GURU Organic Energy Corp. (TSX: GURU) (“

GURU” or

the “

Company”), Canada’s leading organic energy

drink brand, today announced its results for the third quarter

ended July 31, 2022. All amounts are in Canadian dollars unless

otherwise indicated.

|

Financial Highlights(in thousands of dollars,

except per share data) |

Three months endedJuly 31 |

Nine months endedJuly 31 |

|

2022 |

2021 |

2022 |

2021 |

|

Net revenue |

7,730 |

8,049 |

22,299 |

21,725 |

|

Gross profit |

4,238 |

5,037 |

12,161 |

13,569 |

|

Net loss |

(6,530) |

(2,027) |

(13,694) |

(3,862) |

|

Basic and diluted loss per share |

(0.20) |

(0.07) |

(0.42) |

(0.13) |

|

Adjusted EBITDA4 |

(6,492) |

(1,803) |

(13,254) |

(3,067) |

“As we continue our strategy to replicate our

success in Quebec across Canada, we have great confidence in our

game plan, our differentiated brand, and our strong distribution

partner. Year-to-date, we have already generated a 20% increase in

shipments compared to last year. Following our summer campaign, we

are seeing momentum in English Canada consumer scan data and in our

latest round of research, the most significant to date with 4,000

consumers. The positive results confirm our strategy, as we

continue to see improvement in awareness, trial and conversion to

the GURU brand,” said Carl Goyette, President and CEO of

GURU.

“While we are encouraged by our growth in

consumer purchases and market share, more work is required on

execution and marketing. We will continue to invest strategically

and prudently to increase brand awareness and conversion. We will

also continue to improve in-stock positions and execution to

mitigate industry-wide labour and logistics disruptions, which were

felt more over the course of the summer than in previous quarters.

In the beverage industry, executing well at store level is just as

important as creating demand through marketing, and we will be

laser-focused on these two tactics over the coming quarters,” added

Mr. Goyette.

Results of operationsConsumer

scan data in Canada has shown strong year-over-year sales increases

of more than 35% for the last few months. As such, retail internal

shipment volume increased by 12% in the quarter, compared to the

same period in fiscal 2021. The 23% gap between consumer purchases

and shipments can be mainly explained by inventory depletion at

retail and industry-wide labour and logistics disruptions.

Net revenue for the third quarter stood at $7.7

million, compared to $8.0 million in the same quarter last year,

primarily due to the change in the Company’s Canadian distribution,

sales and merchandizing model, and the previously mentioned labour

availability and logistics constraints. For the nine-month period,

net revenue increased to $22.3 million from $21.7 million in

the same period of 2021.

On the marketing front, the Company deployed its

largest Canadian campaign to date, “Good Energy for the Everyday”

during the third quarter of 2022 and was an official sponsor of

CTV’s The Amazing Race Canada, the most-watch summer series in

Canada. Following these campaigns, select Canadian retailers

outside of Quebec are beginning to report increases in GURU market

share, primarily in areas where GURU’s consumers were targeted. In

September, the Company launched its “Back to Reality” national

marketing campaign, including the Occupation Double TV reality show

in Quebec, which is aimed at bringing Good Energy to its

progressive urban consumers across Canada through the fall.

The Company’s U.S. performance held steady

during the quarter, with GURU continuing to hold the number one

energy drink position in the natural store sector in California and

aiming to expand its distribution network in that state. To

replicate the success of its #1 ranked 2022 Innovation SKU in

Quebec, the Company launched GURU Guayusa Tropical Punch this past

August in targeted U.S. banners. Meanwhile, in the online sales

segment, the Company continued to show strong performance in Q3 and

has scaled back investments in consumer acquisition to improve

profitability in that segment.

Gross profit totalled $4.2 million, compared to

$5.0 million in Q3 2021. Gross margin was 54.8% for the third

quarter in 2022, compared to 62.6% for the same quarter in 2021.

However, gross margin has improved from 54.3% in Q2 2022,

reflecting careful supply chain management and prudent pricing

practices. For the nine-month period, gross profit totalled $12.2

million, compared to gross profit of $13.6 million a year ago.

Gross margin for the period was 54.5% versus 62.5% last year. The

decrease in gross margin was anticipated due to the change in

GURU’s Canadian distribution, sales and merchandizing model,

effective as of Q4 2021, and comprised distribution, selling and

merchandizing fees, a portion of which was previously categorized

as SG&A expenses. Gross margin was also slightly impacted by

higher product costs driven by inflationary pressures on input and

transportation costs.

