Ero Copper Corp. (TSX: ERO, NYSE: ERO) ("Ero" or

the “Company”) is pleased to announce its 2024 production results

and 2025 guidance as well as an updated three-year production

outlook.

HIGHLIGHTS

2024 Production Results

- Record quarterly copper production of 12,883 tonnes contributed

to consolidated copper production for 2024 of 40,600 tonnes in

concentrate.

- The Caraíba Operations delivered 8,566 tonnes during the fourth

quarter and 35,444 tonnes of copper in concentrate for the year,

meeting revised 2024 production guidance.

- Steady progress on increasing throughput volumes through

year-end at the Tucumã Operation resulted in production of 4,317

tonnes during the fourth quarter and 5,156 tonnes of copper in

concentrate for the year, below revised 2024 guidance.

- Gold production of 57,210 ounces at the Xavantina Operations

was at the midpoint of original guidance and slightly below

increased 2024 guidance.

Amended Revolving Credit

Facility

- Subsequent to year-end 2024, the Company enhanced financial

flexibility by amending its senior secured revolving credit

facility (the "Amended Credit Facility") to support its larger

operational footprint. Key updates to the Amended Credit Facility

include:

- An increase in aggregate commitments from $150 million to $200

million.

- An extension of the maturity date from December 2026 to

December 2028.

- Improved terms, including a 25-basis point reduction in the

applicable margin on drawn funds at certain leverage ratios.

2025 Guidance

- Consolidated copper production is expected to increase by

approximately 85% to 110% year-on-year to a range of 75,000 and

85,000 tonnes at consolidated C1 cash costs between $1.55 and $1.80

per pound of copper produced(1) with the Tucumã Operation expected

to achieve commercial production in H1 2025.

- The Xavantina Operations are expected to produce 50,000 to

60,000 ounces of gold at C1 cash costs between $650 and $800 per

ounce of gold produced and all-in sustaining costs ("AISC") between

$1,400 and $1,600 per ounce of gold produced.

- Capital expenditures are projected to decrease significantly

year-on-year to between $230 to $270 million in 2025. Full-year

capital estimates include the continued construction of the new

external shaft at the Caraíba Operations' Pilar Mine as well as the

advancement of the Furnas Copper-Gold Project ("Furnas").

Three-Year Production

Outlook

- Consolidated copper production across the Company's operations

is expected to reach between 85,000 and 95,000 tonnes in

concentrate in 2026 and 2027.

- At the Caraíba Operations, capital investments at the Pilar

Mine in 2025 are expected to increase underground development rates

in order to improve operating flexibility and further advance the

construction of the new external shaft, enabling higher sustained

copper production levels at increased operating margins beginning

in 2027.

- Copper production at the Tucumã Operation is expected to remain

elevated through 2027, driven by positive results obtained during

the 2024 infill drill program and the expected achievement of

design mill throughput rates in 2025.

- The Xavantina Operations are expected to sustain annual gold

production levels of 50,000 to 60,000 ounces through 2027.

“2024 was a transformational year for the

Company, marked by significant achievements across our operations

and projects. I am incredibly proud of the dedication and

resilience of our teams in reaching key milestones, including the

safe and on-time delivery of the Tucumã Project," said Makko

DeFilippo, President & Chief Executive Officer. "Despite

challenges, we ended the year with record consolidated copper

production in the fourth quarter, continued our ramp-up efforts at

Tucumã, and commenced drilling at Furnas—positioning us well for a

strong 2025, which we fully expect will be a record year for the

Company by any measure."

"Over the coming years, we expect to sustain

meaningfully higher production levels across our core assets where

we will continue to invest strategically in innovation and in

enhancing operational flexibility to improve margins. In parallel,

we are focusing our efforts on the step- change growth opportunity

we see in Furnas to create long-term value for our

shareholders."

(1) Consolidated 2025 copper C1 cash costs will

reflect the timing of commercial production at the Tucumã

Operation, which will influence the relative weighting of unit

costs by operation.

