Condor Energies Inc. (“Condor” or the “Company”) (TSX: CDR), a

Canadian based energy transition company with activities in Turkiye

and Kazakhstan, is pleased to announce the release of its unaudited

interim condensed consolidated financial statements for the three

months ended March 31, 2023 together with the related management’s

discussion and analysis. These documents will be made available

under Condor’s profile on SEDAR at www.sedar.com and on the Condor

website at www.condorenergies.ca. Readers are invited to review the

latest corporate presentation available on the Condor website. All

financial amounts in this news release are presented in Canadian

dollars, unless otherwise stated.

Highlights

- The Company is

awaiting final approval from the Government of Kazakhstan for its

95% working interest in a lithium brine mining license in

Kazakhstan. Procurement and contracting of long-lead equipment for

2023 drilling activities continues.

- Natural gas

production in Turkiye increased 3% in the first quarter of 2023 to

18,536 Mcf or an average of 206 Mcf/d from 18,003 Mcf or an average

of 200 Mcf/d for the first quarter of 2022.

- The Company

continues to actively pursue an agreement to operate multiple

mid-sized existing natural gas fields in Uzbekistan.

- In Kazakhstan,

activities are ongoing to secure a long-term LNG feed gas supply

contract.

Lithium License Acquisition

The Company is awaiting final approval from the

Government of Kazakhstan for its 95% working interest in a lithium

brine mining license in Kazakhstan (the “Lithium License”). A prior

well drilled in the Lithium License for hydrocarbon exploration

encountered and tested lithium brine deposits with lithium

concentrations of up to 130 milligrams per litre as reported by the

Ministry of Geology of the Republic of Kazakhstan. Title transfer

for the License is expected to be completed in the second quarter

of 2023.

The Lithium License provides subsurface

exploration rights for solid minerals until April 3, 2025. Within

the 6800-hectare Lithium License area, a well drilled in 1975 flow

tested multiple horizons and discovered lithium concentrations in

the Devonian-aged and Carboniferous-aged intervals. Based on

wireline logs, the tested Devonian sand interval is 70 meters and

the tested Carboniferous sand interval is 118 meters. The untested

Devonian and Carboniferous sand intervals provide an additional 863

meters of lithium brine potential.

During 2023, the Company plans to drill and test

up to two wells to confirm the lateral extension and lithium

concentrations in the tested and untested intervals, well

deliverability rates, conduct preliminary engineering for the

production facilities, and prepare a National Instrument 43-101

compliant mineral resources or mineral reserves report. Procurement

and contracting of long-lead equipment for these drilling

activities is underway.

The Company intends to produce the lithium by

utilizing closed-looped Direct Lithium Extraction (“DLE”)

technologies. With the lithium already in brine solution and

applying existing DLE production technologies, the Company expects

to have a much smaller environmental footprint than existing

lithium production operations. Furthermore, the Company is

evaluating the construction of a solar power generation project to

support the long-term expansion of the project to achieve net-zero

emissions. Also, given that the Company’s Lithium License is not

associated with legacy oil wells, a less complex and capital

intensive DLE technology is envisioned for separation of lithium

from the brine.

Turkiye Operations

Gas production for the first quarter of 2023

increased 3% to 18,536 Mcf or an average of 206 Mcf/d from 18,003

Mcf or an average of 200 Mcf/d for the first quarter of 2022. The

Poyraz Ridge field has been producing for over five years and water

production is increasing which requires additional well workovers

to help mitigate its impact along with natural pressure declines.

Artificial lift equipment recently installed on select wells has

contributed to the above noted increased gas rates and additional

wells are being evaluated for future artificial lift

applications.

Posted Turkish gas prices for the first quarter

of 2023 averaged $28.60 per Mcf as compared to $16.36 per Mcf in

the first quarter of 2022, in Canadian dollar terms, but have

decreased to $19.04 per Mcf as of May 1, 2023.

