- Reported third-quarter 2023 Net income attributable to limited

partners of $270.8 million, generating third-quarter Adjusted

EBITDA(1) of $510.9 million.

- Reported third-quarter 2023 Cash flows provided by operating

activities of $394.8 million, generating third-quarter Free cash

flow(1) of $200.4 million.

- Announced a third-quarter Base Distribution of $0.5750 per

unit, or $2.30 on an annualized basis, which represents a

2.2-percent increase to the prior-quarter’s Base Distribution.

- Repurchased 5.1 million common units from Occidental Petroleum

Corporation (“Oxy”) for $127.5 million, reducing Oxy’s total

ownership interest in WES to below 50.0% when taking into account

both its limited and general partner units.

- Repurchased $159.1 million of near-term senior notes at

approximately 94-percent of par during the month of July.

- Subsequent to quarter end, executed an agreement with a large

Delaware Basin customer increasing dedicated acreage to

approximately 40,000 acres and extending the initial term through

2035, which dedicates existing volumes and supports expected

throughput growth.

Today Western Midstream Partners, LP (NYSE: WES) (“WES” or the

“Partnership”) announced third-quarter 2023 financial and operating

results. Net income (loss) attributable to limited partners for the

third quarter of 2023 totaled $270.8 million, or $0.70 per common

unit (diluted), with third-quarter 2023 Adjusted EBITDA(1) totaling

$510.9 million. Third-quarter 2023 Cash flows provided by operating

activities totaled $394.8 million, and third-quarter 2023 Free cash

flow(1) totaled $200.4 million.

RECENT HIGHLIGHTS

- Achieved record Delaware Basin natural-gas throughput of 1.67

Bcf/d for the third quarter, representing a 5-percent

sequential-quarter increase.

- Gathered record Delaware Basin crude-oil and NGLs throughput of

220 MBbls/d for the third quarter, representing a 6-percent

sequential-quarter increase.

- Gathered record Delaware Basin produced-water throughput of

1,101 MBbls/d for the third quarter, representing a 14-percent

sequential-quarter increase.

- Averaged over 1.0 Bcf/d of monthly third-party natural-gas

volumes in the Delaware Basin during August and September.

- Issued $600 million of 6.35% senior notes due 2029 and used the

proceeds to fund a portion of the purchase price for the previously

announced acquisition of Meritage Midstream Services II, LLC

(“Meritage”) in the Powder River Basin.

- Subsequent to quarter-end, closed the acquisition of Meritage,

transforming WES’s Powder River Basin asset base into the largest

gatherer and processor in the basin.

On November 13, 2023, WES will pay its third-quarter 2023

per-unit Base Distribution of $0.5750, representing a 2.2-percent

sequential-quarter increase to the Partnership’s second-quarter

Base Distribution of $0.5625 per unit. This increase is consistent

with prior communication regarding a distribution increase upon the

close of the Meritage acquisition. Third-quarter 2023 Free cash

flow(1) after distributions totaled $(21.0) million. Third-quarter

2023 and year-to-date capital expenditures(2) totaled $194.9

million and $558.5 million, respectively.

Third-quarter 2023 natural-gas throughput(3) averaged 4.5 Bcf/d,

representing a 5-percent sequential-quarter increase. Third-quarter

2023 throughput for crude-oil and NGLs assets(3) averaged 667

MBbls/d, representing a 7-percent sequential-quarter increase.

Third-quarter 2023 throughput for produced-water assets(3) averaged

1,079 MBbls/d, representing a 14-percent sequential-quarter

increase.

“During the third quarter, total throughput for natural-gas,

crude-oil and NGLs, and produced-water increased on a

sequential-quarter basis primarily driven by new production coming

online, and continued high facility operability in the Delaware

Basin,” said Michael Ure, President and Chief Executive Officer.

“We remain focused on creating substantial value for our

unitholders by efficiently allocating capital for future growth

organically and through accretive M&A.”

Mr. Ure continued, “Overall, portfolio-wide throughput growth

drove a sequential-quarter increase in our Adjusted EBITDA, which

was partially offset by decreased distributions from our equity

investments and increased operation and maintenance expense that

was mostly driven by higher utility costs. Despite the prolonged

heat across West Texas, our assets maintained high operability

rates with minimal downtime.”

