- Continued Expansion of Pliaglis® Worldwide -

Strong Cash Balance of $13.1 Million - Growth in Manufacturing

Segment due to New Purchase Orders

Crescita Therapeutics Inc. (TSX: CTX and OTC US: CRRTF)

(“Crescita” or the “Company”), a growth-oriented, innovation-driven

Canadian commercial dermatology company, today reported its

financial results for the second quarter ended June 30, 2021

(“Q2-F2021”) and provided a corporate update. All amounts presented

are in thousands of Canadian dollars (“CAD”) unless otherwise

noted.

Financial Highlights

Q2-F2021 vs. Q2-F2020

- Revenue was $2,949 compared to $1,733, an increase of

$1,216;

- Gross profit was $1,722 compared to $1,092, an increase of

$630;

- Operating expenses were $2,399 compared to $2,318, an increase

of $81;

- Adjusted EBITDA1 was $(269) compared to $(781), an improvement

of $512;

- Ending cash position was $13,083 compared to $9,265, an

increase of $3,818.

1Please refer to the Non-IFRS Financial Measures section of this

press release.

Q2-F2021 and Subsequent Corporate Developments

Expansion of Production Volumes within the Manufacturing and

Services Segment

- We received firm purchase orders of approximately $7 million

within our Manufacturing and Services segment, representing a

significant increase in production and sales volume over the next

12 months. The increase in volume is a result of our customers

ordering product to support anticipated launches into new key

markets and therefore may not be representative of future

orders.

Launch of Pliaglis in Austria

- Our licensing partner, Pelpharma Handels GmbH (“Pelpharma”),

launched Pliaglis in Austria.

Licensing Agreement for Pliaglis with Croma Pharma

GmbH

- We entered into an exclusive commercialization and development

license agreement with Croma Pharma GmbH (“Croma”), a globally

acclaimed pharmaceutical company with specializations in medical

aesthetics, ophthalmology, and orthopaedics, for the rights to

Pliaglis in nine countries comprising: Germany, the United Kingdom,

Ireland, Switzerland, Brazil, Romania, Belgium, the Netherlands and

Luxembourg. Crescita is eligible to receive a combination of

upfront, cumulative sales and other milestone payments of up to

€1.25 million over the term of the agreement with a potential for

further cumulative sales milestones based on tranches of

incremental sales.

Expansion of our Senior Leadership Team

- Mr. François Lafortune joined Crescita’s senior leadership team

as Executive Vice-President and General Manager. This new senior

management position is intended to drive growth within our

Commercial Skincare and Manufacturing and Services segments.

Corporate Update

Serge Verreault, President and CEO of Crescita commented:

“During the quarter, we achieved a number of key milestones as we

executed our strategic growth initiatives. We continued to expand

our Pliaglis footprint with a 9-country licensing deal with Croma

which is well positioned to execute successful multi-country

launches. Our partner, Pelpharma, launched Pliaglis in Austria, and

Cantabria reported positive Pliaglis sales momentum in Italy with

record-high sales for the quarter. In the United States, we didn’t

recognize any Pliagllis royalties in Q2, as Taro continues to face

commercial challenges. On the medical aesthetics side, we launched

NCTF in April. As post-pandemic conditions normalize across Canada,

we believe that our revenues should continue to improve. On another

high note, we received purchase orders of approximately $7 million,

which brings significant production volumes to our plant, a

long-time objective for Crescita. These developments contribute to

increasing recurring revenue streams and move us closer to our goal

of sustained profitability for our shareholders.”

Mr. Verreault added: “I am also pleased with our Q2 results

which showed an overall recovery in Commercial Skincare sales

versus last year. We continue to grow our commercial sales by

furthering brand awareness through various direct-to-consumer

digital marketing initiatives. We believe that our approach to

direct-to-consumer marketing will bring us closer to end consumers,

leading to more opportunities for direct engagement and increased

brand awareness. We are creating a solid platform for upcoming

growth initiatives in 2022 and beyond with the addition of key

members to our sales and marketing teams to support the launch of

the ART-FILLER range, our hyaluronic acid-based dermal fillers,

anticipated in the first half of 2022. We also welcomed Mr.

François Lafortune to the newly created position of Executive Vice

President and General Manager. François has a solid track record of

domestic and international strategic management experience in the

cosmetics industry and will be pivotal to our initiatives to grow

our skincare and manufacturing businesses.”

