Report of Foreign Issuer (6-k)

February 23 2017 - 7:10AM

Edgar (US Regulatory)

Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

February 2017

Vale S.A.

Avenida das Américas, No. 700 – Bloco 8, Sala 218

22640-100 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F

x

Form 40-F

o

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One) Yes

o

No

x

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check One) Yes

o

No

x

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(Check One) Yes

o

No

x

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

Table of Contents

|

|

Press Release

|

|

|

|

|

|

Vale proposes payment of shareholder remuneration

Rio de Janeiro, February 23

rd

, 2017 - In line with the new shareholder remuneration policy approved at the Annual General and Extraordinary Shareholders’ Meetings held on April 25

th

, 2016, Vale S.A. (Vale) informs that its Board of Directors approved and will submit for deliberation at the Annual Shareholders’ Meeting to be held on April 20

th

, 2017, the proposal for payment of shareholder remuneration on April 28

th

, 2017, in the gross amount of R$ 4,666,750,435.04, corresponding to the gross amount of R$ 0.905571689 per common or preferred share outstanding on February 22

nd

, 2017 (5,153,374,926 shares).

If the proposal is approved by the Shareholders’ Meeting, the payment of gross amount R$ 4,666,750,435.04 will be made as of April 28

th

, 2017, fully in the form of interest on equity, and shareholders will be entitled to remuneration, as follows:

(i)

Record date for the owners of Vale shares traded on the BM&F Bovespa will be on April 20

th

, 2017 and for holders of American Depositary Receipts (ADRs) traded on the New York Stock Exchange (NYSE) and Euronext Paris will be on April 26

th

, 2017.

(ii)

Holders of ADRs will receive the payment through Citibank N.A., the depositary agent for ADRs, on May 5

th

, 2017.

(iii)

Vale’s shares will start trading ex-dividends on the BM&F Bovespa, NYSE and Euronext Paris as of April 24

th

, 2017.

Including the first tranche paid out on December 16, 2016, in the amount of R$ 856,975,000.00, if the proposal is approved, Vale’s total gross payment to its shareholders will be R$ 5,523,725.435.04, based on the results of the 2016 financial year.

Considering this amount, we will be paying in an equitable manner for all shareholders the minimum remuneration of 6% (six percent) calculated on the portion of the share capital constituted to the shareholders of preferred shares.

For further information, please contact:

+55-21-3485-3900

Andre Figueiredo: andre.figueiredo@vale.com

Carla Albano Miller: carla.albano@vale.com

Fernando Mascarenhas: fernando.mascarenhas@vale.com

Andrea

Gutman: andrea.gutman@vale.com

Bruno Siqueira: bruno.siqueira@vale.com

Claudia Rodrigues: claudia.rodrigues@vale.com

Denise Caruncho: denise.caruncho@vale.com

Mariano Szachtman: mariano.szachtman@vale.com

Renata Capanema: renata.capanema@vale.com

3

Table of Contents

This press release may include statements that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e)

global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão de Valores Mobiliários (CVM), and the French Autorité des Marchés Financiers (AMF), and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in Vale’s annual report on Form 20-F.

4

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vale S.A.

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ André Figueiredo

|

|

Date: February 23, 2017

|

|

Director of Investor Relations

|

5

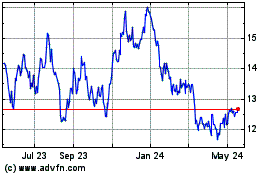

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

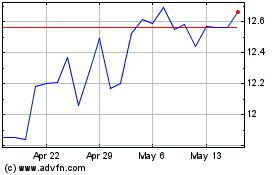

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024