Voya Financial, Inc. (NYSE: VOYA) announced today its

third-quarter 2024 financial results:

- Net income available to common shareholders of $98 million, or

$0.98 per diluted share, and after-tax adjusted operating earnings1

of $190 million, or $1.90 per diluted share.

- Strong results in Wealth Solutions and Investment Management

mitigating higher loss ratios in Health Solutions.

- Disciplined pricing actions expected to improve loss ratios in

Stop Loss in 2025.

- Prudently positioned balance sheet and strong excess capital

generation supporting capital return to shareholders:

- Board of directors authorized repurchase of an additional $500

million of common stock.

- Generated and returned approximately $0.2 billion of capital in

third-quarter 2024.

- Expect to return $0.8 billion of capital for the full-year

2024.

- Acquisition of OneAmerica Financial’s full-service retirement

plan business expected to close on Jan. 1, 2025.

“We delivered robust results in Wealth Solutions and Investment

Management in the third-quarter of 2024. This helped offset higher

loss ratios in Health Solutions, resulting in an adjusted operating

EPS of $1.90 per diluted share,” said Heather Lavallee, chief

executive officer, Voya Financial. “We are building on our

commercial momentum to accelerate profitable growth. We are also

fully focused on executing substantial rate increases in our Stop

Loss business during the fourth- quarter, which we expect will

improve profitability in Health Solutions in 2025.”

“Capital return in the third-quarter reflects our continued

commitment to creating value for shareholders. We remain on track

to return $800 million for the full-year. Looking forward, we

expect to significantly increase excess capital generation in 2025

driven by continued growth in our core businesses, repricing

actions in Stop Loss, and additional earnings from the OneAmerica

acquisition."

“The strategic acquisition of OneAmerica's full-service

retirement plan business will further strengthen our market

position and accelerate profitable growth. We remain focused on

addressing the evolving needs of our customers, who rely on us for

comprehensive workplace benefits, savings, and investment

solutions. This commitment continues to distinguish Voya as a

leader in the marketplace."

_________________________

1 This press release includes certain

non-GAAP financial measures, including adjusted operating earnings.

More information on notable items in the company’s financial

results, non-GAAP measures, and reconciliations to the most

comparable U.S. GAAP measures can be found in the "Use of Non-GAAP

Financial Measures" and reconciliation tables at the end of this

press release, and in the “Non-GAAP Financial Measures” section of

the company’s Quarterly Investor Supplement, which is available at

investors.voya.com.

Third-Quarter 2024 Consolidated Results

Third-quarter 2024 net income available to common shareholders

was $98 million, or $0.98 per diluted share, compared with $248

million, or $2.29 per diluted share, in third-quarter 2023. The

decrease was driven by events in the prior period which did not

repeat this quarter, including the recognition of tax benefits

associated with divested businesses and a revaluation gain on the

Voya India investment. It also included an unfavorable change in

Net investment gains (losses) in the current quarter due to

interest rate movements.

Third-quarter 2024 after-tax adjusted operating earnings were

$190 million, or $1.90 per diluted share, compared with $189

million, or $1.74 per diluted share, in third-quarter 2023. Higher

fee-based revenues in Wealth Solutions and Investment Management

and continued expense discipline were offset by higher loss ratios

in Stop Loss in Health Solutions. Third-quarter 2024 earnings per

share also reflect a reduced share count as a result of share

repurchases.

Business Segment Results

Wealth Solutions

Wealth Solutions third-quarter 2024 pre-tax adjusted operating

earnings were $211 million, up from $179 million in the prior-year

period. The increase was primarily due to growth in fee-based

revenues.

Total client assets as of Sept. 30, 2024, were $608 billion, up

19% compared with Sept. 30, 2023, primarily due to higher equity

market levels.

Net revenues for the trailing twelve months (TTM) ended Sept.

30, 2024, grew 7.2% compared with the prior-year TTM period due to

growth in fee-based revenues.

Adjusted operating margin for the TTM ended Sept. 30, 2024, was

37.9% compared with 33.8% in the prior-year TTM period. The

improvement reflects net revenue growth and disciplined expense

management while investing in the business.

Excluding notable items, for the TTM ended Sept. 30, 2024, net

revenues grew 4.8% and adjusted operating margin was 40.4%.