Mr. Verreault concluded: “We will have intense focus on

execution and financial discipline in implementing our growth

strategies, including elevating our brands and manufacturing

business, and further expanding our international footprint through

strategic partnerships for Pliaglis. We maintain a strong liquidity

position with $13.1 million in cash and $2.2 million available

under our credit facility at June 30, 2021, which allows us to

continue to pursue strategic M&A, an integral part of our

growth strategy.”

Q2-F2021 Financial Results

Note: The Management’s Discussion and Analysis

(“MD&A”), the unaudited Condensed Consolidated Interim

Financial Statements and accompanying notes for the three and six

months ended June 30, 2021 are available at

www.crescitatherapeutics.com/investors and have been filed with

SEDAR at www.sedar.com.

Summary Financial Results

In thousands of CAD, except per share data

and number of shares

Three months ended June

30,

Six months ended June

30,

2021

2020

2021

2020

$

$

$

$

Commercial Skincare

1,869

1,304

3,636

2,843

Licensing and Royalties

475

413

1,281

1,866

Manufacturing and Services

605

16

1,297

839

Revenues

2,949

1,733

6,214

5,548

Cost of goods sold

1,227

641

2,376

1,992

Gross profit

1,722

1,092

3,838

3,556

Gross margin (%)

58.4%

63.0%

61.8%

64.1%

Research and development

118

336

337

564

Selling, general and administrative

1,930

1,568

3,793

3,751

Depreciation and amortization

351

414

682

828

Total operating expenses

2,399

2,318

4,812

5,143

Operating loss

(677)

(1,226)

(974)

(1,587)

Total other expenses

35

1,859

174

1,812

Loss before income taxes

(712)

(3,085)

(1,148)

(3,399)

Deferred income tax expense

-

-

-

180

Net loss

(712)

(3,085)

(1,148)

(3,579)

Adjusted EBITDA1

(269)

(781)

(182)

(669)

Earnings per share

Basic and Diluted

$ (0.03)

$ (0.15)

$ (0.06)

$ (0.17)

Weighted average number of common

shares outstanding

Basic and Diluted

20,612,840

20,648,448

20,619,686

20,674,433

Selected Balance Sheet Information

Cash and cash equivalents, end of

period

13,083

9,265

13,083

9,265

Selected Cash Flow Information

Cash (used in) provided by operating

activities

(743)

84

(939)

350

Cash used in investing activities

(39)

(37)

(43)

(61)

Cash used in financing activities

(82)

(89)

(202)

(292)

Revenue

We have three reportable segments: 1) Commercial Skincare

(“Commercial”), which manufactures branded non-prescription

skincare products for sale in both the Canadian and international

markets and commercializes Pliaglis® and New Cellular Treatment

Factor® (“NCTF”) in Canada; 2) Licensing and Royalties

(“Licensing”), which includes revenues generated from licensing our

intellectual property related to Pliaglis or to our transdermal

delivery technologies; and 3) Manufacturing and Services

(“Manufacturing”), which includes revenue from contract

manufacturing and product development services.

For the three months ended June 30, 2021, total revenue was

$2,949 compared to $1,733 for the three months ended June 30, 2020.

The increase of $1,216 came primarily from our Commercial and

Manufacturing segments in the amounts of $565 and $589,

respectively, largely representing the recovery in consumer demand

following the COVID-19-related prolonged shutdowns of personal

services businesses in Q2-F2020 and periods of 2021.

Gross Profit

For the three months ended June 30, 2021, gross profit was

$1,722, representing a gross margin of 58.4%, compared to $1,092

and 63.0%, respectively, for the three months ended June 30, 2020.

The increase of $630 in gross profit was mainly due to the recovery

in the Commercial and Manufacturing segment sales year-over-year,

as described above, while we continued to benefit from wage and

rent subsidies under the Canada Emergency Wage Subsidy (“CEWS”) and

Canada Emergency Rent Subsidy (“CERS”) programs during the quarter.

The decrease in gross margin of 4.6% was mainly driven by: 1) the

decrease in full-margin licensing revenue, compounded by the

incremental cost of goods sold from supplying Pliaglis under the

Austria licensing agreement; and 2) the unfavourable revenue mix of

having higher revenue in our Manufacturing segment year-over-year,

partly offset by the benefit of government subsidies versus

Q2-F2020.