“In early September, we announced the acquisition of Meritage in

the Powder River Basin in Wyoming for $885 million in cash

consideration. The Meritage acquisition transforms WES into the

largest gathering and processing operator in the Powder River

Basin. Additionally, the transaction further diversifies our

customer base and adds numerous long-term contracts to our

portfolio, secured by large acreage dedications or substantial

minimum-volume commitments. We have also identified numerous cost

synergies that we expect to realize over the coming quarters, which

should reduce the acquisition multiple and drive additional

unitholder value.”

“Finally, in October, we formally announced our second Base

Distribution increase for the year of 2.2% to $0.5750 per unit on a

quarterly basis, or $2.30 per unit annualized, in connection with

the closing of the Meritage acquisition. Our commitment to

improving the strength of our balance sheet over the past three

years provided WES the opportunity to undertake this accretive

transaction, which we expect will contribute to WES’s profitability

and Free cash flow for years to come.”

“When considering the growth we experienced in the third

quarter, combined with over two months of expected contribution

from the Meritage assets, we now anticipate 2023 Adjusted EBITDA(4)

to be towards the high end of our previously announced guidance

range of $1.950 billion to $2.050 billion,” concluded Mr. Ure.

CONFERENCE CALL TOMORROW AT 1:00 P.M. CT

WES will host a conference call on Thursday, November 2, 2023,

at 1:00 p.m. Central Time (2:00 p.m. Eastern Time) to discuss its

third-quarter 2023 results. To participate, individuals should dial

888-770-7129 (Domestic) or 929-203-2109 (International) ten to

fifteen minutes before the scheduled conference call time and enter

the participant access code 2187921. To access the live audio

webcast of the conference call, please visit the investor relations

section of the Partnership’s website at www.westernmidstream.com. A

replay of the conference call also will be available on the website

following the call.

For additional details on WES’s financial and operational

performance, please refer to the earnings slides and updated

investor presentation available at www.westernmidstream.com.

ABOUT WESTERN MIDSTREAM

Western Midstream Partners, LP (“WES”) is a Delaware master

limited partnership formed to acquire, own, develop, and operate

midstream assets. With midstream assets located in Texas, New

Mexico, Colorado, Utah, Wyoming, and Pennsylvania, WES is engaged

in the business of gathering, compressing, treating, processing,

and transporting natural gas; gathering, stabilizing, and

transporting condensate, natural-gas liquids, and crude oil; and

gathering and disposing of produced water for its customers. In its

capacity as a natural-gas processor, WES also buys and sells

natural gas, natural-gas liquids, and condensate on behalf of

itself and its customers under certain contracts.

For more information about Western Midstream Partners, LP,

please visit www.westernmidstream.com, and for more information on

our sustainability efforts, please visit

www.westernmidstream.com/sustainability.

This news release contains forward-looking statements. WES’s

management believes that its expectations are based on reasonable

assumptions. No assurance, however, can be given that such

expectations will prove correct. A number of factors could cause

actual results to differ materially from the projections,

anticipated results, or other expectations expressed in this news

release. These factors include our ability to meet financial

guidance or distribution expectations; our ability to safely and

efficiently operate WES’s assets; the supply of, demand for, and

price of oil, natural gas, NGLs, and related products or services;

our ability to meet projected in-service dates for capital-growth

projects; construction costs or capital expenditures exceeding

estimated or budgeted costs or expenditures; and the other factors

described in the “Risk Factors” section of WES’s most-recent Form

10-K filed with the Securities and Exchange Commission and other

public filings and press releases. WES undertakes no obligation to

publicly update or revise any forward-looking statements.

______________________________________________________________

(1)

Please see the definitions of the

Partnership’s non-GAAP measures at the end of this release and

reconciliation of GAAP to non-GAAP measures.

(2)

Accrual-based, includes equity

investments, excludes capitalized interest, and excludes capital

expenditures associated with the 25% third-party interest in

Chipeta.

(3)

Represents total throughput attributable

to WES, which excludes (i) the 2.0% limited partner interest in WES

Operating owned by an Occidental subsidiary and (ii) for

natural-gas throughput, the 25% third-party interest in Chipeta,

which collectively represent WES’s noncontrolling interests.

