Crescita Therapeutics Announces Approval of Normal Course Issuer Bid

August 29 2023 - 6:30AM

Business Wire

Crescita Therapeutics Inc. (TSX: CTX) (OTC US: CRRTF)

(“Crescita” or the “Company”) announced today that

the Toronto Stock Exchange (the “TSX”) has approved the

Company’s proposed normal course issuer bid (“NCIB”) to

purchase up to a maximum of 1,821,616 common shares (“Common

Shares”) for cancellation, representing approximately 10% of

its public float as of August 18, 2023, as appropriate

opportunities arise from time to time. As of August 27, 2023, the

Company had 20,374,153 issued and outstanding Common Shares.

Crescita’s management and board of directors believe that the

current market price of the Common Shares may not represent the

underlying value of the Company and has determined that, subject to

future price movements and other factors, the repurchase of such

Common Shares may be a desirable use of funds and in the best

interests of the Company and its shareholders.

Purchases under the NCIB will be made through the facilities of

the TSX or through a Canadian alternative trading system and in

accordance with applicable regulatory requirements at a price per

Common Share representative of the market price at the time of

acquisition. The number of Common Shares that can be purchased

pursuant to the NCIB is subject to a current daily maximum of 3,661

Common Shares (which is equal to 25% of 14,646 being the average

daily trading volume from February 1, 2023 through to July 31,

2023), subject to the Company’s ability to make one block purchase

of Common Shares per calendar week that exceeds such limits. All

Common Shares purchased under the NCIB will be cancelled upon their

purchase. The Company intends to fund the purchases from its

available resources.

The Company may begin to purchase Common Shares on August 31,

2023 and the NCIB will terminate on August 30, 2024 or such earlier

time as the Company completes its purchases pursuant to the NCIB or

provides notice of termination. The Company has also entered into

an automatic securities purchase plan in connection with its NCIB

that contains strict parameters regarding how its Common Shares may

be repurchased during times when it would ordinarily not be

permitted to purchase Common Shares due to regulatory restrictions

or self-imposed blackout periods. The automatic securities purchase

plan is effective immediately.

Pursuant to the Company’s previous normal course issuer bid that

commenced on December 17, 2021 and ended on December 16, 2022,

663,600 Common Shares at a weighted average price of $0.66 per

share were purchased. Purchases were made on behalf of the Company

by its broker through the facilities of the TSX. Crescita was

permitted to acquire up to 1,000,000 Common Shares under its

previous normal course issuer bid.

About Crescita Therapeutics Inc. Crescita (TSX: CTX and

OTC US: CRRTF) is a growth-oriented, innovation-driven Canadian

commercial dermatology company with in-house R&D and

manufacturing capabilities. The Company offers a portfolio of

high-quality, science-based non-prescription skincare products and

early to commercial stage prescription products. We also own

multiple proprietary transdermal delivery platforms that support

the development of patented formulations to facilitate the delivery

of active ingredients into or through the skin. For more

information visit, www.crescitatherapeutics.com.

Forward-looking Information This press release contains

“forward-looking information” within the meaning of applicable

securities laws. All information in this press release, other than

statements of current and historical fact, represents

forward-looking information and is qualified by this cautionary

note. Often, but not always, forward-looking information can be

identified by words such as: “anticipate”, “intend”, “plan”,

“goal”, “seek”, “believe”, “aim”, “project”, “estimate”, “expect”,

“strategy”, “future”, “likely”, “may”, “should”, “will” and similar

references to future periods.

Examples of forward-looking information include, but are not

limited to, statements made in this press release relating to the

number of Common Shares to be acquired under the NCIB and other

related matters.

Forward-looking information is neither historical fact nor an

assurance of future performance. Instead, it based only on current

beliefs, expectations, and assumptions regarding the future of the

Company’s business, future plans and strategies, projections,

anticipated events and trends, the economy and other future

conditions.

Because forward-looking information relates to the future, it is

subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict and many of which are

outside of the Company’s control.

Crescita’s actual results and financial condition may differ

materially from those indicated in forward-looking information.

Therefore, you should not unduly rely on any forward-looking

information. Important factors that could cause Crescita’s actual

results and financial condition to differ materially from those

indicated in forward-looking information include, among others:

- economic and market conditions including the uncertainty in the

global economy;

- the impact of inflation and rising interest rates together with

the threats of stagflation and recession;

- the Company’s ability to execute its growth strategies;

- the degree or lack of market acceptance of the Company’s

products;

- reliance on third parties for marketing, distribution and

commercialization, and clinical trials;

- the impact of changing conditions in the regulatory environment

and product development processes;

- manufacturing and supply risks;

- increasing competition in the industries in which the Company

operates;

- the Company’s ability to meet its contractual obligations;

- the impact of product liability matters;

- the impact of litigation involving the Company and/or its

products;

- the impact of changes in relationships with customers and

suppliers;

- the degree of intellectual property protection of the Company’s

products;

- developments and changes in applicable laws and regulations;

and

- other risk factors described from time to time in the reports

and disclosure documents filed by Crescita with Canadian securities

regulatory agencies and commissions, including the sections

entitled “Risk Factors” in the Company’s most recent annual

MD&A and AIF.

As a result of the foregoing and other factors, no assurance can

be given that future results, levels of activity or achievements

indicated in any forward-looking information will actually be

achieved or that the Company will actually decide to purchase any

Common Shares pursuant to the NCIB. Any forward-looking information

in this press release is based only on information currently

available to management and speaks only as of the date on which it

is provided. Except as required by applicable securities laws,

Crescita undertakes no obligation to publicly update any

forward-looking information, whether written or oral, that may be

provided from time to time, whether as a result of new information,

future developments or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230829025923/en/

FOR MORE INFORMATION, PLEASE CONTACT: Investor Relations

Linda Kisa, CPA, CA Email: lkisa@crescitatx.com

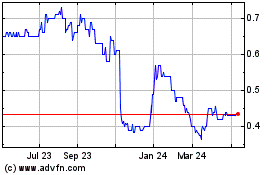

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

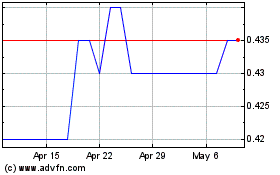

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

From Nov 2023 to Nov 2024