Enerflex Ltd. (TSX: EFX) (NYSE: EFXT) (“Enerflex” or the “Company”)

today reported its financial and operational results for the three

months ended March 31, 2024.

Effective January 1, 2024, the Company changed

its presentation currency from Canadian dollars (“CAD”) to United

States dollars (“USD”) to provide more relevant reporting of the

Company’s financial position. As a result, all amounts presented in

this release are in USD unless otherwise stated.

Q1 2024 FINANCIAL AND OPERATIONAL

OVERVIEW

- Generated

revenue of $638 million compared to $610 million in Q1/23 and $574

million in Q4/23.

- Higher revenue

is mainly attributed to the Energy Infrastructure (“EI”) product

line. During Q1/24, Enerflex expanded the scope and extended the

term of an existing Build-Own-Operate-Maintain (“BOOM”) contract in

the Eastern Hemisphere (“EH”). The contract supports the expansion

of the Company’s treated water solutions business, increases

Enerflex’s presence in a core operating country of Oman, and is

expected to double Enerflex’s revenue from the project and improve

the Company’s returns during its additional four-year term. As

prescribed by International Financial Reporting Standards (“IFRS”),

the contract is now being accounted for as a finance lease.

- Gross margin

before depreciation and amortization of $119 million, or 19% of

revenue, compared to $156 million, or 26% of revenue in Q1/23 and

$159 million, or 28% of revenue during Q4/23. Adjusted earnings

before finance costs, income taxes, depreciation, and amortization

(“adjusted EBITDA”) of $69 million compared to $90 million in Q1/23

and $91 million during Q4/23.

- Based on a

review of a modularized cryogenic natural gas processing facility

in Kurdistan (the “EH Cryo project”) at the end of the quarter,

delays and expected increased costs in the completion of the EH

Cryo Project reduced gross margin and adjusted EBITDA by $41

million during Q1/24. Subsequent to Q1, Enerflex has provided its

client partner with notice of Force Majeure, suspended activity at

the EH Cryo project site and demobilized its personnel as further

detailed in the Outlook section of this release.

- Cash provided by

operating activities was $101 million, which included net working

capital recovery of $83 million. This is a $103 million improvement

over cash provided by operating activities in Q1/23. We are pleased

with our on-going global efforts to efficiently manage working

capital, although the Company does not expect the magnitude of the

recovery realized over the past two quarters will be repeated. Free

cash flow was $78 million in Q1/24 compared to $140 million during

Q4/23 and a use of cash of $3 million during Q1/23.

- Invested $17

million in the business, including $8 million of growth investments

for compression equipment that was deployed on contract with an

existing client partner in the EH.

- Recorded

Engineered Systems bookings of $420 million to bring total backlog

at March 31, 2024 to $1.3 billion, providing strong visibility into

future revenue generation and business activity levels.

- Enerflex’s U.S.

contract compression business continues to perform well, with

utilization of 93% across a fleet size of approximately 424,000

horsepower. The fundamentals for contract compression in the U.S.

remain strong, led by increasing natural gas production in the

Permian.

BALANCE SHEET AND LIQUIDITY

- Repaid $72

million of long-term debt, consistent with the Company’s focus on

strengthening its balance sheet. Enerflex’s net debt balance was

$743 million, which included $110 million of cash and cash

equivalents, and the Company maintained strong liquidity with

access to $548 million under its credit facility.

- Enerflex’s

bank-adjusted net debt-to-EBITDA ratio was approximately 2.2x

compared to 2.3x at the end of Q4/23 and 2.9x at the end of

Q1/23.

MANAGEMENT COMMENTARY

“We are beginning the year with strong

operational results, as the Energy Infrastructure and After-market

Services business lines continue to deliver solid and steady

performance,” said Marc Rossiter, Enerflex’s President and Chief

Executive Officer. “Visibility across the Company’s business

remains strong, supported by approximately $1.6 billion of

contracted revenue that will be recognized over the coming years

from our Energy Infrastructure assets. This will be supplemented by

the recurring nature of our After-market Services business and a

$1.3 billion Engineered Systems backlog. Our focus remains on

further enhancing the profitability of core operations to enable

continued debt reduction and enhance Enerflex’s ability to focus on

growth and return capital to shareholders.”

