Espial Group Inc. (“Espial” or the “Company”) (TSX:ESP) today

announced that, pursuant to an agreement with Vantage Asset

Management Inc. (“Vantage”), Espial will appoint Brian McLaughlin

as a new, independent director of the Company at its Annual General

and Special Meeting of Shareholders scheduled for June 13, 2017. In

addition, Espial and Vantage will work together to nominate a new,

independent director for election at the Company’s 2018 Annual

General Meeting of Shareholders. Vantage has withdrawn its

previously announced nominees and will support Espial’s other six

director nominees set forth in the Company’s Management Information

Circular, comprised of: Jaison Dolvane, Michael Hayashi, Aamir

Hussain, Michael Lee, Peter Seeligsohn and Kumanan Yogaratnam.

Mark Tredgett, Managing Partner at Vantage, which owns 9.5 per

cent of Espial’s outstanding shares, said: “Espial represents a

compelling investment with a large, global opportunity. The recent

board nomination of Aamir Hussain, Executive Vice President and

Chief Technology Officer of CenturyLink, Inc. and the appointment

of Brian McLaughlin, significantly strengthen Espial’s board.

Vantage and Espial’s board have worked collaboratively in this

process and believe the agreement positions the Company for a

stronger future.”

Peter Seeligsohn, Chairman of Espial Group added, “Together with

the support of our large shareholders like Vantage, we are

committed to continuing Espial’s vision of being a trusted partner

to our customers. We are excited about the recent changes to the

Company’s board and welcome Brian’s future contributions.”

“Espial’s strategy of developing next generation solutions that

redefine the video experience and enable operators to innovate and

deliver new services rapidly is working”, said Jaison Dolvane,

Espial’s President and CEO. “Pay TV service providers worldwide

face increasing competition locally and from new global entrants

like Netflix and Amazon. Espial’s software and solutions enable

cable and telecom operators to launch compelling next generation

video services that seamlessly blend advanced TV services with OTT

content across TVs, tablets, PCs and mobile phones.”

Details of the Agreement

- Espial’s board will increase to seven

members at the 2017 AGM – the six previously announced nominees

plus Mr. McLaughlin

- The Board will work with Vantage to

nominate a mutually acceptable candidate as a new, independent

director to the board at the 2018 AGM

- Vantage agrees to vote its shares for

the election of Espial’s nominees and to certain standstill

obligations under which it agrees, among other things, not to

directly or indirectly participate in a proxy contest or make a

shareholder proposal or a shareholder requisition until, (i) no

later than 60 days prior to the 2018 AGM or (ii) if a mutually

acceptable candidate is nominated for election at the 2018 AGM,

until June 30, 2019

Espial’s Management Information Circular, dated April 28, 2017,

is filed on SEDAR at www.sedar.com and is also available on the

Company’s website at

www.espial.com/discover/investor-informaiton.

Vote the Management Proxy

Espial and Vantage are committed to a collaborative relationship

and both firms urge shareholders to vote for the candidates listed

in the management proxy. If shareholders have already voted a blue

proxy, a later-dated Management Proxy will cancel the earlier vote.

Mr. McLaughlin will be added to the board on or around the date of

the 2017 AGM.

The proxy voting deadline is 10:00 AM (Ottawa Time) on June 9,

2017. However, shareholders are encouraged to vote well in advance

of the deadline to ensure their vote is counted. For assistance

voting your shares, please contact Espial’s proxy solicitation

agent, Laurel Hill Advisory Group toll free in North America at,

1-877-452-7184 (+1-416-304-0211 collect outside of North America),

or by email at assistance@laurelhill.com.

Information regarding Brian McLaughlin

Brian McLaughlin is a resident of Toronto, Ontario and has been

in the investment business for 30 years and has been involved in

all aspects of the capital markets, with particular emphasis on

small and mid-capitalization companies. Brian has held leadership

roles at several firms including Gordon Capital and Raymond James

Securities where he was a Managing Director as well as being a

Director and Partner at Cormark Securities. Throughout Mr.

McLaughlin’s career he was involved in the senior management and

direction of the firm.

Brian McLaughlin remains an active investor today. His principal

occupation since 2013 has been as a Partner at Hydra Capital

Partners Inc., a Toronto boutique investment company. Hydra

provides capital markets expertise and capital to public and

private companies. As of April 28, 2017, Mr. McLaughlin held

471,700 common shares of Espial.

To Espial's knowledge, Mr. McLaughlin is not at the date hereof,

nor has he been within 10 years before the date hereof: (a) a

director, chief executive officer or chief financial officer of any

company (including Espial) that: (i) was subject to a cease trade

order, an order similar to a cease trade order or an order that

denied the relevant company access to any exemption under

securities legislation, in each case that was issued while he was

acting in the capacity as director, chief executive officer or

chief financial officer; or (ii) was subject to a cease trade

order, an order similar to a cease trade order or an order that

denied the relevant company access to any exemption under

securities legislation, in each case that was issued after he

ceased to be a director, chief executive officer or chief financial

officer and which resulted from an event that occurred while he was

acting in the capacity as director, chief executive officer or

chief financial officer; (b) a director or executive officer of any

company (including Espial) that, while he was acting in that

capacity, or within a year of ceasing to act in that capacity,

became bankrupt, made a proposal under any legislation relating to

bankruptcy or insolvency or became subject to or instituted any

proceedings, arrangement or compromise with creditors, or had a

receiver, receiver manager or trustee appointed to hold its assets;

or (c) a bankrupt, made a proposal under any legislation relating

to bankruptcy or insolvency, or become subject to or instituted any

proceedings, arrangements or compromise with creditors, or had a

receiver, receiver manager or trustee appointed to hold his assets.

