Profound Medical Corp. (NASDAQ:PROF; TSX:PRN) (“Profound” or the

“Company”), the only company to provide customizable, incision-free

therapies which combine real-time Magnetic Resonance Imaging

(“MRI”), thermal ultrasound and closed-loop temperature feedback

control for the radiation-free ablation of diseased tissue, today

reported financial results for the second quarter ended June 30,

2020, and provided an update on its operations.

Recent Corporate Highlights

- On April 3, 2020, Profound launched

a TULSA procedure website, www.tulsaprocedure.com, as a resource

for patients with prostate disease.

- On July 21, 2020, Profound closed

an underwritten offering of common shares (the “July 2020

Offering”), including the full exercise of the over-allotment

option, for gross proceeds of approximately US$46 million.

“We are very encouraged by the continuing strong

interest shown in TULSA-PRO® by both surgeons and patients across

the United States,” said Arun Menawat, Profound’s CEO. “That

culminated in us completing the first installation of TULSA-PRO® at

a teaching hospital – the world-renowned Mayo Clinic in

Jacksonville, FL – in early July. Moving forward, as we continue to

execute on our U.S. TULSA-PRO® commercialization strategy, building

additional awareness of this technology will be key to our success.

To that end, we are looking forward to launching a new patient

forum in the Fall, through which patients will be able to share

their experiences with the TULSA procedure, as well as rolling out

both surgeon-to-surgeon and patient-to-patient education

programs.”

Summary Second Quarter 2020

Results

All amounts, unless specified otherwise, are

expressed in Canadian dollars and are presented in accordance with

International Financial Reporting Standards as issued by the

International Accounting Standards Board, applicable to the

preparation of interim financial statements, including IAS 34,

Interim Financial Reporting.

For the second quarter ended June 30, 2020, the

Company recorded revenue of $1,421,223, with $1,131,801 from the

sale of product, $97,868 from pay for procedure and $191,554 from

installation and training services. Second quarter 2020 revenue

increased approximately 148% from $574,109 in the same three-month

period a year ago.

The Company recorded a net loss for the three

months ended June 30, 2020 of $7,347,529, or $0.46 per common

share, compared to a net loss of $5,844,134, or $0.54 per common

share, for the three months ended June 30, 2019. The increase in

net loss was primarily attributed to increases in general and

administrative (“G&A”) expenses, selling and distribution

expenses, and net financing costs by $688,764, $220,619,

$1,469,688, respectively. This was offset by a decrease in research

and development (“R&D”) expense of $802,488 and an increase in

gross profits of $245,788.

Expenditures for R&D for the three months

ended June 30, 2020 were $2,383,867, compared to $3,186,355 for the

three months ended June 30, 2019. Clinical trial costs, materials,

travel, salaries and benefits, and software expenses decreased by

$330,260, $517,520, $77,408, $167,227, and $26,646, respectively.

These decreases were due to decreased spending on materials and

R&D projects due to the impact of COVID-19, as hospitals and

testing facilities were not accessible, lower travel due to

COVID-19 restrictions, decreased R&D personnel, the Canada

Emergency Wage Subsidy (CEWS) and lower software and hardware

costs. Offsetting these amounts were increases in consulting fees

and share based compensation of $181,807, and $153,453,

respectively, due to increased spending for reimbursement, market

research and options awarded to employees.

G&A expenses for the three months ended June

30, 2020 increased by $688,764 compared to the three months ended

June 30, 2019. Consulting fees, share based compensation, insurance

and software expenses increased by $59,737, $242,009, $397,181, and

$177,670, respectively, due to increased costs associated with

being Nasdaq listed, options awarded to employees, increased

insurance costs associated with being Nasdaq listed and increased

software costs for cybersecurity. Offsetting these amounts were

decreases to salaries and benefits of $97,607 and travel of $59,146

which were due to lower personnel costs, CEWS and COVID-19 travel

restrictions. Depreciation expenses decreased by $23,173 due to

certain assets being fully depreciated.

Liquidity and Outstanding Share

Capital

As at June 30, 2020, the Company had cash of

$55,964,086. Subsequent to quarter end, the Company completed the

July 2020 Offering, resulting it in having approximate cash of $112

million at July 31, 2020.

As at August 6, 2020, Profound had 19,378,152

common shares issued and outstanding.

For complete financial results, please see our

filings at www.sedar.com and our website at

www.profoundmedical.com.