FOURTH QUARTER AND FULL-YEAR 2024

PRODUCTION RESULTS

|

|

Q4 2024 |

Full Year 2024 |

2024 Guidance(1) |

|

Caraíba Operations |

|

|

|

|

Tonnes Processed |

719,942 |

3,431,294 |

— |

|

Grade (% Cu) |

1.30 |

1.14 |

— |

|

Recovery Rate (%) |

91.8 |

90.6 |

— |

|

Copper Production (tonnes) |

8,566 |

35,444 |

35,000 - 37,000 |

|

|

|

|

|

|

Tucumã Operation |

|

|

|

|

Tonnes Processed |

223,013 |

333,791 |

— |

|

Grade (% Cu) |

2.17 |

1.78 |

— |

|

Recovery Rate (%) |

89.1 |

86.6 |

— |

|

Copper Production (tonnes) |

4,317 |

5,156 |

8,000 - 11,000 |

|

|

|

|

|

|

Consolidated Copper Production (tonnes) |

12,883 |

40,600 |

43,000 - 48,000 |

|

|

|

|

|

|

Xavantina Operations |

|

|

|

|

Tonnes Processed |

26,120 |

146,161 |

— |

|

Grade (gpt Au) |

11.18 |

13.37 |

— |

|

Recovery Rate (%) |

92.8 |

92.0 |

— |

|

Au Production (ounces) |

8,936 |

57,210 |

60,000 - 65,000 |

| |

|

|

|

| (1) Guidance as of November

5, 2024. |

|

|

|

| |

|

|

|

Consolidated copper production for the fourth

quarter and full year was impacted by power disruptions at the

Tucumã Operation and operational challenges associated with the

tailings filtration circuit which impacted the processing plant's

ramp-up schedule. Despite these challenges, metallurgical

recoveries and concentrate grades have continued to perform in-line

with design targets, and throughput volumes have steadily increased

month-over-month, as evidenced by the significant improvements in

both throughput and copper production during the fourth

quarter.

The Xavantina Operations were temporarily halted

in December to complete repairs identified during a routine

inspection by Brazil's National Mining Agency, impacting fourth

quarter and full year production. The Company leveraged this

downtime to accelerate preventative maintenance and infrastructure

upgrades originally planned for 2025.

2025 PRODUCTION GUIDANCE AND THREE-YEAR PRODUCTION

OUTLOOK

The Company's 2025 production guidance and

three-year production outlook demonstrates the continued execution

of its organic growth strategy. Key drivers include the expected

achievement of design mill throughput rates at the Tucumã Operation

in 2025 and the ongoing construction of the new external shaft at

the Caraíba Operations' Pilar Mine, which is expected to become

operational in 2027. As a result, copper production in 2025 is

expected to increase by approximately 85% to 110% year-on-year to a

range of 75,000 to 85,000 tonnes and reach 85,000 to 95,000 tonnes

in concentrate in each of 2026 and 2027.

At the Xavantina Operations, annual gold

production is expected to remain steady at 50,000 to 60,000 ounces

through 2027, with higher mine production and mill throughput

levels offsetting a return to long-term block model gold

grades.

|

|

2025 |

|

2026 |

|

2027 |

|

Copper (tonnes) |

|

|

|

|

|

|

Caraíba Operations |

37,500 - 42,500 |

|

40,000 - 45,000 |

|

45,000 - 50,000 |

|

Tucumã Operations |

37,500 - 42,500 |

|

45,000 - 50,000 |

|

40,000 - 45,000 |

|

Total Copper |

75,000 - 85,000 |

|

85,000 - 95,000 |

|

85,000 - 95,000 |

|

Gold (ounces) |

|

|

|

|

|

|

Xavantina Operations |

50,000 - 60,000 |

|

50,000- 60,000 |

|

50,000 - 60,000 |

|

|

|

|

|

|

|

Note: Guidance is based on estimates and

assumptions including, but not limited to, mineral reserve

estimates, grade and continuity of interpreted geological

formations and metallurgical recovery performance. Please refer to

the Company’s SEDAR+ and EDGAR filings, including the most recent

Annual Information Form ("AIF"), for a detailed summary of risk

factors.

2025 COST GUIDANCE

2025 copper C1 cash cost guidance on a

consolidated basis is $1.55 to $1.80 per pound of copper

produced(1). This is based on C1 cash cost guidance ranges of $2.15

to $2.35 per pound for the Caraíba Operations and $1.05 to $1.25

per pound at the Tucumã Operation.

At the Xavantina Operations, the C1 cash cost

guidance range of $650 to $800 per ounce of gold produced reflects

a planned decrease in mined and processed gold grades. The AISC

guidance range for 2025 is $1,400 to $1,600 per ounce of gold

produced.

|

Copper C1 Cash Cost ($/lb) |

|

|

Caraíba Operations |

$2.15 - $2.35 |

|

Tucumã Operations |

$1.05 - $1.25 |

|

Consolidated Copper Operations(1) |

$1.55 - $1.80 |

|

|

|

|

Gold C1 Cash Cost ($/oz) |

$650 - $800 |

|

Gold All-In Sustaining Cost ($/oz) |

$1,400 - $1,600 |

Note: C1 Cash Costs and AISC are non-IFRS measures. Please see

the Notes section of this press release for additional

information.