Mr. Rossiter continued, “Subsequent to the

quarter, progress on our EH Cryo project was impacted by a drone

attack in Kurdistan which tragically took the lives of four

individuals and injured others. While no Enerflex personnel were

directly impacted by this attack, Enerflex took quick action to

safeguard our people and the project is currently suspended. We are

working closely with our client partner to determine next

steps.”

Preet Dhindsa, Enerflex’s Senior Vice President

and Chief Financial Officer, stated, “We are pleased with the

Company’s on-going efforts to efficiently manage the balance sheet,

resulting in a further $83 million of working capital recovered

during the first quarter. From a financial flexibility perspective,

we remain well positioned, with our leverage ratio exiting the

quarter at 2.2x and ample liquidity to support our global business.

In 2024, Enerflex will continue to focus on generating free cash

flow, repaying debt, and lowering net finance costs.”

SUMMARY RESULTS

|

Three months endedMarch 31, |

|

|

($ millions, except percentages) |

|

2024 |

|

|

2023 |

|

|

Revenue |

$ |

638 |

|

$ |

610 |

|

| Gross margin |

|

87 |

|

|

119 |

|

| Selling, general and

administrative expenses ("SG&A") |

|

78 |

|

|

78 |

|

| Foreign

exchange loss |

|

1 |

|

|

8 |

|

|

Operating income |

$ |

8 |

|

$ |

33 |

|

| Earnings before finance costs,

income taxes, depreciation, and amortization (“EBITDA”) |

|

47 |

|

|

80 |

|

| Earnings before finance costs

and income taxes ("EBIT") |

|

3 |

|

|

33 |

|

| Net earnings (loss) |

|

(18 |

) |

|

10 |

|

| Cash

provided by (used in) operating activities |

|

101 |

|

|

(2 |

) |

|

|

|

|

|

|

| Key Financial

Performance Indicators (“KPIs”)1 |

|

|

|

|

| Engineered Systems (“ES”)

bookings |

$ |

420 |

|

$ |

383 |

|

| ES backlog |

|

1,266 |

|

|

1,139 |

|

| Gross margin as a percentage

of revenue |

|

13.6 |

% |

|

19.5 |

% |

| Gross margin before

depreciation and amortization (“Gross margin before D&A”) |

|

119 |

|

|

156 |

|

| Gross margin before D&A as

a percentage of revenue |

|

18.7 |

% |

|

25.6 |

% |

| Adjusted EBITDA |

|

69 |

|

|

90 |

|

| Free cash flow |

|

78 |

|

|

(3 |

) |

| Long-term debt |

|

853 |

|

|

1,078 |

|

| Net debt |

|

743 |

|

|

884 |

|

| Bank-adjusted net

debt-to-EBITDA ratio |

|

2.2 |

|

|

2.9 |

|

| Return

on capital employed (“ROCE”)2 |

|

0.6 |

% |

|

(0.1 |

)% |

1 These KPIs are non-IFRS measures. Further

detail is provided in the “Non-IFRS Measures” section of the

Company’s MD&A.2 Determined by using the trailing 12-month

period.

Enerflex's interim consolidated financial

statements and notes (the "financial statements") and Management's

Discussion and Analysis ("MD&A") as at March 31, 2024, can be

accessed on the Company's website at www.enerflex.com and under the

Company's SEDAR+ and EDGAR profiles at www.sedarplus.ca and

www.sec.gov/edgar, respectively.

OUTLOOK

Industry Update

Enerflex continues to see consistent demand

across all business units and geographic regions, including high

utilization of Energy Infrastructure assets and the After-market

Services business line. Enerflex’s Energy Infrastructure product

line is supported by customer contracts, which are expected to

generate approximately $1.6 billion of revenue during their

remaining terms.