Conference Call Details

Profound Medical is pleased to invite all

interested parties to participate in a conference call today,

August 6, 2020, at 4:30 pm ET during which time the results will be

discussed.

| Live

Call: |

|

1-844-407-9500

(Canada and the United States) |

| |

|

1-862-298-0850 (International) |

| |

|

|

| Replay: |

|

1-919-882-2331 |

| Replay ID: |

|

35945 |

The call will also be broadcast live and

archived on the Company's website at www.profoundmedical.com under

"Webcasts" in the Investors section.

About Profound Medical

Corp.

Profound is a commercial-stage medical device

company that develops and markets customizable, incision-free

therapies for the ablation of diseased tissue.

Profound is commercializing TULSA-PRO®, a

technology that combines real-time MRI, robotically-driven

transurethral ultrasound and closed-loop temperature feedback

control. TULSA-PRO® is designed to provide customizable and

predictable radiation-free ablation of a surgeon-defined prostate

volume while actively protecting the urethra and rectum to help

preserve the patient’s natural functional abilities.

TULSA-PRO® has the potential to be a flexible technology in

customizable prostate ablation, including intermediate stage

cancer, localized radio-recurrent cancer, retention and hematuria

palliation in locally advanced prostate cancer, and the transition

zone in large volume benign prostatic hyperplasia (BPH). TULSA-PRO®

is CE marked, Health Canada approved, and 510(k) cleared by the

U.S. Food and Drug Administration.

Profound is also commercializing Sonalleve®, an

innovative therapeutic platform that is CE marked for the treatment

of uterine fibroids and palliative pain treatment of bone

metastases. Sonalleve® has also been approved by the China

National Medical Products Administration for the non-invasive

treatment of uterine fibroids. The Company is in the early stages

of exploring additional potential treatment markets for

Sonalleve® where the technology has been shown to have

clinical application, such as non-invasive ablation of abdominal

cancers and hyperthermia for cancer therapy.

Forward-Looking Statements

This release includes forward-looking statements

regarding Profound and its business which may include, but is not

limited to, the expectations regarding the efficacy of Profound’s

technology in the treatment of prostate cancer, uterine fibroids

and palliative pain treatment. Often, but not always,

forward-looking statements can be identified by the use of words

such as "plans", "is expected", "expects", "scheduled", "intends",

"contemplates", "anticipates", "believes", "proposes" or variations

(including negative variations) of such words and phrases, or state

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved. Such

statements are based on the current expectations of the management

of Profound. The forward-looking events and circumstances discussed

in this release, may not occur by certain specified dates or at all

and could differ materially as a result of known and unknown risk

factors and uncertainties affecting the company, including risks

regarding the pharmaceutical industry, economic factors, the equity

markets generally and risks associated with growth and competition.

Although Profound has attempted to identify important factors that

could cause actual actions, events or results to differ materially

from those described in forward-looking statements, there may be

other factors that cause actions, events or results to differ from

those anticipated, estimated or intended. No forward-looking

statement can be guaranteed. In addition, there is uncertainty

about the spread of the COVID-19 virus and the impact it will have

on Profound’s operations, the demand for its products, global

supply chains and economic activity in general. Except as required

by applicable securities laws, forward-looking statements speak

only as of the date on which they are made and Profound undertakes

no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events,

or otherwise, other than as required by law.

For further information, please contact:

Stephen KilmerInvestor Relationsskilmer@profoundmedical.com T:

647.872.4849

|

|

|

|

|

|

|

Profound Medical Corp.Interim Condensed

Consolidated Balance

Sheets(Unaudited) |

|

|

|

|

|

June

30,2020$ |

|

|

December 31,2019$ |

|

|

|

|

|

|

|

| Assets |

|

|

|

|

| |

|

|

|

|

| Current

assets |

|

|

|

|

|

Cash |

|

55,964,086 |

|

|

19,222,195 |

|

|

Trade and other receivables |

|

4,594,426 |

|

|

4,058,136 |

|

|

Investment tax credits receivable |

|

240,000 |

|

|

240,000 |

|

|

Inventory |

|

6,781,987 |

|

|

4,764,458 |

|

|

Prepaid expenses and deposits |

|

583,891 |

|

|

1,335,620 |

|

| Total current

assets |

|

68,164,390 |

|

|

29,620,409 |

|

| |

|

|

|

|

| Property and equipment |

|

663,366 |

|

|

684,718 |

|

| Intangible assets |

|

2,551,997 |

|

|

3,128,820 |

|

| Right-of-use assets |

|

2,012,198 |

|

|

2,199,381 |

|

|

Goodwill |

|

3,409,165 |

|

|

3,409,165 |

|

| |

|

|

|

|

|

Total assets |

|

76,801,116 |

|

|

39,042,493 |

|

| |

|

|

|

|

| Liabilities |

|

|

|

|

| |

|

|

|

|

| Current

liabilities |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

2,742,942 |

|

|

3,933,114 |

|

|

Deferred revenue |

|

1,028,766 |

|

|

654,763 |

|

|

Long-term debt |

|

- |

|

|

5,144,461 |

|

|

Warranty provision |

|

129,871 |

|

|

134,956 |

|

|

Other liabilities |

|

106,513 |

|

|

286,858 |

|

|

Derivative financial instrument |

|

487,235 |

|

|

254,769 |

|

|

Lease liabilities |

|

346,587 |

|

|

258,685 |

|

|

Income taxes payable |

|

5,856 |

|

|

15,763 |

|

| Total current

liabilities |

|

4,847,770 |

|

|

10,683,369 |

|

| |

|

|

|

|

| Long-term debt |

|

- |

|

|

6,719,924 |

|

| Deferred revenue |

|

490,835 |

|

|

829,784 |

|

| Warranty provision |

|

28,509 |

|

|

19,005 |

|

|

Lease liabilities |

|

1,937,279 |

|

|

2,125,873 |

|

| |

|

|

|

|

|

Total liabilities |

|

7,304,393 |

|

|

20,377,955 |

|

| |

|

|

|

|

| Shareholders’

Equity |

|

|

|

|

| |

|

|

|

|

| Share capital |

|

194,991,770 |

|

|

130,266,880 |

|

| Contributed surplus |

|

16,483,466 |

|

|

19,580,338 |

|

| Accumulated other comprehensive

gain/(loss) |

|

42,201 |

|

|

(117,188 |

) |

|

Deficit |

|

(142,020,714 |

) |

|

(131,065,492 |

) |

| |

|

|

|

|

|

Total Shareholders’ Equity |

|

69,496,723 |

|

|

18,664,538 |

|

| |

|

|

|

|

|

Total Liabilities and Shareholders’ Equity |

|

76,801,116 |

|

|

39,042,493 |

|

|

|

|

Profound Medical Corp.Interim Condensed

Consolidated Statements of Loss and Comprehensive Loss

(Unaudited) |

|

|

|

|

|

ThreemonthsendedJune

30,2020$ |

|

|

ThreemonthsendedJune

30,2019$ |

|

|

SixmonthsendedJune

30,2020$ |

|

|

SixmonthsendedJune

30,2019$ |

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

Products |

|

1,131,801 |

|

|

465,840 |

|

|

2,489,340 |

|

|

1,813,621 |

|

|

Services |

|

191,554 |

|

|

108,269 |

|

|

353,148 |

|

|

236,276 |

|

|

Pay per procedure |

|

97,868 |

|

|

- |

|

|

138,953 |

|

|

- |

|

| |

|

1,421,223 |

|

|

574,109 |

|

|

2,981,441 |

|

|

2,049,897 |

|

|

Cost of sales |

|

845,392 |

|

|

244,066 |

|

|

1,811,000 |

|

|

777,422 |

|

|

Gross profit |

|

575,831 |

|

|

330,043 |

|

|

1,170,441 |

|

|

1,272,475 |

|

| |

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

Research and development |

|

2,383,867 |

|

|

3,186,355 |

|

|

5,223,084 |

|

|

5,864,101 |

|

|

General and administrative |

|

2,275,087 |

|

|

1,586,323 |

|

|

5,328,314 |

|

|

3,100,436 |

|

|

Selling and distribution |

|

1,375,488 |

|

|

1,154,869 |

|

|

2,629,817 |

|

|

625,524 |

|

|

Total operating expenses |

|

6,034,442 |

|

|

5,927,547 |

|

|

13,181,215 |

|

|

9,590,061 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating Loss |

|

5,458,611 |

|

|

5,597,504 |

|

|

12,010,774 |

|

|

8,317,586 |

|

| |

|

|

|

|

|

|

|

|

| Net finance

(income)/costs |

|

1,696,118 |

|

|

226,430 |

|

|

(1,372,087 |

) |

|

399,234 |

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

7,154,729 |

|

|

5,823,934 |

|

|

10,638,687 |

|

|

8,716,820 |

|

| |

|

|

|

|

|

|

|

|

| Income taxes |

|

192,800 |

|

|

20,200 |

|

|

316,535 |

|

|

54,000 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the period |

|

7,347,529 |

|

|

5,844,134 |

|

|

10,955,222 |

|

|

8,770,820 |

|

| |

|

|

|

|

|

|

|

|

| Other comprehensive loss

(income) |

|

|

|

|

|

|

|

|

| Item that may be reclassified to

profit or loss |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment - net of tax of $nil (2019