(1) Consolidated 2025 copper C1 cash costs will reflect the

timing of commercial production at the Tucumã Operation, which will

influence the relative weighting of unit costs by operation.

2025 CAPITAL EXPENDITURE

GUIDANCE

2025 capital expenditures are expected to

decrease meaningfully year-on-year to a range of $230 to $270

million million, primarily due to significantly lower capital

expenditures at the Tucumã Operation following the completion of

construction in 2024. Capital expenditures at the Caraíba

Operation are expected to remain elevated in 2025 with

approximately $80 to $90 million earmarked for growth capital

related to the advancement of the new external shaft and related

infrastructure and development.

Figures presented below are in USD millions.

|

Caraíba Operations |

$165 - $180 |

| Tucumã

Operation(1) |

$30 - $40 |

| Xavantina

Operations |

$25 - $35 |

| Furnas Copper-Gold

Project and Other Exploration |

$10 - $15 |

| Total |

$230 - $270 |

| |

|

| (1) Excludes capitalized ramp-up costs prior

to the declaration of commercial production. |

| |

|

AMENDED CREDIT FACILITY

Subsequent to December 31, 2024, the Company

amended its senior secured revolving credit facility to increase

aggregate commitments from $150.0 million to $200.0 million and to

extend the maturity from December 2026 to December 2028. The

interest rate and commitment fee on the Amended Credit Facility

were reduced to sliding scales of SOFR plus 2.00% to 4.25%, and

0.45% to 0.96%, respectively.

The Amended Credit Facility includes standard

and customary terms and conditions with respect to fees,

representations, warranties, and financial covenants. The Bank of

Montreal acted as Administrative Agent, Lead Arranger, and Sole

Bookrunner, Canadian Imperial Bank of Commerce acted as

Documentation Agent, and The Bank of Nova Scotia and National Bank

of Canada participated as lenders.

A copy of the Amended Credit Facility agreement

will be filed on SEDAR+ and EDGAR.

NOTES

Alternative Performance (Non-IFRS)

Measures

The Company utilizes certain alternative

performance (non-IFRS) measures to monitor its performance,

including C1 cash cost of copper produced (per lb), C1 cash cost of

gold produced (per ounce), and AISC of gold produced (per ounce).

These performance measures have no standardized meaning prescribed

within generally accepted accounting principles under IFRS and,

therefore, amounts presented may not be comparable to similar

measures presented by other mining companies. These non-IFRS

measures are intended to provide supplemental information and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with IFRS.

C1 Cash Cost of Copper Produced (per

lb)

C1 cash cost of copper produced (per lb) is a

non-IFRS performance measure used by the Company to manage and

evaluate the operating performance of its copper mining segment and

is calculated as C1 cash costs divided by total pounds of copper

produced during the period. C1 cash costs comprise the total cost

of production, including expenses related to transportation, and

treatment and refining charges. These costs are net of by-product

credits, incentive payments and certain tax credits associated with

sales invoiced to the Company's Brazilian customers.

While the C1 cash cost of copper produced per

pound is widely reported in the mining industry as a performance

benchmark, it does not have a standardized meaning and is disclosed

as a supplement to IFRS measures.

C1 Cash Cost of Gold produced (per

ounce) and AISC of Gold produced (per ounce)

C1 cash cost of gold produced (per ounce) is a

non-IFRS performance measure used by the Company to manage and

evaluate the operating performance of its gold mining segment and

is calculated as C1 cash costs divided by total ounces of gold

produced during the period. C1 cash cost includes total cost of

production, net of by-product credits and incentive payments. C1

cash cost of gold produced per ounce is widely reported in the

mining industry as benchmarks for performance but does not have a

standardized meaning and is disclosed in supplemental to IFRS

measures.

AISC of gold produced (per ounce) is an

extension of C1 cash cost of gold produced (per ounce) discussed

above and is also a key performance measure used by management to

evaluate operating performance of its gold mining segment. AISC of

gold produced (per ounce) is calculated as AISC divided by total

ounces of gold produced during the period. AISC includes C1 cash

costs, site general and administrative costs, accretion of mine

closure and rehabilitation provision, sustaining capital

expenditures, sustaining leases, and royalties and production

taxes. AISC of gold produced (per ounce) is widely reported in the

mining industry as benchmarks for performance but does not have a

standardized meaning and is disclosed in supplement to IFRS

measures.