Selling, general and administrative expenses

(“SG&A”), which include operational, sales, marketing, and

administration costs, amounted to $11.0 million in the third

quarter, compared to SG&A of $7.2 million for the same period a

year ago. Selling and marketing expenses accounted for $8.5 million

of the $11.0 million in SG&A in Q3 2022 and increased 76%

versus the same period a year ago, as the Company invested in

targeted sales and marketing campaigns during the quarter. The

Company’s largest campaigns were its “Good Energy for the Everyday”

marketing campaign, the Amazing Race Canada partnership and the

Canadian Elite Basketball League championship weekend partnership,

but also included many other sponsorships and events across Canada,

as well as continued trade marketing investments in the U.S. For

the nine-month period, SG&A amounted to $26.3 million, compared

to $17.5 million a year ago.

Adjusted EBITDA4 amounted to $(6.5) million

compared to $(2.0) million last year. The decrease in adjusted

EBITDA was mainly due to higher selling and marketing expenses, and

to a lesser extent, to lower gross margins.

Net loss for the third quarter totalled $6.5

million or $(0.20) per share (basic and diluted), compared to a net

loss of $2.0 million or $(0.07) per share (basic and diluted) for

the same period a year ago. The increase in net loss reflects the

lower margins and the additional costs associated with brand, field

and trade marketing activities.

As of July 31, 2022, the Company had cash, cash

equivalents and short-term investments of $48.0 million and unused

$CA and $US denominated credit facilities totalling $10

million.

1 Nielsen: periods ending July 9 and August 6,

2022 - All Channels, Canada.2 Nielsen: Last 18 months, period

ending August 6, 2022 - All Channels, Canada.3 Market Research

conducted by element54 and Patterson Langlois for GURU in June 2021

with 1,500 participants in the province of Quebec.4 Please refer to

the “Non-GAAP financial measure” section for additional information

on reconciliation of net loss to adjusted EBITDA at the end of this

release.

Conference callGURU will hold a

conference call to discuss its third quarter 2022 results today,

September 14, 2022, at 10:00 a.m. ET. Here are the details to

access the call:

- Via webcast:

https://edge.media-server.com/mmc/p/znh9kzg4

- Via telephone, please register for the

call using this link:

https://register.vevent.com/register/BIae0719f6077046f09f0c73cd48ba5562

Once registered, you will receive your dial-in

numbers and unique PIN to access the call seamlessly. It is

recommended that you join 10 minutes before the event, though you

may pre-register at any time.

A webcast replay will be available on GURU’s

website until September 14, 2023.

About GURU ProductsAll GURU

energy drinks are plant-based, high in natural caffeine, free of

artificial sweeteners, artificial colours and flavours, and have no

preservatives. In addition, all drinks are organic, vegan and

gluten free – and the best thing is their amazing taste.

About GURUGURU Organic Energy

Corp. (TSX: GURU) is a dynamic, fast-growing beverage company

launched in 1999, when it pioneered the world’s first natural,

plant-based energy drink. The Company markets organic energy drinks

in Canada and the United States through an estimated distribution

network of over 25,000 points of sale, and through guruenergy.com

and Amazon. GURU has built an inspiring brand with a clean list of

organic plant-based ingredients. Its drinks offer consumers good

energy that never comes at the expense of their health. The Company

is committed to achieving its mission of cleaning the energy drink

industry in Canada and the United States. For more information, go

to www.guruenergy.com or follow us @guruenergydrink on Instagram

and @guruenergy on Facebook.

For further information, please

contact:

|

GURU Organic EnergyInvestorsCarl

Goyette, President and CEOIngy Sarraf, Chief Financial

Officer514-845-4878investors@guruenergy.com |

MediaLyla RadmanovichPELICAN

PR514-845-8763media@rppelican.ca |

Forward-Looking StatementsThis

press release contains “forward-looking statements” within the

meaning of applicable Canadian securities legislation. Such

forward-looking statements include, but are not limited to,

information with respect to our objectives and the strategies for

achieving those objectives, as well as information with respect to

our beliefs, plans, expectations, anticipations, estimates and

intentions. Forward-looking statements are typically identified by

the use of words such as “may”, “would”, “should”, “could”,

“expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”,

“believe”, or “continue”, although not all forward-looking

statements contain these words. Forward-looking statements are

provided for the purposes of assisting the reader in understanding

the Company and its business, operations, prospects, and risks at a

point in time in the context of historical and possible future

developments, and the reader is therefore cautioned that such

information may not be appropriate for other purposes.

Forward-looking statements are based on assumptions and are subject

to a number of risks and uncertainties, many of which are beyond

our control, which could cause actual results to differ materially

from those that are disclosed in or implied by such forward-looking

statements. Those risks and uncertainties include the following,

which are discussed in greater detail under “Risk Factors” in the

Company’s Annual Information Form for the year ended October 31,

2021, available on SEDAR at www.sedar.com: management of growth;

reliance on key personnel; changes in consumer preferences;

significant changes in government regulation; criticism of energy

drink products and/or the energy drink market; economic downturn

and continued uncertainty in the financial markets and other

adverse changes in general economic or political conditions, as

well as the COVID-19 pandemic or other major macroeconomic

phenomena; global or regional catastrophic events; fluctuations in

foreign currency exchange rates; net revenues derived entirely from

energy drinks; increased competition; relationships with co-packers

and distributors and/or their ability to manufacture and/or

distribute GURU’s products; relationships with existing customers;