Health Solutions

Health Solutions third-quarter 2024 pre-tax adjusted operating

earnings were $23 million, down from $53 million in the prior-year

period. The decline was primarily attributable to higher loss

ratios in Stop Loss.

Health Solutions third-quarter 2024 annualized in-force premiums

and fees grew 16% to $3.9 billion compared with the prior-year

period. The increase reflects growth across all product lines due

to strong sales and favorable retention.

Net revenues for the TTM ended Sept. 30, 2024, declined 1.2%

compared with the prior-year TTM period. The decline reflects

unfavorable loss ratios in the current-year TTM period, partially

offset by in-force premium growth and the positive impact of

fee-based revenue diversification as a result of the acquisition of

Benefitfocus.

Adjusted operating margin for the TTM ended Sept. 30, 2024, was

16.6% compared with 30.6% in the prior-year TTM period. The decline

reflects higher loss ratios and the acquisition of

Benefitfocus.

Excluding notable items, for the TTM ended Sept. 30, 2024, net

revenues declined 2.7% and adjusted operating margin was 17.4%.

Investment Management

Investment Management third-quarter 2024 pre-tax adjusted

operating earnings, excluding Allianz's noncontrolling interest,

were $55 million, up from $49 million in the prior-year period. The

increase was primarily due to higher fee-based revenues benefiting

from positive capital markets and strong business momentum.

Investment Management had net inflows of $3.8 billion (excluding

divested businesses) during the three months ended Sept. 30, 2024,

generating organic growth of 1.3%. This reflects further growth

from Insurance channel clients and continued positive flows within

Retail.

Net revenues for the TTM ended Sept. 30, 2024, grew 4.0%

compared with the prior-year TTM period due to an increase in

fee-based revenues reflecting positive capital markets and net

flows.

Adjusted operating margin for the TTM ended Sept. 30, 2024, was

26.3% compared with 24.9% in the prior-year TTM period. The

improvement is due to net revenue growth and disciplined expense

management.

Excluding notable items, for the TTM ended Sept. 30, 2024, net

revenues grew 3.9% and adjusted operating margin was 26.9%.

Corporate

Corporate third-quarter 2024 pre-tax adjusted operating losses,

excluding Allianz's noncontrolling interest, were $59 million, up

from $52 million of losses in the prior-year period primarily

reflecting the impact of the preferred stock dividend reset in the

prior year.

Capital

For the third-quarter 2024, the company generated approximately

$0.2 billion of excess capital reflecting capital generation of

over 90% of after-tax adjusted operating earnings for the TTM. The

company also returned approximately $0.2 billion of excess capital

to shareholders in the third quarter through $149 million of share

repurchases and $44 million of common stock dividends. Share

repurchases included an accelerated share repurchase (ASR)

agreement to repurchase $100 million of common stock of which $80

million was delivered in the third quarter, with the remaining $20

million to be delivered in the fourth quarter. As of Sept. 30,

2024, the company had approximately $0.4 billion of excess

capital.

The company announced today that its board of directors has

increased the company's authorization to repurchase common stock

under the company's share repurchase program by $500 million. This

is in addition to the remaining repurchase capacity of

approximately $382 million available as of Sept. 30, 2024.

During the third-quarter 2024, the company issued $400 million

of unsecured 5.0% Senior Notes due 2034 and intends to use the net

proceeds for repayment at maturity of the $400 million outstanding

principal amount of its 3.976% Senior Notes due Feb. 15, 2025.

In Sept. 2024, Fitch upgraded Voya Financial, Inc.'s life

insurance subsidiaries' Insurer Financial Strength to 'A+' from

'A,' long-term issuer default rating to 'A-' from 'BBB+' and senior

unsecured debt to 'BBB+' from 'BBB.' In conjunction with the

upgrade, Fitch revised its outlook to 'Stable' for the revised

ratings.

Investments in Profitable Growth

On Sept. 11, 2024, the company announced that it had entered

into a definitive agreement to acquire OneAmerica Financial’s

full-service retirement plan business including 401(k), 403(b),

457, non-qualified deferred compensation and employee stock

ownership plans. The acquisition will provide the company with a

broader set of capabilities that complement its existing product

suite within Wealth Solutions, including competitive employee stock

ownership plan capabilities, administration, and new opportunities

to expand its distribution footprint and deepen its existing

advisor relationships. The acquisition will add assets in the

strategically important full-service Emerging and Mid-Market

segments, extend the company’s leadership position in the Large

Market and increase the company’s General Account, which is managed

by Voya Investment Management. The transaction is expected to close

on Jan. 1, 2025, subject to customary closing conditions.