Operating Expenses

For the three months ended June 30, 2021, total operating

expenses were $2,399 compared to $2,318 for the three months ended

June 30, 2020. The year-over-year slight increase of $81 was

primarily driven by higher selling, general and administrative

(“SG&A”) expenses of $362, mainly reflecting a return to

pre-COVID level headcount-related costs compared to Q2-F2020 which

included temporary layoffs and salary reductions in response to the

COVID-19 pandemic. These expenses were partly offset by lower

research and development (“R&D”) spend of $218, largely

reflecting the Company’s proportionate funding of clinical

development activities related to CTX-101 in Q2-F2020 which did not

repeat, and by lower depreciation and amortization expense of

$63.

Other Expenses

We updated our impairment assessment at June 30, 2020, mainly to

reflect the projected impact on our long-term forecasts of the

pandemic-driven decrease in demand for our non-prescription

skincare products and contract manufacturing and development

services. As a result, we recognized an intangible assets

impairment charge of $1,918 in that quarter.

Cash and Cash Equivalents

Cash and cash equivalents were $13,083 at June 30, 2021 compared

to $9,265 at June 30, 2020, representing a year-over-year increase

of $3,818, mainly due to cash of $5,151 received after the

amendment to the Company’s licensing agreement with Taro

Pharmaceuticals Inc. in Q3-F2020, partly offset by the cash used in

operations.

Non-IFRS Financial Measures

We report our financial results in accordance with International

Financial Reporting Standards (“IFRS”). However, we use certain

non-IFRS financial measures to assess our Company’s performance. We

believe these to be useful to management, investors, and other

financial stakeholders in assessing Crescita’s performance. The

non-IFRS measures used in this press release do not have any

standardized meaning prescribed by IFRS and are therefore not

comparable to similar measures presented by other issuers. These

measures should be considered as supplemental in nature and not as

a substitute for the related financial information prepared in

accordance with IFRS. The following are the Company’s non-IFRS

measures along with their respective definitions:

- EBITDA is defined as earnings before interest, income taxes,

depreciation, and amortization.

- Adjusted EBITDA is defined as earnings before interest, income

taxes, depreciation and amortization, other expenses (income),

share-based compensation costs, goodwill and intangible asset

impairment, and foreign exchange (gains) losses, as

applicable.

Management believes that Adjusted EBITDA is an important measure

of operating performance and cash flow and provides useful

information to investors as it highlights trends in the underlying

business that may not otherwise be apparent when relying solely on

IFRS measures. Below is a reconciliation of EBITDA and Adjusted

EBITDA to their closest IFRS measures.

In thousands of CAD dollars

Three months ended June

30,

Six months ended June

30,

2021

2020

2021

2020

$

$

$

$

Net loss

(712)

(3,085)

(1,148)

(3,579)

Adjust for:

Depreciation and amortization

351

414

682

828

Interest expense (income), net

25

(8)

13

(5)

Deferred income tax expense

-

-

-

180

EBITDA

(336)

(2,679)

(453)

(2,576)

Adjust for:

Share-based compensation

57

31

110

90

Foreign exchange loss (gain)

10

(51)

161

(101)

Impairment of intangible assets

-

1,918

-

1,918

Adjusted EBITDA

(269)

(781)

(182)

(669)

Caution Concerning Limitations of Summary Financial Results

Press Release

This summary earnings press release contains limited information

meant to assist the reader in assessing Crescita’s performance, but

it is not a suitable source of information for readers who are

unfamiliar with Crescita and is not in any way a substitute for the

Company's Condensed Consolidated Interim Financial Statements and

notes thereto, MD&A and our latest Annual Information Form

(“AIF”).

About Crescita Therapeutics Inc.

Crescita (TSX: CTX and OTC US: CRRTF) is a growth-oriented,

innovation-driven Canadian commercial dermatology company with

in-house R&D and manufacturing capabilities. The Company offers

a portfolio of high-quality, science-based non-prescription

skincare products and early to commercial stage prescription

products. We also own multiple proprietary transdermal delivery

platforms that support the development of patented formulations to

facilitate the delivery of active ingredients into or through the

skin.