The Company is seeking a partner to fund

development plans at the Yakamoz field, which is located 2 km north

of the existing Poyraz Ridge field. The Company was encouraged with

the results from the previously drilled Yak 1-ST, as it encountered

numerous strong gas shows while confirming reservoir-quality

formations and an active hydrocarbon system and, despite being

temporarily suspended, casing pressure has built up at the surface,

indicating a gas presence. Development of the Yakamoz field would

consist of re-entering, casing and fully evaluating the Yak 1-ST

well, drilling the Yak-2 well and additional production wells as

required. If successful, the Yakamoz field would be tied by

pipeline into the Poyraz Ridge production and sales facilities.

General elections are scheduled to take place in

Turkiye on May 14, 2023 comprising Presidential elections to select

the President and parliamentary elections to select Members of

Parliament to the Grand National Assembly. The previous general

election in Turkiye was conducted in 2018.

Uzbekistan Production Contract and LNG

Strategy

The Company continues to actively pursue an

agreement to operate multiple mid-sized existing natural gas fields

in Uzbekistan to optimize production and increase domestic gas

supply by utilizing modern production technologies and techniques.

The agreement is expected to include eight producing gas fields,

associated gathering pipelines, gas treatment infrastructure and

the rights to explore and develop certain exploration areas

surrounding the respective gas fields.

In addition, the Company has presented a

proposal to the Government of Uzbekistan to use a portion of the

increased gas production for LNG feedstock and provide the

resulting LNG to mining operators and other users to displace

diesel fuel usage. The Company’s LNG strategy in Uzbekistan would

create a vertically integrated business with self-sufficient gas

supply and by replacing expensive diesel with cleaner and cheaper

LNG, decrease the mines operating costs, reduce the country’s

dependency on diesel imports, and positively impact the country’s

carbon reduction efforts by reducing overall

carbon emissions.

LNG Initiatives in

Kazakhstan

The Company continues to mature opportunities to

implement proven North American modular LNG technologies and

processes in Central Asia to displace diesel fuel usage in the

industrial, transportation and power generation sectors. Kazakhstan

is experiencing a natural gas shortage as internal demand continues

to increase without sufficient new gas field development, which is

impacting the Company’s ability to secure a long-term LNG feedstock

gas supply contract.

Front-end engineering for a 125,000 gallons per

day modular LNG facility has been completed. Design on a scaled

down trailer-mounted version is also underway to utilize feed gas

supplied from stranded gas assets that aren’t commercially viable

due to pipeline infrastructure costs or from the associated gas

from producing crude oil fields. The potential to profitably

generate LNG at feed gas site locations is one of the many

advantages that the Company’s LNG approach provides.

RESULTS OF OPERATIONS

Production

|

For the three months ended March 31 |

2023 |

2022 |

Change |

Change % |

|

Natural gas (Mcf) |

18,536 |

18,003 |

533 |

3 |

% |

| Natural

gas (Mcf per day) |

206 |

200 |

6 |

3 |

% |

|

|

|

|

|

|

Natural gas production increased 3% to 18,536

Mcf or an average of 206 Mcf per day for the three months ended

March 31, 2023 from 18,003 Mcf or an average of 200 Mcf per day in

the same period in 2022 due mainly to the ongoing workover program

that is offsetting increased water production and natural pressure

declines. The Company also produced 10 barrels of condensate in the

three months ended March 31, 2023 (2022: nil).