Additional Financial Information and Earnings Call

More detailed financial information can be found in the

company’s quarterly investor supplement, which is available on

Voya’s investor relations website, investors.voya.com. In addition,

Voya will host a conference call on Tuesday, Nov. 5, 2024, at 10

a.m. ET, to discuss the company’s third-quarter 2024 results. The

call and slide presentation can be accessed via the company’s

investor relations website at investors.voya.com. A replay of the

call will be available on the company’s investor relations website,

investors.voya.com, starting at 1 p.m. ET on Nov. 6, 2024.

About Voya Financial

Voya Financial, Inc. (NYSE: VOYA) is a leading health, wealth

and investment company with over 9,000 employees who are focused on

achieving Voya’s aspirational vision: "Clearing your path to

financial confidence and a more fulfilling life." Through products,

solutions and technologies, Voya helps its 15.2 million individual,

workplace and institutional clients become well planned, well

invested and well protected. Benefitfocus, a Voya company and a

leading benefits administration provider, extends the reach of

Voya’s workplace benefits and savings offerings by engaging

directly with over 12 million employees in the U.S. Certified as a

“Great Place to Work” by the Great Place to Work® Institute, Voya

is purpose-driven and committed to conducting business in a way

that is economically, ethically, socially and environmentally

responsible. Voya has earned recognition as one of the World’s Most

Ethical Companies® by Ethisphere; a member of the Bloomberg

Gender-Equality Index; and a “Best Place to Work for Disability

Inclusion” on the Disability Equality Index. For more information,

visit voya.com. Follow Voya Financial on Facebook, LinkedIn and

Instagram.

Use of Non-GAAP Financial

Measures

We believe that Adjusted operating earnings before income taxes

is a meaningful measure used by management to evaluate our business

and segment performance. We use the same accounting policies and

procedures to measure segment Adjusted operating earnings before

income taxes as we do for the directly comparable U.S. GAAP measure

Income (loss) before income taxes. Adjusted operating earnings

before income taxes does not replace Income (loss) before income

taxes as a measure of our consolidated results of operations.

Therefore, we believe that it is useful to evaluate both measures

when reviewing our financial and operating performance. Each

segment’s Adjusted operating earnings before income taxes are

calculated by adjusting Income (loss) before income taxes for the

following items:

- Net investment gains (losses), which are significantly

influenced by economic and market conditions, including interest

rates and credit spreads, and are not indicative of normal

operations;

- Income (loss) related to businesses exited or to be exited

through reinsurance or divestment;

- Income (loss) attributable to noncontrolling interests to which

we are not economically entitled;

- Dividend payments made to preferred shareholders are included

as reductions to reflect the Adjusted operating earnings before

income taxes that are available to common shareholders;

- Other adjustments include items which are not indicative of

normal operations, performance of our segments, current Operating

expense fundamentals, or do not reflect cash-settled expenses.

These items vary widely in timing, scope and frequency between

periods as well as among companies to which we are compared.

Accordingly, we adjust for these items as we believe that these

items distort the ability to make a meaningful evaluation of the

current and future performance of our segments. These may include:

- Income (loss) related to early extinguishment of debt;

- Impairment of goodwill and intangible assets;

- Amortization of acquisition-related intangible assets as well

as contingent consideration fair value adjustments;

- Expected return on plan assets net of interest costs associated

with our qualified defined benefit pension plan and immediate

recognition of net actuarial gains (losses) related to all of our

pension and other postretirement benefit obligations and gains

(losses) from plan amendments and curtailments; and

- Other items such as capital or organizational restructurings,

acquisition / merger integration expenses, severance and other

third-party expenses associated with such activities, and expenses

attributable to vacant real estate.

Sources of Earnings

We analyze our segment performance based on the sources of

earnings. We believe that this supplemental information is useful

because we use it to analyze our business and it can help investors

understand the main drivers of Adjusted operating earnings before

income taxes. The sources of earnings include:

- Investment spread and other investment income.