Our non-prescription portfolio comprises a wide variety of

premium quality dermocosmetic products which include facial creams,

cleansers, exfoliants, masks, serums and suncare, that each serve a

different and personalized consumer need. The portfolio is designed

to address preventive care to combating the first signs of aging,

as well as all primary aesthetic skin concerns. Our products serve

two sub-sets of the skincare market: aesthetics and medical

aesthetics. Our national sales force calls on aesthetic

practitioners, medical aesthetic clinics and medispas across

Canada. In addition, our skincare brands are sold in certain Asian

markets, such as Malaysia, South Korea and China through

international distributors, as well as through various e-commerce

platforms.

Crescita’s portfolio also includes Pliaglis, our lead

prescription product, that utilizes our proprietary phase-changing

topical cream Peel technology. Pliaglis is a topical local

anesthetic cream that provides safe and effective local dermal

analgesia on intact skin prior to superficial dermatological

procedures. The product, currently approved in over 25 different

countries, is sold by commercial partners in the United States,

Italy, Spain and Brazil, and was most recently launched in Austria.

We market Pliaglis in the Canadian physician-dispensed skincare

market through our own sales force.

Our expertise in topical product formulation and development can

be leveraged in combination with our patented transdermal delivery

technologies to develop and manufacture creams, liquids, gels,

ointments and serums under our contract development and

manufacturing organization (“CDMO”) infrastructure. We run our

operations from our head office located in the heart of the Biotech

City in Laval, Québec, where we also manufacture the majority of

our non-prescription skincare products in our 50,000 square-foot

facility.

Forward-looking Statements

This press release contains “forward-looking statements” within

the meaning of applicable securities laws. Forward-looking

statements can be identified by words such as: “anticipate”,

“intend”, “plan”, “goal”, “seek”, “believe”, “project”, “estimate”,

“expect”, “strategy”, “future”, “likely”, “may”, “should”, “will”

and similar references to future periods. Examples of

forward-looking statements include, but are not limited to,

statements regarding the Company’s objectives, plans, goals,

strategies, growth, performance, operating results, financial

condition, our belief that we have sufficient liquidity to fund our

business operations during the upcoming fiscal year, strategy for

customer retention, growth, product development, market position,

financial results and reserves, strategy for risk management,

business prospects, opportunities and industry trends, the expected

impact of, and responses taken by the Company with respect to, the

COVID-19 pandemic, and similar statements concerning anticipated

future events, results, circumstances, performance or expectations.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations and assumptions regarding the

future of our business, future plans and strategies, projections,

anticipated events and trends, the economy and other future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of the Company’s control. Crescita’s actual

results and financial condition may differ materially from those

indicated in the forward-looking statements. Therefore, you should

not unduly rely on any of these forward-looking statements.

Important factors that could cause Crescita’s actual results and

financial condition to differ materially from those indicated in

the forward-looking statements include, among others: economic and

market conditions, the impact of the COVID-19 pandemic and the

response thereto of governments and consumers, the Company’s

ability to execute its growth strategies, reliance on third parties

for clinical trials, marketing, distribution and commercialization,

the impact of changing conditions in the regulatory environment and

product development processes, manufacturing and supply risks,

increasing competition in the industries in which the Company

operates, the Company’s ability to meet its debt commitments, the

impact of unexpected product liability matters, the impact of

litigation involving the Company and/or its products, the impact of

changes in relationships with customers and suppliers, the degree

of intellectual property protection of the Company’s products, the

degree of market acceptance of the Company’s products, developments

and changes in applicable laws and regulations, as well as other

risk factors discussed in the “Risk Factors” sections of our most

recent annual MD&A for the year ended December 31, 2020 and our

AIF dated March 24, 2021. Any forward-looking statement made by the

Company in this press release is based only on information

currently available to management and speaks only as of the date on

which it is made. Except as required by applicable securities laws,

Crescita undertakes no obligation to publicly update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210811005455/en/

FOR MORE INFORMATION, PLEASE CONTACT: Investor Relations

Linda Kisa, CPA, CA Email: ir@crescitatx.com

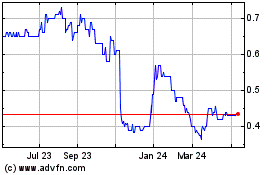

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

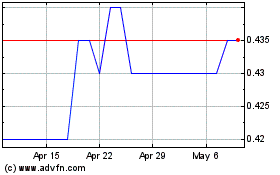

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

From Apr 2023 to Apr 2024