ABOUT ERO COPPER CORP

Ero Copper is a high-margin, high-growth copper

producer with operations in Brazil and corporate headquarters in

Vancouver, B.C. The Company's primary assets include a 99.6%

interest in the Brazilian copper mining company, Mineração Caraíba

S.A. ("MCSA"), 100% owner of the Company's Caraíba Operations,

which are located in the Curaçá Valley, Bahia State, Brazil, and

the Tucumã Operation, an open pit copper mine located in Pará

State, Brazil. The Company also owns 97.6% of NX Gold S.A. ("NX

Gold") which owns the Xavantina Operations, an operating gold and

silver mine located in Mato Grosso State, Brazil. In July 2024, the

Company signed a definitive earn-in agreement with Vale Base Metals

for a 60% interest in the Furnas Copper-Gold Project, located in

the Carajás Mineral Province in Pará State, Brazil. For more

information on the earn-in agreement, please see the Company's

press releases dated October 30, 2023 and July 22, 2024. Additional

information on the Company and its operations, including technical

reports on the Caraíba Operations, Xavantina Operations, Tucumã

Operation and the Furnas Copper-Gold Project, can be found on the

Company’s website (www.erocopper.com), on SEDAR+

(www.sedarplus.ca/landingpage/) and on EDGAR (www.sec.gov). The

Company’s shares are publicly traded on the Toronto Stock Exchange

and the New York Stock Exchange under the symbol “ERO”.

FOR MORE INFORMATION, PLEASE

CONTACT

Courtney Lynn, SVP, Corporate Development, Investor

Relations & Sustainability (604) 335-7504info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION

AND STATEMENTS

This press release contains “forward-looking

statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and “forward-looking

information” within the meaning of applicable Canadian securities

legislation (collectively, “forward-looking statements”).

Forward-looking statements include statements that use

forward-looking terminology such as “may”, “could”, “would”,

“will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”,

“estimate”, “forecast”, “schedule”, “anticipate”, “believe”,

“continue”, “potential”, “view” or the negative or grammatical

variation thereof or other variations thereof or comparable

terminology. Forward-looking statements may include, but are not

limited to, statements with respect to the Company's expected

production, operating costs and capital expenditures at the Caraíba

Operations, the Tucumã Operation and the Xavantina Operations;

estimated timing for certain milestones, including the ramp-up of

production and achievement of commercial production at the Tucumã

Operation and the completion and estimated operating timeline of

the Pilar Mine's new external shaft at the Caraíba Operations; the

ability of the Company to sustain higher copper production levels

and realize higher operating margins once the Pilar Mine's new

external shaft is operational; the ability of the Company to

restore operating flexibility at the Pilar Mine and Caraíba

Operations by accelerated underground development; the budget for,

and the Company's ability to advance, work programs under the

Furnas earn-in agreement; and any other statement that may predict,

forecast, indicate or imply future plans, intentions, levels of

activity, results, performance or achievements.

Forward-looking statements are not a guarantee

of future performance. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Forward-looking statements involve

statements about the future and are inherently uncertain, and the

Company’s actual results, achievements or other future events or

conditions may differ materially from those reflected in the

forward-looking statements due to a variety of risks, uncertainties

and other factors, including, without limitation, those referred to

herein and in the Company's most recent Annual Information Form

under the heading “Risk Factors”.

The Company’s forward-looking statements are

based on the assumptions, beliefs, expectations and opinions of

management on the date the statements are made, many of which may

be difficult to predict and beyond the Company’s control. In

connection with the forward-looking statements contained in this

press release and in the AIF, the Company has made certain

assumptions about, among other things: favourable equity and debt

capital markets; the ability to raise any necessary additional

capital on reasonable terms to advance the production, development

and exploration of the Company’s properties and assets; future

prices of copper, gold and other metal prices; the timing and

results of exploration and drilling programs; the accuracy of any

mineral reserve and mineral resource estimates; the geology of the

Caraíba Operations, the Xavantina Operations, the Tucumã Operation

and the Furnas Copper-Gold Project being as described in the

respective technical report for each property; production costs;

the accuracy of budgeted exploration, development and construction

costs and expenditures; the price of other commodities such as

fuel; future currency exchange rates and interest rates; operating

conditions being favourable such that the Company is able to

operate in a safe, efficient and effective manner; work force

continuing to remain healthy in the face of prevailing epidemics,

pandemics or other health risks, political and regulatory

stability; the receipt of governmental, regulatory and third party

approvals, licenses and permits on favourable terms; obtaining

required renewals for existing approvals, licenses and permits on

favourable terms; requirements under applicable laws; sustained

labour stability; stability in financial and capital goods markets;