Complementing Enerflex's recurring revenue

businesses is the Engineered Systems product line. Engineered

Systems results will be supported by a strong backlog of

approximately $1.3 billion in projects as at March 31, 2024, with

the majority of this work expected to convert to revenue over the

next 12 months. Demand for Engineered Systems products and services

is driven by increases in natural gas, oil, and produced water

volumes across Enerflex’s global footprint and decarbonization

activities. The acquisition of Exterran Corporation (“Exterran”)

expanded the global complexion of Enerflex’s Engineered Systems

product line and strengthened the Company’s presence in areas that

include cryogenic gas processing, carbon capture, and produced

water treatment facilities.

While Enerflex is actively monitoring the

near-term impact of weak natural gas prices on customer demand,

notably in North America, the Company continues to benefit from

activity in oil producing regions and with customers who maintain a

positive medium-term view of natural gas fundamentals. The

fundamentals for contract compression in the U.S. remain strong,

led by increasing natural gas production in the Permian.

EH Cryo Project Update

Enerflex is also providing an update related to

its EH Cryo project. As at March 31, 2024, construction of the EH

Cryo project was approximately 85% complete, however construction

has progressed at a slower pace than anticipated and expected costs

to complete increased. As a result, gross margin and adjusted

EBITDA were reduced by $41 million based on the Company’s estimate

of remaining spend to complete the project of approximately $105

million.

The EH Cryo project is recognized as revenue

within the Engineered Systems product line as construction proceeds

and any amounts not yet invoiced are presented as an unbilled

contract revenue asset on Enerflex’s consolidated statements of

financial position. The net unbilled contract revenue asset

recognized for the EH Cryo project at the end of Q1/24 is

approximately $147 million and remaining revenue to be recognized

is approximately 7% of the Company’s Engineered Systems

backlog.

Subsequent to Q1/24, in response to a drone

attack that resulted in fatalities at an operational facility in

proximity to the EH Cryo project, Enerflex has provided its client

partner with notice of Force Majeure, suspended activity at the

project site and demobilized its personnel. While no Enerflex

personnel were injured and there was no physical damage to the

Company's assets, work at the site is suspended as Enerflex

evaluates the situation in collaboration with our client partner

and assesses next steps.

There can be no assurance that the security

situation will improve and while work is suspended Enerflex will

not incur any material construction expenditures to complete the EH

Cryo project.

Capital Allocation and Shareholder

Returns

Enerflex continues to target a disciplined

capital program in 2024, with total capital expenditures of $90

million to $110 million. This includes a total of approximately $70

million for maintenance and PP&E capital expenditures.

Investments to expand the Energy Infrastructure business are

discretionary and will be allocated to customer supported

opportunities that are expected to generate attractive returns and

create value for Enerflex shareholders.

Enerflex will continue to focus on debt

reduction and lowering net finance costs in 2024, which will

improve the Company’s ability to focus on growth and provide

shareholder returns over the medium and long-term.

DIVIDEND DECLARATION

Enerflex is committed to paying a sustainable

quarterly cash dividend to shareholders. The Board of Directors has

declared a quarterly dividend of CAD$0.025 per share, payable on

July 11, 2024, to shareholders of record on May 23, 2024.

CONFERENCE CALL AND WEBCAST

DETAILS

Investors, analysts, members of the media, and

other interested parties, are invited to participate in a

conference call and audio webcast on Wednesday, May 8, 2024 at 8:00

a.m. (MDT), where members of senior management will discuss the

Company's results. A question-and-answer period will follow.

To participate, register at

https://register.vevent.com/register/BI477ffdfe2ad74d7696d231977d6266ec.

Once registered, participants will receive the dial-in numbers and

a unique PIN to enter the call. The audio webcast of the conference

call will be available on the Enerflex website at www.enerflex.com

under the Investors section or can be accessed directly at

https://edge.media-server.com/mmc/p/bp85brb7.

