Black Iron Inc. (“Black Iron” or the “Company”) (TSX: BKI; OTC:

BKIRF; FRANKFURT: BIN) continues to advance the Shymanivske Iron

Ore Project (“Shymanivske” or the “Project”) towards construction.

In the second half of this year, the Company hosted a few

multibillion-dollar companies at site as part of their due

diligence to fund a portion of Project construction in exchange for

purchase of the ultra high grade 68% iron content pellet feed iron

concentrate expected to be produced. Additionally, several

meetings with Ukraine government officials have been held since

receiving a proposal from Ukraine’s Ministry of Defence to secure

the surface rights for a plot of land adjacent to Black Iron’s

Shymanivske Project for location of the processing plant, tailings

and waste rock.

CONSTRUCTION FUNDING AND OFF-TAKE

AGREEMENTS ADVANCING

During the summer and fall, interested steel

mills and global commodity trading houses visited the Shymanivske

Project site as part of their due diligence for investment in

Project construction in exchange for long term purchase of Black

Iron’s pellet feed. Discussion with these groups remains

ongoing and Black Iron management anticipates being able to

announce its first commercial arrangement early in the new

year. Interest from these groups is largely driven by the

close proximity of the Project to rail, power, ports and people

leading to a scalable project with the second lowest capital

intensity and lowest normalized operating costs in the world for an

undeveloped pellet feed project according to the CRU Group as press

released by the Company on May 2, 2018.

Debt finance discussions with international

finance institutions and European based banks, several of which are

actively lending to producing iron ore companies in Ukraine, are

ongoing. Debt lenders are mainly focused on a company’s

ability to repay their loan in a downside pricing

environment. Since Black Iron is expected to generate

substantial free cash flow in a range of downside price scenario’s

coupled with relatively low amount of debt expected to be required

to produce 4MTpa initially, it is an attractive project for

lenders.

LAND ACQUISITION ADVANCING

As reported by the Company on September 4, 2018,

Black Iron received a proposal from Ukraine’s Ministry of Defence

(“MOD”) to transfer a parcel of land required by the Company for

location of its processing plant, waste rock and tailings.

Several meetings with high ranking Ukraine government officials

including the MOD remain ongoing to finalize the specific parcel of

land that is mutually agreeable for transfer.

An offer to lease a portion of the surface

rights over which the Shymanivske ore body is located has also been

made by the Kryviy Rih City Council who own this land. The

signing of a lease is pending Black Iron (i) finalizing discussions

with Ukraine’s central government on the MOD parcel of land, and

(ii) Black Iron finalizing an agreement with a neighbouring mine,

Central Ore Processing (YuGOK), on the previously agreed relocation

of their mine service garage.

SENIOR MANAGEMENT CHANGES

Black Iron has recently engaged Ivan Markovich

in the capacity of Vice President, Government and Community

relations given his extensive network of relationships with very

senior Ukraine government officials. As part of bringing on

Ivan, Black Iron’s President Michael Spektor has agreed to resign

his position given the overlap in the mandate for this role.

Black Iron’s management and board of directors thank Mr.

Spektor for his contributions and wish him well in his future

endeavours.

IRON ORE PRICES CONTINUE TO STRENGHTEN

ALREADY IMPRESSIVE PROJECT ECONOMICS

Since publishing the re-scoped Preliminary

Economic Assessment (“PEA”), the benchmark 62% iron content fines

price remains above the US$62 per tonne (“/T”) used in the PEA and

is currently at US$69/T. Similarly, iron grade content

premiums remain high with several credible sources reinforcing the

structural shift in the market towards higher grade iron ores given

they reduce the amount of emissions generated per tonne of steel

produced. As can be seen in the picture below taken only a

few weeks ago in Beijing, China by Black Iron’s CEO Matt Simpson,

it is very clear that the Chinese government needs to continue with

its regulation changes to curb emissions from steel mills

particularly during the winter when there is thick smog in the air

mainly due to building heat being primarily produced through the

burning of thermal coal.

Very recently, Vale changed its price basis for

pellets from the 62% iron content benchmark to a newer 65% iron

content index that the Singapore Exchange (SGX) is now offering

future’s contracts on. This is good news for Black Iron as it

further supports the shift globally to higher grade iron feed

products and value of its expected ultra-premium 68% iron content

product.

About Black IronBlack Iron is

an iron ore exploration and development company, advancing its 100%

owned Shymanivske project located in Kryviy Rih, Ukraine. The

Shymanivske project contains a NI 43-101 compliant resource

estimated to be 646 Mt Measured and Indicated mineral resources,

consisting of 355 Mt Measured mineral resources grading 31.6% total

iron and 18.8% magnetic iron, and Indicated mineral resources of

290 Mt grading 31.1% total iron and 17.9% magnetic iron, using a

cut-off grade of 10% magnetic iron. Additionally, the Shymanivske

project contains 188 Mt of Inferred mineral resources grading 30.1%

total iron and 18.4% magnetic iron. Full mineral resource details

can be found in the NI 43-101 compliant technical report entitled

“Preliminary Economic Assessment of the Re-scoped Shymanivske Iron

Ore Deposit” effective November 21, 2017 under the Company's

profile on SEDAR at www.sedar.com. The Shymanivske project is

surrounded by five other operating mines, including ArcelorMittal's

iron ore complex. Please visit the Company's website at

www.blackiron.com for more information.

The technical and scientific contents of this

press release have been prepared under the supervision of and have

been reviewed and approved by Matt Simpson, P.Eng., CEO of Black

Iron, who is a Qualified Person as defined by NI 43-101.

For more information, please contact:

Matt SimpsonChief Executive

OfficerTel: +1 (416) 309-2138info@blackiron.com

Forward-Looking InformationThis

press release contains forward-looking information. Forward-looking

information is based on what management believes to be reasonable

assumptions, opinions and estimates of the date such statements are

made based on information available to them at that time, including

those factors discussed in the section entitled ‘‘Risk Factors’’ in

the Company’s annual information form for the year ended December

31, 2017 or as may be identified in the Company’s public disclosure

from time to time, as filed under the Company’s profile on SEDAR at

www.sedar.com. Forward-looking information may include, but

is not limited to, statements with respect to the Project, the

mineralization of the Project, the results of the PEA, the

realization of the PEA, the expectations of future cash flows, the

expected economics forecast, the geo-political climate in Ukraine,

the impact of changes to the Company’s management team, the

Company’s ability to raise the requisite financing, the Company’s

ability to obtain the requisite land rights for the Project and

other requisite permits or approvals, and future plans for the

Company’s development. Generally, forward looking information can

be identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; the actual results of current exploration

activities; other risks of the mining industry and the risks

described in the annual information form of the Company. Although

the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking information. The Company

does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/9586e98c-1ef6-4e13-8c5f-21ca06cf8d7d

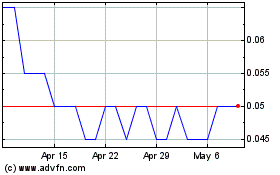

Black Iron (TSX:BKI)

Historical Stock Chart

From Oct 2024 to Nov 2024

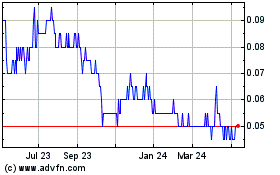

Black Iron (TSX:BKI)

Historical Stock Chart

From Nov 2023 to Nov 2024