January’s Zeta Economic Index (ZEI) Shows US Economy Holding Steady Heading into 2025

February 04 2025 - 7:30AM

Business Wire

Consumer Spending Remains Resilient

Post-Holiday, With Dining Activity Up and Retail Facing Seasonal

Headwinds

Zeta Global (NYSE:ZETA), the AI Marketing Cloud, today released

the Zeta Economic Index (ZEI) for January 2025. Powered by Zeta's

proprietary Generative AI technology and real-time consumer

behavior from over 245 million US consumers, the ZEI provides an

unparalleled view of the strength and momentum of the US

economy.

Following the surge in consumer spending during the 2024 holiday

season, the US economy appears to be holding steady at the start of

2025, despite an expected post-holiday correction from retail. One

bright spot is the dining sector, which saw a 4.1 point increase

month-over-month (MoM) in activity, fueled by seasonal trends such

as gift card redemptions and colder weather driving demand for

takeout.

The Economic Index Score (EIS), the ZEI’s primary measure of US

economic health, dipped slightly to 70.9, a 0.8% month-over-month

(MoM) decrease, as the economy recalibrates post-holiday spending.

Despite the decline, the EIS remains higher than average 2024

levels reinforcing the economy’s solid footing. The Economic

Stability Index (ESI) increased to 66.9, marking a 0.6% QoQ

increase, underscoring consumer spending resilience.

“It’s an encouraging signal for the year ahead that the economy

looks this strong in a month when consumers typically pull back on

spending,” said David A. Steinberg, Co-Founder, Chairman, and CEO

of Zeta Global. “The ZEI provides a real-time, behavior-driven view

of economic conditions in the US offering business leaders a

valuable tool to navigate 2025 investment. In the coming months,

we’ll be closely monitoring whether consumers reignite their

spending patterns or maintain a more cautious approach.”

Additional highlights from the January 2025 ZEI:

- Consumer Spending Remain Strong: Discretionary spend

propensity rose 4.6% MoM. Similarly, credit line expansion intent

edged up .6% MoM, showing a steady, albeit cautious, appetite for

borrowing.

- Dining Sales Are Up: Consumer interest in dining made a

strong comeback in January, marking the biggest MoM gain across

industries. Following a rise in gift card sales during the holiday

season, consumers appear to be eager to redeem them sooner rather

than later, with a 4.1 point increase for the sector.

- Cold Winter Impacts Retail Activity: Retail activity

declined 3.9 points MoM, possibly attributed to the deep freeze

most of the nation experienced in January. Historically, colder

winter months negatively affect retail almost immediately,

especially in small businesses as they opt to close rather than pay

employees for little to no customers.

- Healthcare Activity declines: Healthcare activity

declined, falling 3.9 points. As consumers navigate new coverage

rules and reset deductibles, policy changes in corporate insurance

plans at the start of the year are likely a factor in the decline.

Additionally, some uncertainty may stem from recent headlines

around government stance on vaccines and healthcare policy, which

could add to broader consumer hesitancy.

- Job Market Sentiment Drops Sharply: A drastic decline of

19.6% MoM could indicate rising concerns over job security, hiring

freezes, or shifting employment dynamics—particularly as many jobs

face uncertainly as the new administration begins to implement new

policies.

Unlike traditional surveys, the ZEI leverages Generative AI to

analyze trillions of behavioral signals, recalibrating each month

to reflect actual consumer activity. With insights derived from

over 20 proprietary inputs, the index provides a comprehensive,

real-time view of economic sentiment, activity and spending

trends.

The Zeta Economic Index is publicly available here and is

provided as a complimentary service. It should not be considered

investment advice or be relied upon to make investment

decisions.

About Zeta Global

Zeta Global (NYSE: ZETA) is the AI Marketing Cloud that

leverages advanced artificial intelligence (AI) and trillions of

consumer signals to make it easier for marketers to acquire, grow,

and retain customers more efficiently. Through the Zeta Marketing

Platform (ZMP), our vision is to make sophisticated marketing

simple by unifying identity, intelligence, and omnichannel

activation into a single platform – powered by one of the

industry’s largest proprietary databases and AI. Our enterprise

customers across multiple verticals are empowered to personalize

experiences with consumers at an individual level across every

channel, delivering better results for marketing programs. Zeta was

founded in 2007 by David A. Steinberg and John Sculley and is

headquartered in New York City with offices around the world. To

learn more, go to www.zetaglobal.com.

Forward-Looking Statements

This press release, together with other statements and

information publicly disseminated by the Company, contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The Company intends

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with these safe harbor

provisions. Any statements made in this press release that are not

statements of historical fact are forward-looking statements and

should be evaluated as such. Forward-looking statements include

information concerning our anticipated future financial

performance, our market opportunities and our expectations

regarding our business plan and strategies. These statements often

include words such as “anticipate,” “believe,” “could,”

“estimates,” “expect,” “forecast,” “guidance,” “intend,” “may,”

“outlook,” “plan,” “projects,” “should,” “suggests,” “targets,”

“will,” “would” and other similar expressions. We base these

forward-looking statements on our current expectations, plans and

assumptions that we have made in light of our experience in the

industry, as well as our perceptions of historical trends, current

conditions, expected future developments and other factors we

believe are appropriate under the circumstances at such time.

Although we believe that these forward-looking statements are based

on reasonable assumptions at the time they are made, you should be

aware that many factors could affect our business, results of

operations and financial condition and could cause actual results

to differ materially from those expressed in the forward-looking

statements. These statements are not guarantees of future

performance or results.

The forward-looking statements are subject to and involve risks,

uncertainties and assumptions, and you should not place undue

reliance on these forward-looking statements. These cautionary

statements should not be construed by you to be exhaustive and the

forward-looking statements are made only as of the date of this

press release. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable law.

If we update one or more forward-looking statements, no inference

should be drawn that we will make additional updates with respect

to those or other forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250203833575/en/

Investor Relations Matt Pfau ir@zetaglobal.com

Press Candace Dean press@zetaglobal.com

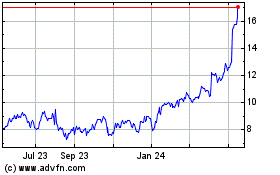

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Jan 2025 to Feb 2025

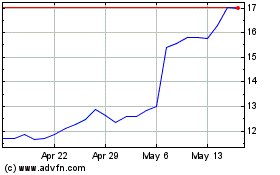

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Feb 2024 to Feb 2025