NON-IFRS MEASURES

Throughout this news release and other materials

disclosed by the Company, Enerflex employs certain measures to

analyze its financial performance, financial position, and cash

flows, including net debt-to-EBITDA ratio and bank-adjusted net

debt-to-EBITDA ratio. These non-IFRS measures are not standardized

financial measures under IFRS and may not be comparable to similar

financial measures disclosed by other issuers. Accordingly,

non-IFRS measures should not be considered more meaningful than

generally accepted accounting principles measures as indicators of

Enerflex's performance. Refer to "Non-IFRS Measures" of Enerflex's

MD&A for the three months ended March 31, 2024, for information

which is incorporated by reference into this news release and can

be accessed on Enerflex's website at www.enerflex.com and under the

Company's SEDAR+ and EDGAR profiles at www.sedarplus.ca and

www.sec.gov/edgar, respectively.

ADJUSTED EBITDA

|

Three months endedMarch 31, 2024 |

|

|

($ millions) |

|

Total |

|

|

North America |

|

Latin America |

|

|

Eastern Hemisphere |

|

|

EBIT |

$ |

3 |

|

$ |

33 |

$ |

5 |

|

$ |

(35 |

) |

|

Depreciation and amortization |

|

44 |

|

|

18 |

|

10 |

|

|

16 |

|

|

EBITDA |

|

47 |

|

|

51 |

|

15 |

|

|

(19 |

) |

| Restructuring, transaction and

integration costs |

|

6 |

|

|

3 |

|

2 |

|

|

1 |

|

| Share-based compensation |

|

6 |

|

|

3 |

|

1 |

|

|

2 |

|

| Impact of finance leases |

|

|

|

|

|

|

|

|

|

Upfront gain |

|

(3 |

) |

|

- |

|

- |

|

|

(3 |

) |

|

Principal repayments |

|

13 |

|

|

- |

|

- |

|

|

13 |

|

|

Adjusted EBITDA |

$ |

69 |

|

$ |

57 |

$ |

18 |

|

$ |

(6 |

) |

|

Three months endedMarch 31, 2023 |

|

| ($

millions) |

|

Total |

|

|

North America |

|

Latin America |

|

|

Eastern Hemisphere |

|

|

EBIT |

$ |

33 |

|

$ |

21 |

$ |

(1 |

) |

$ |

13 |

|

|

Depreciation and amortization |

|

47 |

|

|

15 |

|

13 |

|

|

19 |

|

|

EBITDA |

|

80 |

|

|

36 |

|

12 |

|

|

32 |

|

| Restructuring, transaction and

integration costs |

|

13 |

|

|

3 |

|

3 |

|

|

7 |

|

| Share-based compensation |

|

2 |

|

|

2 |

|

- |

|

|

- |

|

| Impact of finance leases |

|

|

|

|

|

|

|

|

|

Upfront gain |

|

(13 |

) |

|

- |

|

- |

|

|

(13 |

) |

|

Principal repayments |

|

8 |

|

|

- |

|

- |

|

|

8 |

|

|

Adjusted EBITDA |

$ |

90 |

|

$ |

41 |

$ |

15 |

|

$ |

34 |

|

FREE CASH FLOW

The Company defines free cash flow as cash provided by (used in)

operating activities, less maintenance capital expenditures,

mandatory debt repayments, lease payments and dividends paid, with

proceeds on disposals of PP&E and EI assets added back. The

following table reconciles free cash flow to the most directly

comparable IFRS measure, cash provided by (used in) operating

activities:

|

Three months endedMarch 31, |

|

|

($ millions) |

|

2024 |

|

|

2023 |

|

|

Cash provided by (used in) operating activities before changes in

working capital and other |

$ |

18 |

|

$ |

50 |

|

| Net

change in working capital and other |

|

83 |

|

|

(52 |

) |

|

Cash provided by (used in) operating activities |

$ |

101 |

|

$ |

(2 |

) |

| Less: |

|

|

|

|

|

Maintenance capital and PP&E expenditures |

|

(9 |

) |

|

(7 |

) |

|

Mandatory debt repayments |

|

(10 |

) |

|

- |

|

|

Lease payments |

|

(4 |

) |

|

(4 |

) |

|

Dividends |

|

(2 |

) |

|

(2 |

) |

| Add: |

|

|

|

|

|

Proceeds on disposals of PP&E and EI assets |

|

2 |

|

|

12 |

|

|

Free cash flow |

$ |

78 |

|

$ |

(3 |

) |

The Company experienced positive movements in

working capital during the three months ended March 31, 2024,

primarily attributable to significant cash collections that

impacted deferred revenues. While the Company has been able to

efficiently manage its working capital globally, it does not expect

the magnitude of the recovery realized to be repeated.

