current quota and the 165,000 MT of LCE of the additional quota, plus the benefit of the fixed 6.8% lease fee of a determined number of tons per year as established in the CORFO-SQM Agreements, plus the total financial profit of the non-lithium products business. (c) In the event that the remaining 135,000 MT of LCE of the additional quota is partially or totally sold to third parties, the financial profits corresponding to such MT will be distributed to Series A and Series B Shares in proportion to the total number of shares. (d) Additionally, and if applicable, an amount will be distributed against retained earnings or fiscal 2031 income to Series B Shares to recognize those tons produced attributable to its quota that are in foreign subsidiaries and have not been sold to third parties at the end of the First Period, subject to a maximum. In the Second Period, a distribution policy of 100% of each year's profit will be established subject to (i) compliance with the Joint Venture's financial policy, and (ii) that the Joint Venture has paid in full to SQM the Account Payable to SQM referred to in the following paragraph. The Joint Venture shall pay SQM the working capital adjustment referred to in the Joint Venture Agreement through a Series B dividend, payable in installments (the " Account Payable to SQM "), which will accrue interest at a rate to be agreed upon by the parties.

|

18. Financial and debt policy Section 5.1 Section 5.6 | The Shareholder’ Agreement contemplates financial and borrowing policies for the Joint Venture. |

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

| | | | | |

19. Transfers of shares Clause Sixth Clause Seven | The Shareholders’ Agreement permits transfers from one party to companies of the same corporate group. In addition, certain indirect transfers are not restricted. The transfer of shares, other than those permitted, shall be governed by the following: (i) The parties may not initiate a sale process to third parties prior to the later of (a) January 1, 2034; and (b) the first anniversary of the estimated date of commencement of the Salar Futuro Project (as defined below). (ii) After such period, the party wishing to sell may do so for all or only part of the shares of the Joint Venture, subject to compliance with the ROFO and Tag Along (each as defined below), and only for packages representing 7.45% or more of the capital stock. There will be the right of the parties to receive a preferential sale offer if one of them intends to sell its shares to third parties ("ROFO"), as well as the right to accompany the party interested in selling its shares in the sale ("Tag Along"). Shares may not be transferred without simultaneously transferring an equal percentage of shareholder loans granted by the transferor, ensuring consistency between the status of shareholder and holder of shareholder loans. The restrictions will also extend to certain indirect transfers.

The acquirer of Joint Venture shares must adhere to the Shareholders’ Agreement and inform the other party of its ownership structure.

There are also special rules for Series C, Series D and Series E Shares.

|

20. Access to information Section 4.10 | The level of information that the Joint Venture provides to its shareholders (including information about its subsidiaries) shall be at least equivalent to the information that publicly traded corporations are required to provide to their shareholders, the Chilean Financial Market Commission and the general public from time to time. It expressly provides that the directors be authorized to disclose information concerning the Joint Venture to the shareholder that appointed them. |

21. Collaboration in the sale of shares Section 7.1.4 | In all cases in which a party wishes to sell its shares, the other party and the Joint Venture shall cooperate with the party wishing to sell on the terms set forth in the Shareholders’ Agreement. |

22. Put and Call for termination for a material breach Section 12.2 | If the Shareholders’ Agreement is terminated due to a material breach by SQM, Codelco may purchase SQM's shares at fair value with a discount. Similarly, if the Shareholders’ Agreement is terminated due to a material breach by Codelco, SQM may sell its shares to Codelco at fair value with a premium. |

23. Accounting consolidation Section 5.10 | 1.First Period: consolidation of the Joint Venture in SQM. 2.Second Period: consolidation of the Joint Venture in Codelco. |

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

| | | | | |

24. Annual Budget and Cash Flow Projection. Section 5.9 | In managing the business, the Chief Executive Officer shall adhere to an annual budget approved by the Board of Directors for the respective fiscal year. The Joint Venture must also have a "rolling" cash flow projection for the next 12 months and a business plan or equivalent strategic document. |

25. Administration audit Section 4.8 | The ordinary shareholders' meeting shall appoint an external auditing firm on an annual basis. For this purpose, the Audit Committee shall make a non-binding recommendation to the Board of Directors. The Board of Directors shall make a non-binding recommendation to the shareholders' meeting.

|

26. Related party transactions Section 4.9 | The standard and procedures applicable to publicly traded corporations will be followed. Codelco shall not be deemed to be a related party to CCHEN, Corfo, the State of Chile and anybody forming part of the administration of the State, except in connection with the initiation, dismissal and settlement of disputes of the Joint Venture with any of the foregoing or with State enterprises with which it has contracts. |

27. Compliance Clause Eleven | Each party must comply with Anti-Corruption Regulations and not make Prohibited Payments or Prohibited Transactions. Failure to comply with these obligations will result in consequences as set forth in the Agreement. |

28. Resolution of Disputes. Section 17.2 | Any dispute between the parties shall be submitted to arbitration. No appeal shall lie from the decisions of the arbitrage tribunal.

|

FREE TRANSLATION OF THE ORIGINAL DOCUMENT

| | | | | |

29. Salar Futuro Project. Section 4.7 | It is the intention of the parties to implement technological changes in the exploitation of lithium that will allow the return of lithium-free brines to the Salar de Atacama, where possible, and to move towards a water balance in the Salar de Atacama Basin. Such technological changes for a large-scale production, such as the one that exists with respect to the Properties, require the development of a project and all its stages of feasibility assessment, environmental impact study and obtaining the respective environmental and sectorial permits, all of which require a large amount of resources and time (the "Salar Futuro Project"). The Shareholders’ Agreement sets forth general parameters for the Salar Futuro Project. |

30. Lithium Off-take Contract Section 5.11 | Commencing on the later of (a) January 1, 2034 and (b) the first anniversary of the estimated date of commencement of the Salar Futuro Project, each Shareholder that owns more than 30% of the Joint Venture's equity may annually purchase from the Joint Venture up to a percentage of the lithium products sold by the Joint Venture equal to its equity interest in the Joint Venture at the market price, which is the average quarterly price of large volume customers. |

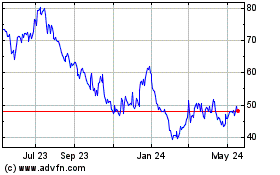

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Nov 2024 to Dec 2024

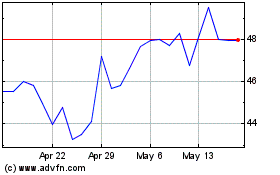

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Dec 2023 to Dec 2024