(4)

A reconciliation of the Adjusted EBITDA

range to net cash provided by operating activities and net income

(loss) is not provided because the items necessary to estimate such

amounts are not reasonably estimable at this time. These items, net

of tax, may include, but are not limited to, impairments of assets

and other charges, divestiture costs, acquisition costs, or changes

in accounting principles. All of these items could significantly

impact such financial measures. At this time, WES is not able to

estimate the aggregate impact, if any, of these items on future

period reported earnings. Accordingly, WES is not able to provide a

corresponding GAAP equivalent for the Adjusted EBITDA.

Western Midstream Partners,

LP

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

thousands except per-unit amounts

2023

2022

2023

2022

Revenues and other

Service revenues – fee based

$

695,547

$

666,555

$

2,004,920

$

1,954,105

Service revenues – product based

48,446

91,356

142,212

202,721

Product sales

31,652

79,430

100,336

314,755

Other

368

227

800

703

Total revenues and other

776,013

837,568

2,248,268

2,472,284

Equity income, net – related

parties

35,494

41,317

116,839

139,388

Operating expenses

Cost of product

27,590

106,833

123,795

328,237

Operation and maintenance

204,434

190,514

562,104

487,643

General and administrative

55,050

48,185

159,572

144,635

Property and other taxes

14,583

19,390

39,961

60,494

Depreciation and amortization

147,363

156,837

435,481

430,455

Long-lived asset and other impairments

245

4

52,880

94

Total operating expenses

449,265

521,763

1,373,793

1,451,558

Gain (loss) on divestiture and other,

net

(1,480

)

(104

)

(3,668

)

(884

)

Operating income (loss)

360,762

357,018

987,646

1,159,230

Interest expense

(82,754

)

(83,106

)

(250,606

)

(249,333

)

Gain (loss) on early extinguishment of

debt

8,565

—

15,378

91

Other income (expense), net

(1,270

)

56

2,817

117

Income (loss) before income

taxes

285,303

273,968

755,235

910,105

Income tax expense (benefit)

905

387

2,980

3,683

Net income (loss)

284,398

273,581

752,255

906,422

Net income (loss) attributable to

noncontrolling interests

7,102

7,836

18,393

25,643

Net income (loss) attributable to

Western Midstream Partners, LP

$

277,296

$

265,745

$

733,862

$

880,779

Limited partners’ interest in net

income (loss):

Net income (loss) attributable to Western

Midstream Partners, LP

$

277,296

$

265,745

$

733,862

$

880,779

General partner interest in net (income)

loss

(6,453

)

(6,244

)

(16,960

)

(19,794

)

Limited partners’ interest in net income

(loss)

$

270,843

$

259,501

$

716,902

$

860,985

Net income (loss) per common unit –

basic

$

0.71

$

0.67

$

1.87

$

2.16

Net income (loss) per common unit –

diluted

$

0.70

$

0.66

$

1.86

$

2.15

Weighted-average common units

outstanding – basic

383,561

388,906

384,211

398,343

Weighted-average common units

outstanding – diluted

384,772

390,318

385,344

399,545

Western Midstream Partners,

LP

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

thousands except number of units

September 30,

2023

December 31,

2022

Total current assets

$

1,135,806

$

900,425

Net property, plant, and equipment

8,664,402

8,541,600

Other assets

1,826,346

1,829,603

Total assets

$

11,626,554

$

11,271,628

Total current liabilities

$

635,900

$

903,857

Long-term debt

7,260,051

6,569,582

Asset retirement obligations

307,945

290,021

Other liabilities

467,566

400,053

Total liabilities

8,671,462

8,163,513

Equity and partners’ capital

Common units (379,516,369 and 384,070,984

units issued and outstanding at September 30, 2023, and December

31, 2022, respectively)

2,821,958

2,969,604

General partner units (9,060,641 units

issued and outstanding at September 30, 2023, and December 31,

2022)

1,678

2,105

Noncontrolling interests

131,456

136,406

Total liabilities, equity, and

partners’ capital

$

11,626,554

$

11,271,628

Western Midstream Partners,

LP

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Nine Months Ended

September 30,

thousands

2023

2022

Cash flows from operating

activities

Net income (loss)

$

752,255

$

906,422

Adjustments to reconcile net income (loss)

to net cash provided by operating activities and changes in assets

and liabilities:

Depreciation and amortization

435,481

430,455

Long-lived asset and other impairments

52,880

94

(Gain) loss on divestiture and other,

net

3,668

884

(Gain) loss on early extinguishment of

debt

(15,378

)

(91

)

Change in other items, net

(40,872

)

(125,557

)

Net cash provided by operating

activities

$

1,188,034

$

1,212,207

Cash flows from investing

activities

Capital expenditures

$

(536,427

)

$

(341,505

)

Acquisitions from third parties

—

(41,018

)

Contributions to equity investments -

related parties

(1,153

)

(8,899

)

Distributions from equity investments in

excess of cumulative earnings – related parties

31,715

41,058

Proceeds from the sale of assets to third

parties

(60

)

1,111

(Increase) decrease in materials and

supplies inventory and other

(32,659

)

(6,999

)

Net cash used in investing activities

$

(538,584

)

$

(356,252

)

Cash flows from financing

activities

Borrowings, net of debt issuance costs

$

1,801,011

$

1,389,010

Repayments of debt

(1,317,928

)

(1,268,548

)

Increase (decrease) in outstanding

checks

(241

)

1,459

Distributions to Partnership

unitholders

(754,998

)

(538,690

)

Distributions to Chipeta noncontrolling

interest owner

(5,083

)

(5,020

)

Distributions to noncontrolling interest

owner of WES Operating

(18,260

)

(20,177

)

Net contributions from (distributions to)

related parties

—

1,161

Unit repurchases

(134,602

)

(447,075

)

Other

(16,511

)

(10,981

)

Net cash provided by (used in) financing

activities

$

(446,612

)

$

(898,861

)

Net increase (decrease) in cash and

cash equivalents

$

202,838

$

(42,906

)

Cash and cash equivalents at beginning

of period

286,656

201,999

Cash and cash equivalents at end of

period

$

489,494

$

159,093

Western Midstream Partners, LP

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

WES defines Adjusted gross margin attributable to Western

Midstream Partners, LP (“Adjusted gross margin”) as total revenues

and other (less reimbursements for electricity-related expenses

recorded as revenue), less cost of product, plus distributions from

equity investments, and excluding the noncontrolling interest

owners’ proportionate share of revenues and cost of product.

WES defines Adjusted EBITDA as net income (loss), plus (i)

distributions from equity investments, (ii) non-cash equity-based

compensation expense, (iii) interest expense, (iv) income tax

expense, (v) depreciation and amortization, (vi) impairments, and

(vii) other expense (including lower of cost or market inventory

adjustments recorded in cost of product), less (i) gain (loss) on

divestiture and other, net, (ii) gain (loss) on early

extinguishment of debt, (iii) income from equity investments, (iv)

interest income, (v) income tax benefit, (vi) other income, and

(vii) the noncontrolling interest owners’ proportionate share of

revenues and expenses.

WES defines Free cash flow as net cash provided by operating

activities less total capital expenditures and contributions to

equity investments, plus distributions from equity investments in

excess of cumulative earnings. Management considers Free cash flow

an appropriate metric for assessing capital discipline, cost

efficiency, and balance-sheet strength. Although Free cash flow is

the metric used to assess WES’s ability to make distributions to

unitholders, this measure should not be viewed as indicative of the

actual amount of cash that is available for distributions or

planned for distributions for a given period. Instead, Free cash

flow should be considered indicative of the amount of cash that is

available for distributions, debt repayments, and other general

partnership purposes.

Below are reconciliations of (i) gross margin (GAAP) to Adjusted

gross margin (non-GAAP), (ii) net income (loss) (GAAP) and net cash

provided by operating activities (GAAP) to Adjusted EBITDA

(non-GAAP), and (iii) net cash provided by operating activities

(GAAP) to Free cash flow (non-GAAP), as required under Regulation G

of the Securities Exchange Act of 1934. Management believes that

Adjusted gross margin, Adjusted EBITDA, and Free cash flow are

widely accepted financial indicators of WES’s financial performance

compared to other publicly traded partnerships and are useful in

assessing WES’s ability to incur and service debt, fund capital

expenditures, and make distributions. Adjusted gross margin,

Adjusted EBITDA, and Free cash flow as defined by WES, may not be

comparable to similarly titled measures used by other companies.