BANK-ADJUSTED NET DEBT-TO-EBITDA

RATIO

The Company defines net debt as short- and

long-term debt less cash and cash equivalents at period end, which

is then divided by EBITDA for the trailing 12 months. In assessing

whether the Company is compliant with the financial covenants

related to its debt instruments, certain adjustments are made to

net debt and EBITDA to determine Enerflex's bank-adjusted net

debt-to-EBITDA ratio. These adjustments and Enerflex's

bank-adjusted net-debt -to EBITDA ratio are calculated in

accordance with, and derived from, the Company's financing

agreements.

GROSS MARGIN BEFORE DEPRECIATION AND

AMORTIZATION

Gross margin before depreciation and

amortization is a non-IFRS measure defined as gross margin

excluding the impact of depreciation and amortization. The

historical costs of assets may differ if they were acquired through

acquisition or constructed, resulting in differing depreciation.

Gross margin before depreciation and amortization is useful to

present operating performance of the business before the impact of

depreciation and amortization that may not be comparable across

assets.

ADVISORY REGARDING FORWARD-LOOKING

INFORMATION

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

laws and “forward-looking statements” (and together with

“forward-looking information”, “forward-looking information and

statements”) within the meaning of the safe harbor provisions of

the US Private Securities Litigation Reform Act of 1995. All

statements other than statements of historical fact are

forward-looking information and statements. The use of any of the

words "future", "continue", "estimate", "expect", "may", "will",

"could", "believe", "predict", "potential", "objective", and

similar expressions, are intended to identify forward-looking

information and statements. In particular, this news release

includes (without limitation) forward-looking information and

statements pertaining to: the continued focus of the Company to

enhance profitability of core operations which will facilitate

continued debt reduction and enhance the Company’s ability to

return capital to shareholders, if at all; all disclosures under

the heading “Outlook” including: (i) continued expectations for

consistent demand across all business units and geographic regions;

(ii) the Company’s expectations that the customer contracts which

support the Energy Infrastructure product line will generate $1.6

billion of revenue during their remaining terms; (iii) expectations

that a majority of the $1.3 billion backlog will convert to revenue

over the next 12 months; (iv) the Company’s estimate that the

remaining revenue to be recognized from the EH Cryo project is

approximately 7% of the Company’s backlog; (v) the Company’s

estimate of remaining spend to complete the EH Cryo project of

approximately $105 million; (vi) expectations for a disciplined

2024 capital program including total capital expenditures of

between US$90 million to US$110 million (including a total of

approximately US$70 million for maintenance and PP&E capital

expenditures); (vii) expectations that the spending to expand the

Company’s Energy Infrastructure business in 2024 will be

discretionary and such spending will generate attractive returns

and create value for shareholders; (viii) expectations that

Enerflex will not incur any material construction expenditures to

complete the EH Cryo project while work is suspended; and (ix) the

ability of the Company to focus on growth and provide shareholder

returns over the medium and long-term; the continuation by

the Company of paying a sustainable quarterly cash dividend; and

expectations by the Company that the magnitude of the recovery

realized in working capital during the three months ended March 31,

2024, will not be repeated.