availability of equipment; positive relations with local groups and

the Company’s ability to meet its obligations under its agreements

with such groups; and satisfying the terms and conditions of the

Company’s current loan arrangements. Although the Company believes

that the assumptions inherent in forward-looking statements are

reasonable as of the date of this press release, these assumptions

are subject to significant business, social, economic, political,

regulatory, competitive and other risks and uncertainties,

contingencies and other factors that could cause actual actions,

events, conditions, results, performance or achievements to be

materially different from those projected in the forward-looking

statements. The Company cautions that the foregoing list of

assumptions is not exhaustive. Other events or circumstances could

cause actual results to differ materially from those estimated or

projected and expressed in, or implied by, the forward-looking

statements contained in this press release. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

Forward-looking statements contained herein are

made as of the date of this press release and the Company disclaims

any obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or results or

otherwise, except as and to the extent required by applicable

securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND

MINERAL RESERVE ESTIMATES

Unless otherwise indicated, all reserve and

resource estimates included in this press release and the documents

incorporated by reference herein have been prepared in accordance

with National Instrument 43-101, Standards of Disclosure for

Mineral Projects (“NI 43-101") and the Canadian Institute of

Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition

Standards on Mineral Resources and Mineral Reserves, adopted by the

CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule

developed by the Canadian Securities Administrators that

establishes standards for all public disclosure an issuer makes of

scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from

the requirements of the United States Securities and Exchange

Commission (the “SEC”), and reserve and resource information

included herein may not be comparable to similar information

disclosed by U.S. companies. In particular, and without limiting

the generality of the foregoing, this press release and the

documents incorporated by reference herein use the terms “measured

resources,” “indicated resources” and “inferred resources” as

defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments, mineral property

disclosure requirements in the United States (the “U.S. Rules”) are

governed by subpart 1300 of Regulation S-K of the U.S. Securities

Act of 1933, as amended (the “U.S. Securities Act”) which differ

from the CIM Standards. As a foreign private issuer that is

eligible to file reports with the SEC pursuant to the

multi-jurisdictional disclosure system (the “MJDS”), Ero is not

required to provide disclosure on its mineral properties under the

U.S. Rules and will continue to provide disclosure under NI 43-101

and the CIM Standards. If Ero ceases to be a foreign private issuer

or loses its eligibility to file its annual report on Form 40-F

pursuant to the MJDS, then Ero will be subject to the U.S. Rules,

which differ from the requirements of NI 43-101 and the CIM

Standards.

Pursuant to the new U.S. Rules, the SEC

recognizes estimates of “measured mineral resources”, “indicated

mineral resources” and “inferred mineral resources.” In addition,

the definitions of “proven mineral reserves” and “probable mineral

reserves” under the U.S. Rules are now “substantially similar” to

the corresponding standards under NI 43-101. Mineralization

described using these terms has a greater amount of uncertainty as

to its existence and feasibility than mineralization that has been

characterized as reserves. Accordingly, U.S. investors are

cautioned not to assume that any measured mineral resources,

indicated mineral resources, or inferred mineral resources that Ero

reports are or will be economically or legally mineable. Further,

“inferred mineral resources” have a greater amount of uncertainty

as to their existence and as to whether they can be mined legally

or economically. Under Canadian securities laws, estimates of

“inferred mineral resources” may not form the basis of feasibility

or pre-feasibility studies, except in rare cases. While the above

terms under the U.S. Rules are “substantially similar” to the

standards under NI 43-101 and CIM Standards, there are differences

in the definitions under the U.S. Rules and CIM Standards.

Accordingly, there is no assurance any mineral reserves or mineral

resources that Ero may report as “proven mineral reserves”,

“probable mineral reserves”, “measured mineral resources”,

“indicated mineral resources” and “inferred mineral resources”

under NI 43-101 would be the same had Ero prepared the reserve or

resource estimates under the standards adopted under the U.S.

Rules.

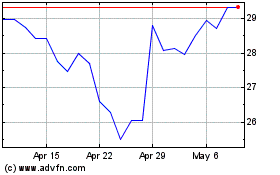

Ero Copper (TSX:ERO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ero Copper (TSX:ERO)

Historical Stock Chart

From Feb 2024 to Feb 2025