changing retail landscape; increases in costs and/or shortages of

raw materials and/or ingredients and/or fuel and/or costs of

co-packing; failure to accurately estimate demand for its products;

history of negative cash flow and no assurance of continued

profitability or positive EBITDA; intellectual property rights;

maintenance of brand image or product quality; retention of the

full-time services of senior management; climate change;

litigation; information technology systems; fluctuation of

quarterly operating results; risks associated with the PepsiCo

distribution agreement; no assurance of continued profitability or

positive EBITDA; and conflicts of interest. Certain assumptions

were made in preparing the forward-looking statements concerning

availability of capital resources, business performance, market

conditions and consumer demand. Consequently, all of the

forward-looking statements contained herein are qualified by the

foregoing cautionary statements, and there can be no guarantee that

the results or developments that we anticipate will be realized or,

even if substantially realized, that they will have the expected

consequences or effects on our business, financial condition, or

results of operation. Unless otherwise noted or the context

otherwise indicates, the forward-looking statements contained

herein are provided as of the date hereof, and we do not undertake

to update or amend such forward-looking statements whether as a

result of new information, future events or otherwise, except as

may be required by applicable law.

Non-GAAP Financial Measure

Adjusted EBITDA Adjusted EBITDA

is a non-GAAP financial measure. Adjusted EBITDA is defined as net

income or loss before national Canadian distribution agreement

set-up costs, reverse acquisition of Mira X expenses, income taxes,

net financial expenses, depreciation and amortization, and

stock-based compensation expense. The exclusion of national

Canadian distribution agreement set-up costs eliminates the impact

on earnings of costs that are not expected to re-occur in the near

term. The exclusion of net finance expense eliminates the impact on

earnings derived from non-operational activities, and the exclusion

of depreciation, amortization, and share-based compensation

eliminates the non-cash impact of these items. We believe that

adjusted EBITDA is a useful measure of financial performance

without the variation caused by the impacts of the items described

above because it provides an indication of the Company’s ability to

seize growth opportunities in a cost-effective manner, finance its

ongoing operations and service its long-term debt. Excluding these

items does not imply that they are necessarily non-recurring.

Management believes this non-GAAP financial measure, in addition to

conventional measures prepared in accordance with IFRS, enable

investors to evaluate the Company’s operating results, underlying

performance and future prospects in a manner similar to management.

Although Adjusted EBITDA is frequently used by securities analysts,

lenders and others in their evaluation of companies, it has

limitations as an analytical tool, and should not be considered in

isolation, or as a substitute for analysis of the Company’s results

as reported under IFRS. This non-GAAP financial measure is not an

earnings or cash flow measure recognized by International Financial

Reporting Standards (IFRS) and does not have a standardized meaning

prescribed by IFRS. Our method of calculating this financial

measure may differ from the methods used by other issuers and,

accordingly, our definition of this non-GAAP financial measure may

not be comparable to similar measures presented by other issuers.

Investors are cautioned that non-GAAP financial measures should not

be construed as an alternative to net income determined in

accordance with IFRS as indicators of our performance or to cash

flows from operating activities as measures of liquidity and cash

flows.

Reconciliation of Net Loss to Adjusted

EBITDA

| |

Three-month periods ended |

Nine-month periods ended |

|

July 31, 2022 |

July 31, 2021 |

July 31, 2022 |

July 31, 2021 |

|

(In thousands of Canadian dollars) |

$ |

$ |

$ |

$ |

| Net loss |

(6,530) |

(2,027) |

(13,694) |

(3,862) |

| National Canadian distribution

agreement set-up costs |

- |

113 |

- |

147 |

| Reverse acquisition of Mira X

expenses |

- |

36 |

- |

112 |

| Net financial (income)

expenses |

(294) |

(6) |

(521) |

97 |

| Depreciation and

amortization |

234 |

147 |

643 |

337 |

| Income taxes |

17 |

(185) |

57 |

(241) |

|

Stock-based compensation expense |

81 |

119 |

261 |

343 |

|

Adjusted EBITDA |

(6,492) |

(1,803) |

(13,254) |

(3,067) |

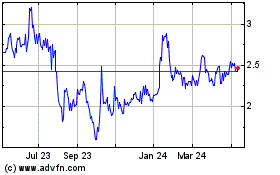

GURU Organic Energy (TSX:GURU)

Historical Stock Chart

From Dec 2024 to Jan 2025

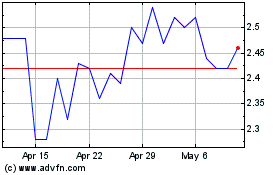

GURU Organic Energy (TSX:GURU)

Historical Stock Chart

From Jan 2024 to Jan 2025