Solaris Expands Leadership Team

January 08 2025 - 6:00AM

Solaris Resources Inc. (“Solaris” or the

“Company”) (TSX: SLS; NYSE: SLSR) is pleased to announce

the strengthening of its leadership team with the appointment of

Richard Hughes as Chief Financial Officer and Company Secretary,

Patrick Chambers as Vice President Investor Relations and Ignacio

Shimamoto as Vice President Finance, effective immediately.

Richard, who succeeds Sunny Lowe as CFO, will

lead the finance function leveraging his recent experience as CFO

and Executive Director of Trident Royalties PLC, which was recently

acquired. With over 20 years in the natural resources sector,

Richard has a strong track record of generating value for all

stakeholders through his significant knowledge across strategy,

capital markets and corporate finance. Patrick will drive global

investor engagement, leveraging his strong geological, investor

relations and business development background. Over the past 12

years, Patrick has worked across a number of commodities, focusing

exclusively on Latin America. Ignacio joins Solaris as VP, Finance

where he will lead financial strategy which includes external and

internal reporting, financial modelling, and oversee procurement

and contract management. He will focus on enhancing operational

efficiency, strengthening compliance, and supporting the Company’s

growth through strategic planning, financial oversight, and

valuations of projects and investments.

Matthew Rowlinson, President and CEO commented,

“I am delighted to welcome Richard, Patrick and Ignacio to the

management team and look forward to working closely with them to

execute our strategy of maximizing returns for all stakeholders. I

would also like to thank the outgoing Solaris team for their

service to the Company and for playing a pivotal role in

establishing the Warintza project as a world-class

multi-generational copper deposit. 2025 is an exciting year for the

Company as the project continues de-risking activities and I look

forward to keeping the market updated on the value accretive

progress.”

About Richard Hughes: Chief Financial

OfficerRichard Hughes has over 20 years of experience in

the natural resources sector with a strong value creation track

record and significant knowledge across strategy, capital markets

and corporate finance. Richard most recently served as CFO and

Executive Director of Trident Royalties PLC, a position he assumed

in September 2022 until its acquisition in late 2024. Prior to

joining Trident, he founded an independent consultancy providing

corporate finance advisory services to both mining and royalty

finance companies. Before that he was a senior member of the Metals

and Mining Investment Banking team at RBC Capital Markets based in

London from 2010 to 2018. Richard began his career at CIBC, where

he was a member of the Global Mining Group. Richard holds an MA

(Oxon) in Economics and Management, from the University of Oxford,

UK.

In connection with his appointment, Mr. Hughes

has agreed to subscribe for C$350,000 of common shares from the

Company pursuant to a private placement.

About Patrick Chambers: Vice President,

Investor RelationsPatrick Chambers is a metals and mining

investor relations professional with an extensive track record

across a range of commodities with a focus on Latin America.

Starting his career as an exploration geologist with Fresnillo PLC

in Mexico, he transitioned into a corporate finance role before

then relocating to London to join their investor relations team.

Patrick most recently served as Head of Investor Relations at

Horizonte Minerals focused on Brazil where he shaped their IR

programme as the company transitioned from a development company

towards production. Patrick holds a BSc in Geology from Edinburgh

University, UK.

About Ignacio Shimamoto: Vice President,

FinanceIgnacio Shimamoto is a senior finance executive

with over 20 years of experience in financial planning, business

improvement, acquisitions, and cost optimization within the natural

resources sectors. He has a proven ability to enhance performance,

streamline processes, and drive operational efficiencies in

complex, multicultural environments. Having served as Finance

Manager for Copper Peru at Glencore where he led the financial

operations of strategic projects such as Antapaccay and

Coroccohuayco, he was later appointed Regional Finance Manager and

Business Improvements where he led continuous improvement

strategies and financial optimization initiatives across mining

operations in Argentina, Chile, and Peru. Ignacio began his career

with Shell Argentina and later advanced through senior positions at

Minera Alumbrera, where he gained extensive expertise in the mining

and oil sectors, specializing in corporate finance, cost analysis,

and project evaluation.

Final Emigration StepsThe

Company announces that the final emigration steps are now complete,

subject to a few administerial matters. See the Company’s news

release dated November 20, 2024, for additional detail.

On behalf of the Board of Solaris

Resources Inc.

“Matthew Rowlinson”President & CEO, Director

For Further Information

Patrick Chambers, VP Investor RelationsEmail:

pchambers@solarisresources.com

About Solaris Resources

Inc.

Solaris is a copper-gold exploration and

development company, committed to a sustainable future by

empowering communities and stakeholders through our dedication to

participatory and responsible mining. The Warintza Project, a large

copper-gold porphyry deposit, with a disclosed resource endowment

of over 2.3Bn tonnes is a unique, global scale and

multigenerational asset with low capital intensity located in

southeast Ecuador. The Company also owns a series of grassroot

exploration projects with discovery potential in Peru and Chile and

a 60% interest in the La Verde joint-venture project with a

subsidiary of Teck Resources in Mexico.

Cautionary Notes and Forward-looking

Statements

This document contains certain forward-looking

information and forward-looking statements within the meaning of

applicable securities legislation (collectively “forward-looking

statements”). The use of the words “will” and “expected” and

similar expressions are intended to identify forward-looking

statements. These statements include statements regarding the

Company’s future growth or value, and expectations regarding the

performance and focus of the new management team and Board of

Directors; the terms of the private placement; the ability of the

Company to satisfy regulatory, stock exchange and commercial

closing conditions of the private placement; and the timing,

benefits, structure and completion of the proposed emigration.

Although Solaris believes that the expectations reflected in such

forward-looking statements and/or information are reasonable,

readers are cautioned that actual results may vary from the

forward-looking statements. The Company has based these

forward-looking statements and information on the Company’s current

expectations and assumptions about future events including

assumptions regarding the exploration and regional programs. These

statements also involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements, including the risks, uncertainties and other factors

identified in the Solaris Management’s Discussion and Analysis, for

the year ended December 31, 2023 available at www.sedarplus.ca.

Furthermore, the forward-looking statements contained in this news

release are made as at the date of this news release and Solaris

does not undertake any obligation to publicly update or revise any

of these forward-looking statements except as may be required by

applicable securities laws.

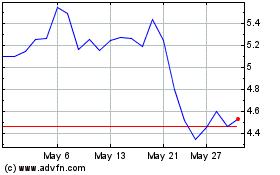

Solaris Resources (TSX:SLS)

Historical Stock Chart

From Jan 2025 to Feb 2025

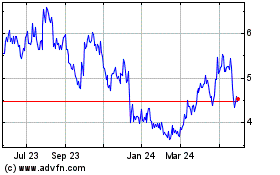

Solaris Resources (TSX:SLS)

Historical Stock Chart

From Feb 2024 to Feb 2025