- Fee-based margin.

- Net underwriting gain (loss).

- Administrative expenses.

- Premium taxes, fees and assessments.

- Net commissions.

- DAC/VOBA and other intangibles amortization.

Net Revenue and Adjusted Operating

Margin

- Adjusted operating margin is defined as Adjusted operating

earnings before income taxes divided by net revenue.

- Net revenue is the sum of investment spread and other

investment income, fee-based margin, and net underwriting gain

(loss).

- We also report net revenue and adjusted operating margin

excluding notable items, such as alternative investment income

above or below our long-term expectations.

- We report net revenue and adjusted operating margin excluding

notable items since they provide the main drivers for Adjusted

operating earnings before income taxes excluding the effects of

items that are not expected to recur at the same level.

Forward-Looking and Other Cautionary

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. The company does not assume any obligation to revise or

update these statements to reflect new information, subsequent

events or changes in strategy. Forward-looking statements include

statements relating to future developments in our business or

expectations for our future financial performance and any statement

not involving a historical fact. Forward-looking statements use

words such as “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “plan,” and other words and terms of similar meaning in

connection with a discussion of future operating or financial

performance. Actual results, performance or events may differ

materially from those projected in any forward-looking statement

due to, among other things, (i) global market risks, including

general economic conditions, our ability to manage such risks, and

interest rates; (ii) liquidity and credit risks, including

financial strength or credit ratings downgrades, requirements to

post collateral, and availability of funds through dividends from

our subsidiaries or lending programs; (iii) strategic and business

risks, including our ability to maintain market share, achieve

desired results from our acquisitions and dispositions, or

otherwise manage our third-party relationships; (iv) investment

risks, including the ability to achieve desired returns or

liquidate certain assets; (v) operational risks, including

cybersecurity and privacy failures and our dependence on third

parties; and (vi) tax, regulatory and legal risks, including limits

on our ability to use deferred tax assets, changes in law,

regulation or accounting standards, and our ability to comply with

regulations. Factors that may cause actual results to differ from

those in any forward-looking statement also include those described

under “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations (“MD&A”) – Trends

and Uncertainties” in our Annual Report on Form 10-K for the year

ended Dec. 31, 2023, as filed with the SEC on Feb. 23, 2024, and in

our Quarterly Report on Form 10-Q for the three months ended Sept.

30, 2024, to be filed with the SEC on or before Nov. 12, 2024.

VOYA-IR VOYA-CF

Consolidated Statement of

Operations

Three Months Ended

(in millions USD, except per share)

9/30/2024

9/30/2023

Revenues

Net investment income

$

506

$

547

Fee income

540

489

Premiums

796

682

Net gains (losses)

(14

)

(7

)

Other revenues

103

81

Income (loss) related to consolidated

investment entities

25

31

Total revenues

1,956

1,823

Benefits and expenses

Interest credited and other benefits to

contract owners/policyholders

(938

)

(799

)

Operating expenses

(775

)

(717

)

Net amortization of DAC/VOBA

(55

)

(57

)

Interest expense

(29

)

(31

)

Operating expenses related to consolidated

investment entities

(43

)

(47

)

Total benefits and expenses

(1,840

)

(1,651

)

Income (loss) before income

taxes

116

172

Income tax expense (benefit)

18

(74

)

Net income (loss)

98

246

Less: Net income (loss) attributable to

noncontrolling interest and redeemable noncontrolling interest

(16

)

(16

)

Net income (loss) available to Voya

Financial, Inc.

114

262

Less: Preferred stock dividends

16

14

Net income (loss) available to Voya

Financial, Inc.'s common shareholders

$

98

$

248

Net income (loss) available to Voya

Financial, Inc.'s common shareholders per common share:

Basic

$

1.00

$

2.35

Diluted

$

0.98

$

2.29

Reconciliation of Net Income

(Loss) to Adjusted Operating Earnings and Earnings Per Share

(Diluted)

Three Months Ended

(in millions USD, except per share)

9/30/2024

9/30/2023

After-tax (1)

Per share

After-tax (1)

Per share

Net Income (loss) available to Voya

Financial, Inc.'s common shareholders

$

98

$

0.98

$

248

$

2.29

Less:

Net investment gains (losses) (2)