All forward-looking information and statements

in this news release are subject to important risks, uncertainties,

and assumptions, which may affect Enerflex's operations, including,

without limitation: the impact of economic conditions; the markets

in which Enerflex's products and services are used; general

industry conditions; the ability to successfully continue to

integrate Exterran and the timing and costs associated therewith;

changes to, and introduction of new, governmental regulations,

laws, and income taxes; increased competition; insufficient funds

to support capital investments; availability of qualified personnel

or management; political unrest and geopolitical conditions; and

other factors, many of which are beyond the control of Enerflex. As

a result of the foregoing, actual results, performance, or

achievements of Enerflex could differ and such differences could be

material from those expressed in, or implied by, these statements,

including but not limited to: the ability of Enerflex to realize

the anticipated benefits of, and synergies from, the acquisition of

Exterran and the timing and quantum thereof; the interpretation and

treatment of the transaction to acquire Exterran by applicable tax

authorities; the ability to maintain desirable financial ratios;

the ability to access various sources of debt and equity capital,

generally, and on acceptable terms, if at all; the ability to

utilize tax losses in the future; the ability to maintain

relationships with partners and to successfully manage and operate

the integrated business; risks associated with technology and

equipment, including potential cyberattacks; the occurrence and

continuation of unexpected events such as pandemics, severe weather

events, war, terrorist threats, and the instability resulting

therefrom; risks associated with existing and potential future

lawsuits, shareholder proposals, and regulatory actions; and those

factors referred to under the heading "Risk Factors" in: (i)

Enerflex's Annual Information Form for the year ended December 31,

2023, (ii) Enerflex's management’s discussion and analysis for the

year ended December 31, 2023, and (iii) Enerflex's Management

Information Circular dated March 15, 2024, each of the foregoing

documents being accessible under the electronic profile of the

Company on SEDAR+ and EDGAR at www.sedarplus.ca and

www.sec.gov/edgar, respectively.

Readers are cautioned that the foregoing list of

assumptions and risk factors should not be construed as exhaustive.

The forward-looking information and statements included in this

news release are made as of the date of this news release and are

based on the information available to the Company at such time and,

other than as required by law, Enerflex disclaims any intention or

obligation to update or revise any forward-looking information and

statements, whether as a result of new information, future events,

or otherwise. This news release and its contents should not be

construed, under any circumstances, as investment, tax, or legal

advice.

The outlook provided in this news release is

based on assumptions about future events, including economic

conditions and proposed courses of action, based on Management's

assessment of the relevant information currently available. The

outlook is based on the same assumptions and risk factors set forth

above and is based on the Company's historical results of

operations. The outlook set forth in this news release was approved

by Management and the Board of Directors. Management believes that

the prospective financial information set forth in this news

release has been prepared on a reasonable basis, reflecting

Management's best estimates and judgments, and represents the

Company's expected course of action in developing and executing its

business strategy relating to its business operations. The

prospective financial information set forth in this news release

should not be relied on as necessarily indicative of future

results. Actual results may vary, and such variance may be

material.

ABOUT ENERFLEX

Enerflex is a premier integrated global provider

of energy infrastructure and energy transition solutions, deploying

natural gas, low-carbon, and treated water solutions – from

individual, modularized products and services to integrated custom

solutions. With over 4,500 engineers, manufacturers, technicians,

and innovators, Enerflex is bound together by a shared vision:

Transforming Energy for a Sustainable Future. The

Company remains committed to the future of natural gas and the

critical role it plays, while focused on sustainability offerings

to support the energy transition and growing decarbonization

efforts.

Enerflex's common shares trade on the Toronto

Stock Exchange under the symbol "EFX" and on the New York Stock

Exchange under the symbol "EFXT". For more information about

Enerflex, visit www.enerflex.com.

For investor and media enquiries, contact:

Marc RossiterPresident and Chief Executive OfficerE-mail:

MRossiter@enerflex.com

Jeff Fetterly Vice President, Corporate Development and Investor

Relations E-mail: JFetterly@enerflex.com

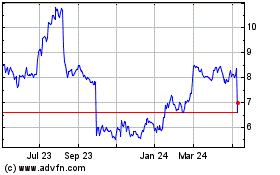

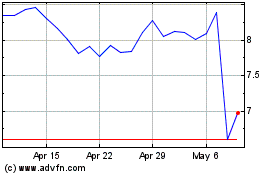

Enerflex (TSX:EFX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Enerflex (TSX:EFX)

Historical Stock Chart

From Nov 2023 to Nov 2024