Operating netback

For the three months ended March 31

|

Operating netback 1 |

2023 |

2022 |

|

|

Gas |

Condensate |

Total2 |

Gas and Total2 |

|

(000's) |

|

|

|

|

|

|

Sales |

396 |

|

15 |

|

411 |

|

260 |

|

|

Royalties |

(57 |

) |

(2 |

) |

(59 |

) |

(34 |

) |

|

Production costs |

(228 |

) |

(10 |

) |

(238 |

) |

(151 |

) |

|

Transportation and selling |

(7 |

) |

(3 |

) |

(10 |

) |

(26 |

) |

|

Operating netback 1 |

104 |

|

- |

|

104 |

|

49 |

|

|

|

|

|

|

|

|

|

|

(Mcf) |

|

(bbl) |

|

|

(Mcf) |

|

|

Sales volume |

15,556 |

|

118 |

|

|

16,335 |

|

|

|

|

|

|

|

|

|

($ per unit) |

($/Mcf) |

|

($/bbl) |

|

|

($/Mcf) |

|

|

Sales |

25.46 |

|

126.95 |

|

|

15.92 |

|

|

Royalties |

(3.66 |

) |

(16.93 |

) |

|

(2.08 |

) |

|

Production costs |

(14.66 |

) |

(84.63 |

) |

|

(9.24 |

) |

|

Transportation and selling |

(0.45 |

) |

(25.39 |

) |

|

(1.59 |

) |

|

Operating netback 1 |

6.69 |

|

- |

|

|

3.01 |

|

1 Operating

netback is a non-GAAP measure and is a term with no standardized

meaning as prescribed by GAAP and may not be comparable with

similar measures presented by other issuers. See “Non-GAAP

Financial Measures” in this news release. The calculation of

operating netback is aligned with the definition found in the

Canadian Oil and Gas Evaluation Handbook.2 Per unit measures

are not presented for Total amounts and analysis is considered more

meaningful presented separately for natural gas and condensate.

The operating netback on natural gas sales

increased to $0.1 million or an average of $6.69 per Mcf for the

three months ended March 31, 2023 from $0.05 million or an average

of $3.01 per Mcf in the same period in 2022 due mainly to higher

natural gas prices, partially offset by higher production costs

which includes $0.1 million related to the workovers conducted in

the first quarter of 2023.

NON-GAAP FINANCIAL MEASURES

The Company refers to “operating netback” in

this news release, a term with no standardized meaning as

prescribed by GAAP and which may not be comparable with similar

measures presented by other issuers. This additional information

should not be considered in isolation or as a substitute for

measures prepared in accordance with GAAP. Operating netback is

calculated as sales less royalties, production costs and

transportation and selling on a dollar basis and divided by the

sales volume for the period on a per Mcf basis for natural gas and

on a per barrel basis for condensate. The reconciliation of this

non-GAAP measure is presented in the “Operating netback” section of

this news release. This non-GAAP measure is commonly used in the

oil and gas industry to assist in measuring operating performance

against prior periods on a comparable basis and has been presented

to provide an additional measure to analyze the Company’s sales on

a per unit basis and the Company’s ability to generate funds.

FORWARD-LOOKING STATEMENTS

Certain statements in this news release

constitute forward-looking statements under applicable securities

legislation. Such statements are generally identifiable by the

terminology used, such as “anticipate”, “intend”, “expect”, “plan”,

“estimate”, “budget”, “schedule”, “may”, “will”, “could”, “would”,

“continue”, “pursue”, “prepare”, “envision”, “project”, “potential”

or other similar wording. Forward-looking information in this news

release includes, but is not limited to, information concerning:

the timing and ability to execute the Company’s growth and

sustainability strategies; the timing and ability to obtain the

approvals required from the Government of Kazakhstan and complete

the Lithium License title transfer; the potential for the Lithium

License area to contain commercials deposits; future lithium

testing results; the timing and ability to fund, permit and

complete the planned drilling activities including drilling up to

two additional wells and conduct preliminary engineering for the

production facilities; the timing and ability to optimize the

planned method for direct lithium extraction; the timing and

ability of the untested Devonian and Carboniferous sand intervals

to provide additional lithium brine potential; the timing and

ability to generate a NI 43-101 compliant report; the Company’s

ability to procure and contract long-lead equipment; the timing and

ability to produce the lithium by utilizing closed-looped DLE

production technologies; the timing and ability to have a much

smaller environmental footprint than existing lithium production

operations; the timing and ability to evaluate the construction of

a solar power generation project to support the long-term expansion

of the project to achieve net-zero emissions; the timing and

ability to conduct future drilling, workover and optimization

activities the timing and ability to perform additional well

workovers including installing artificial lift equipment in

existing wells; the timing and ability of the well workovers to

help mitigate water production and natural pressure declines; the

timing and ability to resume production at Destan; the Company’s

ability to secure a partner to fund development at the Yakamoz

field; the timing and ability to re-enter, case and fully evaluate

the Yakamoz structure; the timing of and ability to drill new wells

and the ability of the new wells to become producing wells; the

ability of the surface casing pressure build up at Yak 1-ST well to

indicate a gas presence; the timing and ability to tie the Yakamoz

field into the Company’s existing gas plant; the timing and result

of the Turkiye elections on May 14, 2023; the result and timing of

negotiation with the Government of Kazakhstan regarding the

construction and operation of modular LNG facilities; the timing

and ability to secure long-term LNG feedstock gas supply contracts

under favourable terms, or at all; the potential to profitably

generate LNG at feed gas site locations; the impact of declining

gas production and increased demand for natural gas in Uzbekistan;

the timing and ability to operate gas fields, optimize production,

increase domestic gas supply, and utilize modern western production

techniques and methods in Uzbekistan; the timing and ability to

increase gas production, use a portion of the incremental gas for

LNG feedstock, provide LNG to mining operators and other users to

displace diesel fuel usage; the timing and ability to create a

vertically integrated business with self-sufficient gas supply and

replace diesel fuel with LNG; the timing and ability to decrease

the mines operating costs, reduce Uzbekistan’s dependency on diesel

imports, and positively impact the country’s carbon reduction

efforts by reducing overall carbon emissions; the timing and

ability to utilize western technologies and improve operational

practices to increase production and profitability in Uzbekistan;

the timing and ability to execute a production contract with the

Government of Uzbekistan under favourable terms, or at all, the

areas to be included and the terms and conditions including but not

limited to royalty rates, cost recovery, profit allocation, gas

marketing and pricing, government participation, governance,

baseline production levels and reimbursement methodology; the

timing and ability to pursue other initiatives and commercial

opportunities; projections and timing with respect to natural gas

and condensate production; expected markets, prices, costs and

operating netbacks for future oil, gas and condensate sales; the

timing and ability to obtain various approvals and conduct the

Company’s planned exploration and development activities; the

timing and ability to access oil and gas pipelines; the timing and

ability to access domestic and export sales markets; anticipated

capital expenditures; forecasted capital and operating budgets and

cash flows; anticipated working capital; sources and availability

of financing for potential budgeting shortfalls; the timing and

ability to obtain future funding on favourable terms, if at all;

general business strategies and objectives; the timing and ability

to obtain exploration contract, production contract and operating

license extensions; the potential for additional contractual work

commitments; the ability to meet and fund the contractual work

commitments; the satisfaction of the work commitments; the results

of non-fulfilment of work commitments; projections relating to the

adequacy of the Company’s provision for taxes; and treatment under

governmental regulatory regimes and tax laws.

This news release also includes forward-looking

information regarding health risk management including, but not

limited to: travel restrictions including shelter in place orders,

curfews and lockdowns which may impact the timing and ability of

Company personnel, suppliers and contractors to travel

internationally, travel domestically and to access or deliver

services, goods and equipment to the fields of operation; the risk

of shutting in or reducing production due to travel restrictions,

Government orders, crew illness, and the availability of goods,

works and essential services for the fields of operations;

decreases in the demand for oil and gas; decreases in natural gas,

condensate and crude oil prices; potential for gas pipeline or

sales market interruptions; the risk of changes to foreign currency

controls, availability of foreign currencies, availability of hard

currency, and currency controls or banking restrictions which

restrict or prevent the repatriation of funds from or to foreign

jurisdiction in which the Company operates; the timing and ability

to execute a production contract with the Government of Uzbekistan;

the Company’s financial condition, results of operations and cash

flows; access to capital and borrowings to fund operations and new

business projects; the timing and ability to meet financial and

other reporting deadlines; and the inherent increased risk of

information technology failures and cyber-attacks.