Therefore, WES’s Adjusted gross margin, Adjusted EBITDA, and Free

cash flow should be considered in conjunction with net income

(loss) attributable to Western Midstream Partners, LP and other

applicable performance measures, such as gross margin or cash flows

provided by operating activities.

Western Midstream Partners,

LP

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Adjusted Gross Margin

Three Months Ended

thousands

September 30,

2023

June 30, 2023

Reconciliation of Gross margin to

Adjusted gross margin

Total revenues and other

$

776,013

$

738,273

Less:

Cost of product

27,590

44,746

Depreciation and amortization

147,363

143,492

Gross margin

601,060

550,035

Add:

Distributions from equity investments

41,562

54,075

Depreciation and amortization

147,363

143,492

Less:

Reimbursed electricity-related charges

recorded as revenues

29,981

23,286

Adjusted gross margin attributable to

noncontrolling interests (1)

18,095

16,914

Adjusted gross margin

$

741,909

$

707,402

Gross margin

Gross margin for natural-gas assets

(2)

$

450,130

$

409,634

Gross margin for crude-oil and NGLs

assets (2)

87,911

88,024

Gross margin for produced-water

assets (2)

70,353

59,130

Adjusted gross margin

Adjusted gross margin for natural-gas

assets

$

518,765

$

489,476

Adjusted gross margin for crude-oil and

NGLs assets

139,430

147,036

Adjusted gross margin for produced-water

assets

83,714

70,890

(1)

For all periods presented, includes (i)

the 25% third-party interest in Chipeta and (ii) the 2.0% limited

partner interest in WES Operating owned by an Occidental

subsidiary, which collectively represent WES’s noncontrolling

interests.

(2)

Excludes corporate-level depreciation and

amortization.

Western Midstream Partners,

LP

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Adjusted EBITDA

Three Months Ended

thousands

September 30,

2023

June 30, 2023

Reconciliation of Net income (loss) to

Adjusted EBITDA

Net income (loss)

$

284,398

$

259,516

Add:

Distributions from equity investments

41,562

54,075

Non-cash equity-based compensation

expense

7,171

7,665

Interest expense

82,754

86,182

Income tax expense

905

659

Depreciation and amortization

147,363

143,492

Impairments

245

234

Other expense

1,269

199

Less:

Gain (loss) on divestiture and other,

net

(1,480

)

(70

)

Gain (loss) on early extinguishment of

debt

8,565

6,813

Equity income, net – related parties

35,494

42,324

Other income

27

2,872

Adjusted EBITDA attributable to

noncontrolling interests (1)

12,134

11,737

Adjusted EBITDA

$

510,927

$

488,346

Reconciliation of Net cash provided by

operating activities to Adjusted EBITDA

Net cash provided by operating

activities

$

394,787

$

490,823

Interest (income) expense, net

82,754

86,182

Accretion and amortization of long-term

obligations, net

(1,882

)

(2,403

)

Current income tax expense (benefit)

806

728

Other (income) expense, net

1,270

(2,872

)

Distributions from equity investments in

excess of cumulative earnings – related parties

8,536

10,813

Changes in assets and liabilities:

Accounts receivable, net

60,614

(4,078

)

Accounts and imbalance payables and

accrued liabilities, net

(12,535

)

(36,885

)

Other items, net

(11,289

)

(42,225

)

Adjusted EBITDA attributable to

noncontrolling interests (1)

(12,134

)

(11,737

)

Adjusted EBITDA

$

510,927

$

488,346

Cash flow information

Net cash provided by operating

activities

$

394,787

$

490,823

Net cash used in investing activities

(207,916

)

(151,490

)

Net cash provided by (used in) financing

activities

88,670

(238,025

)

(1)

For all periods presented, includes (i)

the 25% third-party interest in Chipeta and (ii) the 2.0% limited

partner interest in WES Operating owned by an Occidental

subsidiary, which collectively represent WES’s noncontrolling

interests.