(26

)

(0.26

)

43

0.40

Income (loss) related to businesses exited

or to be exited through reinsurance or divestment (3)

(41

)

(0.41

)

38

0.35

Other adjustments (4)

(25

)

(0.25

)

(21

)

(0.19

)

Adjusted operating earnings

$

190

$

1.90

$

189

$

1.74

Less:

Alternative investment income and

prepayment fees above (below) long-term expectations net of

variable compensation

(22

)

(0.22

)

(23

)

(0.21

)

Other (5)

—

—

(13

)

(0.12

)

Adjusted operating earnings excluding

notable items

$

212

$

2.12

$

224

$

2.07

Note: Totals may not sum due to

rounding.

(1) For adjusted operating earnings, we

apply a 21% tax rate and adjust for the dividends received

deduction, tax credits, non-deductible compensation, and other tax

benefits and expenses that relate to adjusted operating earnings.

For net investment gains (losses), income (loss) related to

businesses exited, and other non-operating items, we apply a 21%

tax rate and adjust for related tax benefits and expenses,

including changes to tax valuation allowances and impacts related

to changes in tax law.

(2) Includes a $45 million revaluation

gain on the Voya India investment for the three months ended Sept.

30, 2023. There was no tax expense associated with this gain.

(3) Includes tax benefits of $92 million

related to a divested business for the three months ended Sept. 30,

2023.

(4) Primarily consists of acquisition and

integration costs associated with the Allianz Global Investors and

Benefitfocus transactions and amortization of acquisition-related

intangible assets. For the three months ended Sept. 30, 2024, also

includes $7 million, after-tax, of severance costs.

(5) Includes changes in certain legal and

other reserves not expected to recur at the same level.

Adjusted Operating Earnings

and Notable Items

Three Months Ended Sept. 30,

2024

(in millions USD, except per share)

Amounts Including

Notable Items

Alternative investment income

and prepayment fees above (below) long-term expectations

(1)

Amounts Excluding

Notable Items

a

b

c = a - b

Adjusted operating earnings

Wealth Solutions

$

211

$

(21

)

$

232

Health Solutions

23

(3

)

26

Investment Management

55

(4

)

59

Corporate

(59

)

—

(59

)

Adjusted operating earnings before

income taxes

230

(28

)

258

Income taxes (2)

39

(6

)

45

Adjusted operating earnings after

income taxes

$

190

$

(22

)

$

212

Adjusted operating earnings per

share

1.90

(0.22

)

2.12

Note: Totals may not sum due to

rounding.

(1) Amount by which Investment income from

alternative investments and prepayments exceeds or is less than our

long-term expectations, net of variable compensation. Long-term

expectation for alternative investments is a 9% annual return,

which for the three months ended Sept. 30, 2024, was approximately

$48 million, pre-tax and before variable compensation. Long-term

expectation for prepayment fees is a 10 basis point annual

contribution to yield, which for the three months ended Sept. 30,

2024, was approximately $9 million, pre-tax and before variable

compensation.

(2) For adjusted operating earnings, we

apply a 21% tax rate and adjust for the dividends received

deduction, tax credits, non-deductible compensation, and other tax

benefits and expenses that relate to adjusted operating

earnings.

Adjusted Operating Earnings

and Notable Items

Three Months Ended Sept. 30,

2023

(in millions USD, except per share)

Amounts Including

Notable Items

Alternative investment income

and prepayment fees above (below) long- term expectations

(1)

Other (2)

Amounts Excluding

Notable Items

a

b

c

d = a - b - c

Adjusted operating earnings

Wealth Solutions

$

179

$

(24

)

$

—

$

202

Health Solutions

53

(2

)

(16

)

71

Investment Management

49

(3

)

—

52

Corporate

(52

)

—

—

(52

)

Adjusted operating earnings before

income taxes

229

(29

)

(16

)

273

Income taxes (3)

39

(6

)

(3

)

49

Adjusted operating earnings after

income taxes

$

189

$

(23

)

$

(13

)

$

224

Adjusted operating earnings per

share

1.74

(0.21

)

(0.12

)

2.07

Note: Totals may not sum due to

rounding.