To Espial's knowledge, Mr. McLaughlin has not been subject to: (a)

any penalties or sanctions imposed by a court relating to

securities legislation, or by a securities regulatory authority, or

has entered into a settlement agreement with a securities

regulatory authority; or (b) any other penalties or sanctions

imposed by a court or regulatory body that would likely be

considered important to a reasonable securityholder in deciding

whether to vote for Mr. McLaughlin. To Espial's knowledge, Mr.

McLaughlin does not have: (a) any material interest, direct or

indirect, in any transaction since the commencement of the Espial's

most recently completed financial year or in any proposed

transaction which has materially affected or would materially

affect Espial or its subsidiaries; or (b) any material interest,

direct or indirect, by way of beneficial ownership of securities or

otherwise, in any matter proposed to be acted on at the Meeting,

other than the election of directors.

About Espial (www.espial.com)

With Espial, video service providers create responsive and

engaging subscriber viewing experiences incorporating powerful

content discovery and intuitive navigation. Service providers

achieve ‘Web-speed’ innovation with Espial’s flexible, open

software leveraging RDK and HTML5 technologies. This provides

competitive advantage through an immersive and personalized user

experience, seamlessly blending advanced TV services with OTT

content. With customers spanning six continents, Espial is

headquartered in Ottawa, Canada, with R&D centers in Seattle,

Montreal, Silicon Valley, Cambridge and Lisbon, and with sales

offices in North America, Europe and Asia. For more information,

visit www.espial.com.

Forward Looking Statements:

This press release contains information that is forward looking

information with respect to Espial within the meaning of Section

138.4(9) of the Ontario Securities Act (forward looking statements)

and other applicable securities laws. In some cases,

forward-looking information can be identified by the use of terms

such as "may", "will", "should", "expect", "plan", "anticipate",

"believe", "intend", "estimate", "predict", "potential", "continue"

or the negative of these terms or other similar expressions

concerning matters that are not historical facts. In particular,

statements or assumptions about future ongoing or future

advancement of our leadership position, growth expectations, future

progress, ongoing or future benefits of our board nominees,

existing or future opportunities for the company and products

(including our ability to successfully execute on market

opportunities and secure new customer wins), economic conditions,

and any other statements regarding Espial's objectives (and

strategies to achieve such objectives), future expectations,

beliefs, goals or prospects are or involve forward-looking

information.

Forward-looking information is based on certain factors and

assumptions. While the company considers these assumptions to be

reasonable based on information currently available to it, they may

prove to be incorrect. Forward-looking information, by its nature

necessarily involves known and unknown risks and uncertainties. A

number of factors could cause actual results to differ materially

from those in the forward-looking statements or could cause our

current objectives and strategies to change, including but not

limited to changing conditions and other risks associated with the

on-demand TV software industry and the market segments in which

Espial operates, competition, Espial’s ability to continue to

supply existing customers and partners with its products and

services and avoid being displaced by competitive offerings,

effectively grow its integration and support capabilities, execute

on market opportunities, develop its distribution channels and

generate increased demand for its products, economic conditions,

technological change, unanticipated changes in our costs,

regulatory changes, litigation, the emergence of new opportunities,

many of which are beyond our control and current expectation or

knowledge.

Additional risks and uncertainties affecting Espial can be found

in Management’s Discussion and Analysis of Results of Operations

and Financial Condition and its Annual Information Form for the

fiscal years ended December 31, 2016 on SEDAR at www.sedar.com. If

any of these risks or uncertainties were to materialize, or if the

factors and assumptions underlying the forward-looking information

were to prove incorrect, actual results could vary materially from

those that are expressed or implied by the forward-looking

information contained herein and our current objectives or

strategies may change. Espial assumes no obligation to update or

revise any forward looking statements, whether as a result of new

information, future events or otherwise, except as required by law.

Readers are cautioned not to place undue reliance on these

forward-looking statements that speak only as of the date

hereof.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170530005607/en/

Investor:Espial Group Inc.Carl Smith, Chief Financial Officer+1

613-230-4770csmith@espial.com

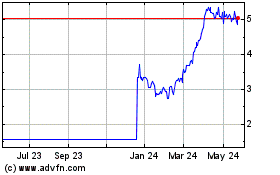

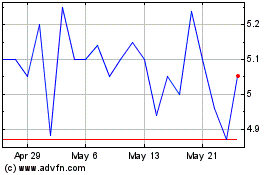

Brompton Energy Split (TSX:ESP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Brompton Energy Split (TSX:ESP)

Historical Stock Chart

From Dec 2023 to Dec 2024