Western Midstream Partners,

LP

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Free Cash Flow

Three Months Ended

thousands

September 30,

2023

June 30, 2023

Reconciliation of Net cash provided by

operating activities to Free cash flow

Net cash provided by operating

activities

$

394,787

$

490,823

Less:

Capital expenditures

201,857

161,482

Contributions to equity investments –

related parties

1,021

22

Add:

Distributions from equity investments in

excess of cumulative earnings – related parties

8,536

10,813

Free cash flow

$

200,445

$

340,132

Cash flow information

Net cash provided by operating

activities

$

394,787

$

490,823

Net cash used in investing activities

(207,916

)

(151,490

)

Net cash provided by (used in) financing

activities

88,670

(238,025

)

Western Midstream Partners,

LP

OPERATING STATISTICS

(Unaudited)

Three Months Ended

September 30,

2023

June 30, 2023

Throughput for natural-gas assets

(MMcf/d)

Gathering, treating, and

transportation

457

395

Processing

3,699

3,567

Equity investments (1)

495

454

Total throughput

4,651

4,416

Throughput attributable to noncontrolling

interests (2)

167

162

Total throughput attributable to WES for

natural-gas assets

4,484

4,254

Throughput for crude-oil and NGLs

assets (MBbls/d)

Gathering, treating, and

transportation

334

316

Equity investments (1)

347

323

Total throughput

681

639

Throughput attributable to noncontrolling

interests (2)

14

13

Total throughput attributable to WES for

crude-oil and NGLs assets

667

626

Throughput for produced-water assets

(MBbls/d)

Gathering and disposal

1,101

963

Throughput attributable to noncontrolling

interests (2)

22

20

Total throughput attributable to WES for

produced-water assets

1,079

943

Per-Mcf Gross margin for

natural-gas assets (3)

$

1.05

$

1.02

Per-Bbl Gross margin for

crude-oil and NGLs assets (3)

1.40

1.51

Per-Bbl Gross margin for

produced-water assets (3)

0.69

0.68

Per-Mcf Adjusted gross margin for

natural-gas assets (4)

$

1.26

$

1.26

Per-Bbl Adjusted gross margin for

crude-oil and NGLs assets (4)

2.27

2.58

Per-Bbl Adjusted gross margin for

produced-water assets (4)

0.84

0.83

(1)

Represents our share of average throughput for investments

accounted for under the equity method of accounting.

(2)

For all periods presented, includes (i) the 2.0% limited

partner interest in WES Operating owned by an Occidental subsidiary

and (ii) for natural-gas assets, the 25% third-party interest in

Chipeta, which collectively represent WES’s noncontrolling

interests.

(3)

Average for period. Calculated as Gross margin for

natural

-gas assets, crude

-oil and NGLs assets, or

produced

-water assets, divided by the respective total

throughput (MMcf or MBbls) for natural

-gas assets,

crude

-oil and NGLs assets, or produced

-water assets.

(4)

Average for period. Calculated as Adjusted gross margin for

natural

-gas assets, crude

-oil and NGLs assets, or

produced

-water assets, divided by the respective total

throughput (MMcf or MBbls) attributable to WES for

natural

-gas assets, crude

-oil and NGLs assets, or

produced

-water assets.

Western Midstream Partners,

LP

OPERATING STATISTICS

(CONTINUED)

(Unaudited)

Three Months Ended

September 30,

2023

June 30, 2023

Throughput for natural-gas assets

(MMcf/d)

Delaware Basin

1,674

1,592

DJ Basin

1,331

1,309

Equity investments

495

454

Other

1,151

1,061

Total throughput for natural-gas

assets

4,651

4,416

Throughput for crude-oil and NGLs

assets (MBbls/d)

Delaware Basin

220

208

DJ Basin

68

66

Equity investments

347

323

Other

46

42

Total throughput for crude-oil and NGLs

assets

681

639

Throughput for produced-water assets

(MBbls/d)

Delaware Basin

1,101

963

Total throughput for produced-water

assets

1,101

963

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231031991056/en/

WESTERN MIDSTREAM CONTACTS Daniel Jenkins Director,

Investor Relations Investors@westernmidstream.com 866.512.3523

Rhianna Disch Manager, Investor Relations

Investors@westernmidstream.com 866.512.3523

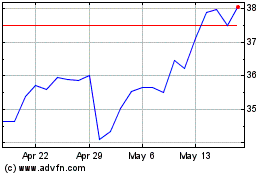

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Jan 2025 to Feb 2025

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Feb 2024 to Feb 2025