Westlake Chemical Partners Provides Update about Tax Information

February 27 2024 - 5:45AM

Business Wire

Westlake Chemical Partners LP (the “Partnership”) (NYSE: WLKP)

today provided an update on the expected availability of the

Partnership’s 2023 Investor Tax Packages including Schedule K-1 for

its common unitholders.

Historically, the Partnership’s Investor Tax Packages have been

available by the end of February for the preceding tax year;

however, the timing of the availability of Partnership’s 2023

Investor Tax Packages is dependent upon actions of the U.S.

Congress and the Biden administration with regard to the passage,

or not, of the Tax Relief for American Families and Workers Act of

2024, (referred to as “H.R. 7024”). H.R. 7024 was passed by the

House of Representatives on January 31, 2024 and is now among the

legislative items that the U.S. Senate may consider after it

reconvenes on Monday, February 26, 2024 from its current two-week

recess. This legislation includes changes in tax law which would be

applied retroactively to the 2023 tax year. As passed by the House

of Representatives, certain provisions in H.R. 7024 would lower the

Partnership’s taxable income for 2023 compared to existing tax

law.

H.R. 7024 is subject to the legislative process, which may

include amendments introduced by the Senate and thus reconciliation

of this bill between the House of Representatives and the Senate

and subject to the ultimate approval by the President.

Due to the ongoing consideration of H.R. 7024 by Congress and

thus the uncertainty of the ultimate tax laws applicable to tax

year 2023, the Partnership currently expects that its 2023 Investor

Tax Packages, including Schedule K-1 and all information to

fiduciaries for common units owned in tax exempt accounts, will be

delayed in comparison to previous years and will be available

online through our website at www.taxpackagesupport.com/wlkp on or

before March 29, 2024 and the mailing of the tax packages would be

completed by April 5, 2024. Once the applicable tax laws for 2023

are known and finalized by the passage, or not, of H.R. 7024, the

Partnership will provide an update on the availability of the 2023

Investor Tax Packages. While these matters are beyond our control,

we apologize for any inconvenience the timing of this pending tax

legislation may cause our unitholders.

Online K-1 Access To obtain the Partnership’s 2023

Investor Tax Packages including Schedule K-1 as soon as they are

available, sign-up for paperless K-1 delivery, view K-1s from

previous years, update ownership information, estimate gain/loss

calculations, or download files for Turbo Tax, visit the website at

www.taxpackagesupport.com/wlkp.

About Westlake Chemical Partners: Westlake Chemical

Partners is a limited partnership formed by Westlake Corporation to

operate, acquire and develop ethylene production facilities and

other qualified assets. Headquartered in Houston, the Partnership

owns an 22.8% interest in Westlake Chemical OpCo LP. Westlake

Chemical OpCo LP's assets consist of three ethylene production

facilities in Calvert City, Kentucky, and Lake Charles, Louisiana

and an ethylene pipeline. For more information about Westlake

Chemical Partners LP, please visit http://www.wlkpartners.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240227044329/en/

Media Relations – L. Ben Ederington – 713.585.2900 Investor

Relations – Steve Bender – 713.585.2900

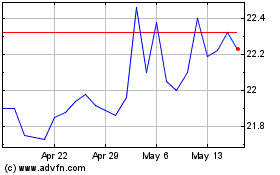

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Nov 2024 to Dec 2024

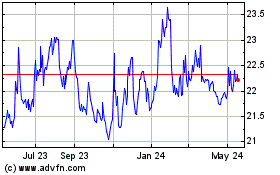

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Dec 2023 to Dec 2024