- $nil) |

|

(25,728 |

) |

|

(11,843 |

) |

|

159,389 |

|

|

(58,232 |

) |

|

Net loss and comprehensive loss for the

period |

|

7,321,801 |

|

|

5,832,291 |

|

|

11,114,611 |

|

|

8,712,588 |

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share |

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share |

|

0.46 |

|

|

0.54 |

|

|

0.71 |

|

|

0.81 |

|

|

|

|

Profound Medical Corp.Interim Condensed

Consolidated Statements of Cash

Flows(Unaudited) |

|

|

|

|

Sixmonthsended June

30,2020$ |

|

Sixmonthsended June 30,

2019$ |

|

|

|

|

|

| Operating

activities |

|

|

| Net loss for the period |

(10,955,222 |

) |

(8,770,820 |

) |

| Adjustments to reconcile net loss

to net cash flows from operating activities: |

|

|

|

Depreciation of property and equipment |

245,277 |

|

257,299 |

|

|

Amortization of intangible assets |

203,663 |

|

564,219 |

|

|

Depreciation of right-of-use assets |

576,823 |

|

204,126 |

|

|

Share-based compensation |

1,490,806 |

|

456,427 |

|

|

Interest and accretion expense |

696,866 |

|

681,258 |

|

|

Deferred revenue |

35,054 |

|

387,165 |

|

|

Change in fair value of derivative financial instrument |

232,466 |

|

54,220 |

|

|

Change in fair value of contingent consideration |

11,580 |

|

(208,911 |

) |

|

Foreign exchange on cash |

(1,701,391 |

) |

- |

|

| Changes in non-cash working

capital balances |

|

|

|

Trade and other receivables |

(536,290 |

) |

(248,171 |

) |

|

Prepaid expenses and deposits |

751,729 |

|

63,186 |

|

|

Inventory |

(2,206,342 |

) |

20,277 |

|

|

Accounts payable and accrued liabilities |

(1,071,273 |

) |

(1,612,144 |

) |

|

Provisions |

4,419 |

|

(1,219,114 |

) |

|

Income taxes payable |

(9,907 |

) |

(133,274 |

) |

|

Net cash flow used in operating activities |

(12,231,742 |

) |

(9,504,257 |

) |

| |

|

|

| Financing

activities |

|

|

| Issuance of common shares |

52,098,723 |

|

- |

|

| Transaction costs paid |

(4,152,072 |

) |

- |

|

| Payment of other liabilities |

(191,925 |

) |

(16,203 |

) |

| Payment of long-term debt and

interest |

(12,497,993 |

) |

(534,709 |

) |

| Proceeds from share options

exercised |

1,540,180 |

|

5,399 |

|

| Proceeds from warrants

exercised |

10,650,381 |

|

- |

|

|

Payment of lease liabilities |

(175,052 |

) |

(143,943 |

) |

|

Total cash from financing activities |

47,272,242 |

|

(689,456 |

) |

| |

|

|

| Net change in cash during the

period |

35,040,500 |

|

(10,193,713 |

) |

| Foreign exchange on cash |

1,701,391 |

|

- |

|

|

Cash – Beginning of period |

19,222,195 |

|

30,687,183 |

|

|

Cash – End of

period |

55,964,086 |

|

20,493,470 |

|

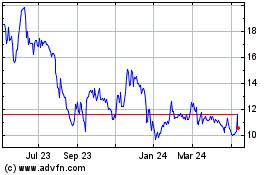

Profound Medical (TSX:PRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

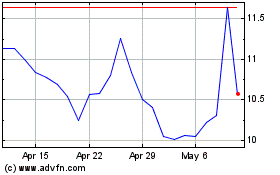

Profound Medical (TSX:PRN)

Historical Stock Chart

From Apr 2023 to Apr 2024