Brompton Oil Split Corp. Announces Extension of Term and Preferred Share Distribution Rate

January 30 2020 - 4:04PM

(TSX: OSP, OSP.PR.A) As previously announced, the

board of directors of Brompton Oil Split Corp. (the “Fund”)

determined that it would extend the maturity date of the class A

and preferred shares of the Company for a period of up to five

years beyond the current maturity date of March 31, 2020.

Today, the board of directors announces that the new term of the

Fund will be 3 years to March 30, 2023. In addition,

the distribution rate for the preferred shares (the “Preferred

Shares”) for the new 3 year term from April 1, 2020 to March 30,

2023 has been increased to $0.65 per Preferred Share per annum

(6.5% on the original issue price of $10) payable quarterly.

The new Preferred Share distribution rate was determined

considering current market rates for preferred shares with similar

terms, as well as the current Preferred Share coverage level of the

Fund. Based on the net asset value of the portfolio holdings

as of January 29, 2020, in order to meet the new Preferred Share

distribution rate and maintain the net asset value per unit, the

Fund’s portfolio requires capital appreciation of approximately

4.0% per annum. In addition, the Fund confirmed that it will

maintain the targeted monthly Class A Share distribution rate of at

least $0.10 per Class A Share which will become payable when the

net asset value per unit (consisting of one Class A Share and one

Preferred Share) is greater than $15.00, after taking into

consideration the payment of the Class A Share distribution.

The Fund invests in a portfolio of equity

securities of large capitalization North American oil and gas

issuers, primarily focused on those with significant exposure to

oil.

In connection with the extension, shareholders

who do not wish to continue their investment in the Fund, may

retract their Preferred Shares and Class A Shares on March 31, 2020

pursuant to a special retraction right and receive a retraction

price that is calculated in the same way that such price would be

calculated if the Fund were to terminate on March 31, 2020.

Pursuant to this option, the retraction price may be less than the

market price if the security is trading at a premium to net asset

value. To exercise this retraction right shareholders must

provide notice to their investment dealer by their dealer’s

deadline which in any event cannot be later than February 28, 2020

at 5:00 p.m. (Toronto time). Alternatively, shareholders may

sell their shares through their securities dealer for the market

price at any time, potentially at a higher price than would be

achieved through retraction, or shareholders may take no action and

continue to hold their shares.

In the event that more Class A Shares than

Preferred Shares have been redeemed pursuant to the non-concurrent

retraction right, the Company may redeem Preferred Shares on a pro

rata basis in a number to be determined by the Company reflecting

the extent to which the number of Preferred Shares outstanding

following the non-concurrent retraction exceeds the number of Class

A Shares outstanding following the non-concurrent retraction.

Conversely, in the event that more Preferred Shares than Class A

Shares have been redeemed pursuant to the non-concurrent retraction

right, the Company may redeem Class A Shares on a pro rata basis in

a number to be determined by the Company reflecting the extent to

which the number of Class A Shares outstanding following the

non-concurrent retraction exceeds the number of Preferred Shares

outstanding following the non-concurrent retraction.

About Brompton Funds

Founded in 2000, Brompton is an experienced

investment fund manager with approximately $2 billion in assets

under management. Brompton’s investment solutions include TSX

closed-end funds and exchange-traded funds. For further

information, please contact your investment advisor, call

Brompton’s investor relations line at 416-642-6000 (toll-free at

1-866-642-6001), email info@bromptongroup.com or visit our website

at www.bromptongroup.com.

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of the investment funds on

the Toronto Stock Exchange or other alternative Canadian trading

system (an “exchange”). If the shares are purchased or sold

on an exchange, investors may pay more than the current net asset

value when buying shares of the investment fund and may receive

less than the current net asset value when selling them.

There are ongoing fees and expenses associated

with owning shares of an investment fund. An investment fund

must prepare disclosure documents that contain key information

about the fund. You can find more detailed information about

the Fund in the public filings available at www.sedar.com.

Investment funds are not guaranteed, their values change

frequently, and past performance may not be repeated.

Certain statements contained in this document

constitute forward-looking information within the meaning of

Canadian securities laws. Forward-looking information may relate to

matters disclosed in this document and to other matters identified

in public filings relating to the Fund, to the future outlook of

the Fund and anticipated events or results and may include

statements regarding the future financial performance of the Fund.

In some cases, forward-looking information can be identified by

terms such as “may”, “will”, “should”, “expect”, “plan”,

“anticipate”, “believe”, “intend”, “estimate”, “predict”,

“potential”, “continue” or other similar expressions concerning

matters that are not historical facts. Actual results may vary from

such forward-looking information. Investors should not place

undue reliance on forward-looking statements. These

forward-looking statements are made as of the date hereof and we

assume no obligation to update or revise them to reflect new events

or circumstances.

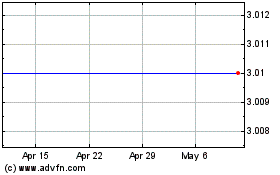

Brompton Oil Split (TSX:OSP)

Historical Stock Chart

From Feb 2025 to Mar 2025

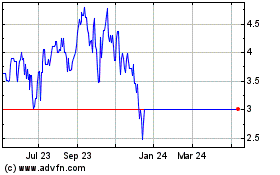

Brompton Oil Split (TSX:OSP)

Historical Stock Chart

From Mar 2024 to Mar 2025