By its very nature, such forward-looking

information requires Condor to make assumptions that may not

materialize or that may not be accurate. Forward-looking

information is subject to known and unknown risks and uncertainties

and other factors, which may cause actual results, levels of

activity and achievements to differ materially from those expressed

or implied by such information. Such risks and uncertainties

include, but are not limited to: regulatory changes; the timing of

regulatory approvals; the risk that actual minimum work programs

will exceed the initially estimated amounts; the results of

exploration and development drilling and related activities;

factors affecting the Lithium License Seller’s ability to transfer

the title of the Lithium License to Condor; prior lithium testing

results may not be indicative of future testing results or actual

results; imprecision of reserves estimates and ultimate recovery of

reserves; the effectiveness of lithium mining and production

methods including DLE technology; historical production and testing

rates may not be indicative of future production rates,

capabilities or ultimate recovery; the historical composition and

quality of oil and gas may not be indicative of future composition

and quality; general economic, market and business conditions;

industry capacity; uncertainty related to marketing and

transportation; competitive action by other companies; fluctuations

in oil and natural gas prices; the effects of weather and climate

conditions; fluctuation in interest rates and foreign currency

exchange rates; the ability of suppliers to meet commitments;

actions by governmental authorities, including increases in taxes;

decisions or approvals of administrative tribunals and the

possibility that government policies or laws may change or

government approvals may be delayed or withheld; changes in

environmental and other regulations; risks associated with oil and

gas operations, both domestic and international; international

political events; and other factors, many of which are beyond the

control of Condor. Capital expenditures may be affected by cost

pressures associated with new capital projects, including labour

and material supply, project management, drilling rig rates and

availability, and seismic costs.

These risk factors are discussed in greater

detail in filings made by Condor with Canadian securities

regulatory authorities including the Company’s Annual Information

Form, which may be accessed through the SEDAR website

(www.sedar.com).

Readers are cautioned that the foregoing list of

important factors affecting forward-looking information is not

exhaustive. The forward-looking information contained in this news

release are made as of the date of this news release and, except as

required by applicable law, Condor does not undertake any

obligation to update publicly or to revise any of the included

forward-looking information, whether as a result of new

information, future events or otherwise. The forward-looking

information contained in this news release is expressly qualified

by this cautionary statement.

ABBREVIATIONS

The following is a summary of abbreviations used in this news

release:

| M |

|

Thousands |

| MM |

|

Millions |

| Mcf |

|

Thousands of standard cubic feet |

| Mcf/d |

|

Thousands of standard cubic feet per day |

| bbl |

|

Barrels |

| CAD |

|

Canadian dollars |

| KZT |

|

Kazakhstan tenge |

| TRL |

|

Turkish lira |

| USD |

|

United States dollars |

| Q |

|

Quarter |

| LNG |

|

Liquefied natural gas |

| |

|

|

The TSX does not accept responsibility

for the adequacy or accuracy of this news release.

For further information, please contact Don

Streu, President and CEO or Sandy Quilty, Vice President of Finance

and CFO at 403-201-9694.

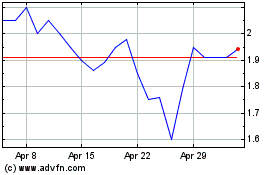

Condor Energies (TSX:CDR)

Historical Stock Chart

From Apr 2024 to May 2024

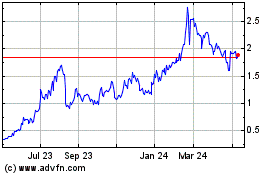

Condor Energies (TSX:CDR)

Historical Stock Chart

From May 2023 to May 2024