(1) Amount by which Investment income from

alternative investments and prepayments exceeds or is less than our

long-term expectations, net of variable compensation. Long-term

expectation for alternative investments is a 9% annual return,

which for the three months ended Sept. 30, 2023, was approximately

$48 million, pre-tax and before variable compensation. Long-term

expectation for prepayment fees is a 10 basis point annual

contribution to yield, which for the three months ended Sept. 30,

2023, was approximately $9 million, pre-tax and before variable

compensation.

(2) Includes changes in certain legal and

other reserves not expected to recur at the same level.

(3) For adjusted operating earnings, we

apply a 21% tax rate and adjust for the dividends received

deduction, tax credits, non-deductible compensation, and other tax

benefits and expenses that relate to adjusted operating

earnings.

Net Revenue, Adjusted

Operating Margin, and Notable Items

Twelve Months Ended Sept. 30,

2024

(in millions USD)

Amounts Including Notable

Items

Alternative investment income

and prepayment fees above (below) long-term expectations

(1)

Amounts Excluding Notable

Items

a

b

c = a - b

Net revenue

Wealth Solutions

$

1,999

$

(82

)

$

2,081

Health Solutions

1,123

(11

)

1,134

Investment Management

939

(9

)

948

Total net revenue

$

4,061

$

(102

)

$

4,163

Adjusted operating margin

Wealth Solutions

37.9

%

(2.5

)%

40.4

%

Health Solutions

16.6

%

(0.8

)%

17.4

%

Investment Management

26.3

%

(0.6

)%

26.9

%

Adjusted operating margin, excluding

Corporate

29.3

%

(1.7

)%

31.0

%

Note: Totals may not sum due to

rounding.

(1) Amount by which Investment income from

alternative investments and prepayments exceeds or is less than our

long-term expectations, net of variable compensation. Long-term

expectation for alternative investments is a 9% annual return,

which for the trailing twelve months ended Sept. 30, 2024, was

approximately $188 million, pre-tax and before variable

compensation. Long-term expectation for prepayment fees is a 10

basis point annual contribution to yield, which for the trailing

twelve months ended Sept. 30, 2024, was approximately $36 million,

pre-tax and before variable compensation.

Net Revenue, Adjusted

Operating Margin, and Notable Items

Twelve Months Ended Sept. 30,

2023

(in millions USD)

Amounts Including Notable

Items

Alternative investment income

and prepayment fees above (below) long- term expectations

(1)

Other (2)

Amounts Excluding Notable

Items

a

b

c

d = a - b - c

Net revenue

Wealth Solutions

$

1,864

$

(121

)

$

—

$

1,985

Health Solutions

1,137

(9

)

(16

)

1,165

Investment Management

903

(9

)

—

912

Total net revenue

$

3,904

$

(139

)

$

(16

)

$

4,061

Adjusted operating margin

Wealth Solutions

33.8

%

(4.0

)%

—

%

37.8

%

Health Solutions

30.6

%

(0.6

)%

(1.0

)%

32.2

%

Investment Management

24.9

%

(0.6

)%

—

25.5

%

Adjusted operating margin, excluding

Corporate

30.8

%

(2.4

)%

(0.2

)%

33.4

%

Note: Totals may not sum due to

rounding.

(1) Amount by which Investment income from

alternative investments and prepayments exceeds or is less than our

long-term expectations, net of variable compensation. Long-term

expectation for alternative investments is a 9% annual return,

which for the trailing twelve months ended Sept. 30, 2023, was

approximately $190 million, pre-tax and before variable

compensation. Long-term expectation for prepayment fees is a 10

basis point annual contribution to yield, which for the trailing

twelve months ended Sept. 30, 2023, was approximately $37 million,

pre-tax and before variable compensation.

(2) Includes changes in certain legal and

other reserves not expected to recur at the same level.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104246985/en/

Media: Donna Sullivan Donna.Sullivan@voya.com

Investor: Mei Ni Chu IR@voya.com

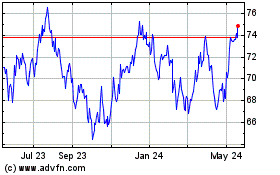

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Jan 2025 to Feb 2025

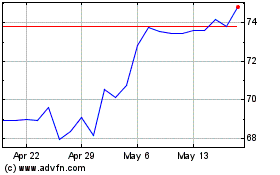

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Feb 2024 to Feb 2025